Rebate In Income Tax 2022 23 Verkko 12 tammik 2023 nbsp 0183 32 Salary 2022 euros month Annual income 2022 euros Tax rate 2022 Tax rate 2023 Change in tax rate points Easing Increasing EUR year 1 600 20 000 14 0 14 5 0 5 100 2 000 25 000 18 9 18 8 0 1 25 2 400 30 000 22 4 22 6 0 2 60 2 800 35 000 25 2 25 1 0 1

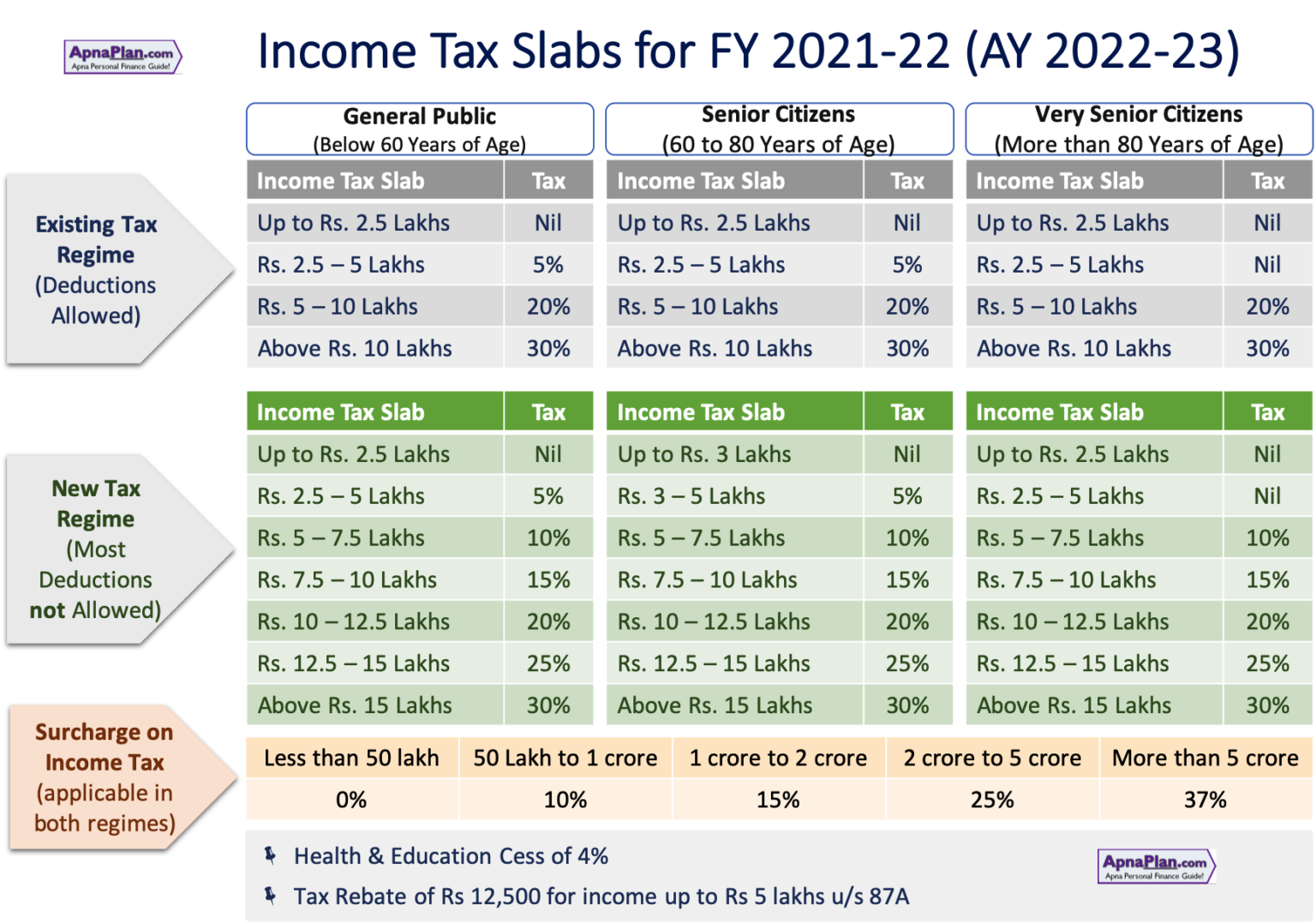

Verkko 2 toukok 2023 nbsp 0183 32 11 min read CONTENTS Show Tax Rebate Under Section 87A Find out Who can claim Income Tax Rebate u s 87A for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Verkko 9 syysk 2023 nbsp 0183 32 a For Assessment Year 2023 24 a resident individual whose net income does not exceed Rs 5 00 000 can avail rebate under section 87A It is deductible from income tax before calculating education cess The amount of rebate is 100 percent of income tax or Rs 12 500 whichever is less

Rebate In Income Tax 2022 23

Rebate In Income Tax 2022 23

https://www.relakhs.com/wp-content/uploads/2021/01/Income-Tax-Rebate-Vs-Tax-Exemption-Vs-Tax-Deduction-FY-2020-21-AY-2021-22.jpg

Latest Income Tax Slab Rates For FY 2022 23 AY 2023 24 Budget 2022

https://www.basunivesh.com/wp-content/uploads/2022/02/Latest-Income-Tax-Slab-Rates-for-FY-2022-23-AY-2023-24.jpg

What Is Income Tax Rebate Under Section 87A HDFC Life

https://www.hdfclife.com/content/dam/hdfclifeinsurancecompany/knowledge-center/images/tax/section-87A.jpg

Verkko 13 kes 228 k 2022 nbsp 0183 32 Income Tax Rates for Financial Year 2022 23 AY 2023 24 Editor Income Tax Articles Trending Download PDF 13 Jun 2022 1 976 532 Views 9 comments Income Tax Rates for Financial Year FY 2022 23 Assessment Year AY 2023 24 Different tax rates have been provided for various categories of taxpayers Verkko December stimulus check 2023 update If you received one of those special state rebate payments sometimes called quot stimulus checks quot last year there s some news from the IRS that you need to

Verkko April 6 2023 2 02 pm On occasion people are overcharged on their tax bill there is a system in place for you to receive money back from HMRC You may be eligible for a tax rebate if you ve Verkko 24 toukok 2023 nbsp 0183 32 Your rebate income is the total amount of your taxable income excluding any assessable First home super saver released amount plus the following amounts if they apply to you adjusted fringe benefits total which is the sum of reportable fringe benefits amounts you received from employers exempt from fringe benefits tax

Download Rebate In Income Tax 2022 23

More picture related to Rebate In Income Tax 2022 23

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

How To Use TAX REBATE In Income Tax TAX REBATE Tips Tricks

https://i.ytimg.com/vi/2Bx_7lRoC78/maxresdefault.jpg

How To Claim Tax Rebate Under Income Tax Goyal Mangal Company

https://www.cagmc.com/wp-content/uploads/2020/07/How-to-claim-Tax-rebate-under-Income-Tax-1.png

Verkko 10 helmik 2023 nbsp 0183 32 IRS issues guidance on state tax payments to help taxpayers IR 2023 23 Feb 10 2023 WASHINGTON The Internal Revenue Service provided details today clarifying the federal tax status involving special payments made by 21 states in 2022 The IRS has determined that in the interest of sound tax administration and Verkko 2 huhtik 2022 nbsp 0183 32 New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as this special benefit announced

Verkko 5 tammik 2023 nbsp 0183 32 Taxpayers seeking tuition fees exemption in income tax 2022 23 must ensure they meet the following criteria Individual Assesse The tuition fee tax deduction is only available to individual taxpayers and Hindu undivided families HUF Corporations are not subject to Section 80C deduction tax Limit Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 Beginning Feb 13 more than 700 000 Michigan families will receive tax rebate checks averaging approximately 550 Gov Gretchen Whitmer announced the rebates Thursday morning which will come ahead of schedule as part of 1 billion in tax cuts she signed into law earlier this year that also decreased taxes on retirement

2022 Tax Brackets JeanXyzander

https://www.nexia-sabt.co.za/wp-content/uploads/2021/03/Tax-Table-and-Rebates-2021-2022.jpg

Sources Of U S Tax Revenue By Type Of Tax 2022

https://files.taxfoundation.org/20220211164025/Individual-income-taxes-are-the-most-important-revenue-source-for-the-US-Sources-of-US-tax-revenue-by-tax-type-2022.png

https://finrepo.fi/en/news-important-tax-changes-finland

Verkko 12 tammik 2023 nbsp 0183 32 Salary 2022 euros month Annual income 2022 euros Tax rate 2022 Tax rate 2023 Change in tax rate points Easing Increasing EUR year 1 600 20 000 14 0 14 5 0 5 100 2 000 25 000 18 9 18 8 0 1 25 2 400 30 000 22 4 22 6 0 2 60 2 800 35 000 25 2 25 1 0 1

https://cleartax.in/s/income-tax-rebate-us-87a

Verkko 2 toukok 2023 nbsp 0183 32 11 min read CONTENTS Show Tax Rebate Under Section 87A Find out Who can claim Income Tax Rebate u s 87A for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

2022 Tax Brackets JeanXyzander

Income Tax Rates For FY 2020 21 FY 2021 22 2022

Income Tax Calculator India FY 2021 22 AY 2022 23 ApnaPlan

Where To Invest For Tax Rebate In Income Tax Of Bangladesh

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Income Tax Rebate Under Section 87A

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

2022 Federal Tax Brackets And Standard Deduction Printable Form

Rebate In Income Tax 2022 23 - Verkko 24 toukok 2023 nbsp 0183 32 Your rebate income is the total amount of your taxable income excluding any assessable First home super saver released amount plus the following amounts if they apply to you adjusted fringe benefits total which is the sum of reportable fringe benefits amounts you received from employers exempt from fringe benefits tax