Rebate In Income Tax 2023 24 Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under 3

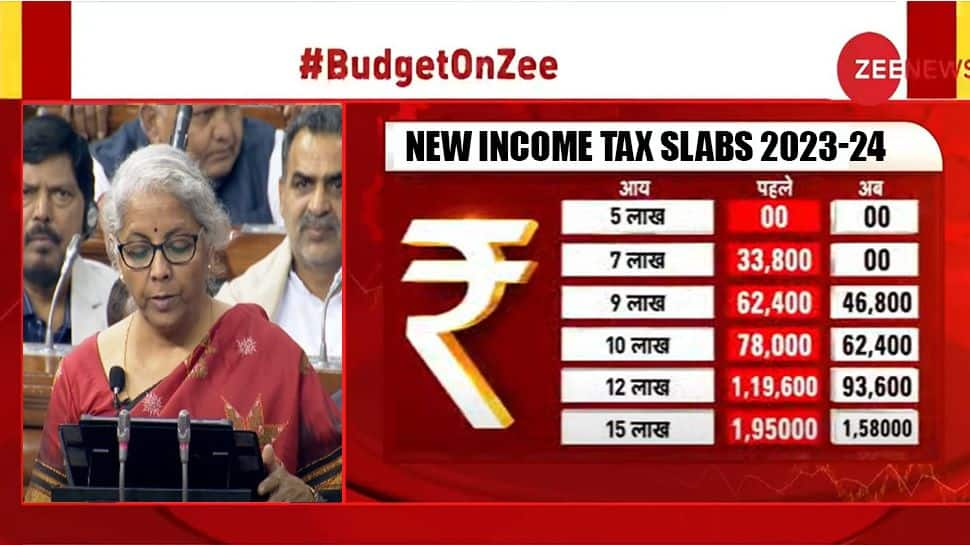

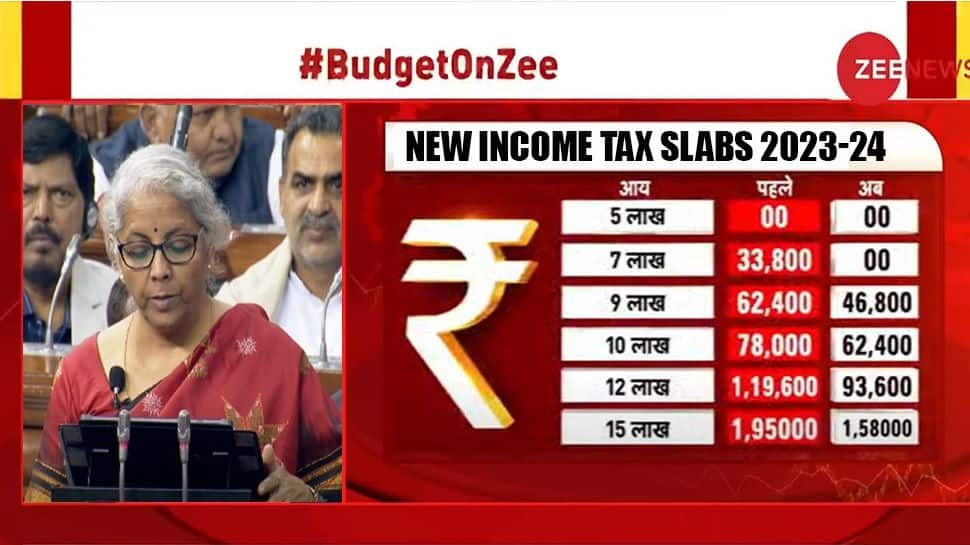

Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under In Budget 2023 rebate under new regime has been increased to Rs 7 00 000 Therefore income upto Rs 7 00 000 will be tax free from FY 2023 24 AY 2024 25 This is

Rebate In Income Tax 2023 24

Rebate In Income Tax 2023 24

https://english.cdn.zeenews.com/sites/default/files/2023/02/01/1148068-income-tax-slab.jpeg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

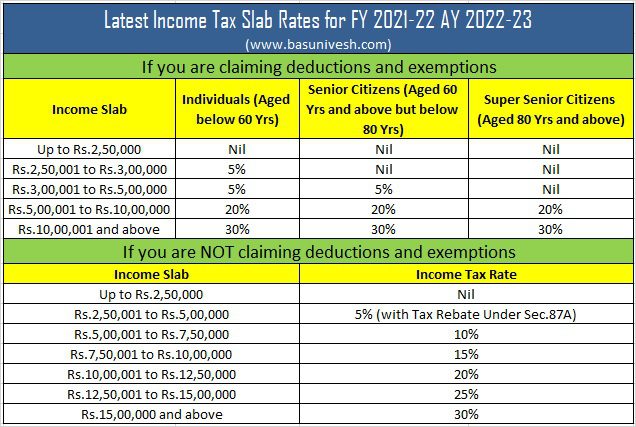

Individuals with net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A under the old tax regime i e tax liability will be NIL Important Points to note if you select the new tax regime For FY 2023 24 the income tax rates and slabs under the old tax regime remain in effect The deductions and exemptions that were permitted under the old tax system remain unchanged as well If taxable income does not exceed Rs 5

Budget 2023 announced that individuals will not have to pay any tax if the taxable income does not exceed Rs 7 lakh in a financial year The maximum limit of rebate available under section 87A of the Income tax Act 1961 has been A rebate of Rs 12 500 is available u s 87A for those under the OLD tax regime for individuals whose taxable income is Rs 5 lakh or less in a year Therefore the Section 87A Tax rebate is available under both new and old tax

Download Rebate In Income Tax 2023 24

More picture related to Rebate In Income Tax 2023 24

PA Rent Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PA-Rent-Rebate-Form-2021-768x993.jpg

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/585/571/585571881/large.png

ITR Forms AY 2022 23 FY 2021 22 Which Form To Use BasuNivesh

https://b2382649.smushcdn.com/2382649/wp-content/uploads/2021/02/Latest-Income-Tax-Slab-Rates-for-FY-2021-22-AY-2022-23.jpg?lossy=1&strip=1&webp=1

So one of the major changes is the tax rebate for those with an annual income of up to Rs 7 lakh under the new tax regime This move is aimed at encouraging salaried taxpayers to switch to a new tax regime that does not Rebate income 2023 Work out your rebate income and if you re eligible for the seniors and pensioners tax offset at question T1 Last updated 24 May 2023 Print or Download

Rebate rates Your rebate rate is the percent that you get back from your health insurance premiums in the form of a reduction of the premium or as a refundable tax offset In this post let s understand What are the income tax slab rates for FY 2023 24 under old and new tax regimes What are the available income tax deductions list FY 2023

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

Budget 2023 What Is Rebate In Income Tax Explained YouTube

https://i.ytimg.com/vi/an8fx5EFlJo/maxresdefault.jpg

https://www.incometax.gov.in/iec/foportal/help/...

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under 3

https://fintaxblog.com/income-tax-rebate-…

Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

Georgia Income Tax Rebate 2023 Printable Rebate Form

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Income Tax Slabs Budget 2021 No Changes In Income Tax Slabs In 2021 And

Form For Renters Rebate RentersRebate

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

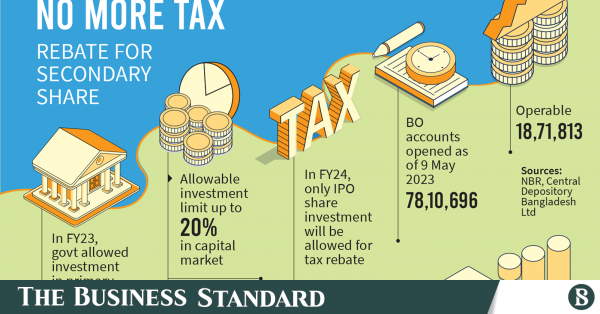

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

How To Get Tax Rebate In Income Tax

Province Of Manitoba School Tax Rebate

Rebate In Income Tax 2023 24 - Use our income tax calculator to calculate tax payable on your income for FY 2024 25 old tax regime vs new tax regime as per Union Budget 2024 FY 2023 24 and FY 2022 23 in a few