Rebate In Income Tax For Ay 18 19 Web 3 ao 251 t 2017 nbsp 0183 32 d Rebate under Section 87A The rebate is available to a resident individual if his total income does not exceed Rs 3 50 000 The amount of rebate shall be 100 of

Web 21 juil 2022 nbsp 0183 32 Les remboursements d imp 244 t sur les revenus seront vers 233 s le jeudi 21 juillet 2022 ou le mardi 2 ao 251 t 2022 Suite 224 la d 233 claration de vos revenus 2021 et le calcul Web 30 avr 2018 nbsp 0183 32 c Rebate under Section 87A The rebate is available to a resident individual if his total income does not exceed Rs 3 50 000 The amount of rebate shall be 100 of

Rebate In Income Tax For Ay 18 19

Rebate In Income Tax For Ay 18 19

http://apnaplan.com/wp-content/uploads/2017/02/Income-Tax-Slab-for-FY-2017–18-AY-2018-19-1024x441.png

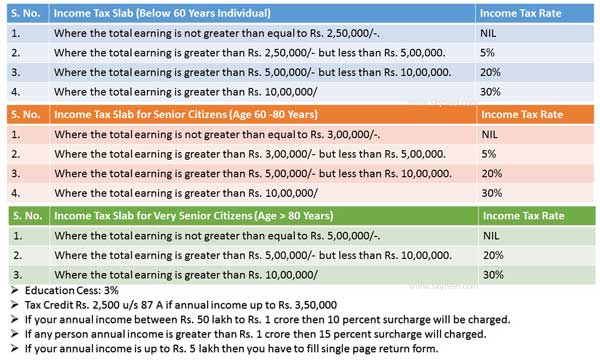

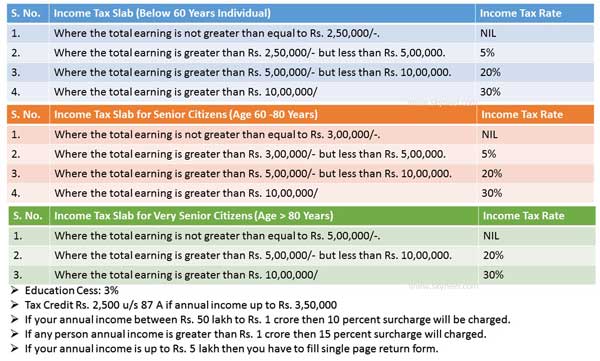

Income Tax Slab Rate FY 2017 18 AY 2018 19

https://dailytally.in/wp-content/uploads/2017/02/Income-Tax-Slab-Rate-FY-2017-18-AY-2018-19.jpg

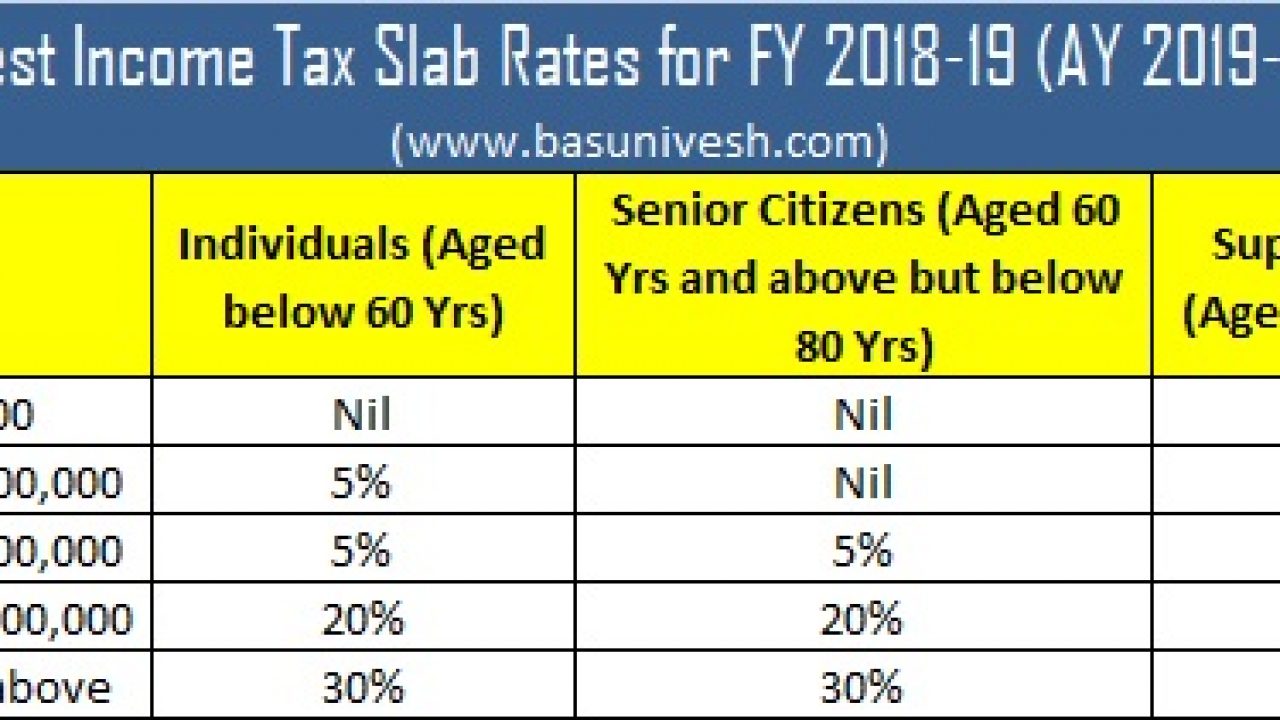

Income Tax Slab For Ay 2019 20 Income Tax Slab For Fy 2018 2018 08 02

https://www.relakhs.com/wp-content/uploads/2018/02/Latest-Income-Tax-Slab-Rates-FY-2018-19-Tax-rate-chart-Assessment-year-2019-2020.jpg

Web 26 janv 2017 nbsp 0183 32 The Union Budget 2017 18 was presented on 1st February 2017 With a reduction of tax rate to 5 in place of existing 10 the Government has reduced the Web 16 nov 2017 nbsp 0183 32 30 Plus Surcharge 10 of tax where total income exceeds Rs 50 lakh 15 of tax where total income exceeds Rs 1 crore Education cess 3 of tax plus

Web 9 mars 2018 nbsp 0183 32 Income Tax Deductions List FY 2018 19 List of important Income Tax Exemptions for AY 2019 20 Budget 2018 19 amp the Finance Bill 2018 have been tabled Web 4 f 233 vr 2018 nbsp 0183 32 How To Calculate Income Tax FY 2018 19 Examples Slab Rates Tax Rebate AY 2019 20 FinCalC TVDOWNLOAD FinCalC Android APP https play google store a

Download Rebate In Income Tax For Ay 18 19

More picture related to Rebate In Income Tax For Ay 18 19

Income Tax Deductions List FY 2018 19 How To Save Tax For AY 19 20

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Tds Slab Rate Fy 2019 20

https://www.basunivesh.com/wp-content/uploads/2018/02/Latest-Income-Tax-Slab-Rates-for-FY-2018-19-AY-2019-20-1280x720.jpg

Income Tax Calculator For Salaried Employees Ay 2018 19 In Excel Fasrthai

https://www.apnaplan.com/wp-content/uploads/2018/02/Budget-2018-Income-Tax-Slabs-for-FY-2018-19-1024x493.png

Web 30 ao 251 t 2019 nbsp 0183 32 A rebate under Section 87A is allowed against the income tax payable by you To this end you have to file an income tax return You should aggregate your Web INCOME TAX REBATE FOR FY 2018 19 Standard Deduction of Rs 40 000 allowed for salaried persons pensioners However transport allowance of Rs 19 200 and medical

Web 12 sept 2023 nbsp 0183 32 The amount of rebate is 100 per cent of income tax or Rs 2 500 whichever is less EDUCATION CESS ON INCOME TAX The amount of Income tax Web 3 f 233 vr 2022 nbsp 0183 32 A resident Individual whose Taxable Income does not exceed Rs 3 50 000 after deductions is eligible for rebate of 100 of Income tax or Rs 2 500 whichever is

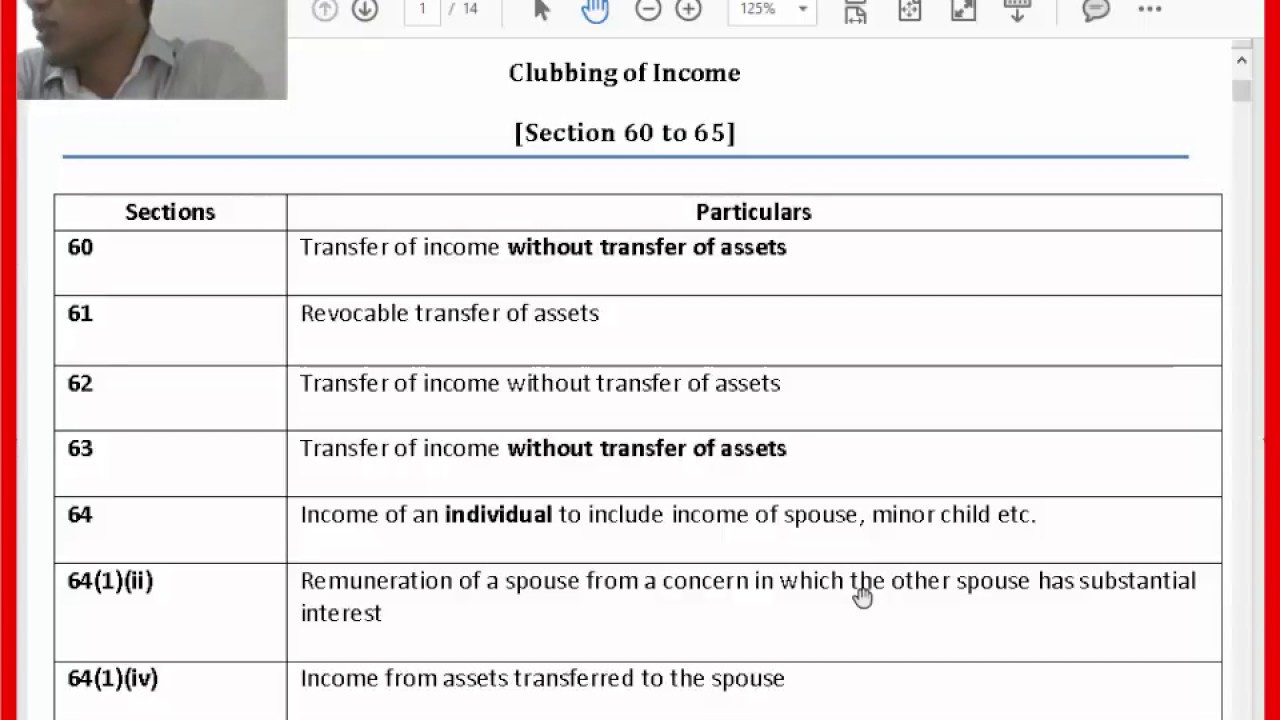

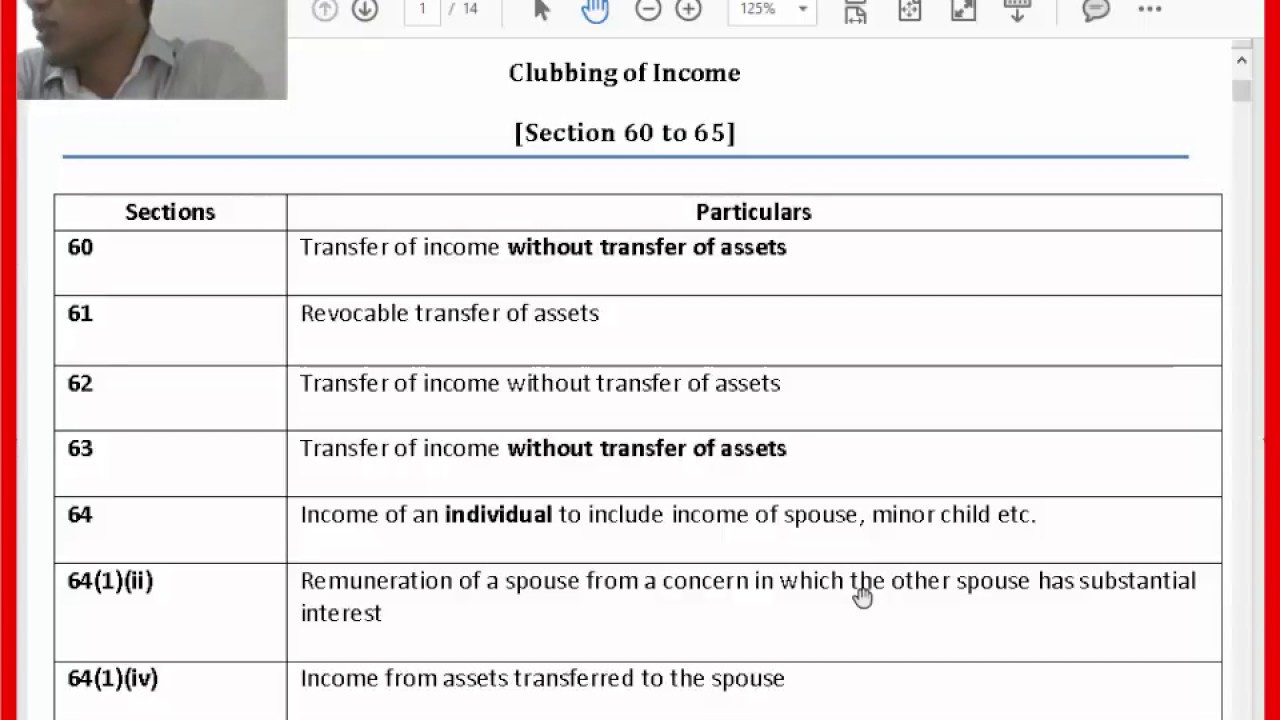

Clubbing Of Income For AY 18 19 For CMA YouTube

https://i.ytimg.com/vi/UEc8jaNMe8w/maxresdefault.jpg

MANDATORY FEES ON LATE FILING OF INCOME TAX RETURN FOR AY 18 19

https://1.bp.blogspot.com/-Ni38l3QpnTw/WkclLsLBGrI/AAAAAAAADzQ/tK8E6ntUPQ8jkLq66RBwf7HOZnXSwaazQCLcBGAs/s1600/mandatory%2Bfees%2Bon%2Blate%2Bfiling%2Bof%2Bincome%2Btax%2Breturn.png

https://taxguru.in/income-tax/income-tax-slabs-ay-201819-fy-201718.html

Web 3 ao 251 t 2017 nbsp 0183 32 d Rebate under Section 87A The rebate is available to a resident individual if his total income does not exceed Rs 3 50 000 The amount of rebate shall be 100 of

https://www.impots.gouv.fr/actualite/remboursement-dimpot-sur-les-re...

Web 21 juil 2022 nbsp 0183 32 Les remboursements d imp 244 t sur les revenus seront vers 233 s le jeudi 21 juillet 2022 ou le mardi 2 ao 251 t 2022 Suite 224 la d 233 claration de vos revenus 2021 et le calcul

TAX AUDIT LIMIT FOR AY 2018 19 FY 2017 18 SIMPLE TAX INDIA

Clubbing Of Income For AY 18 19 For CMA YouTube

Income Tax Slab For Ay 2019 20 Income Tax Slab For Fy 2018 2018 08 02

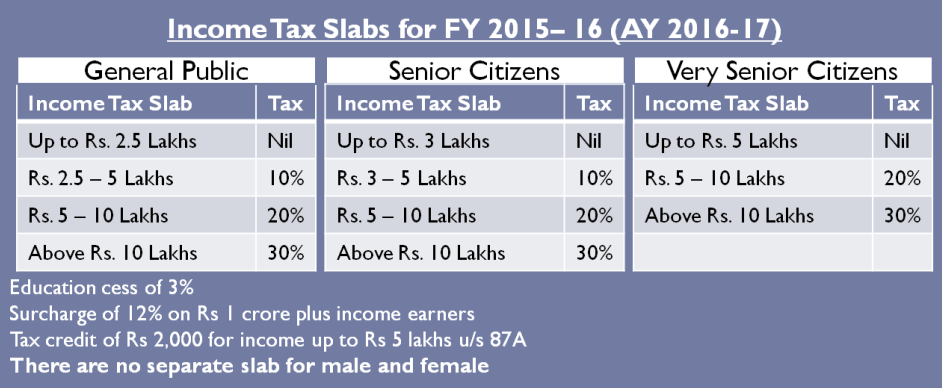

Income Tax Slab Rates For AY 2017 18 FY 2016 17

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Income Tax For FY 2017 18 Or AY 2018 19

Income Tax Comparison Of Calculation With Examples AY 2018 19 AY

Income Tax Slab Rates For AY 19 20 Go For Filing

Rebate In Income Tax For Ay 18 19 - Web 16 nov 2017 nbsp 0183 32 30 Plus Surcharge 10 of tax where total income exceeds Rs 50 lakh 15 of tax where total income exceeds Rs 1 crore Education cess 3 of tax plus