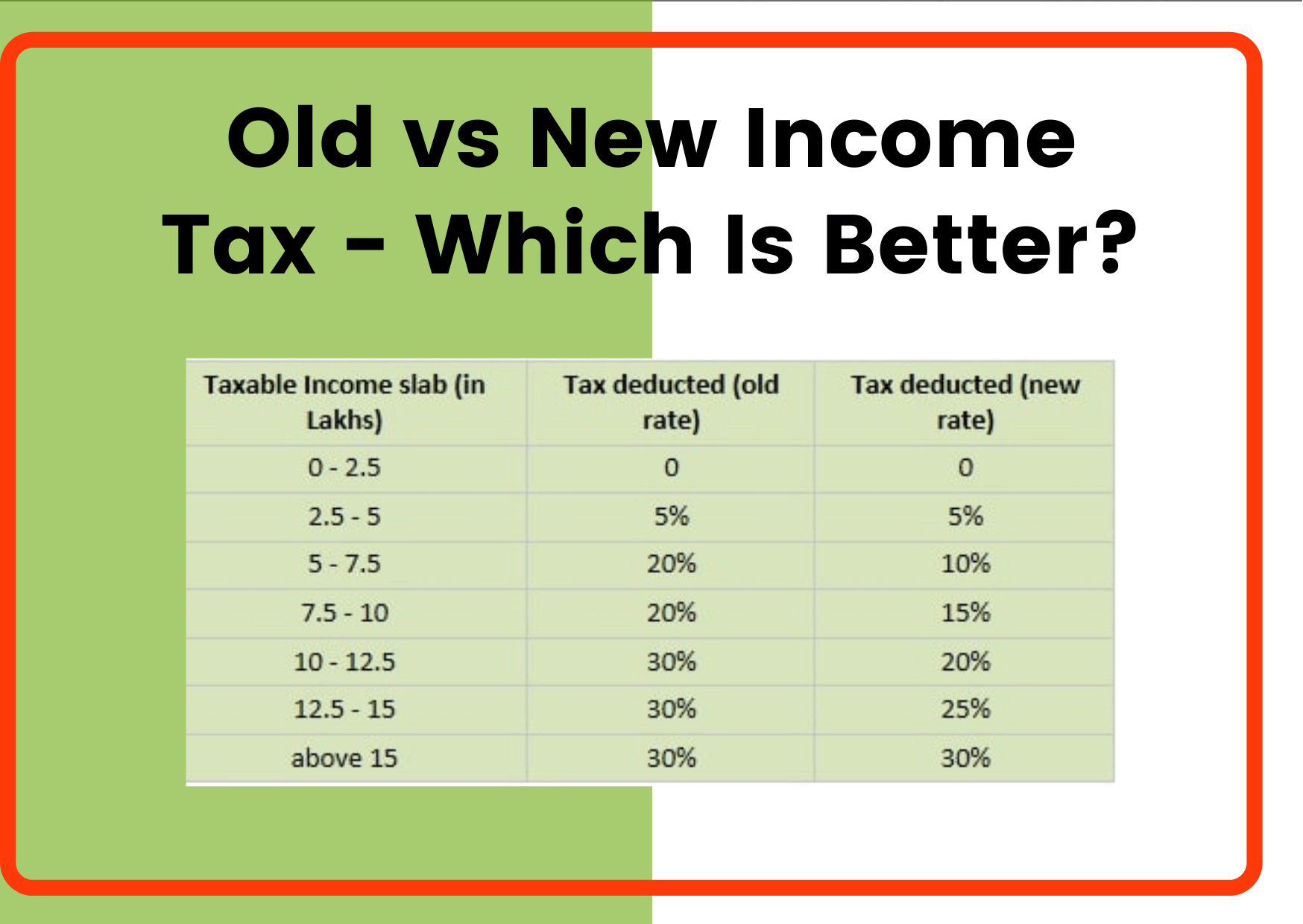

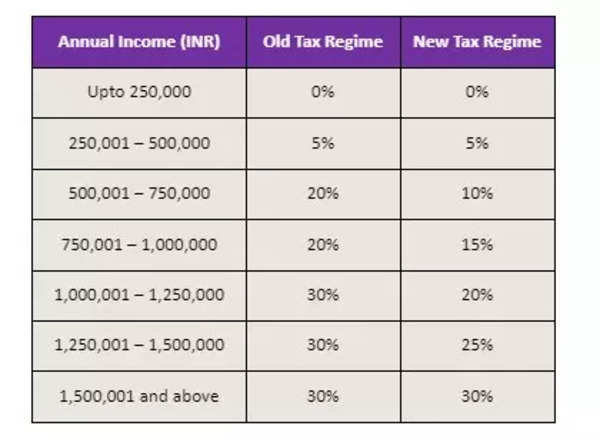

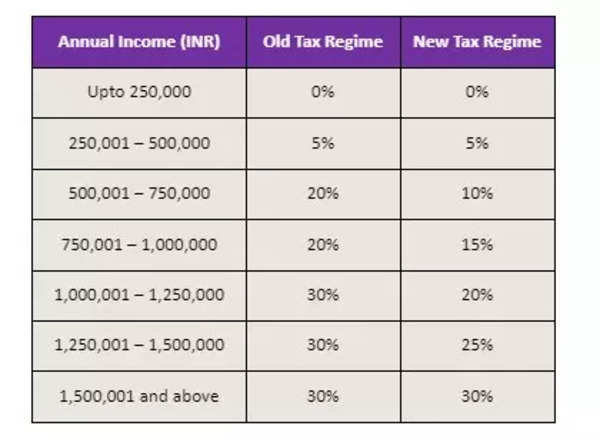

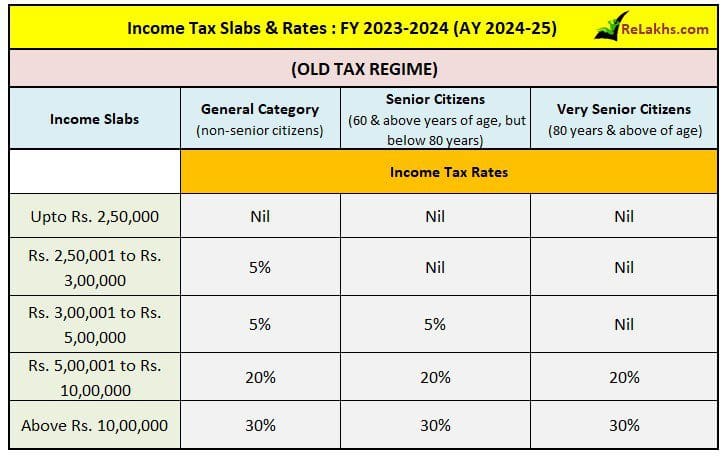

Rebate In Income Tax New Regime Presently rebate is allowed u s 87A of Rs 12 500 in old regime of Income Tax if any resident individual whose total income during the previous year does not exceed Rs 5 00 000 Rebate is available only

Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if Sitharaman proposed to raise the rebate limit from Rs 5 lakh to Rs 7 lakh in the new tax regime Therefore if an individual has opted for the new tax regime he or she will not be required to pay any tax up to an

Rebate In Income Tax New Regime

Rebate In Income Tax New Regime

https://www.inventiva.co.in/wp-content/uploads/2021/07/New-Tax-or-Old-Tax-Regime.jpg

Old Income Tax Regime Vs New Regime Filing Of Return After Due Date

https://cachandanagarwal.com/wp-content/uploads/2022/03/Income-Tax-3-1024x576.jpeg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Currently section 87A allows individuals to claim a tax rebate of Rs 12 500 under the old tax regime and Rs 25 000 under the new tax regime This means that Put simply only those with an annual income of up to Rs 7 lakh under the new tax regime will benefit from the proposal as they will get a 100 per cent rebate on their tax liability On the other hand those with

The new income tax regime is perfect for salaried individuals earning up to Rs 15 lakh particularly those with limited tax saving investments beyond those covered Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less

Download Rebate In Income Tax New Regime

More picture related to Rebate In Income Tax New Regime

New Tax Regime Vs Old Tax Regime How To Choose The Better Option For

https://imgk.timesnownews.com/media/1_2_7.jpg

Income Tax Slab As Per New Regime 2023 24 Calendar Free Printable

https://savemoremoney.in/wp-content/uploads/2020/09/Old-vs-New-Income-Tax.png

The New Tax Regime FY 2020 21 VS The Old Tax Regime Quick Tax Help

https://mkrk.co.in/wp-content/uploads/2021/03/Blog18-Old-Versus-New-Tax-Regime-33-1170x560.png

What are the rebates in the new tax regime in 2024 Under the new tax regime if your taxable income is upto Rs 7 lakh you are eligible for a tax rebate and The new tax regime offers a higher tax rebate as compared to the old tax regime Reduced surcharge in new tax regime A high income earner opting for the

Photo Pixabay Koustav Das New Delhi UPDATED Apr 14 2023 12 53 IST The new income tax regime which got a massive makeover in Budget 2023 As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in new tax regime as per

Budget 2023 Income Tax New Vs Old Tax Regime What Lies Ahead Times

https://static.toiimg.com/thumb/imgsize-23456,msid-97495867,width-600,resizemode-4/97495867.jpg

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

https:// taxguru.in /income-tax/marginal-relief-u-s...

Presently rebate is allowed u s 87A of Rs 12 500 in old regime of Income Tax if any resident individual whose total income during the previous year does not exceed Rs 5 00 000 Rebate is available only

https:// m.economictimes.com /wealth/tax/who-is...

Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if

Easy Way To Switch New To Old Income Tax Scheme For Taxpayers

Budget 2023 Income Tax New Vs Old Tax Regime What Lies Ahead Times

Earnings Tax Deductions Checklist FY 2023 24 MoreFinancialNews

New Tax Regime Versus Old Tax Regime Tax Calculator Tax Ninja Vrogue

Rebate Limit New Income Slabs Standard Deduction Understanding What

New Income Tax Regime Vs Old Key Things To Consider Budget 2023 Regimes

New Income Tax Regime Vs Old Key Things To Consider Budget 2023 Regimes

How To Choose Between The New And Old Income Tax Regimes Chandan

Old Personal Tax Regime Vs New Tax Regime Choosing Made Easy Here Mint

Old Vs New Income Tax Slabs After Budget Which Is Better Mint

Rebate In Income Tax New Regime - Put simply only those with an annual income of up to Rs 7 lakh under the new tax regime will benefit from the proposal as they will get a 100 per cent rebate on their tax liability On the other hand those with