Rebate In Old Tax Regime Individuals with net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A under the old tax regime i e tax liability will be NIL Important Points to note if you select the new tax regime

In the old tax regime in case of a resident individual whose total income does not exceed Rs 5 00 000 there is rebate of 100 percent of income tax subject to a maximum of Rs 12 500 Designed to ease the financial burden on low income earners this section offers a rebate to individuals with a total taxable income of up to 5 lakh under the old regime and 7

Rebate In Old Tax Regime

Rebate In Old Tax Regime

https://static.tnn.in/photo/msid-101208384/101208384.jpg

Rebate Under New Tax Regime PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/10/Rebate-Under-New-Tax-Regime.png

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

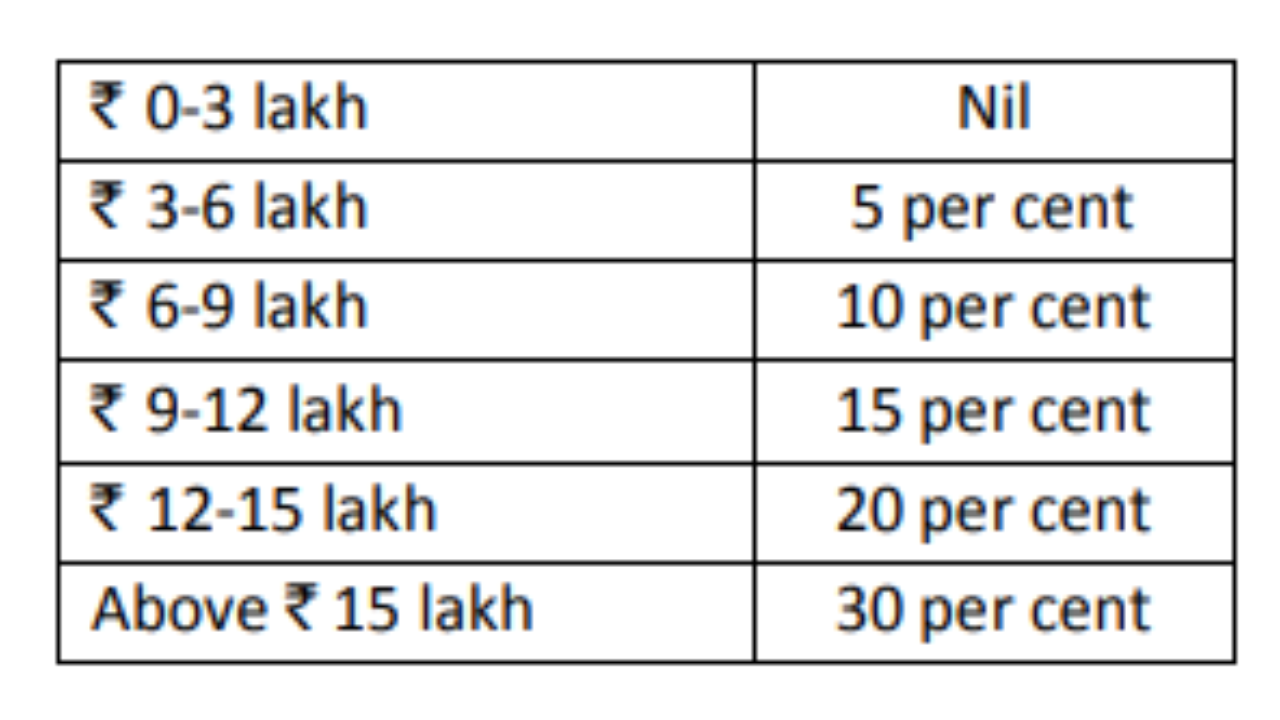

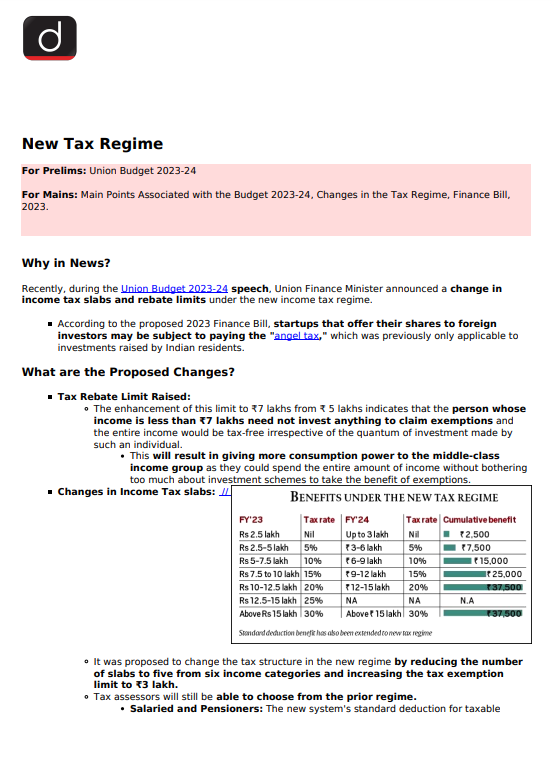

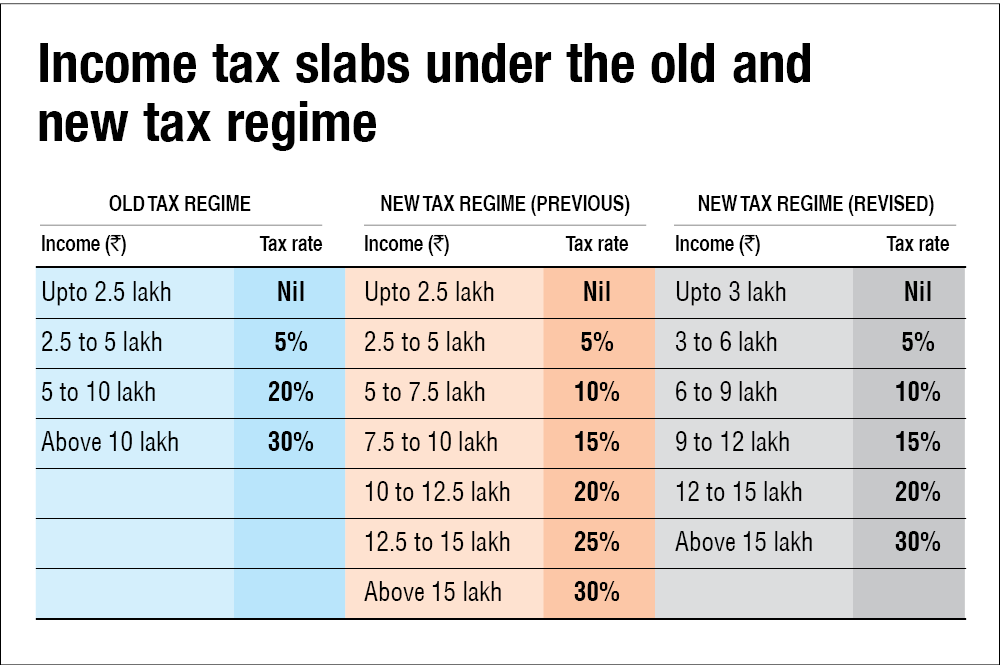

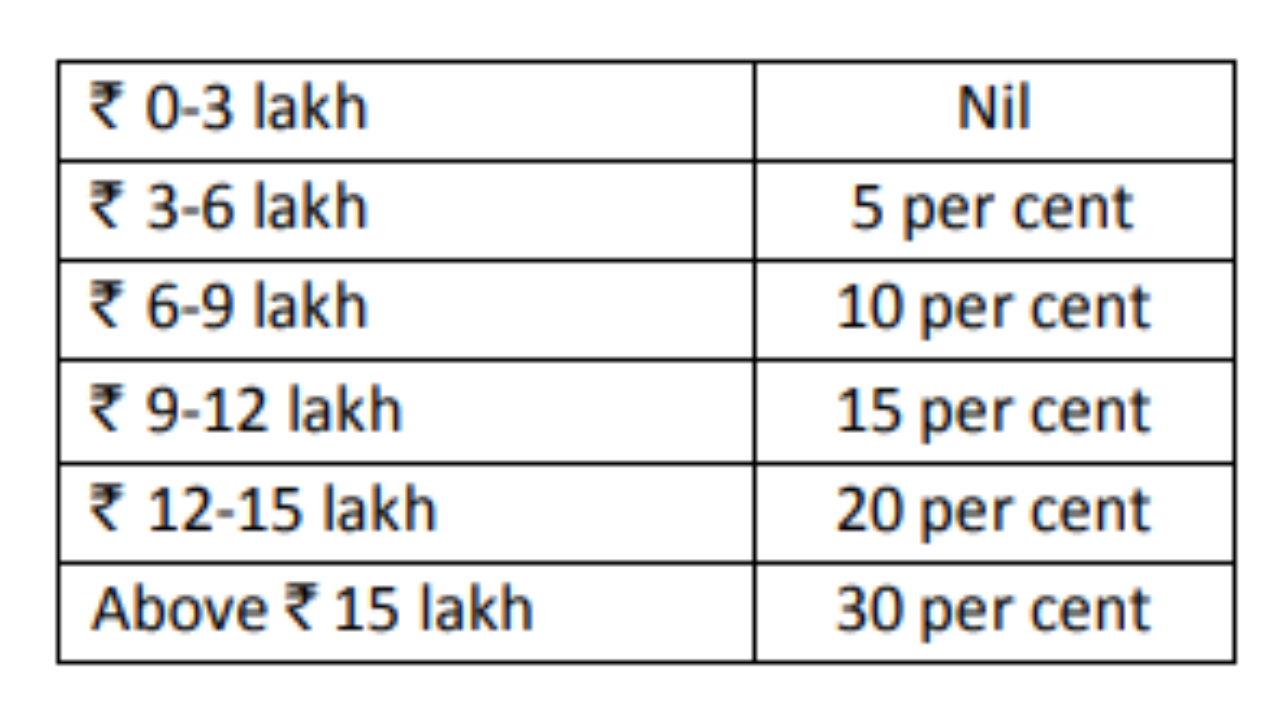

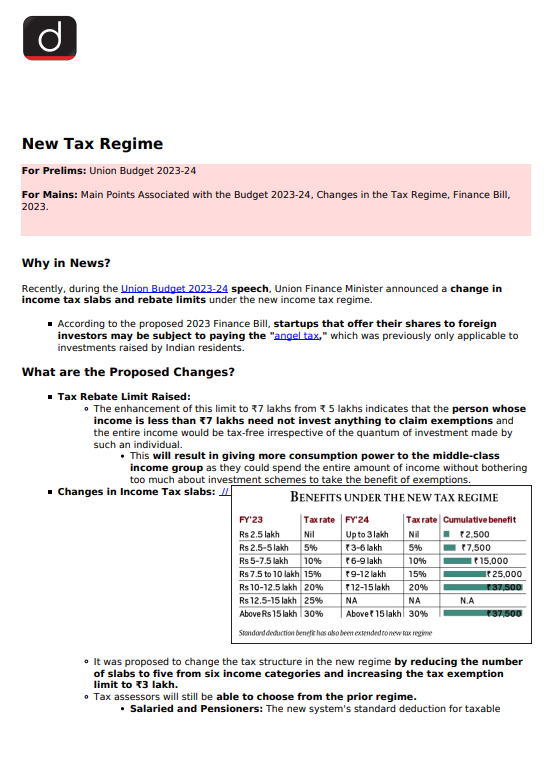

The change was computation of tax liability has been modified and the maximum declaration for the Section 87A rebate removed For this first we need to understand the Rebate u s 87A in old tax regime and new tax regime As per the old tax regime the applicable rebate limit is Rs 12 500 for incomes up to Rs 5 lakhs However under the new tax regime this rebate limit has increased to Rs 25 000 if

Income Tax Rebate under section 87A of Income Tax Act 1961 provides a rebate from income tax up to Rs 12500 to an individual resident assessee whose total income taxable income does not exceed Rs five lakhs Rebate limit Full tax rebate on an income up to Rs 7 00 000 was introduced The threshold is Rs 5 00 000 in the old tax regime Individuals earning up to Rs 7 00 000 will not be liable to pay any tax under the new tax regime

Download Rebate In Old Tax Regime

More picture related to Rebate In Old Tax Regime

Income Tax New Regime For Fy 2023 24 Image To U

https://www.valueresearchonline.com/content-assets/images/52110_468973008-old-vs-new-1__w1000__.png

Budget 2023 Tax Saving Under New Tax Regime Vs Old Tax Regime For Rs 7

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202302/illustration_1.jpg?itok=kH6KXKc9

Old Tax Regime And New Tax Regime Explained In 3 Scenarios Forum

https://c.ndtvimg.com/2023-02/hfvfqj2o_income-tax-slab_625x300_02_February_23.jpg

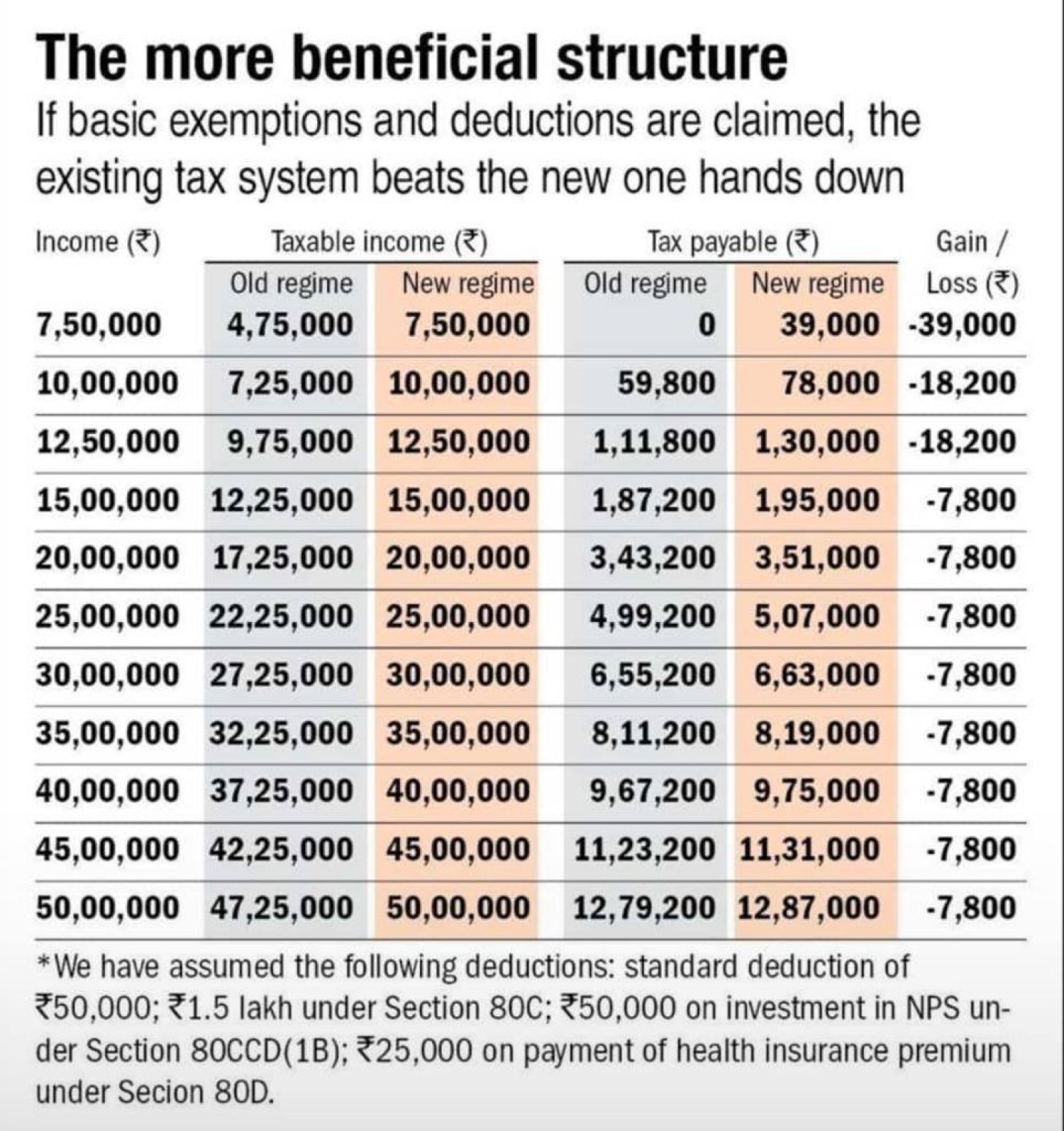

A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if To help you choose between the existing and new tax regimes consider the following estimates New Regime Advantage The new tax regime becomes favorable if your

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime Income tax laws provide a tax rebate to resident individuals in both tax regimes This rebate available under Section 87A does away with the need to pay tax if the net taxable

Old Tax Regime Vs New Tax Regime For The Assessment Year 2024 25

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhFzJwJHyVBIaFv0G0rI9CycAztACJH2ffDNgtSG3IRxDkB8E8neD3ScVZdjeaFsEGlRNFOqKLdxATPyE6sMa7P2WhsdLZv3UJrW1PuAJqOiUXvDtJ4GGzrXO4yvVbUK8NRVEwbATdQ9KZblStNks1dIgMF8yCHF-iAGrgmOApYakwfpsgcIG_WKP3T/s633/Tax Slab for A.Y.2024-25.jpg

Income Tax Rebate 10 7 Slab 2 5

https://www.valueresearchonline.com/content-assets/images/47951_20220601-tax_slabs-old_and_new__w1000__.png

https://cleartax.in/s/income-tax-slabs

Individuals with net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A under the old tax regime i e tax liability will be NIL Important Points to note if you select the new tax regime

https://www.incometax.gov.in/iec/foportal/sites...

In the old tax regime in case of a resident individual whose total income does not exceed Rs 5 00 000 there is rebate of 100 percent of income tax subject to a maximum of Rs 12 500

Shift Between Old And New Tax Regime Cant Come Back To Old Tax Regime

Old Tax Regime Vs New Tax Regime For The Assessment Year 2024 25

New Tax Regime Versus Old Tax Regime Tax Calculator T Vrogue co

Old Tax Regime Vs New Tax Regime YouTube

Budget 2024 Income Tax Slab Rates FY 2024 25

Income Tax Clarification Opting For The New Income Tax Regime U s

Income Tax Clarification Opting For The New Income Tax Regime U s

Opt New Tax Regime If Deduction Exemption Claims Less Than Rs 3 75

New Tax Regime Vs Old Which Is Better For You Rupiko Peoplesoft

Share

Rebate In Old Tax Regime - Old Tax Regime Rebate under Section 87A is available only if the taxable income is Rs 5 lakhs or less New Tax Regime The rebate is now applicable to individuals and HUFs with taxable