Rebate Income Tax India Web 1 f 233 vr 2023 nbsp 0183 32 In her Union Budget speech Finance Minister Nirmala Sitharaman proposed to raise the income tax rebate limit from Rs 5

Web 11 avr 2023 nbsp 0183 32 To claim income tax rebate as a Non Resident Indian NRI in India follow these steps Determine residential status Understand your residential status as per the Web 1 f 233 vr 2023 nbsp 0183 32 Next generation common IT form has been rolled out for MSMEs and professionals if their cash receipts is no more than 5

Rebate Income Tax India

Rebate Income Tax India

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

http://cachandanagarwal.com/wp-content/uploads/2021/04/Income-Tax-Rebate.jpeg

Daily current affairs

http://www.benevolentacademy.com/wp-content/uploads/2023/03/budget-2023-income-tax-india-tv-4-1675237269.jpg

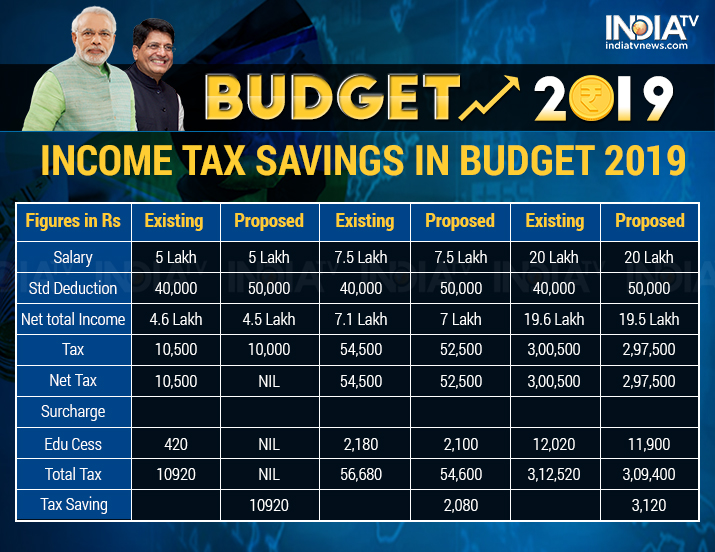

Web 1 f 233 vr 2023 nbsp 0183 32 NEW DELHI Feb 1 Reuters India will raise the personal income tax rebate limit to 700 000 rupees 8 565 under the new tax regime from the previous 500 000 rupees Finance Minister Nirmala Web 1 ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an Web 1 f 233 vr 2023 nbsp 0183 32 In a huge relief to salaried and middle class Union Finance Minister Nirmala Sitharaman while presenting Union Budget 2023 24 in Parliament today said the income tax rebate has been extended on

Download Rebate Income Tax India

More picture related to Rebate Income Tax India

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

https://gstguntur.com/wp-content/uploads/2021/07/Section-87A-Rebate-Income-Tax-Act-768x432.png

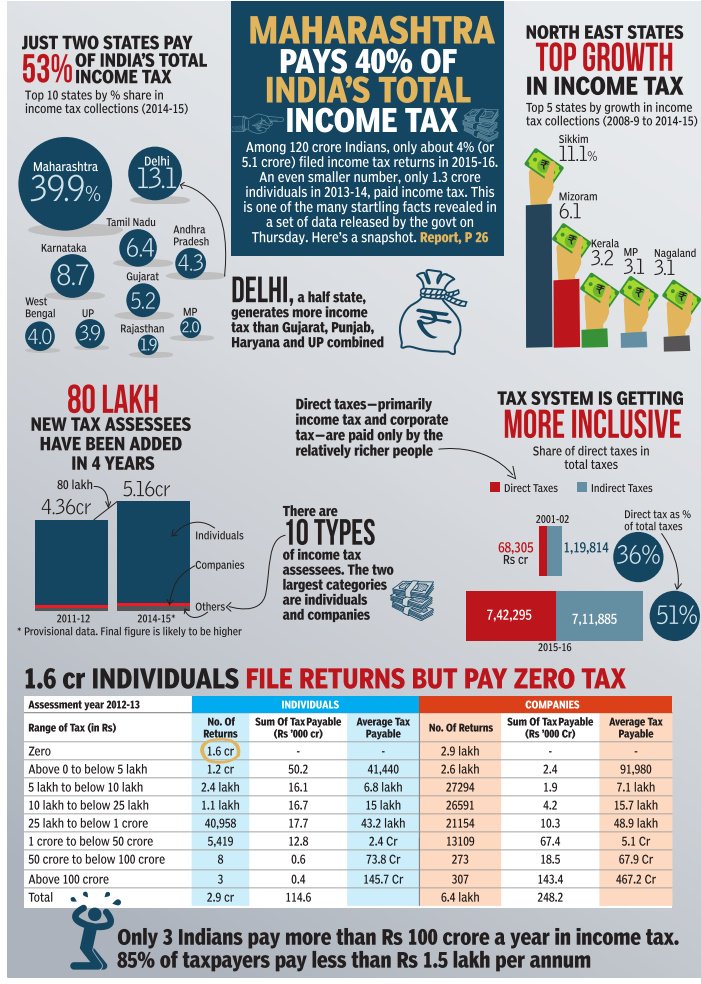

Infographic Income Tax In India Alpha Ideas

https://alphaideas.in/wp-content/uploads/2016/05/ChQRnLWWIAA-lSr.jpg

How You May Not Have To Pay Tax Even With Rs 9 5 Lakhs Income Yadnya

https://i0.wp.com/blog.investyadnya.in/wp-content/uploads/2019/02/transcript-interim-budget-banner.png?fit=1080%2C614&ssl=1

Web 25 mai 2021 nbsp 0183 32 Maximum amount of permissible income tax rebate is Rs 12 500 under Section 87A Hence if your total tax liability is less than Rs 12 500 the entire amount is Web 1 avr 2016 nbsp 0183 32 A unit in the IFSC with specified income and subject to prescribed conditions is eligible for a tax exemption of 100 of the specified income for 10 years at the option

Web 24 mars 2020 nbsp 0183 32 The only way to get this tax rebate is to file an IT return for the financial year However there can be two scenarios the first wherein your gross income is less Web 2 f 233 vr 2023 nbsp 0183 32 As part of its Budget 2023 announcement Finance Minister Nirmala Sitharaman said that the tax rebate has been extended on income up to Rs 7 lakh in

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

https://4.bp.blogspot.com/-ygld82QNGGs/Xd_7fFpO9WI/AAAAAAAAJBU/w2H37lRhli4Tk4pgjN-Ra8So_O_t_RJ-wCK4BGAYYCw/s1600/slab_rate_%25281%2529-20190201043639.png

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

https://akm-img-a-in.tosshub.com/indiatoday/images/bodyeditor/202002/new_income_tax_slabs-1200x1149.jpg?RA2r0ErOqnEHAPszFYqp_R3A8vlGK5kS

https://indianexpress.com/article/explained/ex…

Web 1 f 233 vr 2023 nbsp 0183 32 In her Union Budget speech Finance Minister Nirmala Sitharaman proposed to raise the income tax rebate limit from Rs 5

https://www.bajajfinserv.in/insights/income-tax-rebate

Web 11 avr 2023 nbsp 0183 32 To claim income tax rebate as a Non Resident Indian NRI in India follow these steps Determine residential status Understand your residential status as per the

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Decoding Section 87A Rebate Provision Under Income Tax Act

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

2007 Tax Rebate Tax Deduction Rebates

Interim Budget 2019 Check How Will Income Tax Rebate Announced By Fin

Rebate Income Tax India - Web e Filing of Income Tax Return or Forms and other value added services amp Intimation Rectification Refund and other Income Tax Processing Related Queries 1800 103