Rebate Income Tax Slab Web 2 f 233 vr 2023 nbsp 0183 32 The limit of total income for rebate under section 87A of the Income tax Act 1961 has been increased from Rs 5 lakh to Rs 7 lakh for those opting for the new tax

Web 1 f 233 vr 2023 nbsp 0183 32 Union Budget 2023 income tax slabs New tax regime is default rebate increased from Rs 5 lakh to Rs 7 lakh quot Currently those Web 16 mars 2017 nbsp 0183 32 A resident individual with taxable income up to Rs 5 00 000 will be eligible for a tax rebate of Rs 12 500 or the amount of tax payable whichever is lower Under

Rebate Income Tax Slab

Rebate Income Tax Slab

https://www.basunivesh.com/wp-content/uploads/2018/02/Latest-Income-Tax-Slab-Rates-for-FY-2018-19-AY-2019-20-1280x720.jpg

Corporate Tax Rebate Budget 2022 Rebate2022

https://www.rebate2022.com/wp-content/uploads/2023/05/latest-income-tax-slab-rates-for-fy-2022-23-ay-2023-24-budget-2022.jpg

Income Tax Rebate 10 7 Slab 2 5

https://www.valueresearchonline.com/content-assets/images/47951_20220601-tax_slabs-old_and_new__w1000__.png

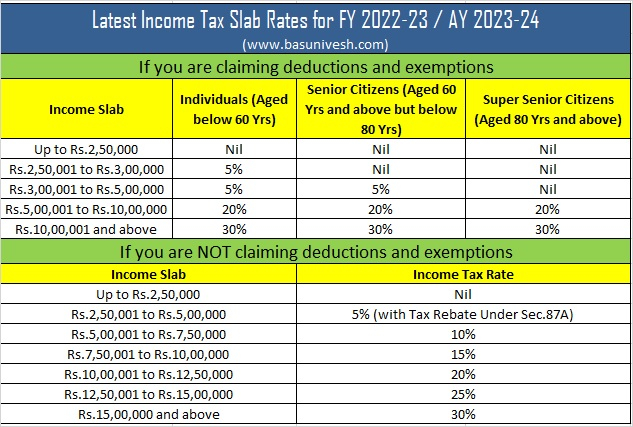

Web 4 f 233 vr 2023 nbsp 0183 32 The number of income tax slabs has been reduced from six to five The tax rebate under Section 87A hiked to taxable income level Web FY 2022 23 Income Tax Slab FY 2023 24 Income Tax Slab NIL Rs 0 Rs 2 5 lakh Rs 0 Rs 3 lakh 5 Rs 2 5 lakh Rs 5 lakh Rs 3 lakh Rs 6 lakh 10 Rs 5 lakh Rs 7 5

Web 13 f 233 vr 2023 nbsp 0183 32 Budget 2023 has further tweaked the tax slabs under the new income tax regime There will not be any tax for income of up to Rs 3 lakh Income above Rs 3 lakh Web 1 f 233 vr 2023 nbsp 0183 32 Persons in the new tax regime with annual income up to Rs 7 lakh will not pay any tax at all Union Finance Minister Nirmala Sitharaman announced several

Download Rebate Income Tax Slab

More picture related to Rebate Income Tax Slab

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

Income Tax Slabs For Ay20 21 Which Itr Option Is Better For You Here

https://static.wixstatic.com/media/78f35a_bd55247cf7cc4428b1d9d1697f6e5542~mv2.png/v1/fill/w_600,h_237,al_c,usm_0.66_1.00_0.01/Tax Slabs2_FY 2019-20_PNG.png

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

https://akm-img-a-in.tosshub.com/indiatoday/images/bodyeditor/202002/new_income_tax_slabs-1200x1149.jpg?RA2r0ErOqnEHAPszFYqp_R3A8vlGK5kS

Web New income tax slab 2023 24 No tax if income is up to Rs 7 5 lakh As a result of deduction rebate and the tweak in the income tax slabs announced in the Budget 2023 salaried pensioners and family Web 6 sept 2023 nbsp 0183 32 Section 87A of the income tax act 1961 was launched to give relief to the taxpayers who fall under the 10 percent tax slab If a person whose total net income does not cross INR 5 lakh can claim the

Web If the individual is an employee the maximum income tax rebate in India they can avail is lesser of 10 of their salary or 10 of their gross income Individuals who are self Web 1 f 233 vr 2023 nbsp 0183 32 By India Today Web Desk The income tax rebate is the one aspect of the budget that the salaried class looks forward to The slabs were modified by Finance

Income Tax Slab Rate For New Tax Regime Fy 2020 21 Gambaran

https://i2.wp.com/www.askbanking.com/wp-content/uploads/2020/04/income-tax-slabs.jpg?fit=660%2C440&ssl=1

Income Tax Slab Ay 2019 2020 In Pdf Carfare me 2019 2020

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

https://economictimes.indiatimes.com/wealth/tax/income-tax-budget-2023...

Web 2 f 233 vr 2023 nbsp 0183 32 The limit of total income for rebate under section 87A of the Income tax Act 1961 has been increased from Rs 5 lakh to Rs 7 lakh for those opting for the new tax

https://indianexpress.com/article/business/bud…

Web 1 f 233 vr 2023 nbsp 0183 32 Union Budget 2023 income tax slabs New tax regime is default rebate increased from Rs 5 lakh to Rs 7 lakh quot Currently those

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Income Tax Slab Rate For New Tax Regime Fy 2020 21 Gambaran

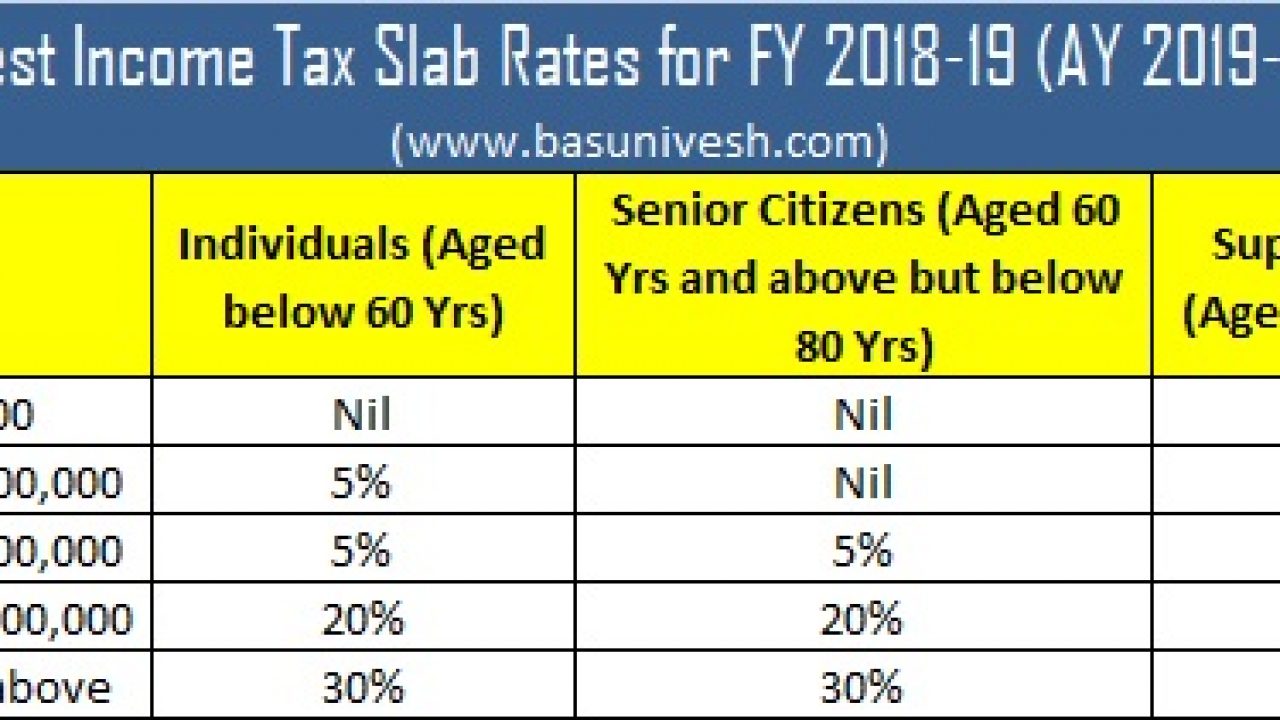

Latest Income Tax Slab Rates FY 2018 19 AY 2019 20 BasuNivesh

Budget 2023 Summary Of Direct Tax Proposals

Treatment Of Standard Deduction Rs 50000 Under The New Tax Regime

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

Old And New Tax Regime Rates For Ay 2022 23 Maju 3D

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax Slab

Rebate Income Tax Slab - Web 1 f 233 vr 2023 nbsp 0183 32 Persons in the new tax regime with annual income up to Rs 7 lakh will not pay any tax at all Union Finance Minister Nirmala Sitharaman announced several