Rebate Income Tax Under Section 80d Web Deduction under section 80D Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D

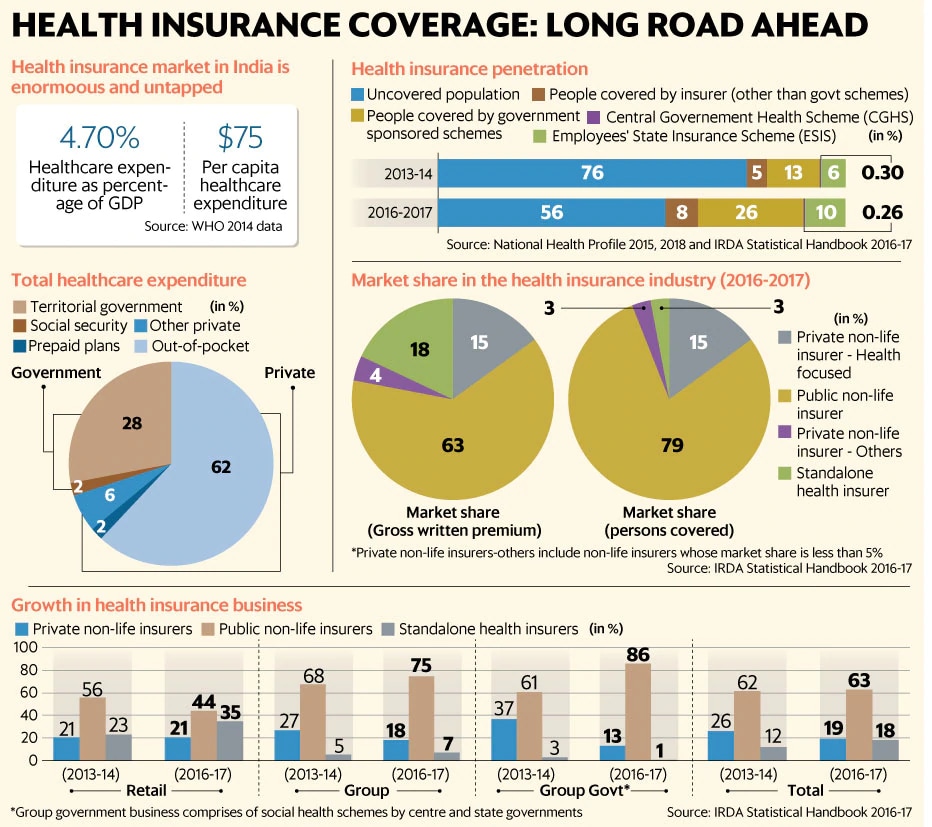

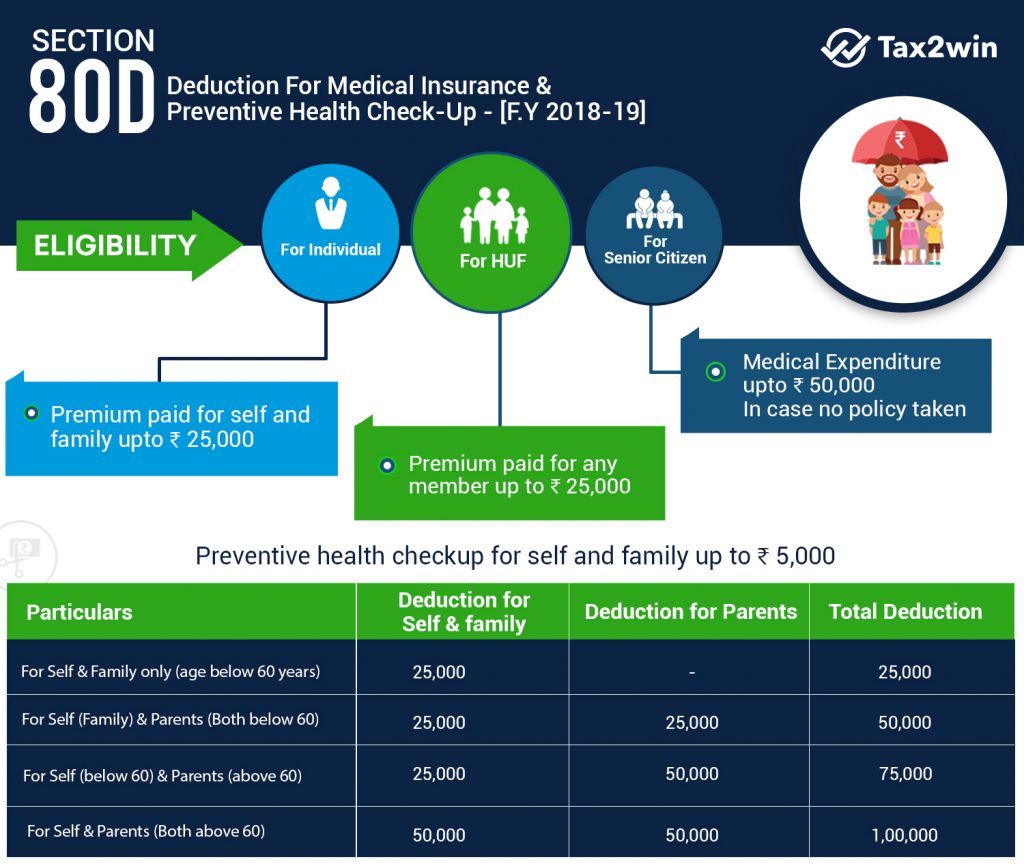

Web 15 f 233 vr 2023 nbsp 0183 32 How much tax is saved under Section 80D The amount of income tax that can be saved under Section 80D depends on the income tax slab in which your taxable Web The Central Government of India provides provisions for taxpayers to claim deductions and benefits in respect to health insurance premium paid

Rebate Income Tax Under Section 80d

Rebate Income Tax Under Section 80d

https://www.policybazaar.com/images/IncomeTax/section-80d-income-tax-act.jpg

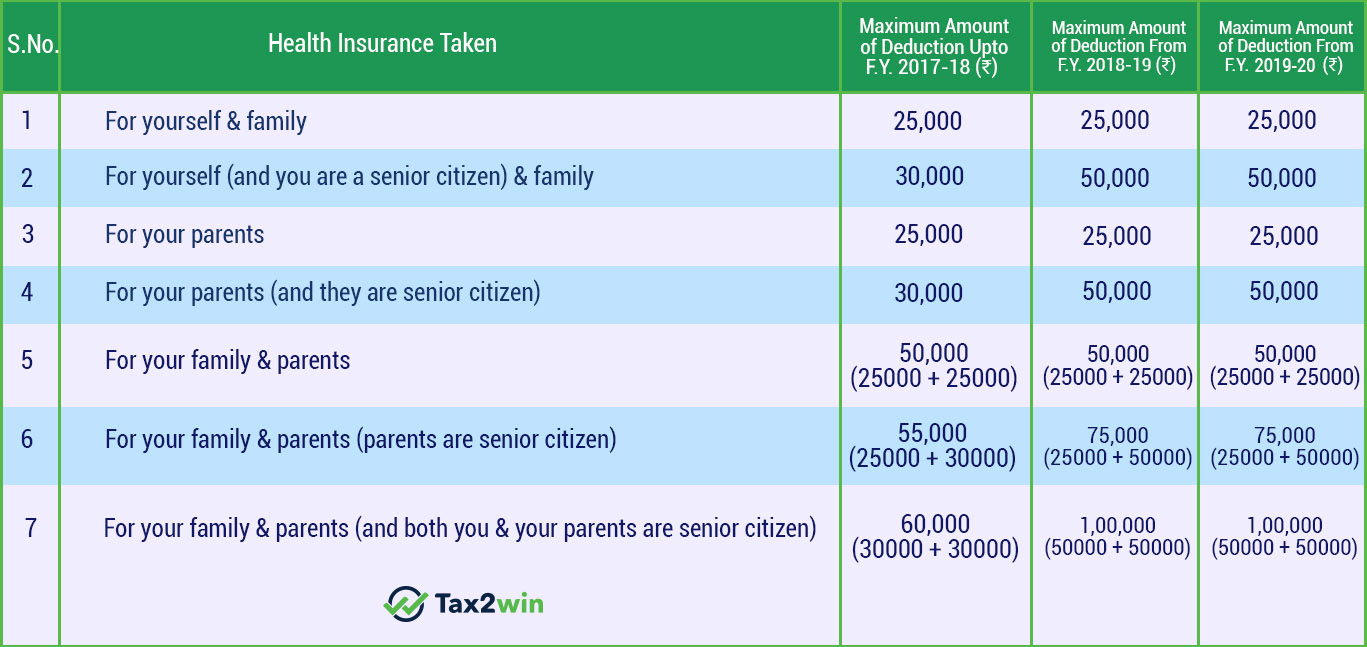

Section 80D Income Tax Deduction For Medical Insurance Preventive

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80D-Income-Tax-Deduction-For-Medical-Insurance-Preventive-Check-Up-1024x866.jpg

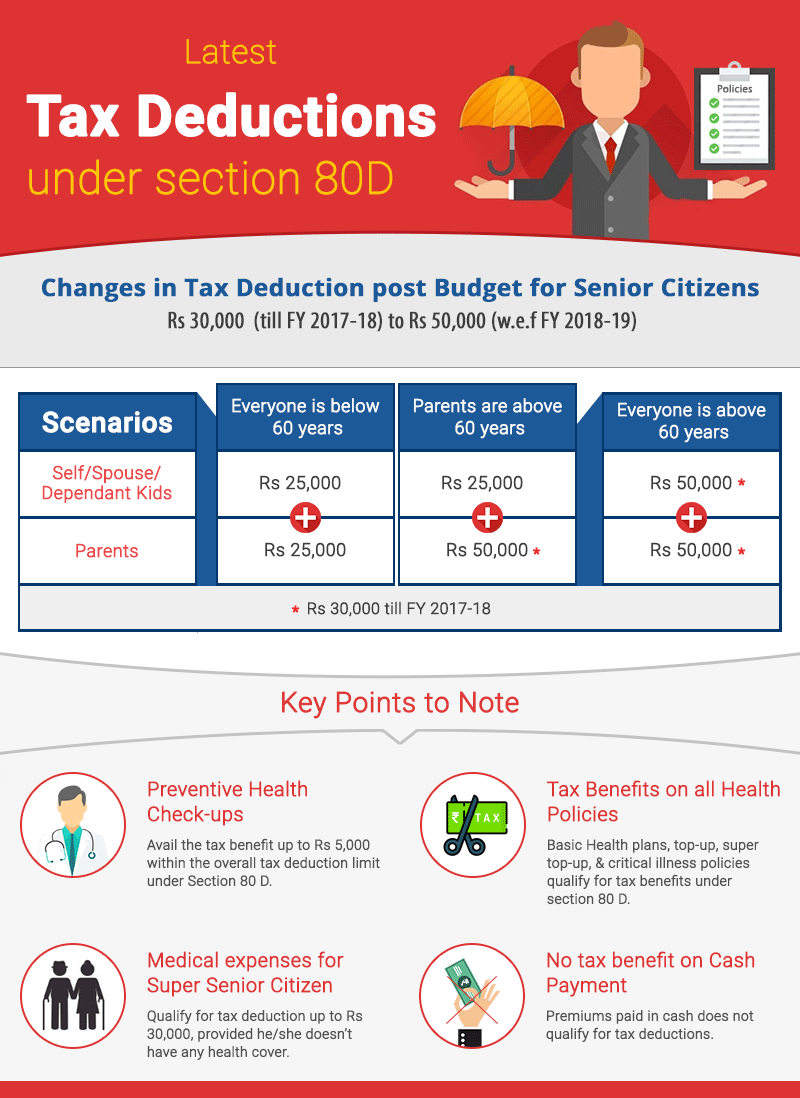

New Tax Benefits Under Section 80D ComparePolicy

https://www.comparepolicy.com/blogs/wp-content/uploads/2018/02/Tax-Deduction-under-Section-80D.png

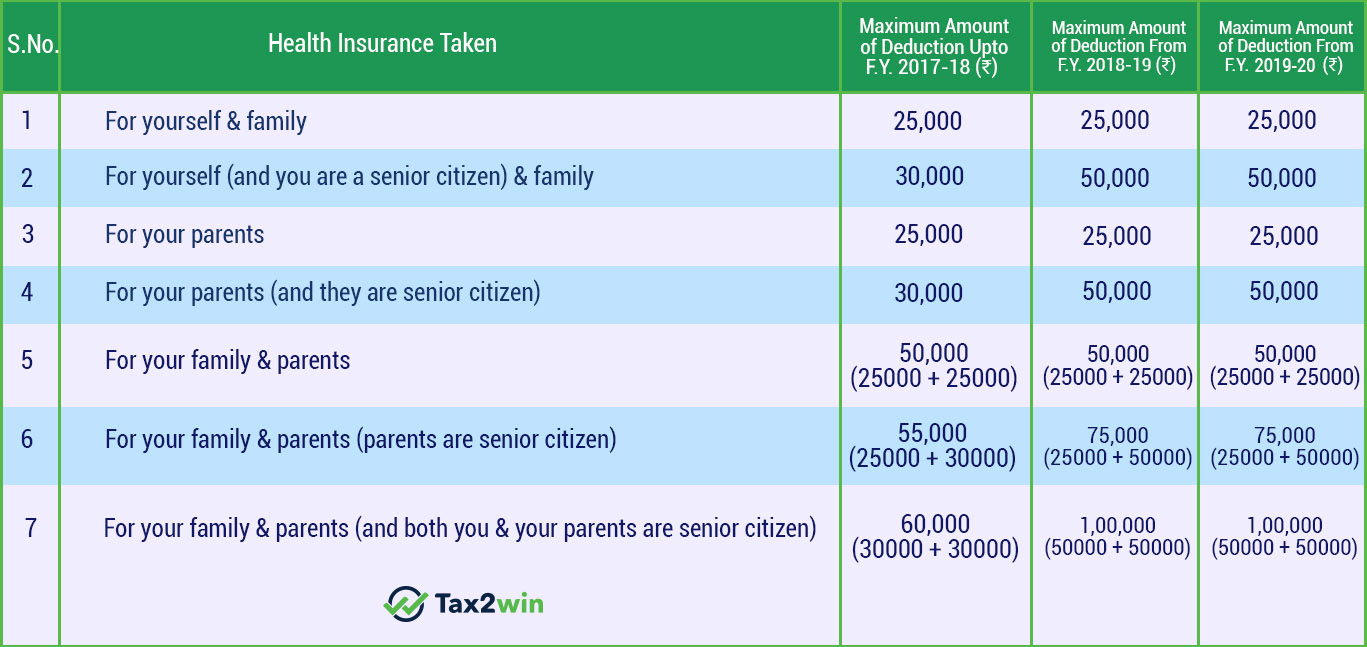

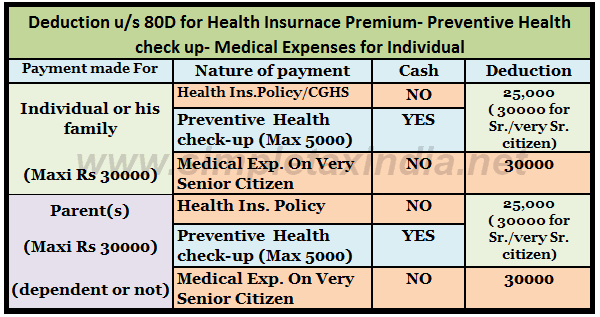

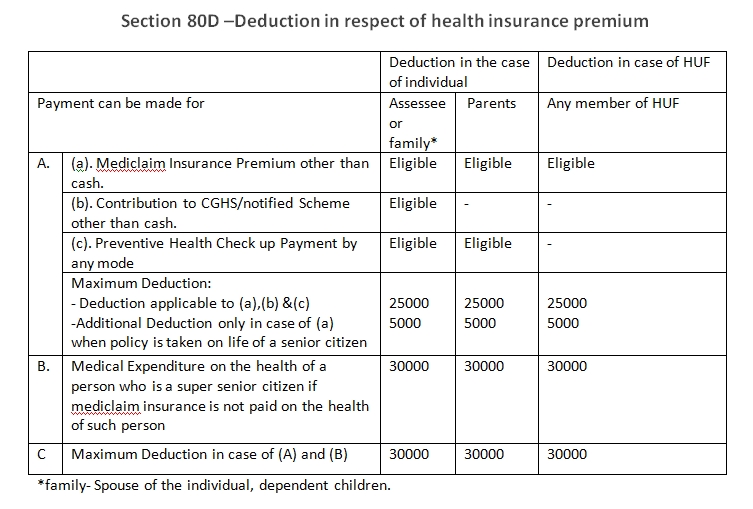

Web 12 sept 2023 nbsp 0183 32 Deductions under Section 80D provide tax savings benefits for expenses related to health and critical illness insurance You can take advantage of Section 80D s Web 8 juil 2020 nbsp 0183 32 Case 1 When the policyholder who is under the age of 60 has opted only for self spouse and children the limit of deduction is fixed at only 25 000 Case 2

Web 9 mars 2023 nbsp 0183 32 Tax deduction under Section 80D Rs 39 000 Rs 12 000 Rs 22 000 Rs 5 000 Web 1 f 233 vr 2023 nbsp 0183 32 As per the Income Tax provisions the tax assessees can claim a deduction under section 80D of the Income Tax for the premium paid towards a mediclaim insurance In this article we will discuss in

Download Rebate Income Tax Under Section 80d

More picture related to Rebate Income Tax Under Section 80d

Income Tax Deductions FY 2016 17 AY 2017 18 Details

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

80D Tax Deduction Under Section 80D On Medical Insurance

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/tax-savings/section-80d.png

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Web 9 mars 2022 nbsp 0183 32 For individuals under 60 years of age the maximum limit of tax deduction is 40 000 whereas for senior citizens the maximum limit of tax deductions is 1 00 000 Web 12 juil 2023 nbsp 0183 32 In order to claim deduction under section 80D it is mandatory to make the payment of premium via modes other than cash The taxpayer will not be eligible for

Web Section 80D of the Income Tax Act 1961 offers tax deductions of up to Rs 25 000 on health insurance premiums paid in a financial year The tax deduction limit increases to Web Guide Income Tax Rebate in Health Insurance Policies Section 80D of the Income Tax Act 1961 essentially offers a tax deduction on an individual s taxable income if they

Section 80D Income Tax Deduction For Medical Insurance Preventive

https://blog.tax2win.in/wp-content/uploads/2019/10/Section-80D-Summary.jpg

6 Tax Saving Tips And Tricks For Salaried Employees RTDS Blog

https://www.myrealdata.in/wp-content/uploads/2019/07/tax-deductions-under-section-80D.png

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.a…

Web Deduction under section 80D Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D

https://economictimes.indiatimes.com/wealth/tax/you-can-claim-maximum...

Web 15 f 233 vr 2023 nbsp 0183 32 How much tax is saved under Section 80D The amount of income tax that can be saved under Section 80D depends on the income tax slab in which your taxable

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Section 80D Income Tax Deduction For Medical Insurance Preventive

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Deduction Under Section 80D Of Income Tax For F Y 2018 19 A Y

Deduction Under Section 80D Of Income Tax For F Y 2018 19 A Y

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

Section 80D Deduction In Respect Of Health Or Medical Insurance

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Rebate Income Tax Under Section 80d - Web 8 juil 2020 nbsp 0183 32 Case 1 When the policyholder who is under the age of 60 has opted only for self spouse and children the limit of deduction is fixed at only 25 000 Case 2