Rebate Irs 2023 IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it s too late

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 Electric Panel Upgrade Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695

Rebate Irs 2023

Rebate Irs 2023

https://s3-eu-central-1.amazonaws.com/cja-blogassets/wp-content/uploads/sites/3/2020/12/11151039/Escalões-IRS-2.png

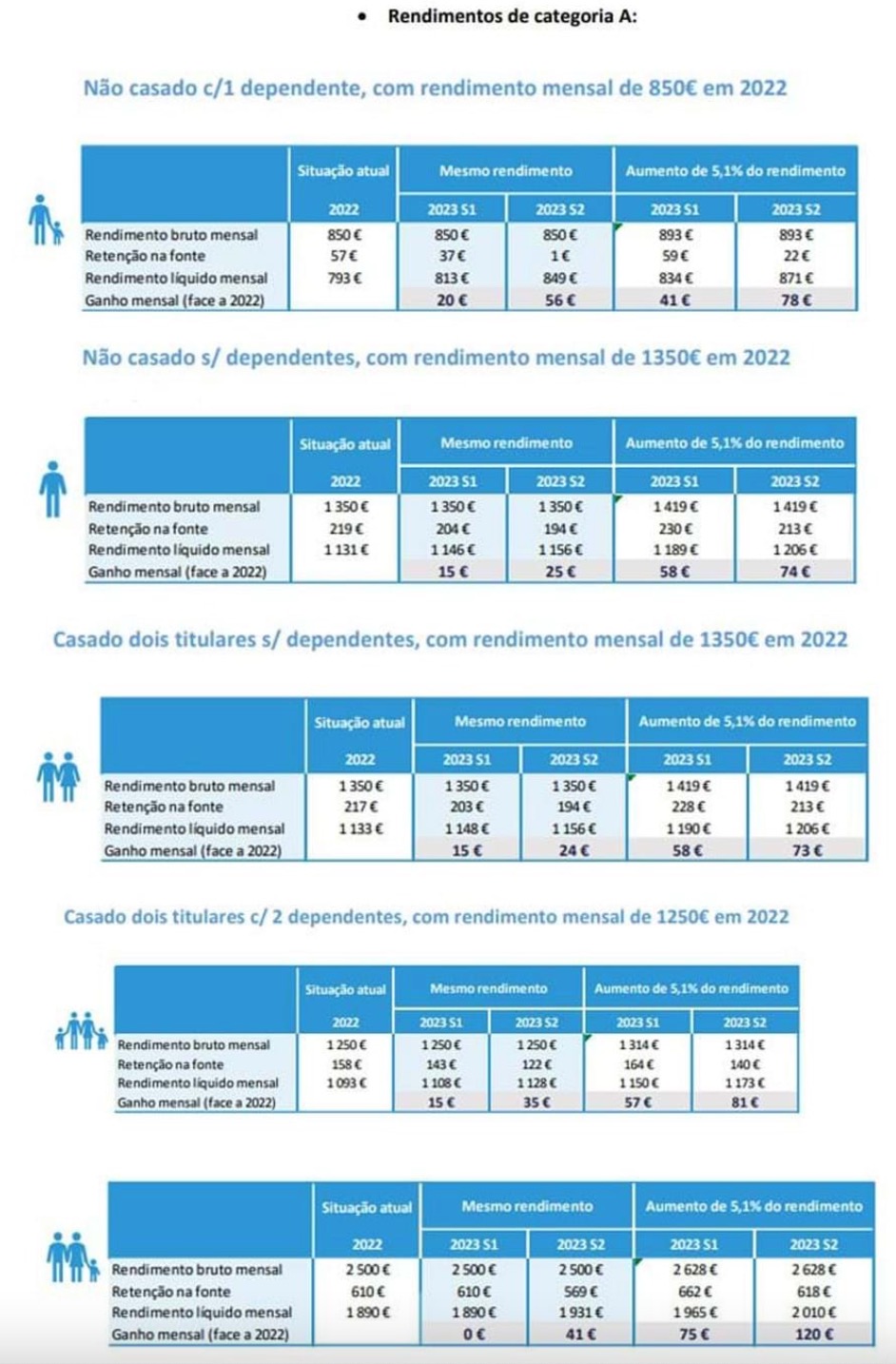

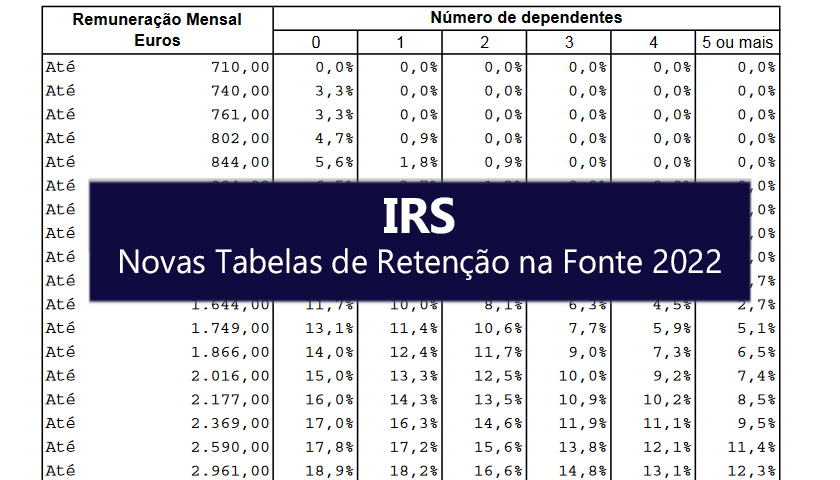

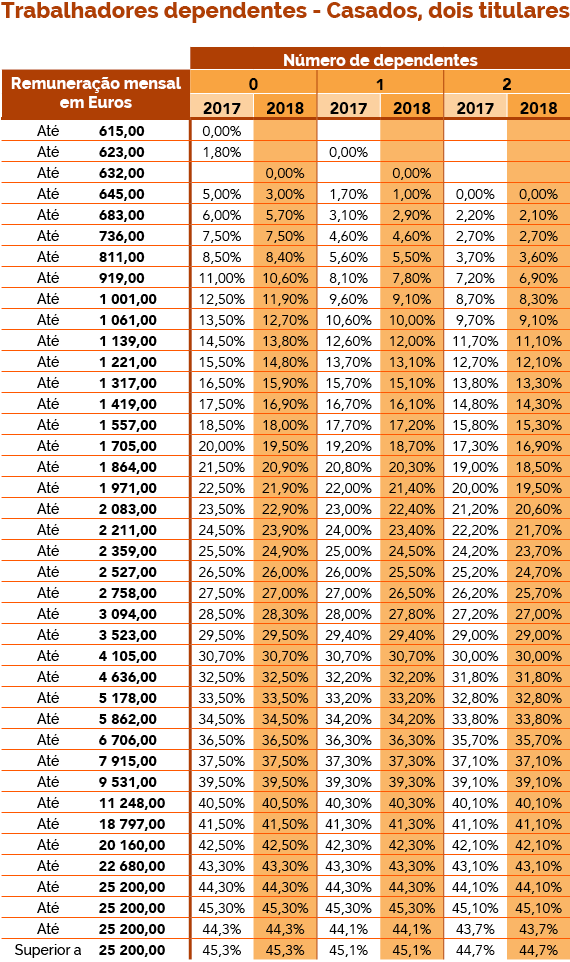

Novas Tabelas De Irs Para 2023 IMAGESEE

https://pplware.sapo.pt/wp-content/uploads/2022/12/rendimento_00.jpg

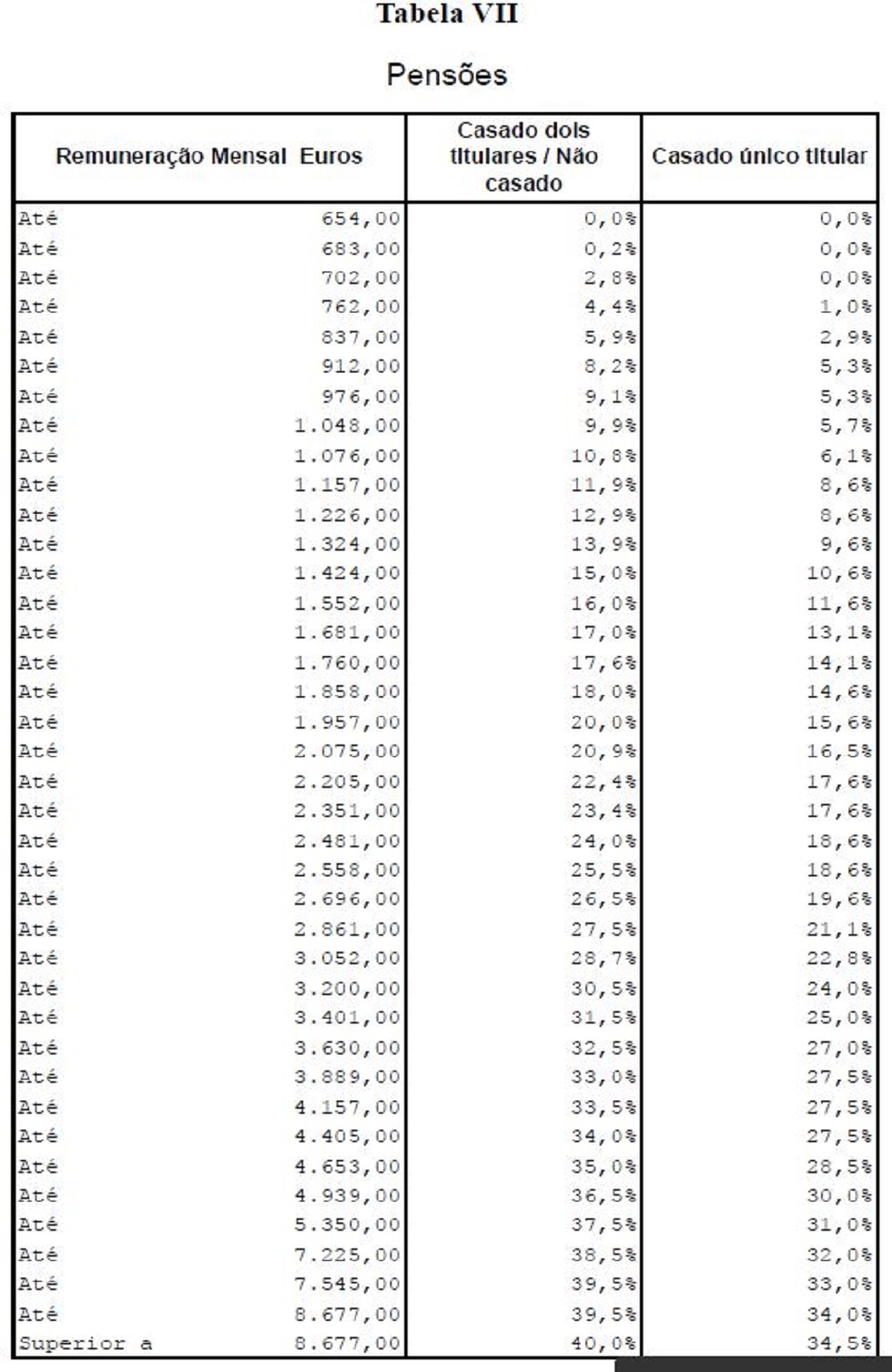

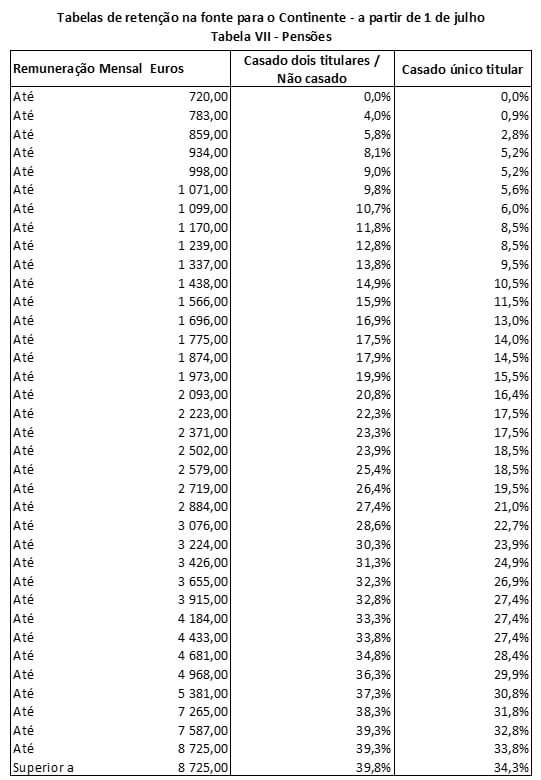

Tabela De Irs 2023 Continente Modelo Folhetos Supermercados IMAGESEE

https://s.economias.pt/upload/tabelas-de-irs-para-pensionistas-8-cke.jpg

The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively The Recovery Rebate Credit is a refundable credit for those who missed out on one or more Economic Impact Payments Starting in 2023 income tax credit amounts will increase and new rebates should become available for making improvements to your home that save energy and support a clean energy future

The Recovery Rebate Credit was established to give those who are entitled to stimulus checks but did not receive them an opportunity to claim them The credit is available only to taxpayers who did not receive all three of the stimulus payments issued by the government See the IRS s Recovery Rebate Credit page for more information about the credit and how to claim it on a 2021 income tax return

Download Rebate Irs 2023

More picture related to Rebate Irs 2023

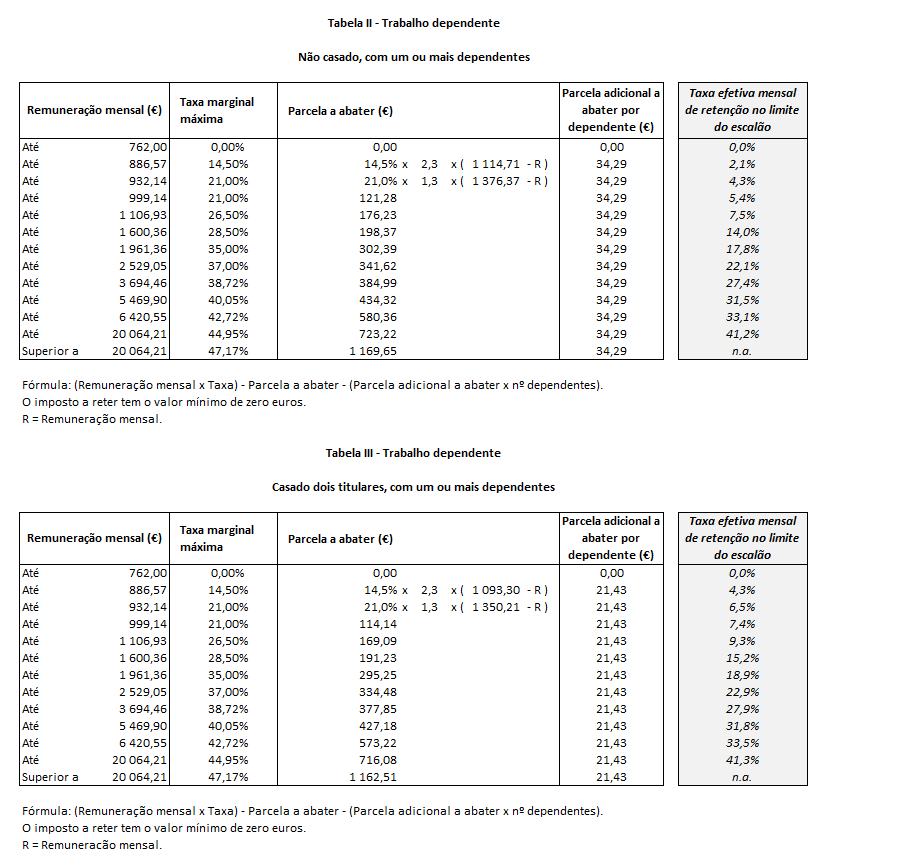

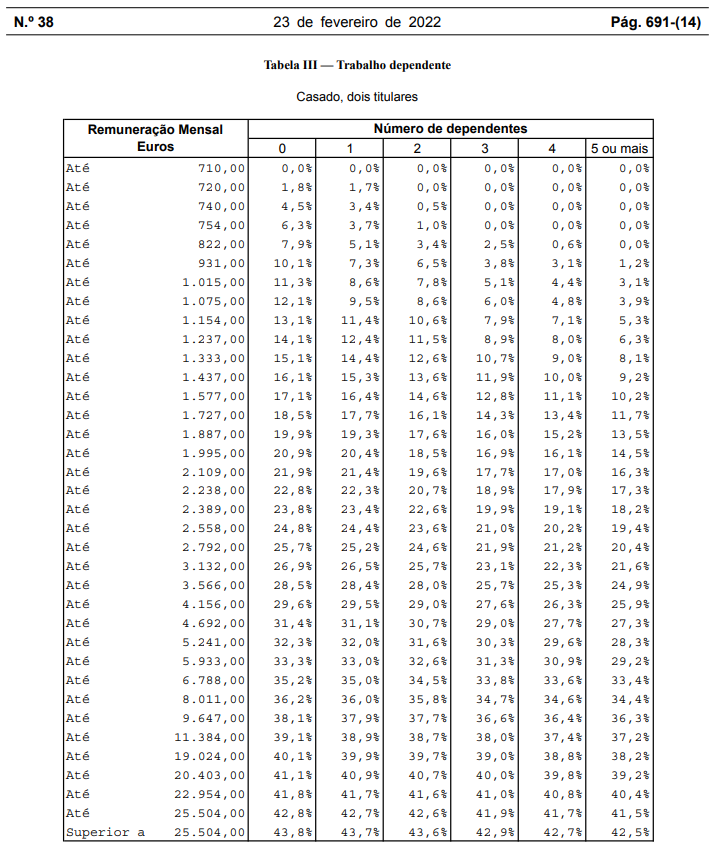

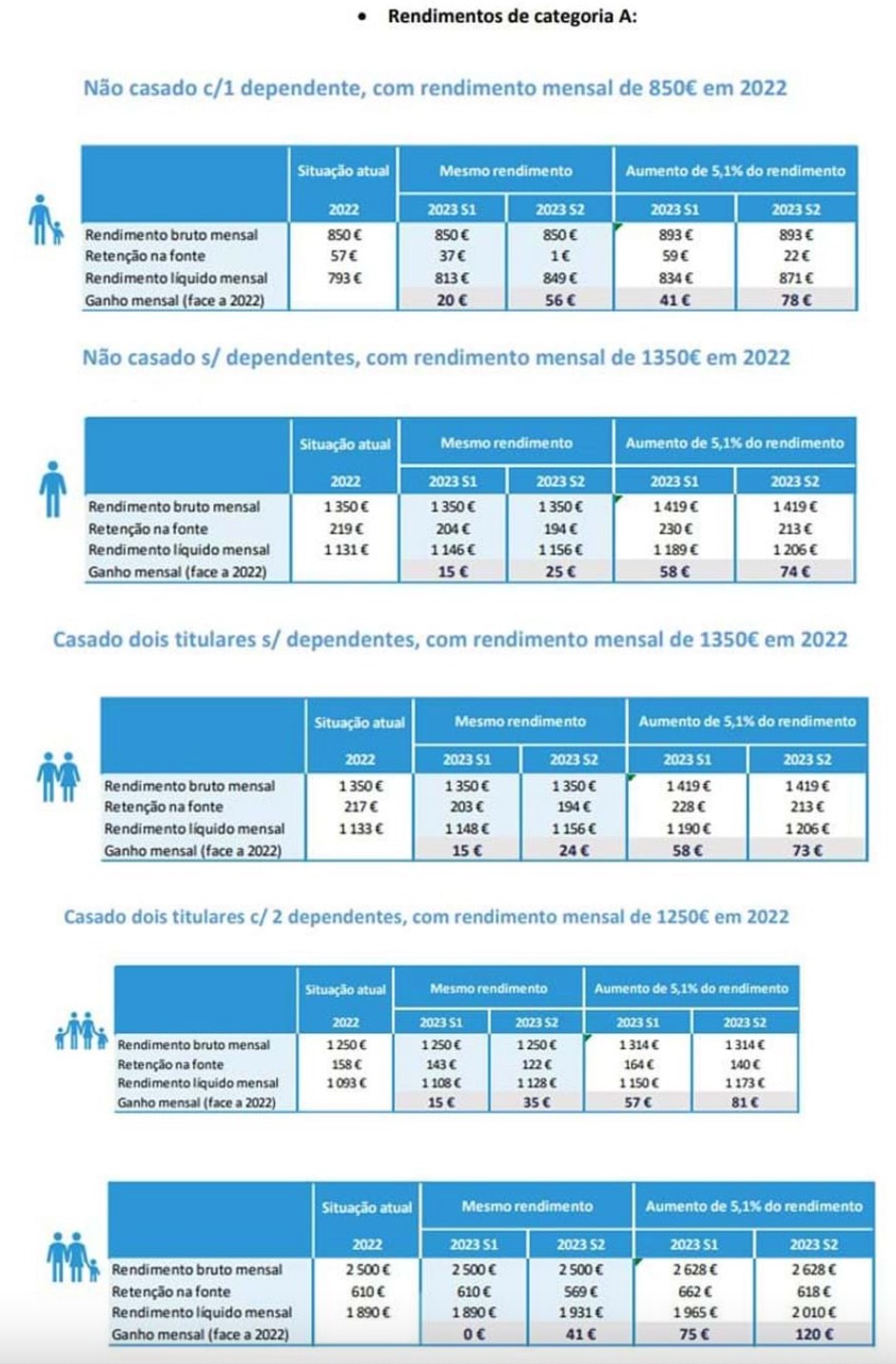

Tabelas De Irs Para 2023 Simulador Ant Examen Renovacion IMAGESEE

https://economiafinancas.com/wp-content/uploads/2023/01/Tabelas-IRS-2o-semestre-de-2023.png

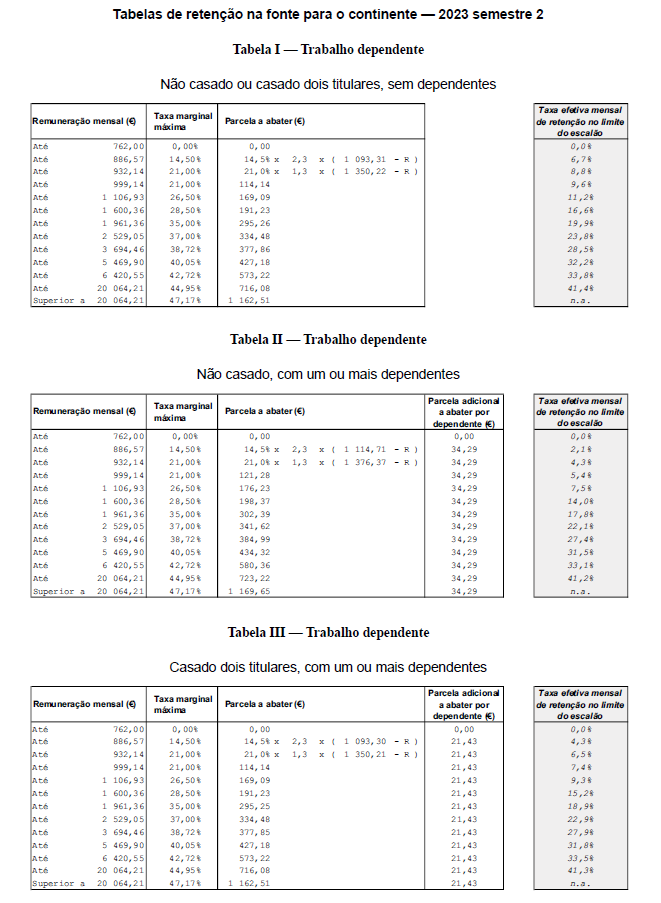

Tabela De Irs 2023 2 Semestre Calendario Google IMAGESEE

https://economiafinancas.com/wp-content/uploads/2022/12/Tabelas-IRS-2023-Segundo-Semestre-PDF.png

Novas Tabelas De Irs 2023 Corrigidas IMAGESEE

https://www.apcmc.pt/wp-content/uploads/irs_novas_tabelas.jpg

May be eligible for a Home Efficiency Rebate which provides up to 8 000 off projects that significantly reduce household energy use How to access Tax Credit Submit IRS Form 5695 if you meet the IRS requirements Rebate Visit our Rebates portal to check the status of your locality s program 1 Go Renewable One of the best ways to save money on electricity is by generating your own Under the Inflation Reduction Act you can get a tax credit for 30 percent of the cost of installing clean energy systems in your home including solar panels wind turbines battery storage and more 2 Get Pumped

The IRS has issued a reminder to those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before the deadline Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the improvements are made As part of the Inflation Reduction Act beginning Jan 1 2023 the credit equals 30 of certain qualified expenses

Tabelas Mensais De Irs Para 2023 IMAGESEE

https://ecoonline.s3.amazonaws.com/uploads/2022/12/tabelas-de-retencao_link-1-01.png

Tabelas De Irs Para 2023 Simulador Image Seedy IMAGESEE

https://economiafinancas.com/wp-content/uploads/2022/02/TABELAS-IRS-2022.png

https://www.irs.gov/newsroom/irs-reminds-eligible...

IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before it s too late

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022

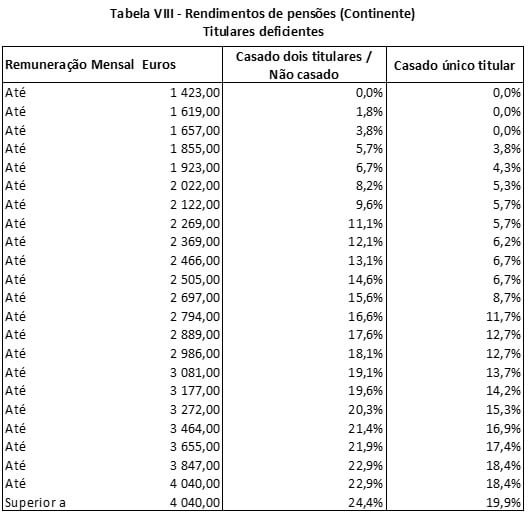

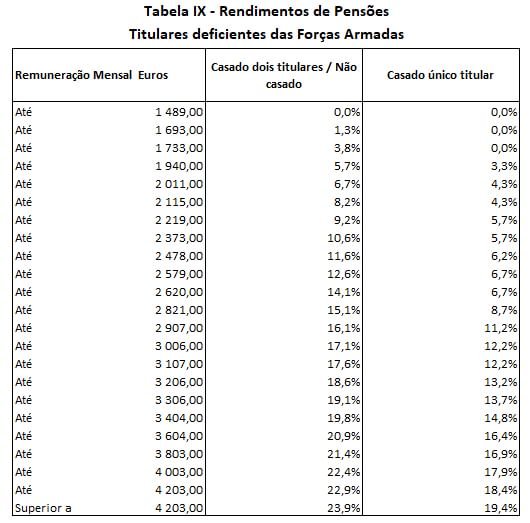

Tabelas De Irs Madeira 2023 IMAGESEE

Tabelas Mensais De Irs Para 2023 IMAGESEE

Tabela De Descontos De Irs 2023 IMAGESEE

Nova Tabelas De Irs 2023

Tabela Do Irs Para 2023 IMAGESEE

Tabelas De Irs 2023 Madeira Joram Pronunciation IMAGESEE

Tabelas De Irs 2023 Madeira Joram Pronunciation IMAGESEE

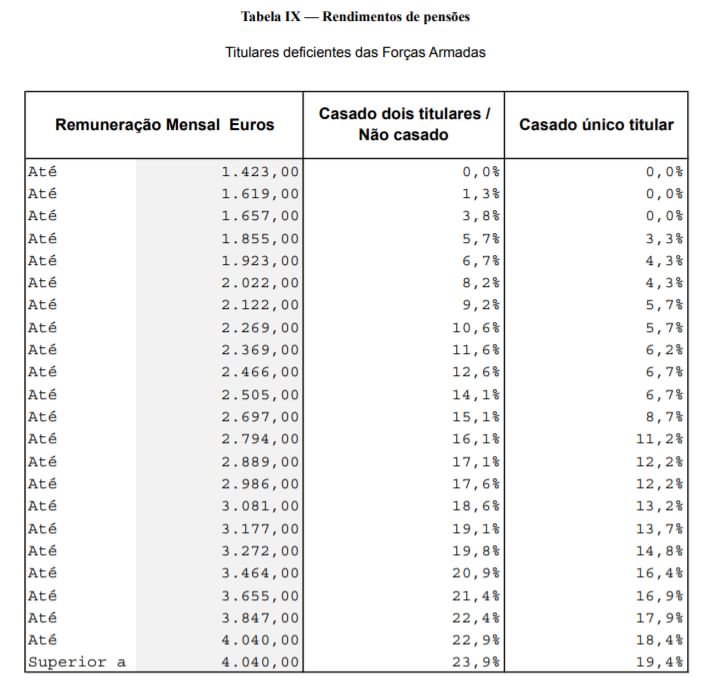

Tabela De Irs 2023 Pensionistas Significado IMAGESEE

Tabela Irs 2023 Simulador Imt Apemip IMAGESEE

Novas Tabelas De Irs Para 2023 IMAGESEE

Rebate Irs 2023 - Windows Skylights Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings Claim the credits using the IRS Form 5695 Instructions for Form 5695