Rebate Of Income Tax Is Defined As Per Section Section 87A of the Income Tax offers a rebate to specific taxpayers that can help them lower their income tax liability A rebate is offered when the taxpayer s total taxable income falls above the basic exemption limit

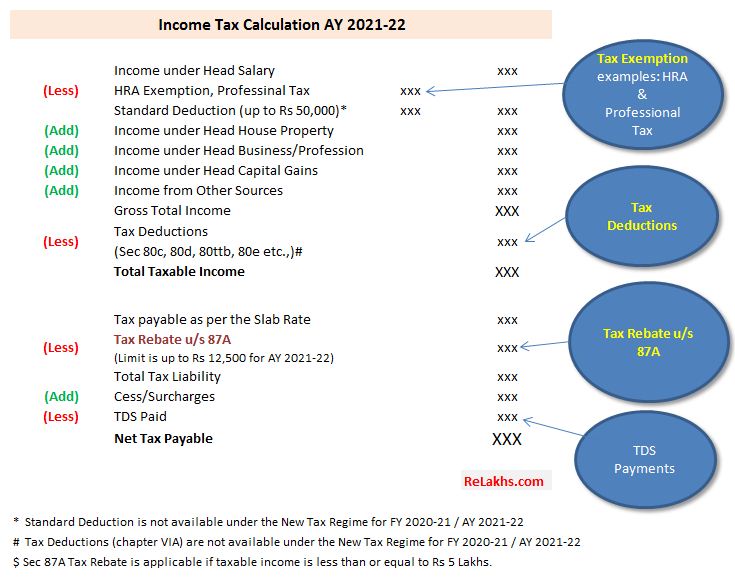

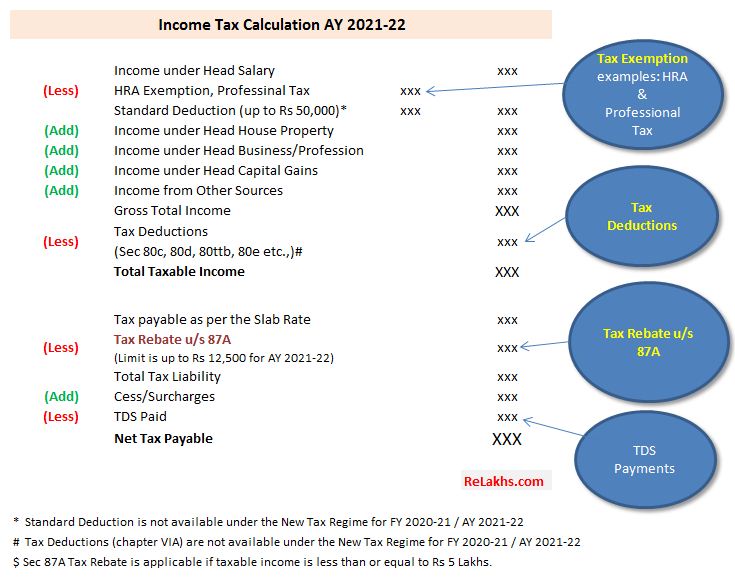

REBATES AND RELIEFS A Rebate of income tax Rebate to be allowed in computing income tax 87 1 In computing the amount of income tax on the total income of an assessee with which he is chargeable for any assessment year there shall be allowed from the amount of income tax a s computed before allowing the deductions under this Chapter What is Rebate Section 87 In simple terms rebate is deduction from income tax payable Here Income Tax Payable Tax Payable Cess Surcharge Interest if any TDS Note that Rebate is deduction from tax payable and not from taxable income Aggregate amount of Rebate shall not exceed Income Tax Payable in any case Rebates for

Rebate Of Income Tax Is Defined As Per Section

Rebate Of Income Tax Is Defined As Per Section

https://www.planyourfinances.in/wp-content/uploads/2019/11/Difference-Between-Income-Tax-Deductions-Exemptions-and-Rebate.jpg

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

http://cachandanagarwal.com/wp-content/uploads/2021/04/Income-Tax-Rebate.jpeg

Rebate Of Income Tax Under Section 87A YouTube

https://i.ytimg.com/vi/lgmblbkc7Qs/maxresdefault.jpg

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable income is upto Rs 5 lakhs then he will get the tax benefit of Rs 12 500 or the amount of tax Explore the benefits of Section 87A of the Income Tax Act 1961 and learn how eligible resident individuals can reduce their tax liability with this rebate This guide covers eligibility rebate limits and how to claim for FY 2024 25 and AY 2025 26

As per section 237 to 245 of the income tax act refund arises when the amount of tax paid by a person is greater than the taxed amount Section 87A of the income tax act 1961 was launched to give relief to the taxpayers who fall under the 10 percent tax slab Section 87A of the Income Tax Act 1961 was introduced in Finance Act 2013 and was further amended As per Finance Act 2017 a rebate shall be allowed to the taxpayers being resident individual whose net total income does not exceeds Rs 3 50 000

Download Rebate Of Income Tax Is Defined As Per Section

More picture related to Rebate Of Income Tax Is Defined As Per Section

Section 87A Of Income Tax Act Claim 12500 Income Tax Rebate For FY

https://www.aubsp.com/wp-content/uploads/income-tax-rebate-750x422.jpg

Rebate Of Income tax In Case Of Certain Individuals TaxDose

https://taxdose.b-cdn.net/wp-content/uploads/2018/05/Rebate-of-incometax-in-case-of-certain-individuals3.png

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

As per Section 87A an income tax rebate is proposed for people who are having a salary less than the pre defined limit The Income Tax Act of 1961 provides several provisions that offer tax relief to taxpayers to reduce their tax liabilities Claiming a rebate under Section 87A provides significant tax relief to eligible individuals with an annual income up to 5 lakhs Section 87 A s rebate is a valuable provision aimed at reducing tax burdens for resident individuals including senior citizens aged 60 to 79 years

Rebate under section 87A is allowed from tax payable before levy of Education cess secondary and higher education cess Surcharge The amount of rebate is 100 income tax liability subject to maximum limits as under As per recent income tax slab rates an Indian resident with a total income of up to INR 5 lakh in a financial year can claim a rebate under section 87A The maximum limit on a rebate under Section 87A is 100 up to Rs 12 500 in a financial year

Rebate Under Section 87A AY 2021 22 CapitalGreen

https://capitalgreen.in/wp-content/uploads/2021/01/Income-Tax-Rebate-Vs-Tax-Exemption-Vs-Tax-Deduction-FY-2020-21-AY-2021-22.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

https://www.adityabirlacapital.com/abc-of-money/income-tax-rebate

Section 87A of the Income Tax offers a rebate to specific taxpayers that can help them lower their income tax liability A rebate is offered when the taxpayer s total taxable income falls above the basic exemption limit

https://taxmacs.com/wp-content/uploads/2018/05/8...

REBATES AND RELIEFS A Rebate of income tax Rebate to be allowed in computing income tax 87 1 In computing the amount of income tax on the total income of an assessee with which he is chargeable for any assessment year there shall be allowed from the amount of income tax a s computed before allowing the deductions under this Chapter

Rebate Of Income Tax Under Section 87A YouTube

Rebate Under Section 87A AY 2021 22 CapitalGreen

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Tax Rebate Defined taxservices Www smarttaxservicestx Tax

Rebate U s 87A Of I Tax Act Income Tax

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Income Tax Rebate Under Section 87A Rebate For Financial Year GST

Income Tax Rebate Under Section 87A

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

Rebate Of Income Tax Is Defined As Per Section - Taxpayers are entitled to claim a rebate under section 87A of the Income Tax I T Act 1961 which enables them to pay nil tax when their income is up to 5 lakh in the old tax regime and