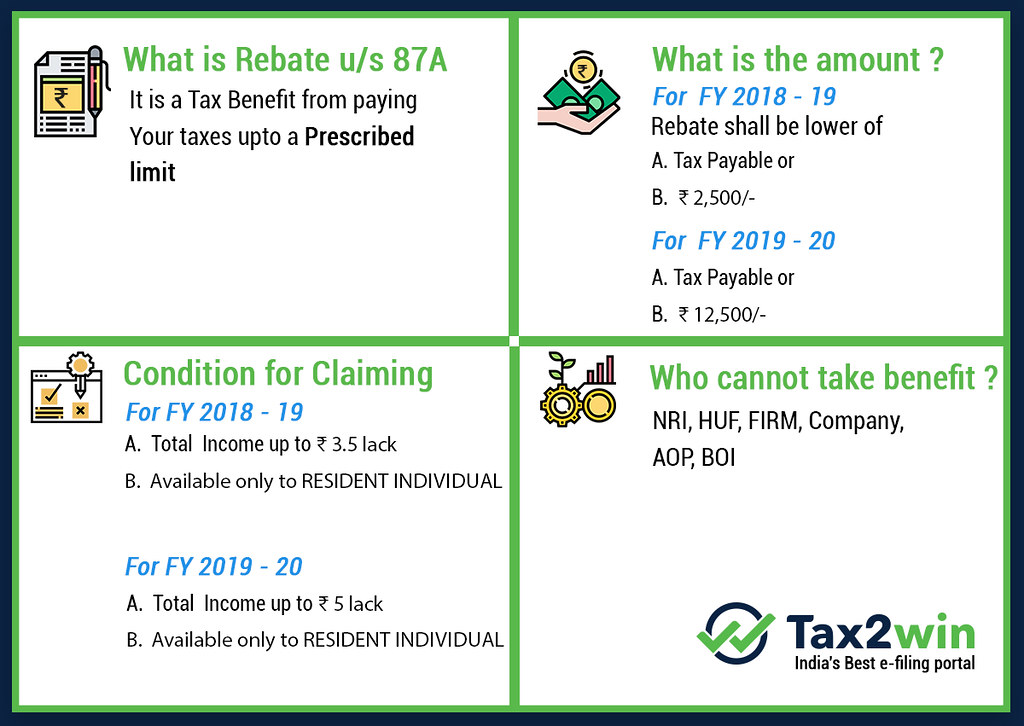

Rebate Of Tax U S 87a Web 3 Feb 2023 nbsp 0183 32 If your net taxable income does not exceed Rs 7 lakh you are eligible for the tax rebate under Section 87A This rebate will be automatically taken into account at the time of filing the income tax return The tax payable will be shown as zero If you are opting for the old tax regime

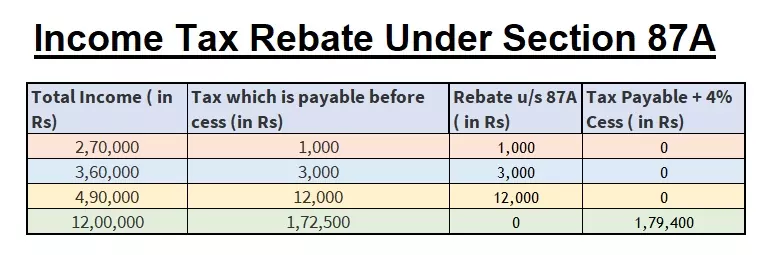

Web 4 Juni 2023 nbsp 0183 32 A rebate u s 87A is available if his total income during the previous year does not exceed Rs 7 00 000 Rebate is available to the extent of Rs 25 000 and no rebate will be available if total income exceeds Rs 7 00 000 The situation is exhibited in the Table given herein below New Marginal Scheme Web 28 Dez 2023 nbsp 0183 32 Rs 4 00 000 Since his TTI is below the threshold of Rs 5 00 000 hence taxpayer Mr Virat is

Rebate Of Tax U S 87a

Rebate Of Tax U S 87a

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

Rebate Under 87a Of Income Tax REBATE UNDER 87A OF INCOME TAX ACT FOR

https://i.ytimg.com/vi/KePXPu9nUAQ/maxresdefault.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Web For the fiscal years 2021 22 and 2022 23 AY 2022 23 and AY 2023 24 senior citizens with taxable income up to Rs 5 00 000 can claim a tax rebate u s 87A The rebate amount is either Rs 12 500 or the amount of tax payable whichever is lower This applies to both the old and new tax regimes Web 9 Dez 2022 nbsp 0183 32 As per the Income Tax Act 1961 if you have gross taxable income below 5 lakhs per year you can claim a tax rebate u s 87A We can also easily claim an income tax rebate of around 12 500 via tax SOP self occupied properties On the contrary if your annual income exceeds 5 lakhs you must pay the tax per your slab rate

Web 1 Dez 2023 nbsp 0183 32 Rebate under section 87A of the Income Tax Act helps taxpayers to reduce their tax liability Resident individuals with a net taxable income less than or equal to INR 5 00 000 can claim a tax rebate of a maximum of INR 12 500 or the amount of tax payable whichever is lower under both tax regimes Web What is tax rebate u s 87A A tax rebate is a type of discount offered on your tax

Download Rebate Of Tax U S 87a

More picture related to Rebate Of Tax U S 87a

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

https://i.ytimg.com/vi/TYfP6LlV2QU/maxresdefault.jpg

Rebate U s 87A Tax Slab Format For Computing Tax Liability Session 23

https://i.ytimg.com/vi/pdHTAr-HPP0/maxresdefault.jpg

Tax Rebate Section 87A With Examples Income Tax Calculation With Old

https://i.ytimg.com/vi/AxcNywrn8AQ/maxresdefault.jpg

Web Vor 2 Tagen nbsp 0183 32 An image of an electric car charging is overlaid on money Changes to the federal electric vehicle EV tax credit are set to take effect Jan 1 reflecting a push by the Biden administration to Web Vor 6 Tagen nbsp 0183 32 A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models qualify

Web 24 Okt 2023 nbsp 0183 32 The tax rebate u s 87A allows a taxpayer to reduce his her tax liability marginally depending on the net total income In this article we will cover the eligibility steps to claim points to keep in mind while claiming the Web The income tax rebate under Section 87a provides some relief to the taxpayers who fall under the tax category of 10 Any individual whose annual net income does not exceed Rs 5 Lakh qualifies to claim tax rebate under Section 87a of the Income Tax Act 1961 This implies an individual can get a rebate on the tax of up to Rs 2 000

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2022 23 In Hindi

https://i.ytimg.com/vi/jocxPhsi0f0/maxresdefault.jpg

REBATE U S 87A INCOME TAX ACT REBATE 87A Rebate 87A

https://i.ytimg.com/vi/mgUSJnyzCJA/maxresdefault.jpg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 Feb 2023 nbsp 0183 32 If your net taxable income does not exceed Rs 7 lakh you are eligible for the tax rebate under Section 87A This rebate will be automatically taken into account at the time of filing the income tax return The tax payable will be shown as zero If you are opting for the old tax regime

https://taxguru.in/income-tax/marginal-relief-u-s-87a-tax-regime-u-s...

Web 4 Juni 2023 nbsp 0183 32 A rebate u s 87A is available if his total income during the previous year does not exceed Rs 7 00 000 Rebate is available to the extent of Rs 25 000 and no rebate will be available if total income exceeds Rs 7 00 000 The situation is exhibited in the Table given herein below New Marginal Scheme

Rebate U s 87A Of I Tax Act Income Tax

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2022 23 In Hindi

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

All You Need To Know About 87a Tax Rebate For Annual Year 2017 18

Income Tax Sec 87A Amendment Rebate YouTube

Rebate U s 87A

Rebate U s 87A

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

Income Tax Rebate 2024

1 Rebte Of Tax U s 87A Income Tax YouTube

Rebate Of Tax U S 87a - Web 9 Dez 2022 nbsp 0183 32 As per the Income Tax Act 1961 if you have gross taxable income below 5 lakhs per year you can claim a tax rebate u s 87A We can also easily claim an income tax rebate of around 12 500 via tax SOP self occupied properties On the contrary if your annual income exceeds 5 lakhs you must pay the tax per your slab rate