Rebate On Agricultural Income For Ay 2023 23 Tax Rebate Under Section 87A Find out Who can claim Income Tax Rebate u s 87A for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 Know how to claim section 87A rebate in ClearTax Software

There is a complete tax rebate on agriculture income in these cases If your total agricultural income is less than Rs 5 000 p a If the income from agricultural land is the only source of income i e no other income Is rebate 87A applicable on agricultural income Yes The resident individuals earning from agricultural income sources are eligible to claim tax rebate under section 87A I have agricultural income as the only source of income should I file income tax return It is not required to file IT returns if agriculture is your only source of

Rebate On Agricultural Income For Ay 2023 23

Rebate On Agricultural Income For Ay 2023 23

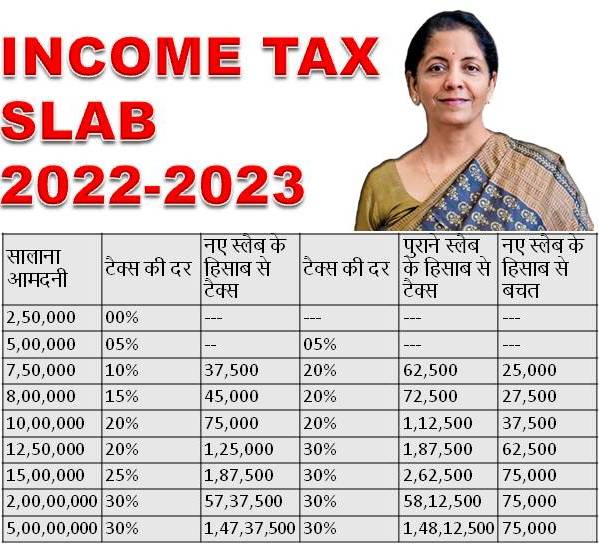

https://www.wecanspirit.com/wp-content/uploads/2022/02/Income-Tax-Slab-for-AY-2022-23.jpg

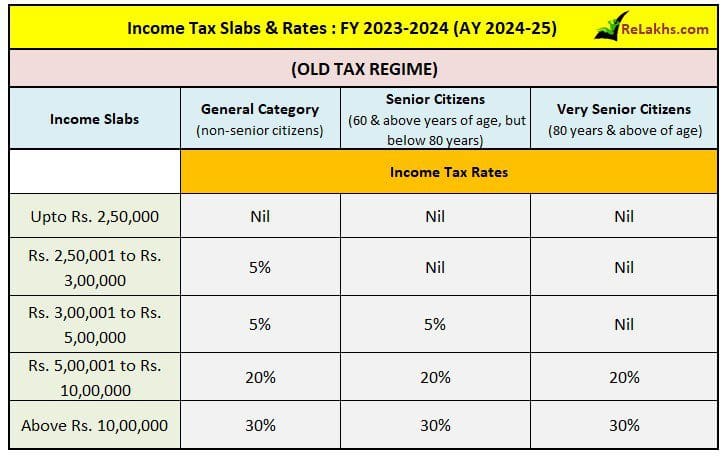

Know The New Income Tax Slab Rates For FY 2023 24 AY 2024 25

https://academy.tax4wealth.com/public/storage/uploads/1684828745-know-the-new-income-tax-slab-rates-for-fy-2023-24-ay-2024-25.jpeg

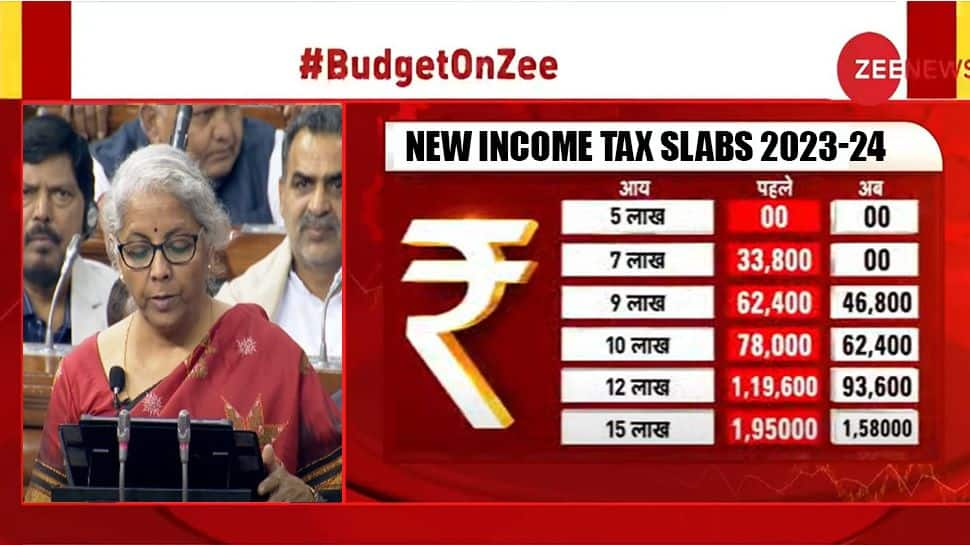

New Income Tax Slabs 2023 24 No Income Tax Till Rs 7 Lakh Check New

https://english.cdn.zeenews.com/sites/default/files/2023/02/01/1148068-income-tax-slab.jpeg

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under 3 Yes income tax rebate u s 87A is available on taxable income which includes agricultural income as well Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount

Section 87A provides a rebate from the total tax liability of an assessee being a resident individual in India whose total income is not more than 5 00 000 and 7 00 000 in the new regime for FY 2023 24 The new income tax regime which will be effective from FY 2023 24 AY 2024 25 has changed the rebate amount under Section 87A Under this regime if you are a resident individual whose taxable income is up to INR 7 00 000 then you can avail of

Download Rebate On Agricultural Income For Ay 2023 23

More picture related to Rebate On Agricultural Income For Ay 2023 23

Income Tax Slab Rates For AY 2023 24

https://eadvisors.in/wp-content/uploads/2022/12/Income-tax-Slab-Rates-for-AY-2023-24.jpg

Income Tax Rates For Computation Of Taxable Income AY 2023 24

https://www.taxmann.com/post/wp-content/uploads/2022/11/income-tax-rates.jpg

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Claim tax rebate under Section 87A only when the income does not exceed 5 lakhs The maximum rebate under section 87A for AY 2024 25 FY 2023 24 is 25 000 under the new tax regime and 12 500 under the optional tax regime This rebate is applicable under section 87A of the Income Tax Act Click to view the list of Tax Tools including Tax Calculator Income tax Calculator and more Click to view the institutions registered under section 80G 12 A and more As amended upto Finance Act 2023

Marginal Relief under section 87A of Income Tax Act 1961 for New Tax Regime u s 115BAC 1A Presently rebate is allowed u s 87A of Rs 12 500 in old regime of Income Tax if any resident individual whose total income during the previous year does not exceed Rs 5 00 000 A complete tax rebate is possible if The total agricultural income is Rs 5 000 The income from agricultural land is your only source of income no other income You have both agricultural income and other income The total income excluding agricultural income is less than the basic exemption limit

Income Tax Slab Rates For Fy 2023 24 Ay 24 25 SIMPLE TAX INDIA

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi6r0URXbbBko-rEyglNqM6x1NZ7YdV83bhq1vxfoQA-vw4tbDgkVGLwKENBgCUQAFw3p18YyJXyT2XTX7bIch_uzT5g-ra8C9gnzjRGP5rNQY_afcmkoZACn28Zd3m1VHWaTI2tXyVnMKv_Xk8u7HyK6E1W8cqIpXTDHIjuvZQG-5Fdnopdpjy01EgeA/w1200-h630-p-k-no-nu/Income Tax Slab Rates Fy 2023-24 Ay 2024-25.png

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

https://academy.tax4wealth.com/public/storage/uploads/1686567553-file-income-tax-return-for-ay-2023-24-by-july-31st-2023.jpg

https://cleartax.in/s/income-tax-rebate-us-87a

Tax Rebate Under Section 87A Find out Who can claim Income Tax Rebate u s 87A for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 Know how to claim section 87A rebate in ClearTax Software

https://tax2win.in/guide/income-tax-agricultural-income

There is a complete tax rebate on agriculture income in these cases If your total agricultural income is less than Rs 5 000 p a If the income from agricultural land is the only source of income i e no other income

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

Income Tax Slab Rates For Fy 2023 24 Ay 24 25 SIMPLE TAX INDIA

Income Tax Slab For Ay 2023 24 2023 Updates

Surcharge For AY 2023 24

Income Tax Slabs For FY 2022 23 AY 2023 24 FinCalC Blog

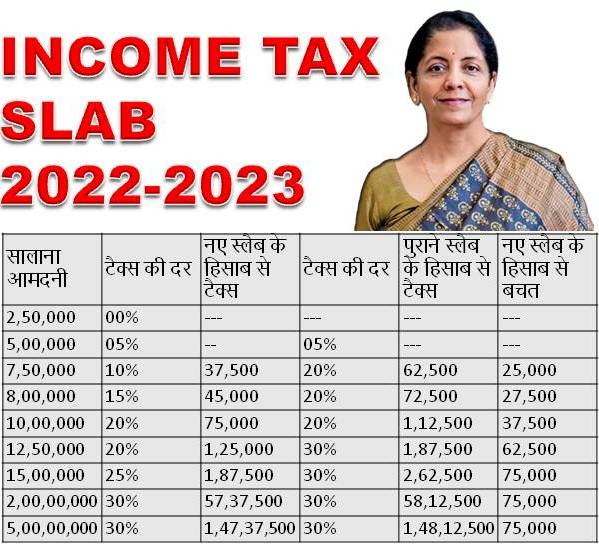

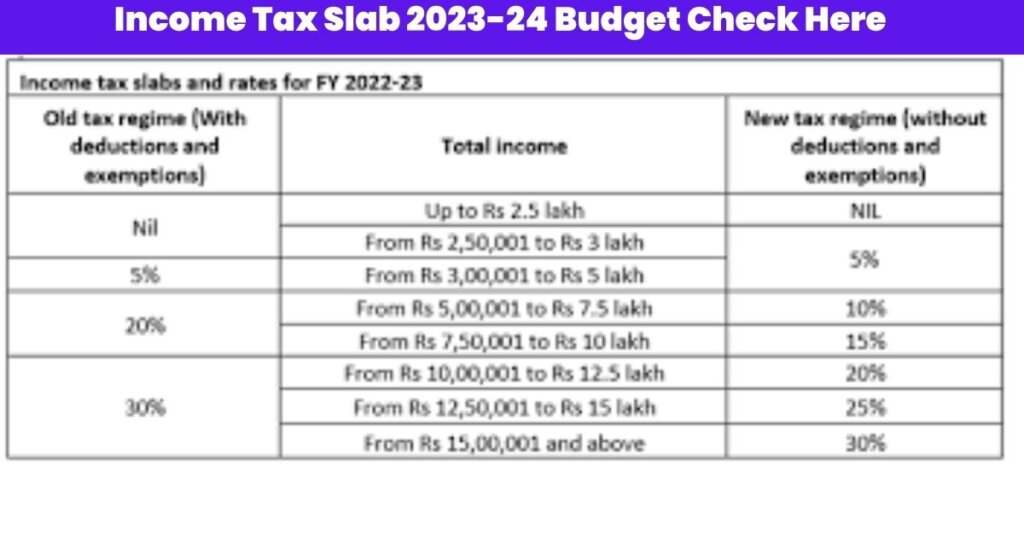

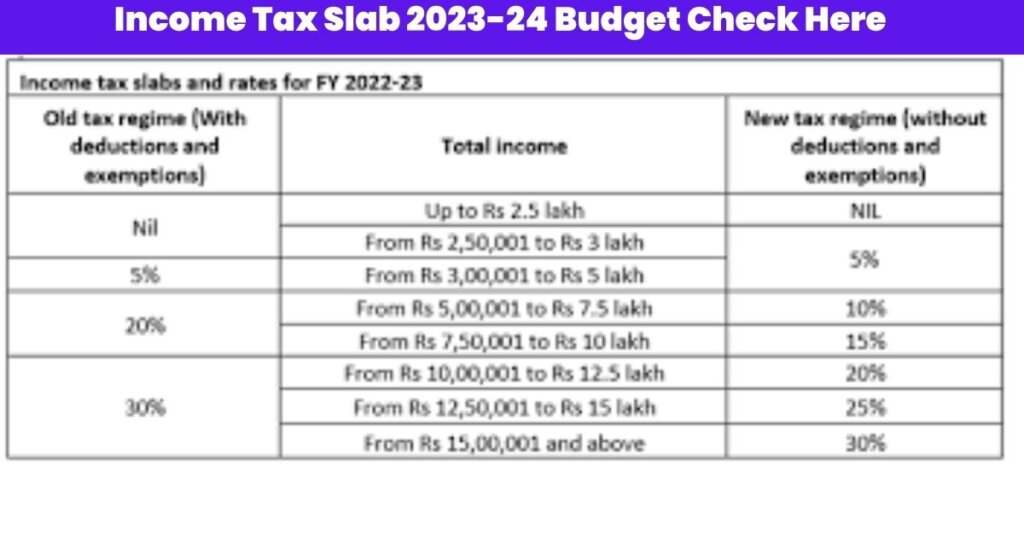

Income Tax Slab 2023 24 Budget Check Here

Income Tax Slab 2023 24 Budget Check Here

Income Tax Slab Rate Calculation For FY 2023 24 AY 2024 25 With

Earnings Tax Deductions Checklist FY 2023 24 MoreFinancialNews

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

Rebate On Agricultural Income For Ay 2023 23 - Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under 3