Rebate On Car Loan Income Tax To get a tax rebate on car loan you have to list the car loan interest paid as a business expense For this you can request your lender to issue an interest certificate indicating the amount paid as interest on the car loan to enjoy tax savings

What is Section 80EEB Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to purchase an electric car However certain restrictions and conditions concerning the loan issuer and the electric vehicle must be followed in order to claim the 80EEB deduction Learn how to save money on your income tax by claiming tax benefits on your car loan interest depreciation and maintenance costs Find out the eligibility criteria documentation and tips for self employed and business owners who use their cars for work

Rebate On Car Loan Income Tax

Rebate On Car Loan Income Tax

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Income Tax Return How To Claim Home Loan Tax Rebate In This Husband

https://cdn.zeebiz.com/sites/default/files/styles/zeebiz_850x478/public/2020/04/28/117658-bank-loan-pti.jpg?itok=G0GkZm2Q&c=4d7c9c9efe3dff224ff5225977fd6c8f

Home Loan Tax Rebate

https://www.indiareviews.com/wp-content/uploads/2022/04/homeloan-tax-rebate-1.jpg

The government will legislate to close loopholes in company car tax rules by ending contrived car ownership schemes and encourage taxpayers to pay tax on time by increasing the interest rate You can then deduct 12 of Rs 15 lakh Rs1 8 lakh from your taxable income while filing your tax returns So when you are claiming tax rebate on car loan deduct the interest you have paid towards your in that year from your taxable income The interest paid can be added as a business expenditure

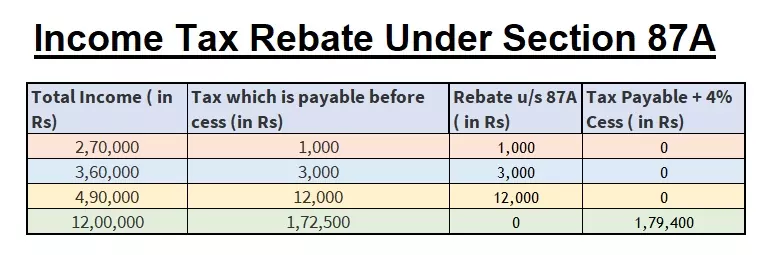

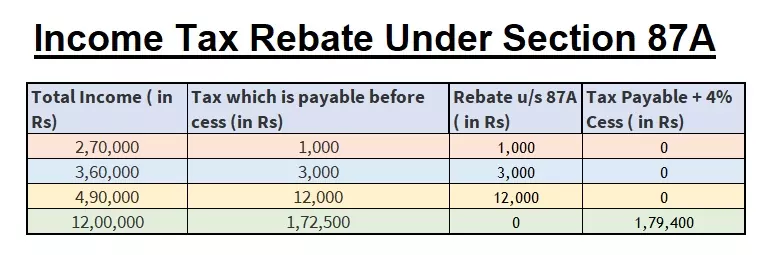

Learn how to deduct car loan interest from your taxes if you use your vehicle for business purposes Find out the requirements documentation and calculation methods for this tax benefit Tax rebate is a relief for individuals to avoid income tax burden if income is below a certain threshold The rebate is up to Rs 7 lakh in the new tax regime and up to Rs 5 lakh in the old regime Steps limits and calculations under Section 87A are discussed

Download Rebate On Car Loan Income Tax

More picture related to Rebate On Car Loan Income Tax

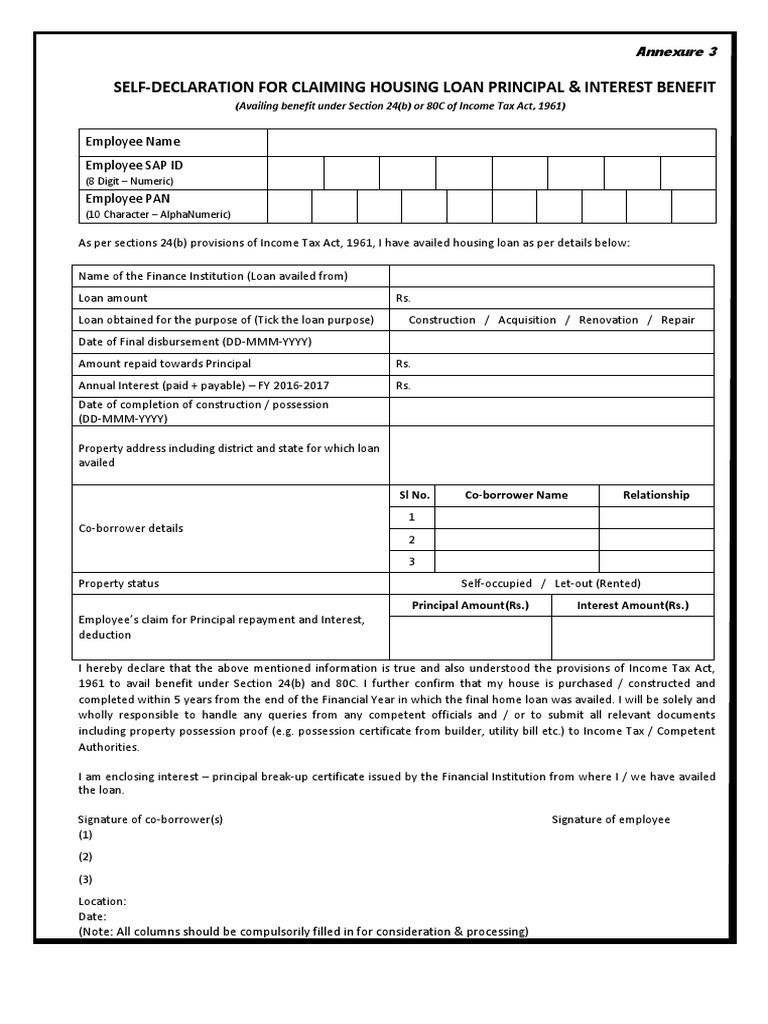

Self Declaration For Claiming Housing Loan Principal Interest Benefit

https://imgv2-2-f.scribdassets.com/img/document/558860084/original/8382a4f494/1672898190?v=1

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

https://i.ytimg.com/vi/IrYTqu6Hohg/maxresdefault.jpg

To claim tax rebates on car loans individuals can list the interest paid on the car loan as a business expense They can then request a lender to issue an interest certificate that details the amount paid as interest on the loan Learn how to claim a tax deduction of up to Rs 1 50 lakh for interest paid on loans taken for purchasing electric vehicles EVs under section 80EEB of the I T Act 1961 Find out the eligibility criteria conditions and documents required for this benefit

Key takeaways A car rebate is a flat sum taken off how much you pay for the car often totaling thousands of dollars A rebate may only apply to more expensive trims if you finance As announced at Autumn Budget 2024 the appropriate percentage used to calculate an individual s company car tax for zero emission vehicles will increase for 2028 to 2029 and 2029 to 2030 by 2

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Income Tax Rebate Under Section 87A Legalraasta

https://www.legalraasta.com/blog/wp-content/uploads/2021/08/Income-tax-rebate-tax-deduction-and-exemption-scaled.jpg

https://www.tatacapital.com › blog › loan-for-vehicle › ...

To get a tax rebate on car loan you have to list the car loan interest paid as a business expense For this you can request your lender to issue an interest certificate indicating the amount paid as interest on the car loan to enjoy tax savings

https://cleartax.in

What is Section 80EEB Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to purchase an electric car However certain restrictions and conditions concerning the loan issuer and the electric vehicle must be followed in order to claim the 80EEB deduction

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits On Home Loan Know More At Taxhelpdesk

Latest Income Tax Rebate On Home Loan 2023

Save Income Tax On Car Loan By Opting For EV Here s How

Home Loan Tips Income Tax Rebate On Home Loan By Section 80c And

Income Tax Rebate 2024

Income Tax Rebate 2024

Section 87A Income Tax Rebate

Income Tax Benefits On Car Loan Tata Capital

Joint Home Loan Declaration Form For Income Tax Savings And Non

Rebate On Car Loan Income Tax - Tax rebate is a relief for individuals to avoid income tax burden if income is below a certain threshold The rebate is up to Rs 7 lakh in the new tax regime and up to Rs 5 lakh in the old regime Steps limits and calculations under Section 87A are discussed