Rebate On Car Tax What s new for 2024 instant rebate EV buyers no longer have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead there s a new option

Learn how to get a federal tax credit of up to 7 500 for buying a new electric vehicle or up to 4 000 for a used one in 2024 Find out which cars qualify how to claim the credit and how to Find out which electric vehicles and plug in hybrids qualify for a federal tax credit of up to 7 500 in 2024 The list includes Tesla Rivian Ford Honda Nissan and more but excludes

Rebate On Car Tax

Rebate On Car Tax

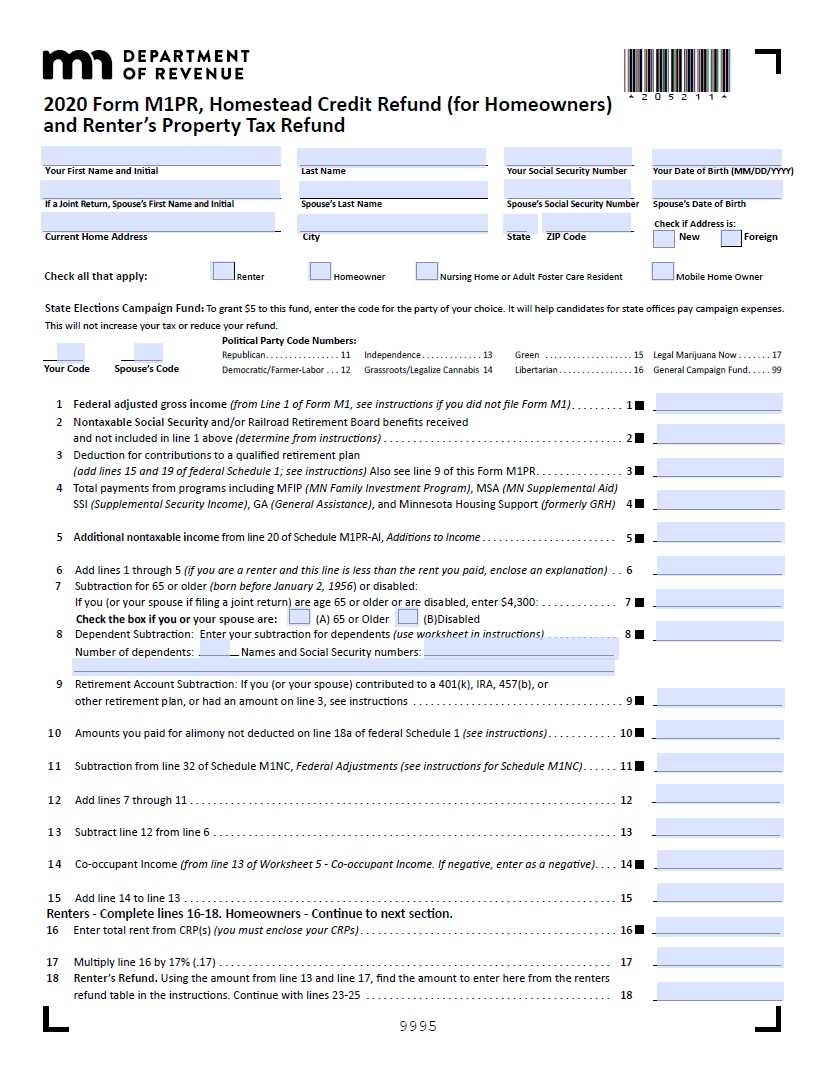

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

Section 87A Income Tax Rebate

https://taxguru.in/wp-content/uploads/2018/07/Tax-rebate.jpg

Learn how to use the Electric Vehicle Savings Finder to discover local and federal deals on electric cars Compare tax credits rebates and charging options for different models and ZIP codes The Treasury Department released new guidance for car dealers to apply the electric vehicle tax credit immediately or provide cash rebate to customers The move aims to make EVs more

Learn about the new and used clean vehicle tax credits offered by the Inflation Reduction Act IRA for electric plug in hybrid and fuel cell vehicles Find out the eligibility requirements income limits vehicle types and how to claim the credits As announced at Autumn Budget 2024 the appropriate percentage used to calculate an individual s company car tax for zero emission vehicles will increase for 2028 to 2029 and 2029 to 2030 by 2

Download Rebate On Car Tax

More picture related to Rebate On Car Tax

Car Road Tax Size Malaysia KarsonteRitter

https://paultan.org/image/2022/02/2022-EV-LKM-road-tax-rebate-630x630.jpg

Traderider Rebate Program Verify Trade ID

https://traderider.com/rebate/assets/img/rebate-forex.jpg

How To Calculate Minimum Tax For Corporate Taxpayer In Bangladesh

http://www.jasimrasel.com/wp-content/uploads/2017/08/Invest-for-Tax-Rebate-520x400.jpg

What is Section 80EEB Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to purchase an electric car However certain restrictions and conditions concerning the loan issuer and the electric vehicle must be followed in order to claim the 80EEB deduction Commercial fleets and tax exempt organizations that buy a qualified commercial clean vehicle may qualify for a clean vehicle tax credit per vehicle these include all electric plug in hybrid electric or fuel cell EVs The maximum credit is 7 500 for qualified commercial clean vehicles with gross vehicle weight ratings of under 14 000 pounds

Learn how to qualify for a credit up to 7 500 for a new plug in EV or FCV purchased in 2023 or after Find out the eligibility requirements credit amount qualified vehicles and how to claim the credit on Form 8936 Learn how to claim the clean vehicle tax credit of up to 7 500 for new electric plug in hybrid or fuel cell vehicles in 2023 or later Find out how to exchange the credit for cash or down

XM Rebates 12 45 USD Daily And Direct PipRebate

https://www.piprebate.com/images/newrebateCryptoAltum.jpg

Printable Rebate Form For Old Style Beer Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/2100/21003/2100371/rebate-form_print_big.png

https://www.npr.org

What s new for 2024 instant rebate EV buyers no longer have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead there s a new option

https://www.nerdwallet.com › article › taxes › ev-tax...

Learn how to get a federal tax credit of up to 7 500 for buying a new electric vehicle or up to 4 000 for a used one in 2024 Find out which cars qualify how to claim the credit and how to

Md88safe

XM Rebates 12 45 USD Daily And Direct PipRebate

Legacy Tax Service Mobile AL

How To Get Your 2020 Stimulus Check In 2021 OpenCashAdvance

NFocus Tax Service LLC Clearwater FL

How To Calculate Tax Rebate In Income Tax Of Bangladesh

How To Calculate Tax Rebate In Income Tax Of Bangladesh

Tax i potou

EV Tax Credit Boost At Up To 12 500 Here s How The Two Versions Compare

Tax Policy And The Family Cornerstone

Rebate On Car Tax - Learn which hybrids qualify for the 7 500 or 3 750 federal tax credit in 2024 and how to get a rebate for used plug in vehicles Check the EPA s lists of eligible vehicles and state benefits