Rebate On Home Loan In New Tax Regime The new tax regime has limited these benefits Here are 3 questions What are the maximum deductions for home loan interest payments How can joint home

If you financed your home purchase with a loan and you have let it out you can claim a deduction for the interest paid under both old and new tax regimes In other Interest on Home Loan on let out property Section 24 Gifts up to Rs 50 000 Deduction for employer s contribution to NPS account Section 80CCD 2

Rebate On Home Loan In New Tax Regime

Rebate On Home Loan In New Tax Regime

https://www.indiareviews.com/wp-content/uploads/2022/04/homeloan-tax-rebate-1.jpg

5 Tips For Choosing A Home Equity Loan In 2021 Best Finance Blog

https://www.bestfinance-blog.com/wp-content/uploads/2021/04/AdobeStock_165000956-scaled.jpeg

Do You Know When Old And New Tax Regimes Give The Same Tax Liability

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202302/break-even-point-for-old-and-new-tax-regime-.jpg?itok=h3-wLBy8

Unlike the previous tax system the new tax structure lowers tax rates but it comes with a trade off certain exemptions available before are no longer applicable The list below The tax deductions you can claim if you have a home loan in 2023 24 Advertisement Anagh Pal Apr 27 2023 11 28 IST Source Pixabay Apart from the

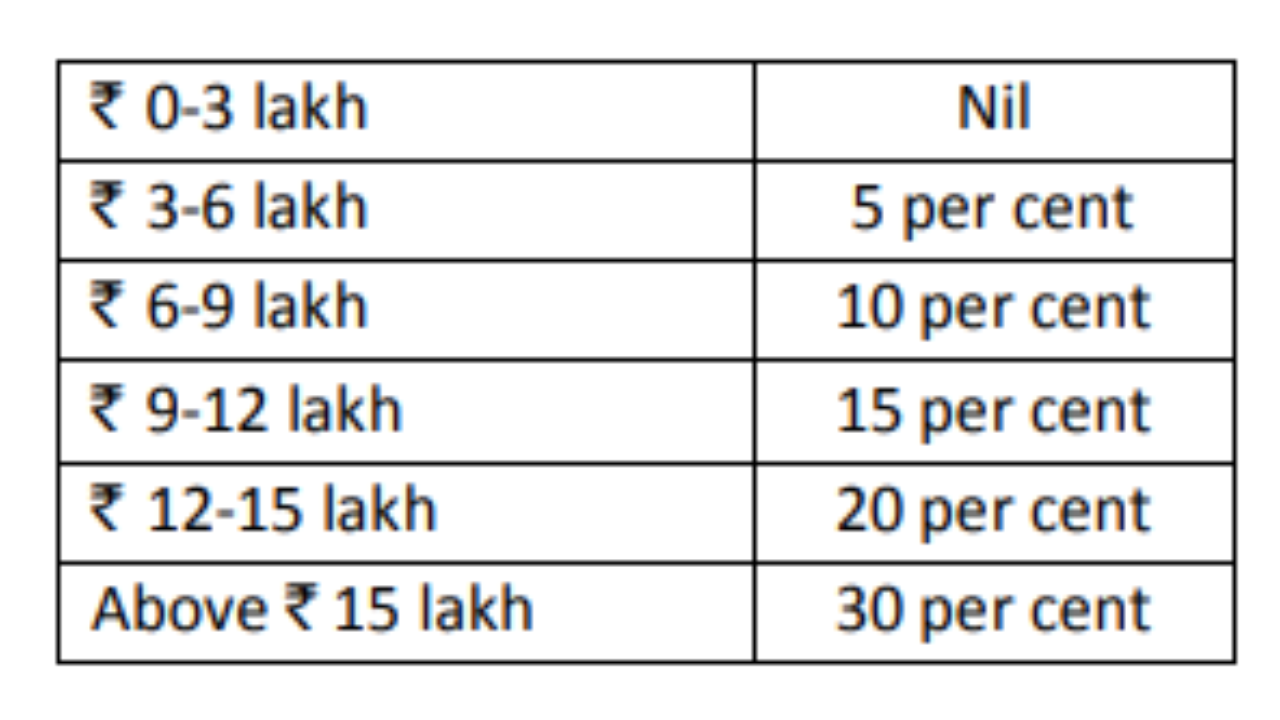

17 min read Latest update Budget 2023 changes under new tax regime New tax regime will be the default tax regime However taxpayers can opt for the old The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a borrower can claim exemptions

Download Rebate On Home Loan In New Tax Regime

More picture related to Rebate On Home Loan In New Tax Regime

What Is New Tax Regime Slabs Benefits Section 115BAC

https://fincalc-blog.in/wp-content/uploads/2022/09/new-tax-regime-slabs-and-benefits.webp

New Tax Regime Vs Old Which Is Better For You Rupiko

https://rupiko.in/wp-content/uploads/2020/08/New-vs-Old-Tax-Regime-1.png

Income Tax Under New Regime Understand Everything

https://www.taxhelpdesk.in/wp-content/uploads/2022/06/New-Regime-under-Income-Tax-819x1024.jpeg

However for homebuyers income tax deduction of up to 1 50 lakhs on the repayment of housing loans principal interest under Sec 80C is available under the New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as

Deepesh Raghaw 7 min read Last Updated Feb 10 2023 6 04 PM IST Union Budget 2023 made the new tax regime attractive by reducing rates You have two options continue with the old regime and Similar to the existing regime under the new regime you can claim deductions on municipal tax standard deduction of 30 and interest paid on

Home Loan Tax Benefits 2023 24 Income Tax Benefits On Home Loan

https://i.ytimg.com/vi/fTr85fqqkaI/maxresdefault.jpg

Menards Price Adjustment Rebate Form October 2022 RebateForMenards

https://i0.wp.com/www.rebateformenards.com/wp-content/uploads/2022/10/menards-price-adjustment-rebate-form-october-2022.jpg?resize=1536%2C1510&ssl=1

https://cleartax.in/s/home-loan-tax-benefit

The new tax regime has limited these benefits Here are 3 questions What are the maximum deductions for home loan interest payments How can joint home

https://www.etmoney.com/learn/income-tax/save...

If you financed your home purchase with a loan and you have let it out you can claim a deduction for the interest paid under both old and new tax regimes In other

Tax abatements appraisals pilgrim colonial Pilgrim Colonial Hampden

Home Loan Tax Benefits 2023 24 Income Tax Benefits On Home Loan

Home Loan Tips Income Tax Rebate On Home Loan By Section 80c And

New Income Tax Regime Changes In Tax Slabs And Rebate Limits See

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Home Loan Rebate In Income Tax In Hindi

Home Loan Rebate In Income Tax In Hindi

Rebate Under New Tax Regime PrintableRebateForm

Rebate Limit New Income Slabs Standard Deduction Understanding What

Home Loan For Women Own Your Dream Home

Rebate On Home Loan In New Tax Regime - New tax regime allows deduction of interest on home loan on rental property ET CONTRIBUTORS Last Updated Apr 24 2023 03 37 00 PM IST