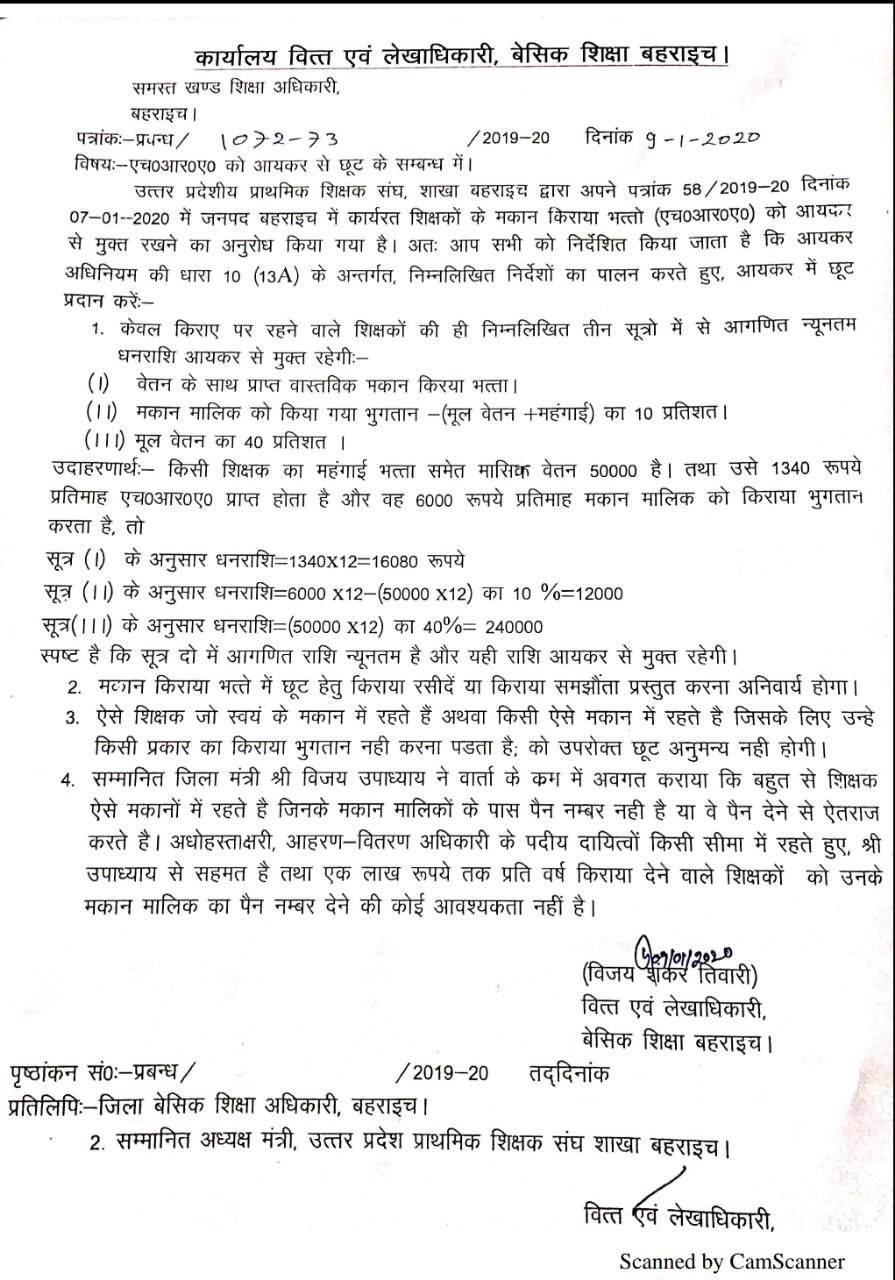

Rebate On Hra In Income Tax Web 22 sept 2022 nbsp 0183 32 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces your

Web 22 avr 2022 nbsp 0183 32 HRA exemptions are allowed under the Income Tax IT Act Section 10 13A of the Act provides that a salaried person can claim tax benefits with respect to the Web 9 f 233 vr 2023 nbsp 0183 32 What is House Rent Allowance HRA House Rent Allowance HRA is paid by an employer to employees as a part of their salary to meet the accommodation

Rebate On Hra In Income Tax

Rebate On Hra In Income Tax

https://blogger.googleusercontent.com/img/a/AVvXsEgXrgE31VjACIISfpSa17566pKHsUahqfZcuE_qmK0iX4jVYf9ovQSqiHrQdUT3fgPaS7c8e6f2IY-4l5UBzNH8oohEmIgyGgaSbobfCrm-vF95bGebe8RYdnj1DJUWNsR8JrN2JscJwBoe13dhI2txEHKYoyWG7omsGX7bDHFNJNpwuDZ_ejiUWnZL=s16000

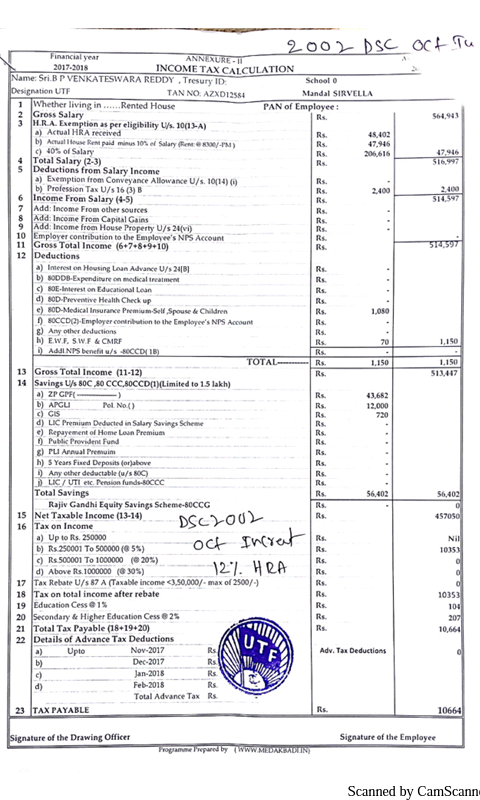

DSC 2002 All HRA Income Tax Ready Reckonar Tables 2017 18

https://lh3.googleusercontent.com/-LExJ7Fn3NeQ/WjNScODcCEI/AAAAAAAAKoI/QGSeXWWFzDwYLIqhPiZxWhCbH-Ha5iyMgCHMYCw/s1600/Screenshot_20171215-100951.png

Income Tax HRA

https://cdn.zeebiz.com/hindi/sites/default/files/inline-images/HRA.jpg

Web 26 janv 2022 nbsp 0183 32 The income tax rules allow deduction of the salary component received as HRA from the taxable salary income However HRA is fully taxable for an employee not living in a rented house Web 19 juil 2023 nbsp 0183 32 In Income Tax HRA is defined as a house rent allowance It is the amount paid by the employer to the employees to help them meet living costs in rented

Web HRA exemption in income tax for self employed and other employees If you live in rented accommodation and you are A self employed individual or Salaried individual but your Web HRA can be claimed as a tax deduction under the Income Tax Act The amount of HRA received depends on factors such as the employee s salary the actual rent paid and the

Download Rebate On Hra In Income Tax

More picture related to Rebate On Hra In Income Tax

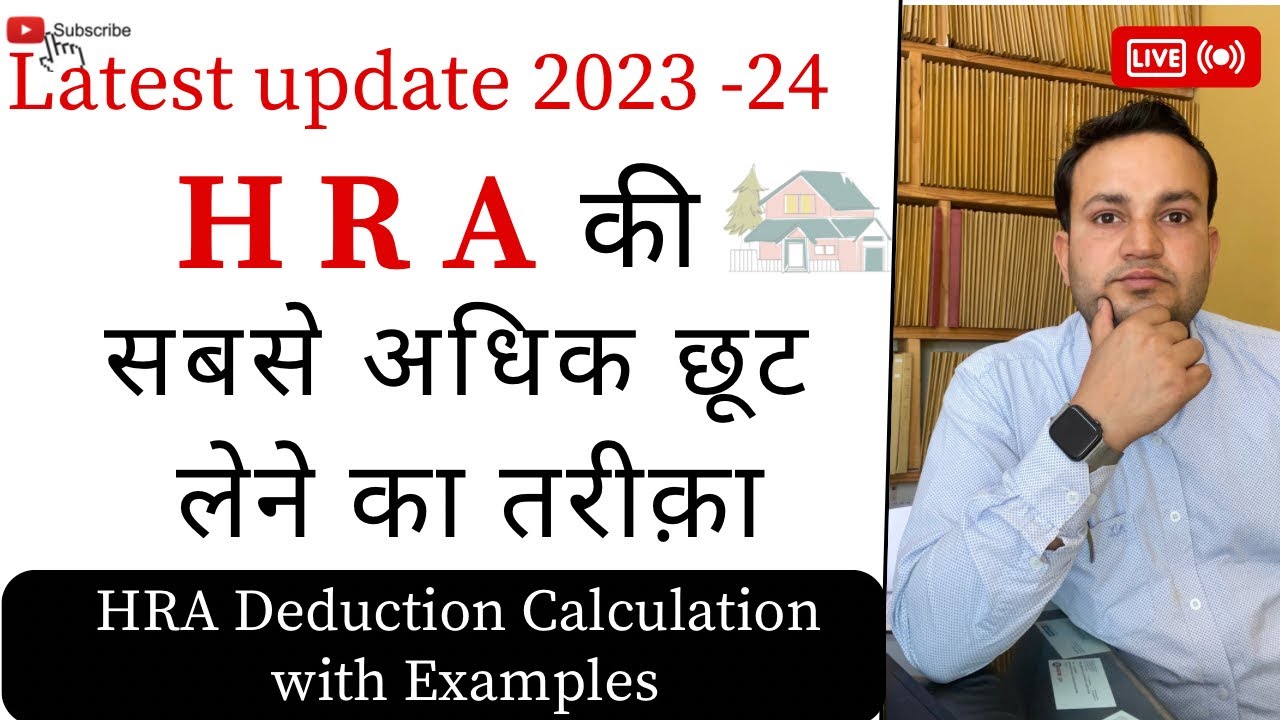

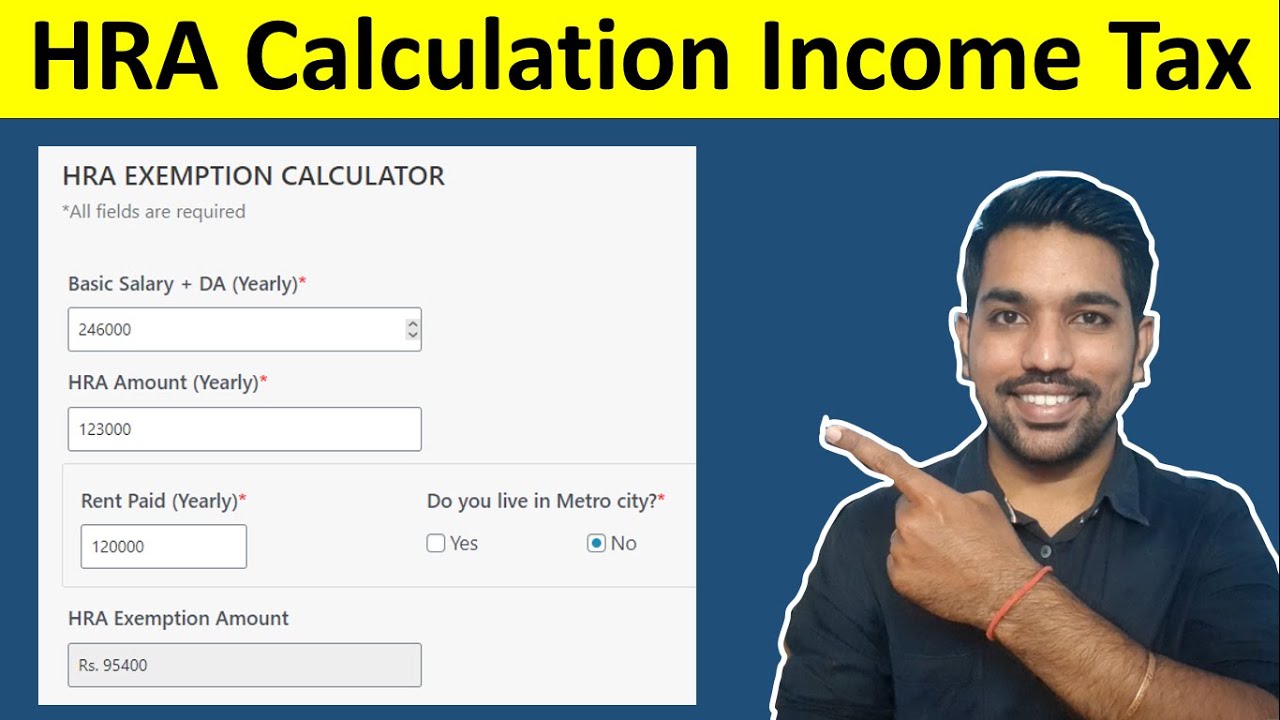

HRA Calculation Income Tax HRA Deduction In Income Tax How To

https://i.ytimg.com/vi/nBI1DkBtZSA/maxresdefault.jpg

HRA Tax Rebate HRA In Income Tax HRA Rebate Kasie Le HRA Rebate

https://i.ytimg.com/vi/TwVhPWbbcIU/maxresdefault.jpg

HRA Calculation In Income Tax House Rent Allowance Calculator

https://i.ytimg.com/vi/J5KugtFfmJw/maxresdefault.jpg

Web 28 oct 2022 nbsp 0183 32 Actual HRA received Rs 3 lakh 50 of basic salary plus dearness allowance Rs 3 5 lakh Actual rent paid less 10 of basic salary and dearness Web The exemption on your HRA benefit is the minimum of The actual HRA received rent paid annually reduced by 10 of salary 50 of your basic salary if you live in a metro city

Web 31 janv 2022 nbsp 0183 32 Answer There is no restriction on you claiming HRA while claiming tax benefits in respect of home loan as long as you are satisfying the conditions laid down Web 17 juil 2018 nbsp 0183 32 You can claim exemption on your HRA under the Income Tax Act if you stay in a rented house and get a HRA from your employer The HRA deduction is based on

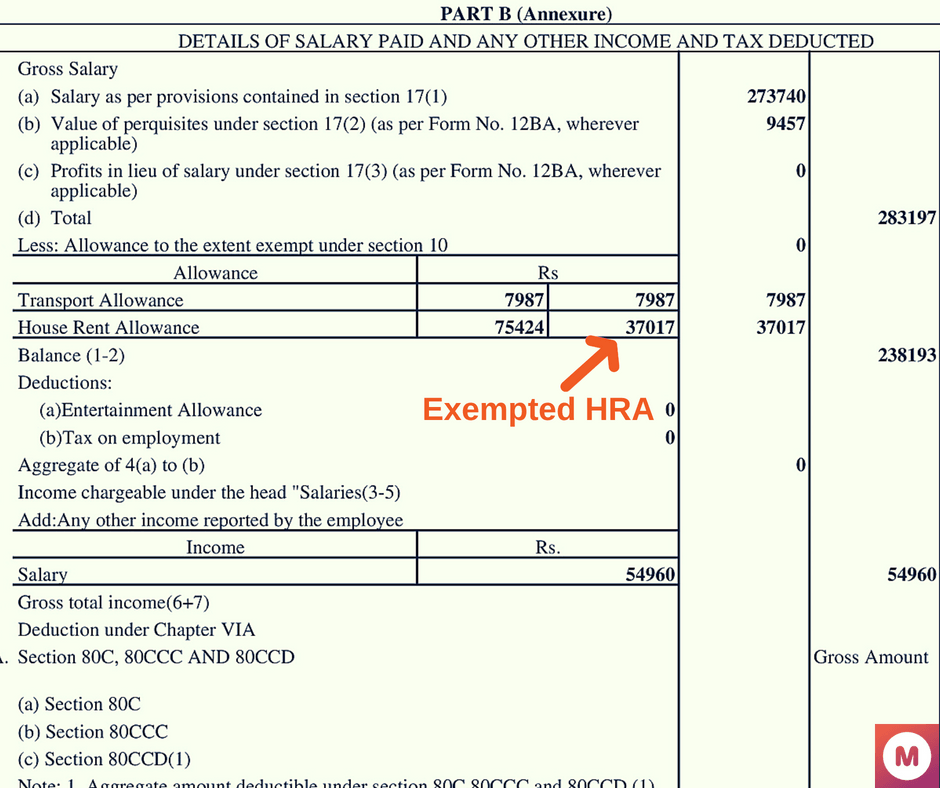

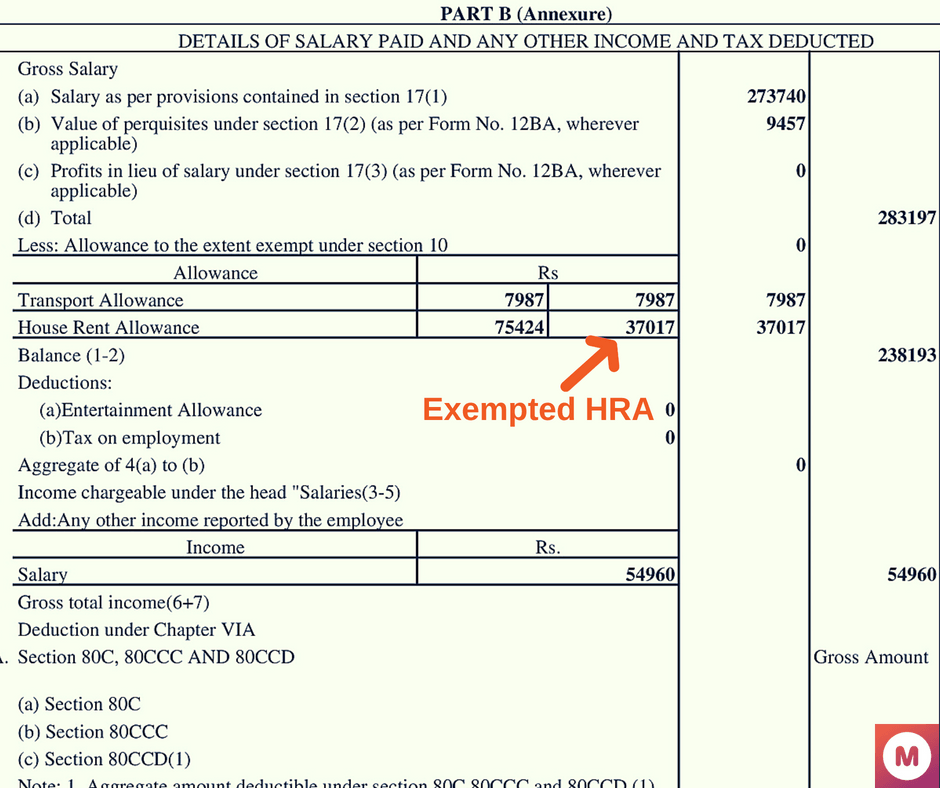

House Rent Allowance HRA Deduction Calculation AY 2019 20 Meteorio

https://www.meteorio.com/wp-content/uploads/2018/05/Exempted-HRA-.png

How To Get More Out Of Your HRA Taxpayers Forum

http://im.rediff.com/getahead/2011/jun/21table3.gif

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

Web 22 sept 2022 nbsp 0183 32 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces your

https://housing.com/news/hra-house-rent-allowance-tax-exemption

Web 22 avr 2022 nbsp 0183 32 HRA exemptions are allowed under the Income Tax IT Act Section 10 13A of the Act provides that a salaried person can claim tax benefits with respect to the

How To Show HRA Not Accounted By The Employer In ITR

House Rent Allowance HRA Deduction Calculation AY 2019 20 Meteorio

Tax Rebate On HRA

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

Documents Required To Claim HRA CommonFloor Groups Invoice Template

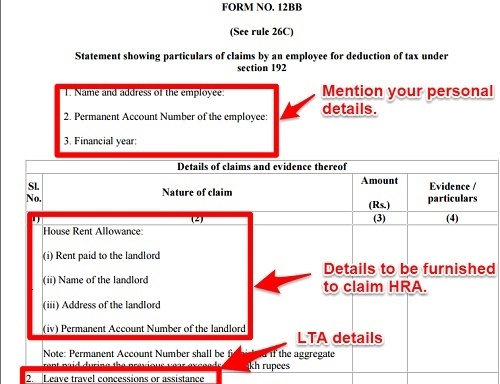

Form 12BB To Claim HRA Deduction By Salaried Employees

Form 12BB To Claim HRA Deduction By Salaried Employees

Form 12BB Changes In Declaring HRA LTA And Sec 80 Deductions

Danpirellodesign Income Tax Rebate On Home Loan And Hra

How To Claim HRA In Income Tax YouTube

Rebate On Hra In Income Tax - Web HRA can be claimed as a tax deduction under the Income Tax Act The amount of HRA received depends on factors such as the employee s salary the actual rent paid and the