Rebate On Property Tax 2024 JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX REBATE 0

Ways to Apply There are three ways to apply for the Property Tax Rent Rebate Program online by mail or in person Applicants are encouraged to apply online for the fastest review process Learn more about your options to ensure your application is submitted correctly by the June 30 2024 filing deadline Apply Online Governor Shapiro s expansion of the Property Tax Rent Rebate program delivered the largest targeted tax cut for seniors in nearly two decades expanding access to nearly 175 000 more Pennsylvanians and increasing maximum rebate from 650 to 1000 2024 For more information and to access forms instructions visit revenue pa gov ptrr or

Rebate On Property Tax 2024

Rebate On Property Tax 2024

https://www.signnow.com/preview/585/571/585571881/large.png

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

How To Get Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

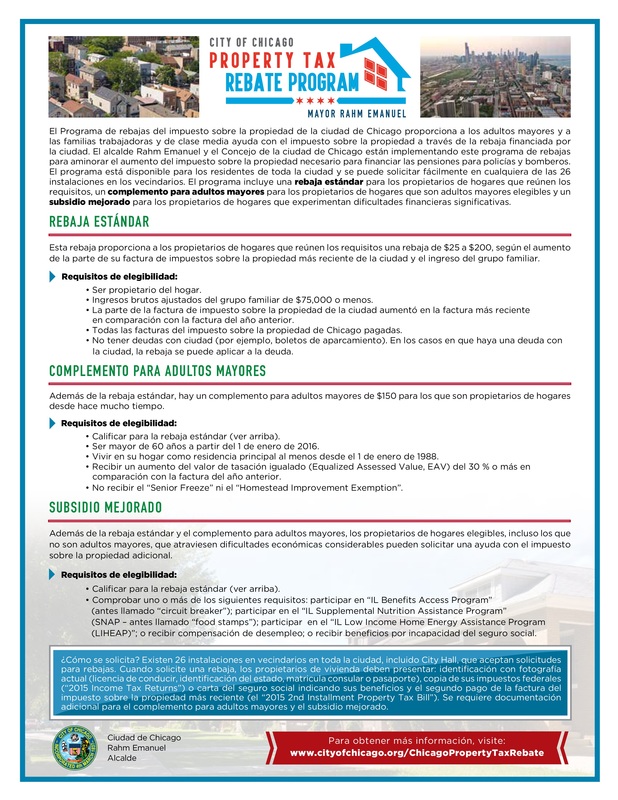

If you have not received your benefit by January 12 2024 contact us This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age First time filers who have filed by June 1 2024 should expect to receive their rebates between July 1 and September 1 2024 Some rebates may take additional time if DOR needs to correct or verify any information on a rebate application Governor Josh Shapiro signed into law a historic expansion of the Property Tax Rent Rebate PTRR

Under the expansion crucial updates will be in place when the Department of Revenue in January 2024 opens the filing period to submit applications for property taxes and rent paid in 2023 First the maximum standard rebate will increase from 650 to 1 000 The Property Tax Rent Rebate program has been a lifeline for hundreds of As rebates on property taxes and rent paid in 2022 start going out today Governor Josh Shapiro is calling for a major expansion of the PTRR program in his 2023 2024 proposed budget The Governor s commonsense proposal would provide a lifeline for Pennsylvania renters and homeowners who need it most and help more seniors across the

Download Rebate On Property Tax 2024

More picture related to Rebate On Property Tax 2024

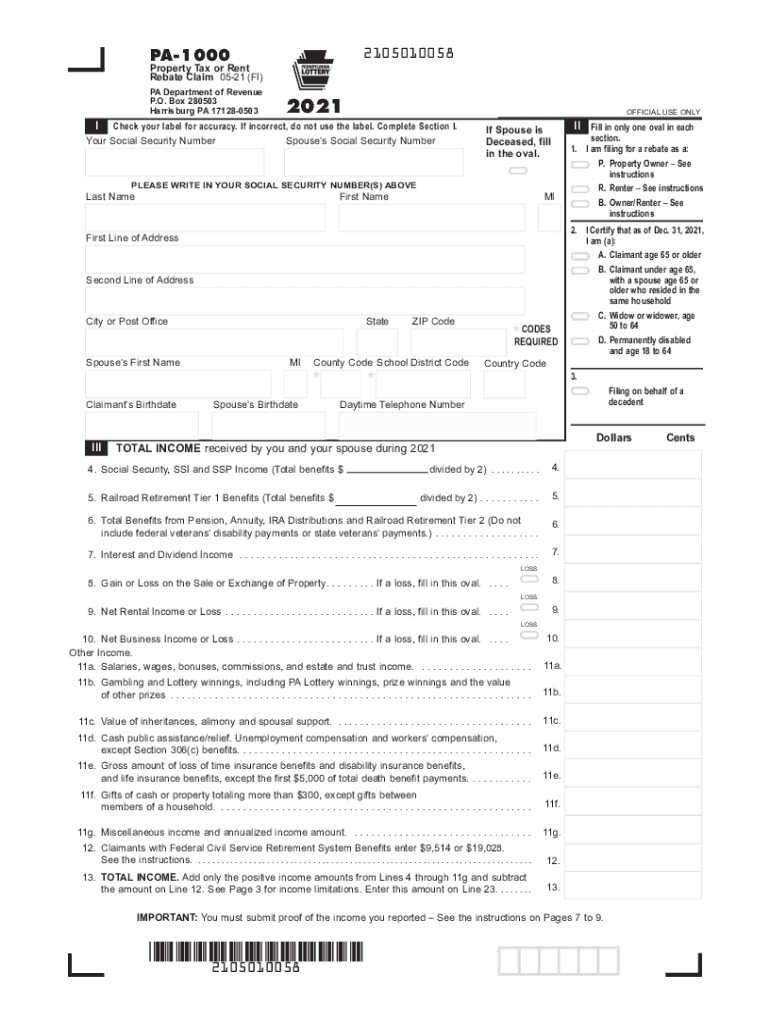

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189550-Z9C3QJVKXYFO4N04VXT7/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_2.jpg

Pennsylvania s Property Tax Rent Rebate Program May Help Low income Households Apply By 12 31

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

The expansion Increases the maximum standard rebate from 650 to 1 000 Increases the income cap from 35 000 to 45 000 for homeowners Increases the income cap from 15 000 to Nearly 175 000 additional eligible Pennsylvanians can apply for a rebate of up to 1 000 through the Property Tax Rent Rebate PRTT program 2024 The deadline to apply is June 30 however

The Pennsylvania Property Tax Rent Rebate program is open to state residents 65 or older widows and widowers 50 or older or anyone age 18 and over who is 100 disabled New income limits for 2024 are 45 000 a year for both homeowners and renters NOTE Only half of your Social Security income is included in calculations H ATTENTION H More than 430 000 Pennsylvanians benefit from the income and property tax rebate program the ceiling this year Starting in 2024 8 000 a year could receive the full 1 000 refund

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

2023 Rent Rebate Form Printable Forms Free Online

https://www.pdffiller.com/preview/47/686/47686220/large.png

https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PTRR/Documents/2023_pa-1000_inst.pdf

JUNE 30 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX REBATE 0

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRentRebateProgram/Ways-to-Apply

Ways to Apply There are three ways to apply for the Property Tax Rent Rebate Program online by mail or in person Applicants are encouraged to apply online for the fastest review process Learn more about your options to ensure your application is submitted correctly by the June 30 2024 filing deadline Apply Online

Deadline For Tax And Rent Relief Extended

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

Homeowner Renters District 16 Democrats

PA Property Tax Rebate Fillable Form Printable Rebate Form

Residents Can File Property Tax Rent Rebate Program Applications Online Lower Bucks Times

How To Apply For A Rebate On Pa Property Tax Or Rent Pennlive

How To Apply For A Rebate On Pa Property Tax Or Rent Pennlive

What Is Rebate In Property Tax PRORFETY

California Tax Rebate 2023 How To Claim And Eligibility Criteria Tax Rebate

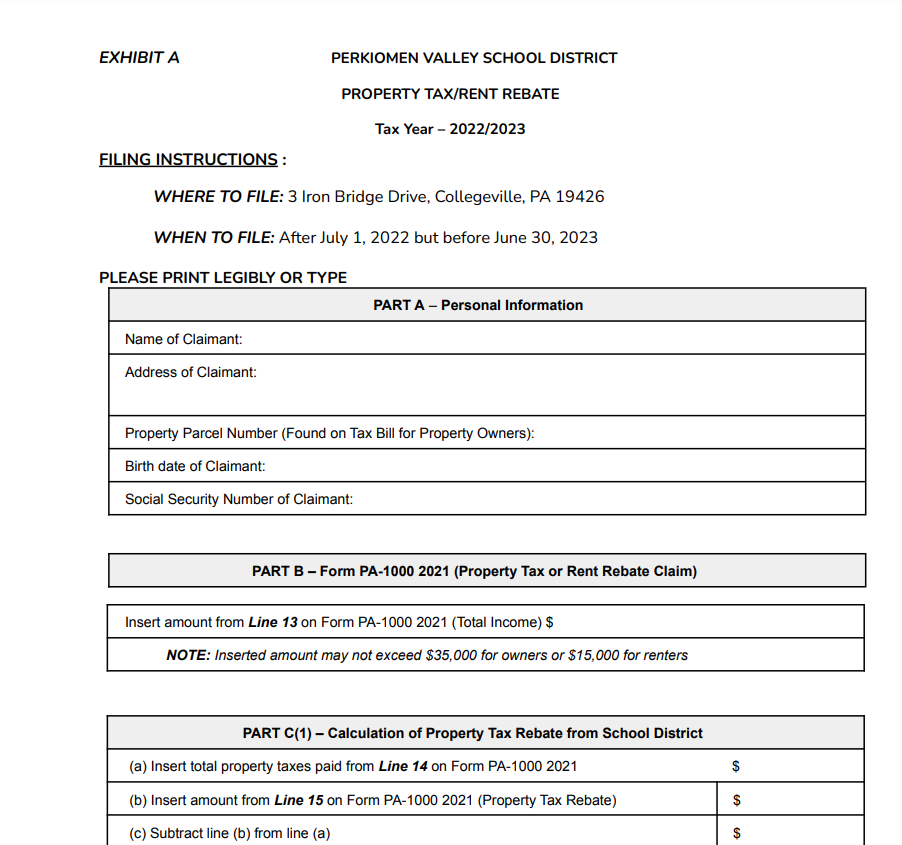

City Of Chicago Proper ty Tax Rebate Program CLARETIAN ASSOCIATES BUILDING COMMUNITY IN

Rebate On Property Tax 2024 - If you have not received your benefit by January 12 2024 contact us This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age