Rebate Recovery Credit 2023 Web 20 d 233 c 2022 nbsp 0183 32 Most eligible people already received their stimulus payments and won t be eligible to claim a Recovery Rebate Credit People who are missing a stimulus payment

Web An online tool that will track your tax refund Online Payment Agreements Apply for a payment plan to pay your balance over time IRS2Go mobile app Check your refund Web 17 janv 2023 nbsp 0183 32 Simply put Recovery Rebate Credit is a federal tax credit for those who need financial assistance In this article read and find out what you need to know about

Rebate Recovery Credit 2023

Rebate Recovery Credit 2023

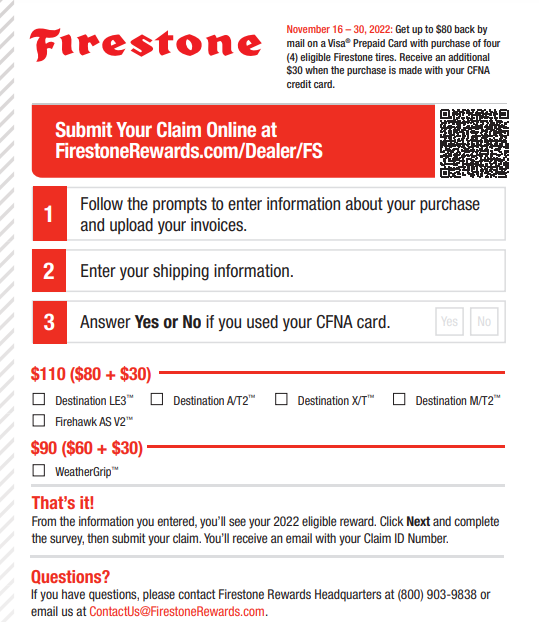

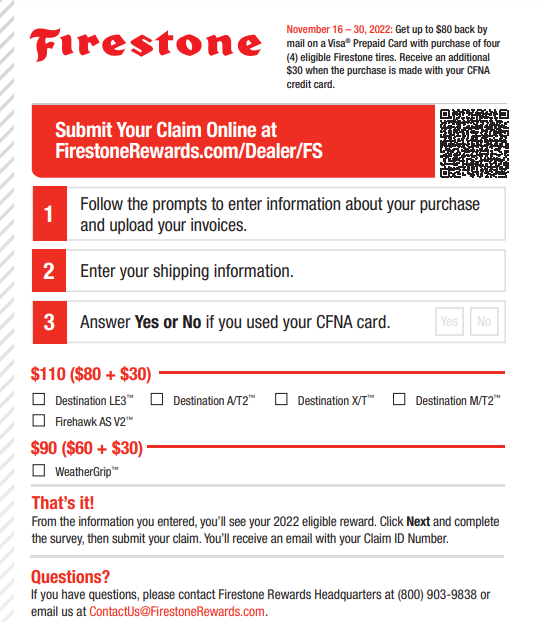

https://www.recoveryrebate.net/wp-content/uploads/2023/02/firestone-rebates-2023-printable-rebate-form.png

Recovery Rebate Credit 2023 Married Filing Separately Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/strategies-to-maximize-the-2021-recovery-rebate-credit-18.png

Recovery Rebate May 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-2022-2023-credits-zrivo-10.jpg?fit=640%2C480&ssl=1

Web 8 f 233 vr 2021 nbsp 0183 32 Check your Recovery Rebate Credit eligibility February 8 2021 Most people who are eligible for the Recovery Rebate Credit already received it in advance as two Web 1 f 233 vr 2023 nbsp 0183 32 Heads of households will begin to receive their rebates for recovery decreased to 112 500 People who have not received full stimulus payments in 2020

Web 17 f 233 vr 2023 nbsp 0183 32 February 17 2023 by tamble What Is A 2023 Recovery Rebate Credit The Recovery Rebate offers taxpayers the opportunity to receive a tax return without Web 17 janv 2023 nbsp 0183 32 Your income will affect the amount of your recovery rebate credit Your credit score will fall to zero for those who make over 75 000 Joint filers who have

Download Rebate Recovery Credit 2023

More picture related to Rebate Recovery Credit 2023

Recovery Rebate Credit 2023 Limits Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/2023-new-hsa-limits-claremont-insurance-services.jpg

2023 Recovery Rebate Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/recovery-rebate-credit-2023.jpg?resize=980%2C551&ssl=1

Recovery Rebate Credit Qualifications 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-2023-12.jpg

Web 24 janv 2023 nbsp 0183 32 Claiming Recovery Rebate Credit 2023 Taxpayers can receive a tax rebate through the Recovery Rebate program This lets them receive a tax refund for Web 26 nov 2022 nbsp 0183 32 The Recovery Rebate Credit for 2023 is an economic stimulus program that provides credits to help individuals and families recover from the economic impact of the COVID 19 pandemic This

Web Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return Web 27 avr 2023 nbsp 0183 32 You can claim missing or partial first and second round stimulus payments only on your 2020 federal tax return Any missing or partial third round stimulus

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-2023-eligibility-calculator-how-to-claim-6.jpg?resize=768%2C596&ssl=1

Irs Cp11 Recovery Rebate Credit 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-updates-recovery-rebate-credit-and-eip-guidance-scott-m-aber-cpa-pc-6.jpg

https://www.irs.gov/newsroom/recovery-rebate-credit

Web 20 d 233 c 2022 nbsp 0183 32 Most eligible people already received their stimulus payments and won t be eligible to claim a Recovery Rebate Credit People who are missing a stimulus payment

https://www.irs.gov/coronavirus/coronavirus-tax-relief-and-economic...

Web An online tool that will track your tax refund Online Payment Agreements Apply for a payment plan to pay your balance over time IRS2Go mobile app Check your refund

2023 Recovery Rebate Credi Recovery Rebate

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

What Is Recovery Rebate Credit 2023 Recovery Rebate

What Is The Recovery Rebate Credit 2023 Detailed Information

The Recovery Rebate Credit Calculator ShauntelRaya Rebate2022

Recovery Rebate Credit Married In 2023 Recovery Rebate

Recovery Rebate Credit Married In 2023 Recovery Rebate

Recovery Rebate Credit Child Born In 2023 Recovery Rebate

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

Recovery Rebate Credit Faq Recovery Rebate

Rebate Recovery Credit 2023 - Web 5 janv 2023 nbsp 0183 32 Heads of households will begin to receive their rebates for recovery decreased to 112 500 The people who did not receive full stimulus payments can still