Rebate Recovery Credit 2024 The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively The Recovery Rebate Credit is a refundable credit for those who missed out on one or more Economic Impact Payments Economic Impact Payments also referred to as stimulus payments were issued in 2020 and 2021

Those who didn t receive checks or received the wrong amount could claim them by filing a tax return and claiming the Recovery Rebate Credit If you missed out initially there s still time The Your Recovery Rebate Credit will be included in your tax refund If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit Recovery Rebate Credit

Rebate Recovery Credit 2024

Rebate Recovery Credit 2024

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2021/04/Recovery-Rebate-Credit.png?fit=1200%2C675&ssl=1

Recovery Rebate Credit 2023 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2022/05/Recovery-Rebate-Credit-zrivo-1.jpg

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

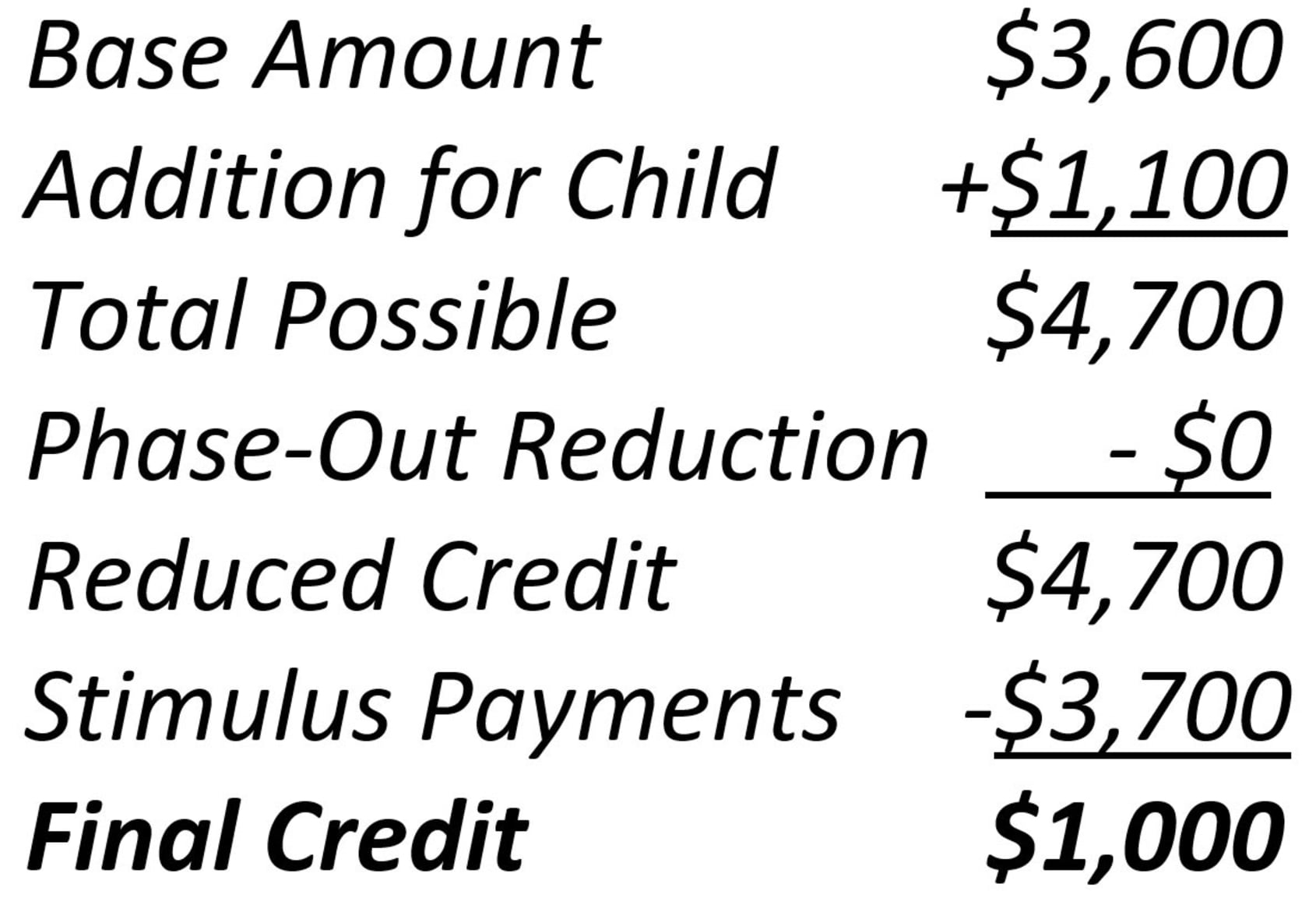

The second full stimulus payment was 600 for single individuals 1 200 for married couples and 600 per dependent If you earned more than 99 000 198 000 for married couples you got no Before claiming a Recovery Rebate Credit you would have had to first determine whether you were due one For 2023 taxes filed in 2024 the Child Tax Credit is 2 000 for children under age 17

The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial stimulus payment provided up to 1 200 per qualifying adult and up to 500 per qualifying dependent Most of these payments went out to recipients in mid 2020 3Excludes Recovery Rebate Credits associated with all Economic Impact Payments FY 2021 Budget Authority 38 512M of which 23 4 03M was obligated in FY 2021 12 673M was obligated in FY 2022 2 236M is estimated to be obligated in FY 2023 and 200M estimate d in FY 2024 Also excludes recoveries

Download Rebate Recovery Credit 2024

More picture related to Rebate Recovery Credit 2024

Recovery Rebate Credit 2024 Eligibility Calculator How To Claim

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEimxxHMVm4XxeDkVaSMSFoj9CX2XqGBjiPWj49fhO8klFSJrHN4Rbr5b3-zi4xSiAaa58C9r_f4Fc9AdeFh2CA51yQPsKTignpJ4wQvAhC7rp8drJR7xe5CxkmwSkVk1nWyZPNxWcqS2tVks6h4fP0QiW59YCZUG37lxHpjiqBAgggUng7A4gFgvhWK/s958/RRR.jpg

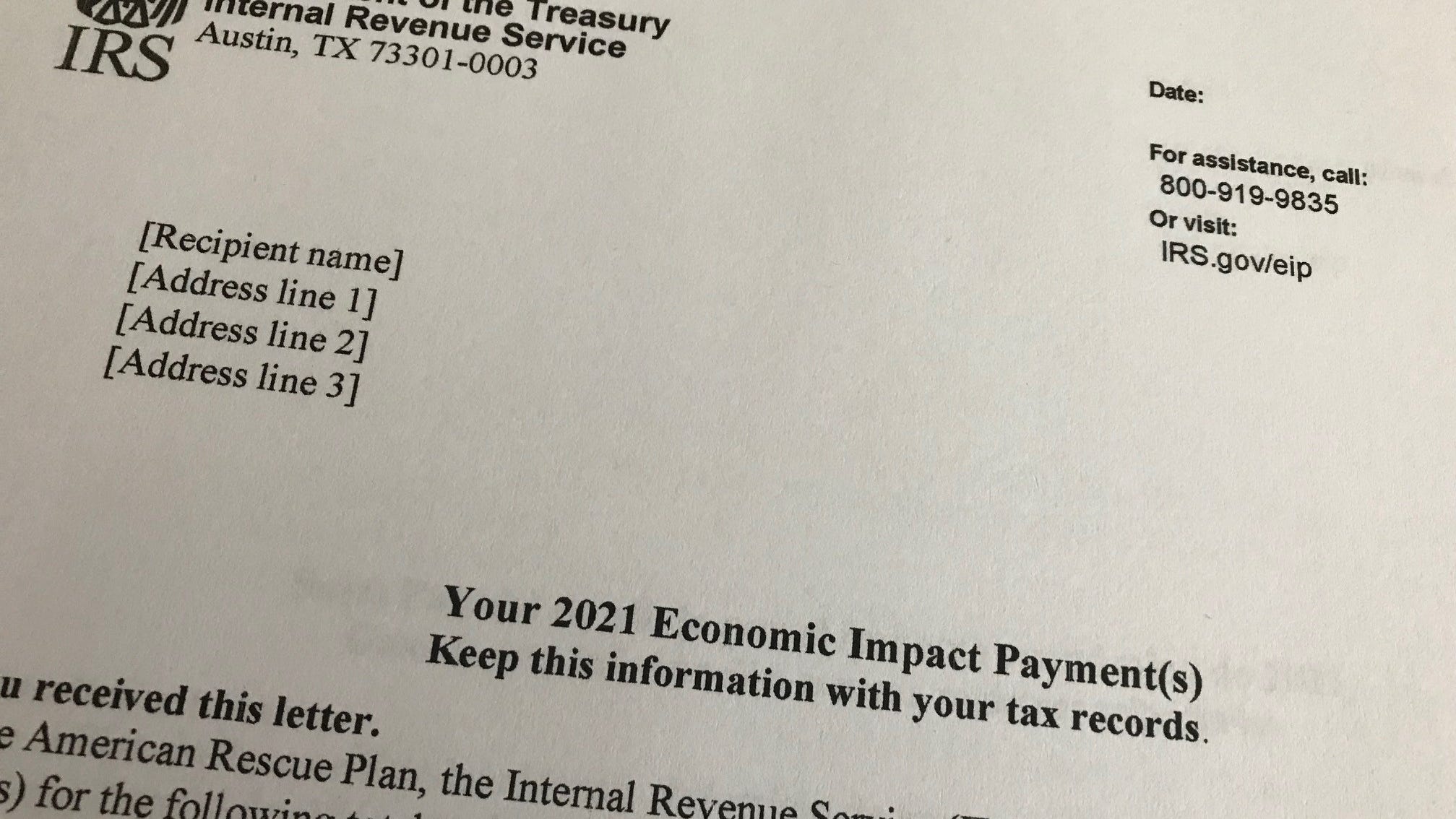

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

Recovery Rebate Credit Santa Barbara Tax Products Group

https://www.sbtpg.com/wp-content/uploads/2021/01/recovery-rebate-credit.jpg

Recovery Rebate Credit With this option enabled the Recovery Rebate Credit Worksheet won t be added to your returns automatically During final review a diagnostic will generate informing you that stimulus payments should be entered if the client didn t receive all EIP they were entitled to You can always add the worksheet to a return In 2024 Gov Josh Shapiro said that older residents would receive more financial help courtesy of his signed Act 7 of 2023 The law expanded the Property Tax Rent Rebate to provide a larger tax

A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models qualify Fewer vehicles qualify for the 7 500 federal tax rebate in 2024 but it s now easier to access the credit at the time of purchase Tesla and Rivian have the most vehicles on the list of qualifying EVs for the tax rebate in 2024 The automotive world is in the middle of a seismic change Electric cars are becoming ever more prominent on our

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/how-to-claim-stimulus-recovery-rebate-credit-on-turbotax-7.png?fit=1003%2C552&ssl=1

Recovery Rebate Credit 2023 Date Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/strategies-to-maximize-the-2021-recovery-rebate-credit-4.png

https://www.irs.gov/newsroom/irs-reminds-eligible-2020-and-2021-non-filers-to-claim-recovery-rebate-credit-before-time-runs-out

The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively The Recovery Rebate Credit is a refundable credit for those who missed out on one or more Economic Impact Payments Economic Impact Payments also referred to as stimulus payments were issued in 2020 and 2021

https://www.forbes.com/sites/kellyphillipserb/2023/11/18/theres-still-time-left-to-claim-your-stimulus-checks/

Those who didn t receive checks or received the wrong amount could claim them by filing a tax return and claiming the Recovery Rebate Credit If you missed out initially there s still time The

The Recovery Rebate Credit Calculator ShauntelRaya

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax Credit

What Is The Recovery Rebate Credit 2023 Detailed Information

What Is The Recovery Rebate Credit 2023 Detailed Information

20 2020 Recovery Rebate Credit Worksheet Worksheets Decoomo

FAQs And Answers For 2021 Recovery Rebate Credit

IRS Updates Info On Recovery Rebate Credit And Pandemic Response Scott M Aber CPA PC

Rebate Recovery Credit 2024 - 3Excludes Recovery Rebate Credits associated with all Economic Impact Payments FY 2021 Budget Authority 38 512M of which 23 4 03M was obligated in FY 2021 12 673M was obligated in FY 2022 2 236M is estimated to be obligated in FY 2023 and 200M estimate d in FY 2024 Also excludes recoveries