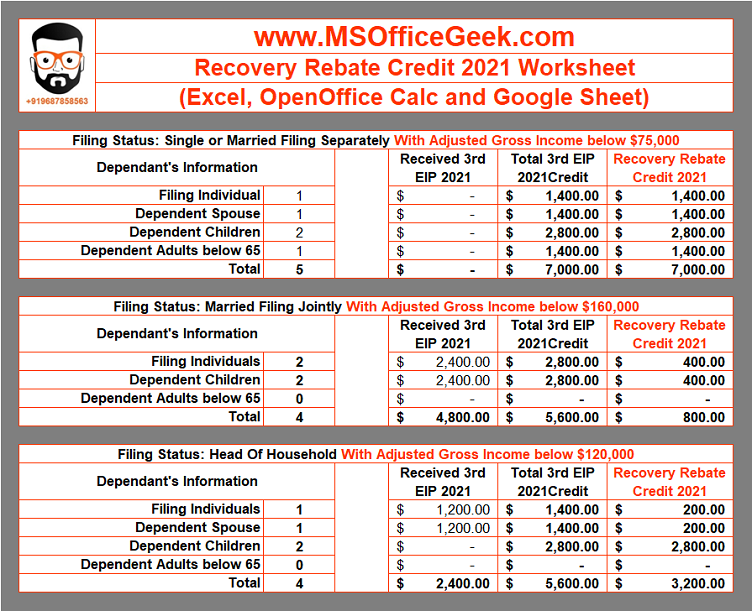

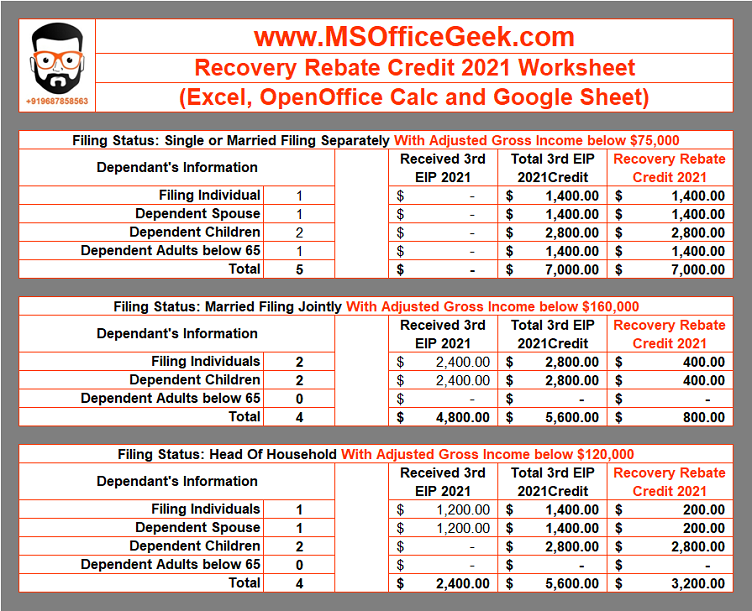

Rebate Recovery Credit Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

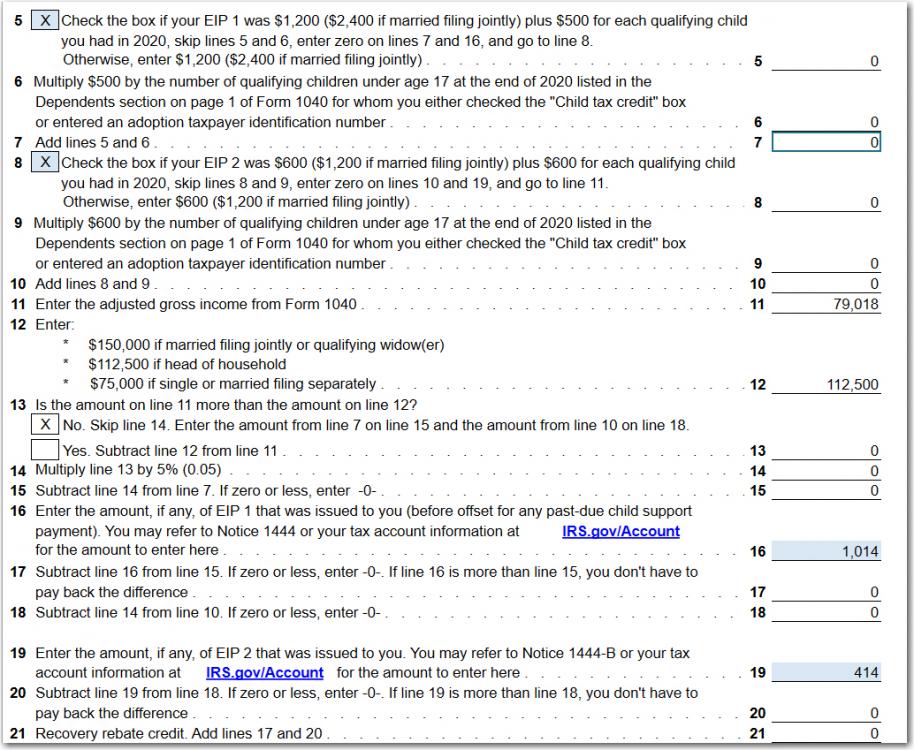

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form

Rebate Recovery Credit

Rebate Recovery Credit

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

Recovery Rebate Credit Taking Forever Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-credit-printable-rebate-form-4.png?w=670&h=627&ssl=1

IRS CP 12R Recovery Rebate Credit Overpayment

https://www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

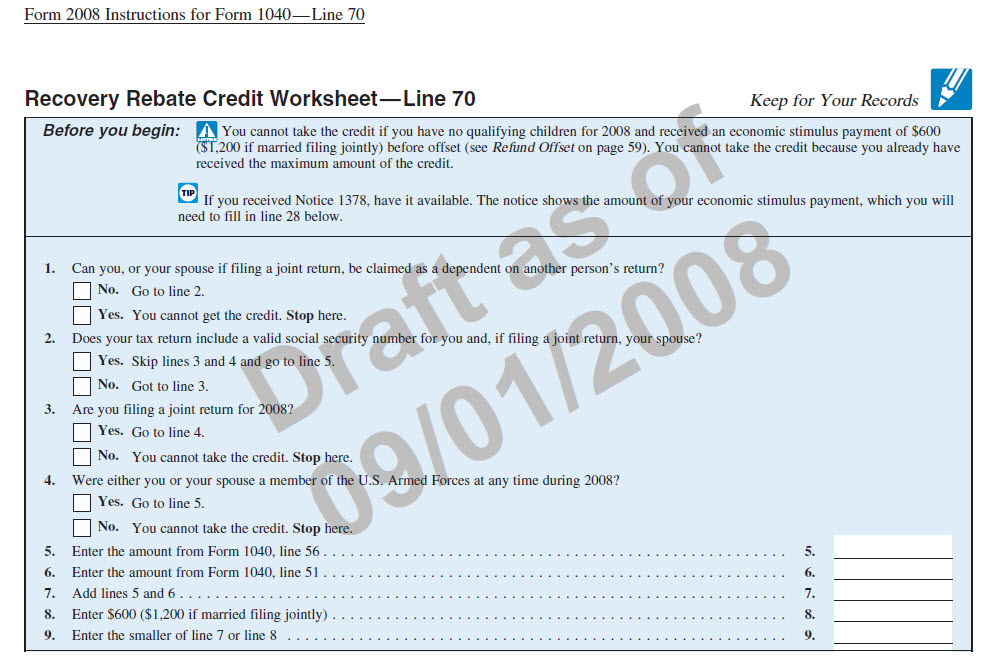

Web 10 d 233 c 2021 nbsp 0183 32 A10 The only way to get a Recovery Rebate Credit is to file a 2020 tax return even if you are otherwise not required to file a tax return The Recovery Rebate Web 1 d 233 c 2022 nbsp 0183 32 Assuming that all three meet all of the requirements for the credit their maximum 2020Recovery Rebate Credit is 4 700 This is made up of 2 900 1 200 for Alex 1 200 for Samantha 500 for

Web 12 oct 2022 nbsp 0183 32 As a result after subtracting the amount of their third stimulus payment the recovery rebate credit they report on Line 30 of their 2021 tax return is equal to 840 Web 17 ao 251 t 2022 nbsp 0183 32 You could claim a Recovery Rebate Credit when you filed your 2020 and or 2021 taxes if you did not receive your full authorized Economic Impact Payments

Download Rebate Recovery Credit

More picture related to Rebate Recovery Credit

What Is The Recovery Rebate Credit CD Tax Financial

https://cdtax.com/wp-content/uploads/2021/02/Recovery-Rebate-Worksheet-1-1187x1536.png

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

http://www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108-780101.jpg

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 30 d 233 c 2020 nbsp 0183 32 The Recovery Rebate Credit is a credit that was authorized by the Coronavirus Aid Relief and Economic Security CARES Act So if you were eligible

Web 23 mai 2022 nbsp 0183 32 IRS mostly correct on recovery rebate credits TIGTA says The IRS correctly calculated taxpayers eligibility for a recovery rebate credit in the 2021 filing Web 19 janv 2022 nbsp 0183 32 The IRS states that your recovery rebate credit will reduce any tax you owe for 2021 or be included in your tax refund This means you will either shave off the top

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

https://www.atxcommunity.com/uploads/monthly_2021_02/199195342_Line30JF.thumb.jpg.e31662de98fd0de6ecee8a30cd267c75.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

Recovery Rebate Credit Santa Barbara Tax Products Group

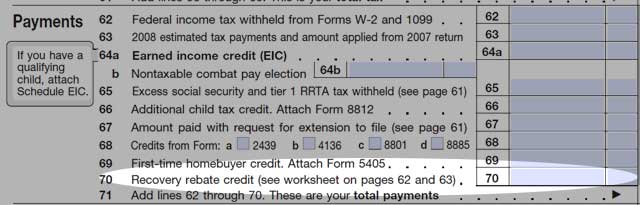

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

The Recovery Rebate Credit Calculator ShauntelRaya Rebate2022

Recovery Rebate Credit Worksheet Example Studying Worksheets Recovery

Recovery Rebate Credit 2020 Calculator KwameDawson

Rebate Recovery Credit - Web 27 avr 2023 nbsp 0183 32 The recovery rebate credit is considered a refundable credit meaning it can reduce the amount of taxes you owe or generate a refund to you