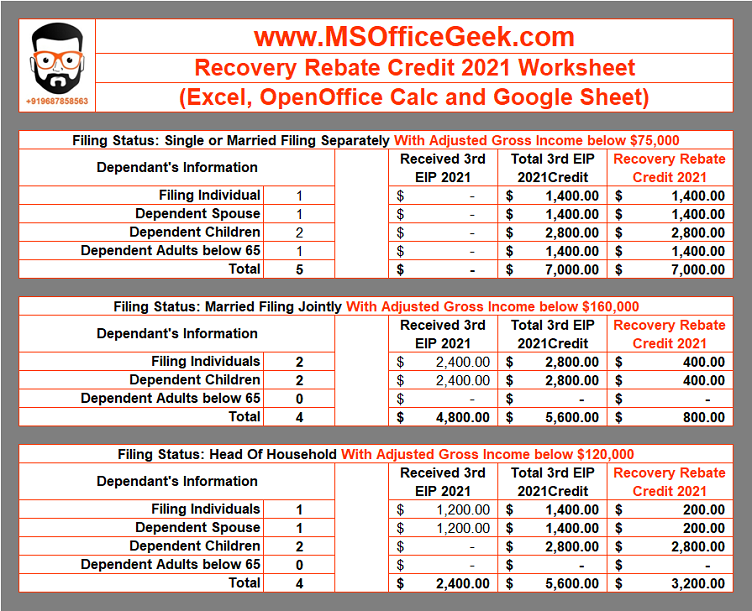

Rebate Recovery Tax Credit Web 13 avr 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 15 mars 2023 nbsp 0183 32 You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of their third Economic Impact Payments through their individual

Rebate Recovery Tax Credit

Rebate Recovery Tax Credit

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

https://images.dailykos.com/images/912447/story_image/1040.PNG?1612073472

Web 1 d 233 c 2022 nbsp 0183 32 The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit The government sent payments beginning in April of 2020 and a second round beginning in late December of 2020 and into 2021 The Web 3 mars 2022 nbsp 0183 32 What is the Recovery Rebate Credit In the simplest of terms it is money in your pocket In more nuanced terms the Recovery Rebate Credit is a tax credit against

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on

Download Rebate Recovery Tax Credit

More picture related to Rebate Recovery Tax Credit

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Irs Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/irs-cp-12r-recovery-rebate-credit-overpayment-15.png?w=1050&ssl=1

Web 30 d 233 c 2020 nbsp 0183 32 The Recovery Rebate Credit is a credit that was authorized by the Coronavirus Aid Relief and Economic Security CARES Act Web When you file your 2021 tax return you can use the Recovery Rebate Credit RRC to claim any missing amounts from the third EIP Do I qualify for the Recovery Rebate

Web 10 d 233 c 2021 nbsp 0183 32 If you didn t get the full first and second Economic Impact Payment you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return Web 15 janv 2023 nbsp 0183 32 Taxpayers who are eligible can receive Recovery Rebate credits in advance That means if you owe an amount of tax that is higher in 2020 than you did in

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/proconnect.intuit.com/community/image/serverpage/image-id/2609i6F2345BD501809A1/image-size/large?v=1.0&px=999

What Is A Recovery Rebate Credit Here s What To Do If You Haven t

https://cdn.abcotvs.com/dip/images/9476384_recoery-rebate.jpg?w=1600

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Web 13 avr 2022 nbsp 0183 32 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Federal Recovery Rebate Credit Recovery Rebate

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

1040 Line 30 Recovery Rebate Credit Recovery Rebate

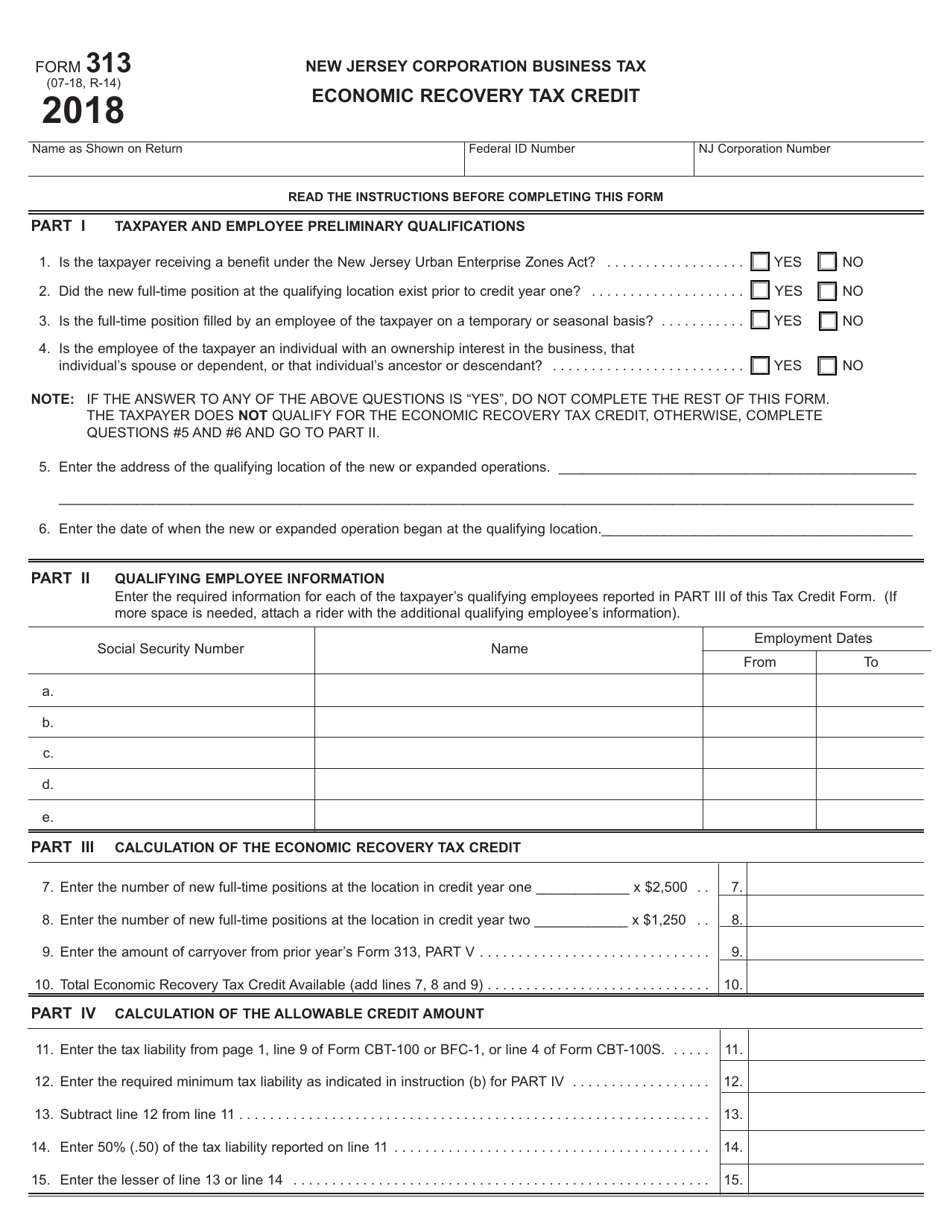

Form 313 Download Fillable PDF Or Fill Online Economic Recovery Tax

Recovery Rebate Credit Worksheet Example Studying Worksheets Recovery

Recovery Rebate Credit Third Stimulus StimulusInfoClub Recovery Rebate

Recovery Rebate Credit Third Stimulus StimulusInfoClub Recovery Rebate

10 Recovery Rebate Credit Worksheet

Solved Recovery Rebate Credit Error On 1040 Instructions

Recovery Rebate Credit stimulus Checks On Draft 1040

Rebate Recovery Tax Credit - Web Tax credits and rebates for home energy efficiency The credits in the IRA fall mainly into two categories the Residential Clean Energy Credit and the Energy Efficient Home