Rebate Revenue Recognition Web This handbook provides a detailed analysis of the revenue standard IFRS 15 Revenue from Contracts with Customers including insights and examples to help entities to

Web 30 mars 2021 nbsp 0183 32 IFRS 15 radically changed how the revenue from ordinary activities should be recognized Discounts under IFRS 15 are recognized as using as a reference the performance obligations established in a Web 6 avr 2022 nbsp 0183 32 1 What is a Rebate 2 What are Supplier Rebates 3 What are the Types of Rebates 4 What is an Example of a Rebate 5 How to Account for Customer Rebates 6 How to Account for Vendor Rebates

Rebate Revenue Recognition

Rebate Revenue Recognition

https://i.ytimg.com/vi/ZBa2bEaED54/maxresdefault.jpg

Revenue Recognition Professional Services Automation

https://uplandsoftware.com/psa/wp-content/uploads/sites/3/2014/01/Revenue-Recognition.jpg

Revenue Recognition Transaction Price Ohio CPA

https://gbq.com/wp-content/uploads/2018/03/Revenue-Recognition-ASC-606-Placemat-1.jpg

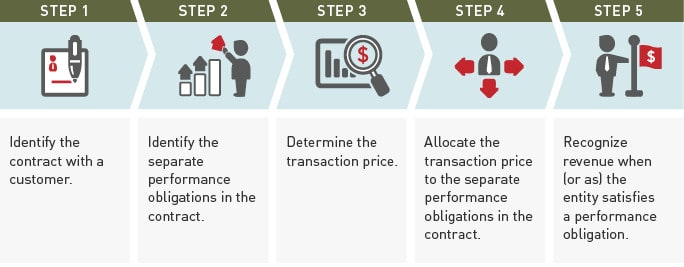

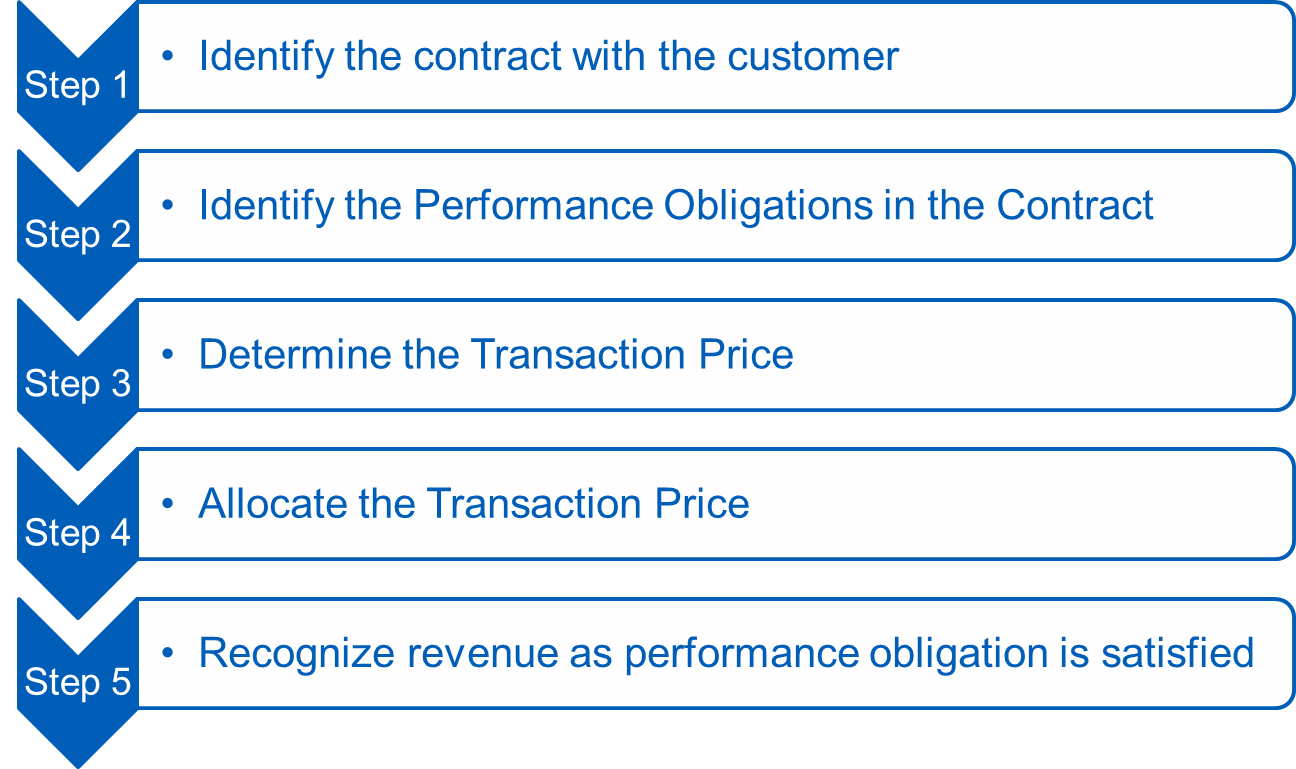

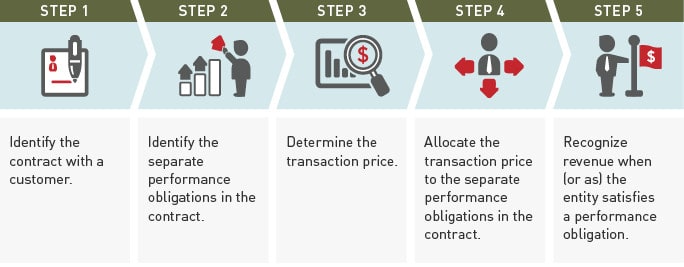

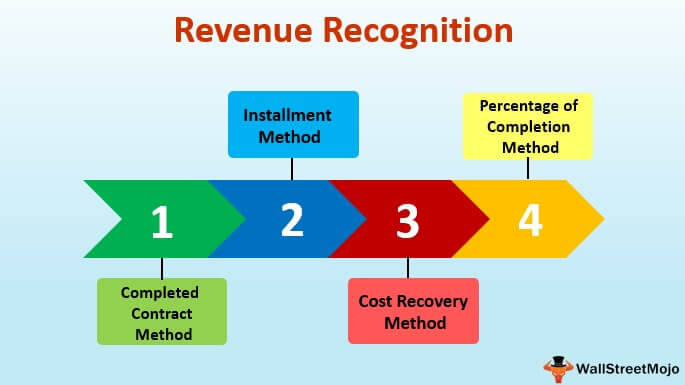

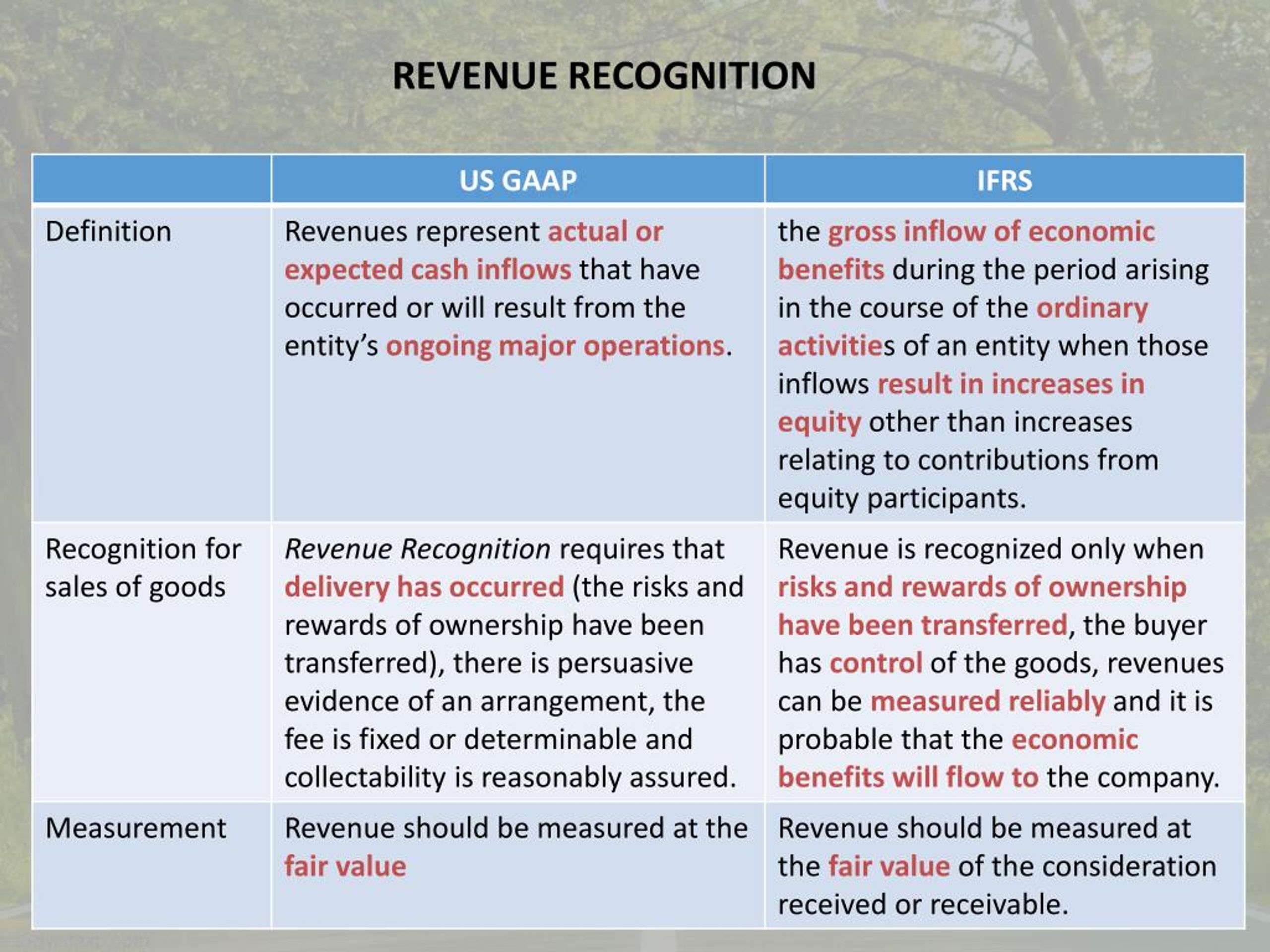

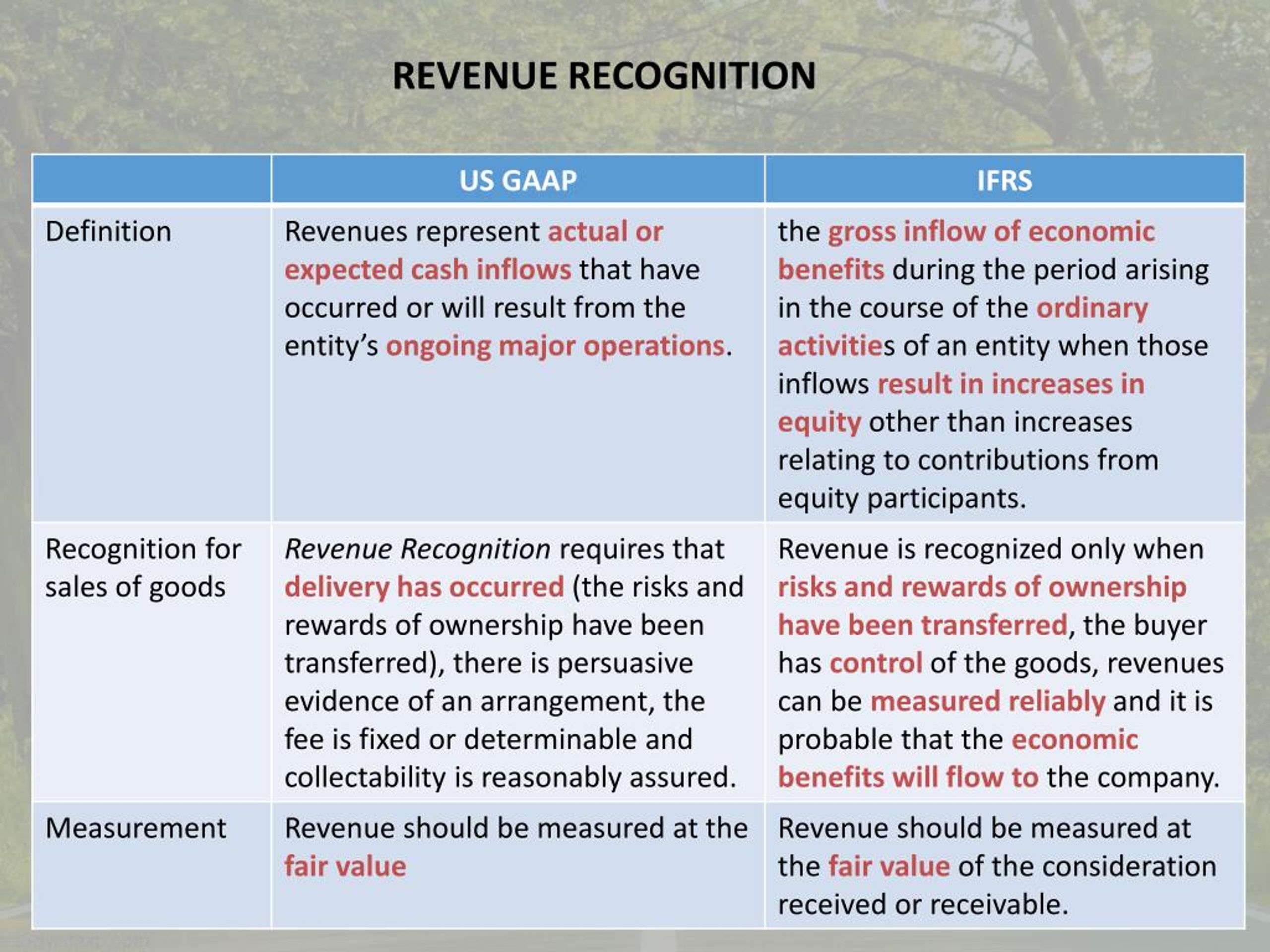

Web 1 Identify the contract 2 Identify separate performance obligations 3 Determine the transaction price 4 Allocate transaction price to performance obligations 5 Recognise Web New model Current US GAAP Current IFRS Revenue should not be recognised for goods expected to be returned and a liability should be recognised for expected refunds to

Web The revenue standard provides guidance on when a reporting entity should reduce revenue for consideration paid to a customer ASC 606 10 32 27 If consideration payable to a Web A rebate accrual is the amount of rebate that has been earnt but not yet received Learn about year end revenue recognition accrued rebates and more

Download Rebate Revenue Recognition

More picture related to Rebate Revenue Recognition

New Revenue Recognition Standards Achieving ASC 606 Compliance

http://www.projectp.com/ppblog/wp-content/uploads/2017/06/five-steps-to-revenue-recognition-standards-1.png

Revenue Recognition ASC 606

https://www.herbein.com/hubfs/Revenue Recognition Steps.png#keepProtocol

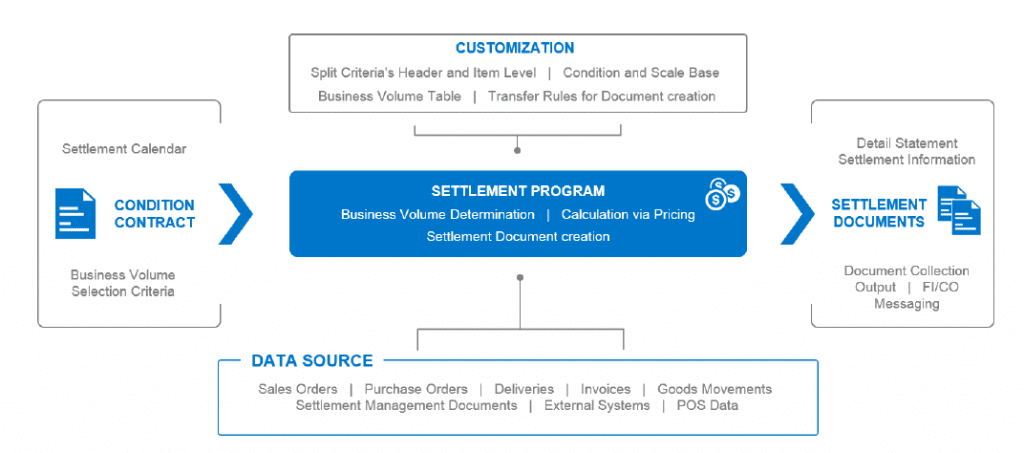

What Does SAP SD Look Like In SAP S 4 HANA

https://eursap.eu/wp-content/uploads/2017/03/Rebate-Management-x-1024x453.png

Web The core principle of the revenue standard is to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which an entity expects to be entitled in exchange for Web When does the consumer products company recognise revenue in accordance with IFRS 15 Background Relevant guidance Paragraph 31 of IFRS 15 an entity shall recognize

Web 26 sept 2019 nbsp 0183 32 Revenue recognition is an accounting principle that outlines the specific conditions under which revenue is recognized In theory there is a wide Web 16 juin 2020 nbsp 0183 32 As of 31 March 2020 the aggregate amount of revenue to be recognised is Delivery of 7 tractors CU1 000 x 7 CU7 000 Share of performance bonus CUnil Total

![]()

Revenue Recognition Basics With Brad Dempsey Solutions360

https://www.solutions360.com/wp-content/blogs.dir/13/files/2019/10/Revenue-Recognition-icon.jpg

Ias 15 Revenue Recognition IFRS 15 Revenue Recognition ASC606

https://warrenaverett.com/wp-content/uploads/graphic.png

https://assets.kpmg.com/content/dam/kpmg/be/pdf/2022/han…

Web This handbook provides a detailed analysis of the revenue standard IFRS 15 Revenue from Contracts with Customers including insights and examples to help entities to

https://www.ifrsmeaning.com/rebates-and-dis…

Web 30 mars 2021 nbsp 0183 32 IFRS 15 radically changed how the revenue from ordinary activities should be recognized Discounts under IFRS 15 are recognized as using as a reference the performance obligations established in a

E bate Reveal Your Rebate Revenue YouTube

Revenue Recognition Basics With Brad Dempsey Solutions360

Basic Elements Of Revenue Recognition Principlesofaccounting

Revenue Recognition Principle Class 11

Revenue Recognition Principle Criteria Requirement Example

Custom Essay Amazonia fiocruz br

Custom Essay Amazonia fiocruz br

:max_bytes(150000):strip_icc()/Revenuerecognition_rev-8feb74977e684b129ee86aa234791964.jpg)

Revenue Recognition What It Means In Accounting And The 5 Steps

Ch 4 Revenue And Expense Recognition YouTube

Eac Revenue Recognition

Rebate Revenue Recognition - Web 1 Identify the contract 2 Identify separate performance obligations 3 Determine the transaction price 4 Allocate transaction price to performance obligations 5 Recognise