Rebate Tax Credit 2024 Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

Rebate Tax Credit 2024

Rebate Tax Credit 2024

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

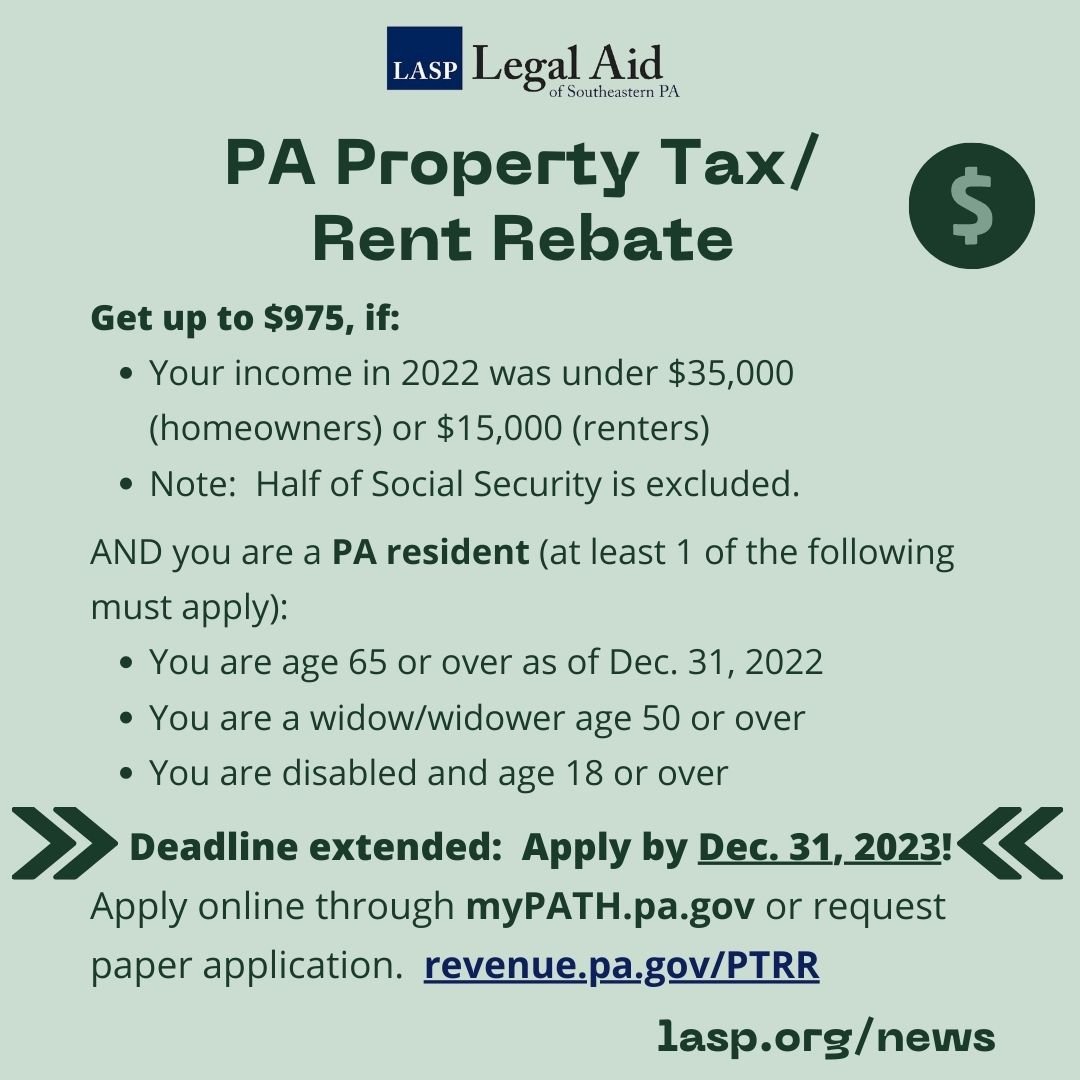

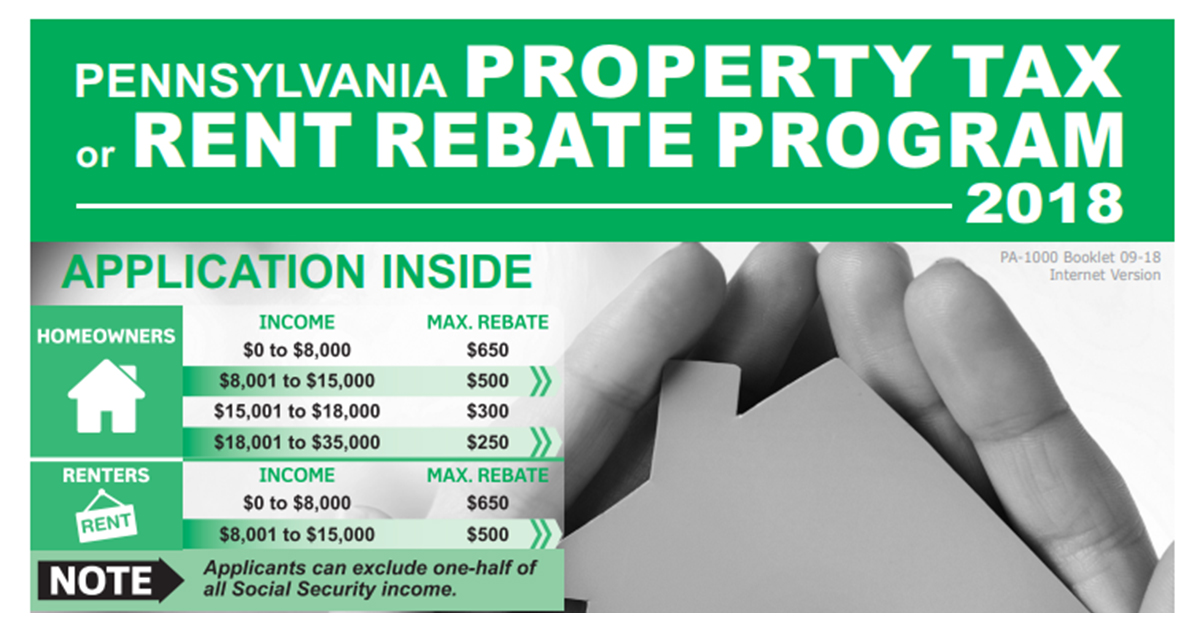

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of Southeastern Pennsylvania

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/9e98951b-5acf-419a-afcd-ce4692a6a772/2023-12-31+property+tax+rebate+DEADLINE.2-insta.jpg

What Is the Heat Pump Tax Credit How to Qualify for the Heat Pump Tax Credit Related Tax Credits Heat Pump Tax Rebate State Heat Pump Installation Incentives How to Apply for Heat What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead

Home Energy Rebates are not yet available but DOE expects many states and territories to launch their programs in 2024 Our tracker shows which states and territories have applied for and received funding Households looking for assistance today may be eligible for other federal programs including tax credits or the Weatherization Assistance Program The EV Tax Credit Now Acts Like an Instant Rebate Changes to the EV tax credit in 2024 allow an immediate discount on an EV purchase but there are additional requirements that

Download Rebate Tax Credit 2024

More picture related to Rebate Tax Credit 2024

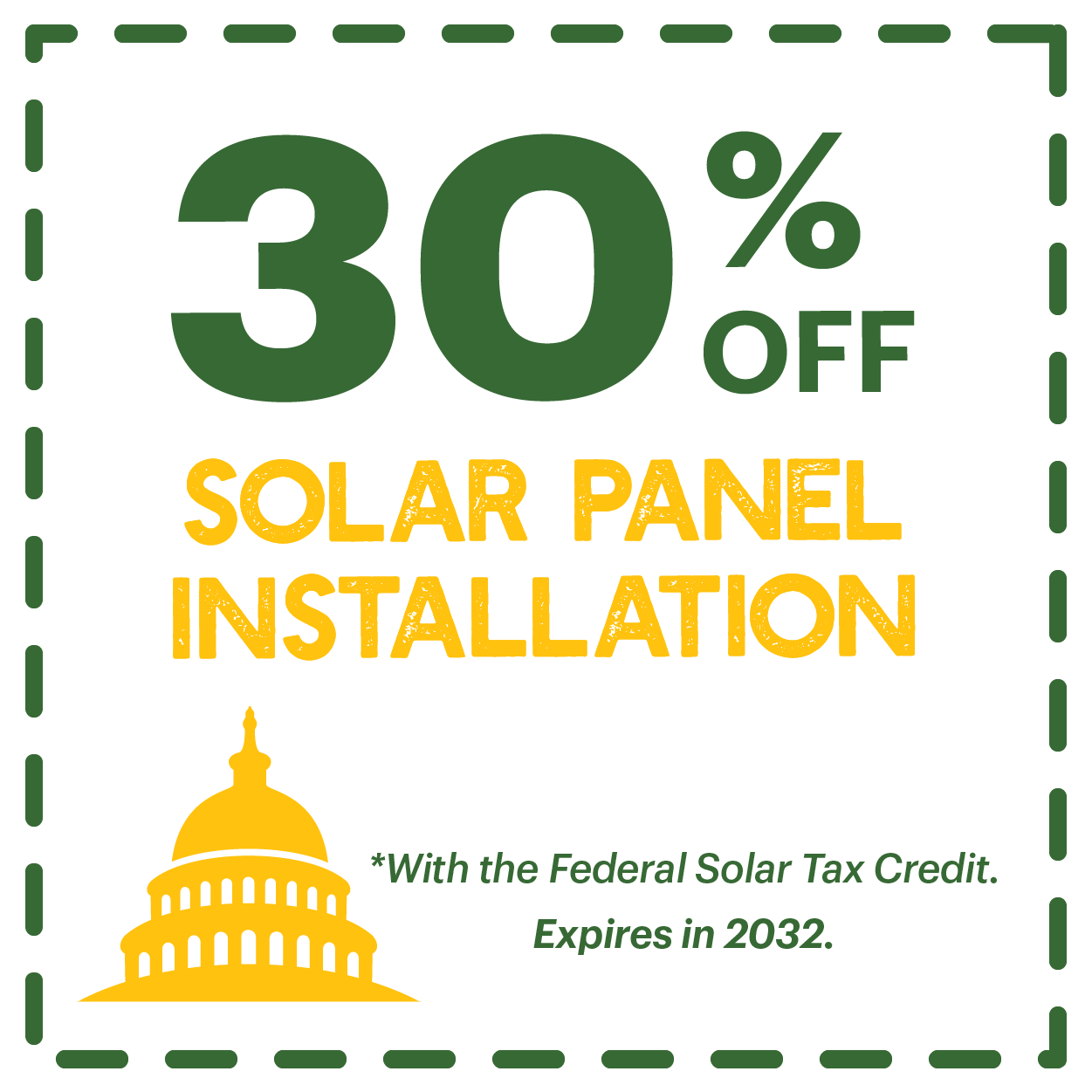

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of The Most Important Ways

https://lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

What Is A Recovery Rebate Tax Credit The TurboTax Blog

https://blog.turbotax.intuit.com/wp-content/uploads/2020/12/what-is-a-recovery-rebate-tax-credit.jpg?w=600&h=1068&crop=1

The tax benefit which was recently modified by the Inflation Reduction Act for years 2023 through 2032 allows for a maximum credit of 7 500 for new EVs and up to 4 000 limited to 30 of the Rules for claiming the federal tax credit for electric vehicles have changed for 2024 Here s what you need to know if you want to buy an EV Image credit Getty Images By Kelley R

The law gives states until August 2024 to start handing out the rebates or lose the funding DOE has just taken the first step in a long process of getting these programs designed and those Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

What Is Recovery Rebate Tax Credit For 2020 All About AOTAX COM

https://www.aotax.com/wp-content/uploads/2021/02/What-is-Recovery-Rebate-Tax-Credit-for-2020-all-about-1-980x613.jpg

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

WASHINGTON The Internal Revenue Service today announced Monday Jan 29 2024 as the official start date of the nation s 2024 tax season when the agency will begin accepting and processing 2023 tax returns The IRS expects more than 128 7 million individual tax returns to be filed by the April 15 2024 tax deadline

2023 Tax Rebate Credit Tax Rebate

Income Tax Rebate Under Section 87A

Section 87A Tax Rebate Under Section 87A Rebates Financial Management Income Tax

Recovery Rebate Tax Credit En Tax Season Professional Software YouTube

Recovery Rebate Tax Credit 2020 Tax Refunds And Tips YouTube

The Recovery Rebate Tax Credit Are You Eligible Silver Tax Group

The Recovery Rebate Tax Credit Are You Eligible Silver Tax Group

ERC TAX CREDIT REBATE

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse Solar LLC

Recovery Rebate Form 2021 Printable Rebate Form

Rebate Tax Credit 2024 - The EV Tax Credit Now Acts Like an Instant Rebate Changes to the EV tax credit in 2024 allow an immediate discount on an EV purchase but there are additional requirements that