Rebate Taxable Tax Web La d 233 claration et le paiement de la taxe affect 233 e sont obligatoires pour toutes les personnes et les entreprises qui fabriquent des produits ou r 233 alisent des op 233 rations taxables que

Web 1 d 233 c 2022 nbsp 0183 32 Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer money after a retroactive tax decrease These measures are more immediate than tax refunds Web Although the IRS appears to be moving toward allowing most seller paid rebates as exclusions it is now insisting that even accrual taxpayers delay the exclusion until the

Rebate Taxable Tax

Rebate Taxable Tax

https://cdn.techgyd.com/tax-rebate.jpg

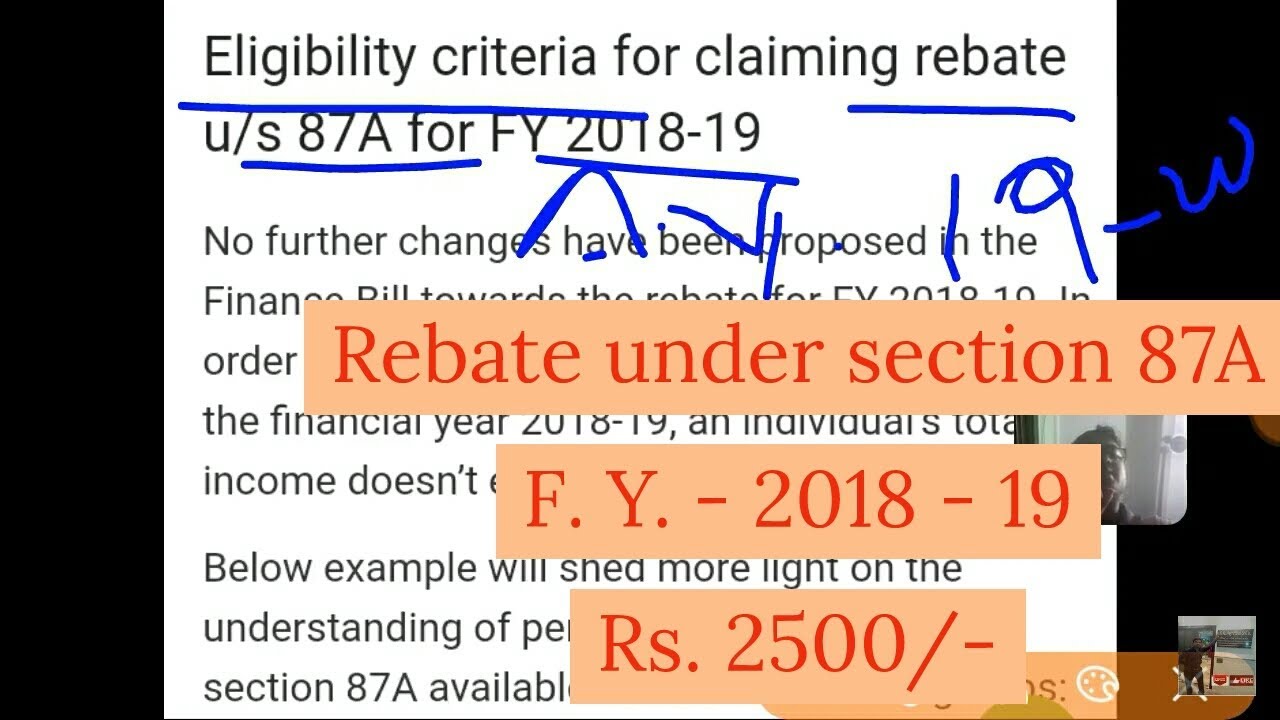

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Is Recovery Rebate Taxable Find All Answers

https://stimulusmag.com/wp-content/uploads/2022/12/is-recovery-rebate-taxable-1024x791.jpeg

Web The IRS may be taxing rebates points and rewards and sending out 1099s How the IRS interprets taxing rebates points and rewards can be confusing at best For example Web 9 sept 2023 nbsp 0183 32 taxes taxable income Will Your State Rebate Check Be Taxed for 2023 Here s what the IRS says about taxing state stimulus checks and other special state

Web 6 f 233 vr 2023 nbsp 0183 32 According to the Massachusetts Office of Administration and Finance All tax refunds including the 62F refunds are taxable by the federal government to the extent Web 10 f 233 vr 2023 nbsp 0183 32 Key Points If you received a state tax rebate or payment in 2022 it s unclear whether the funds are taxable on your federal return The IRS last week told

Download Rebate Taxable Tax

More picture related to Rebate Taxable Tax

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

https://i.ytimg.com/vi/OS6nlwtzz-A/maxresdefault.jpg

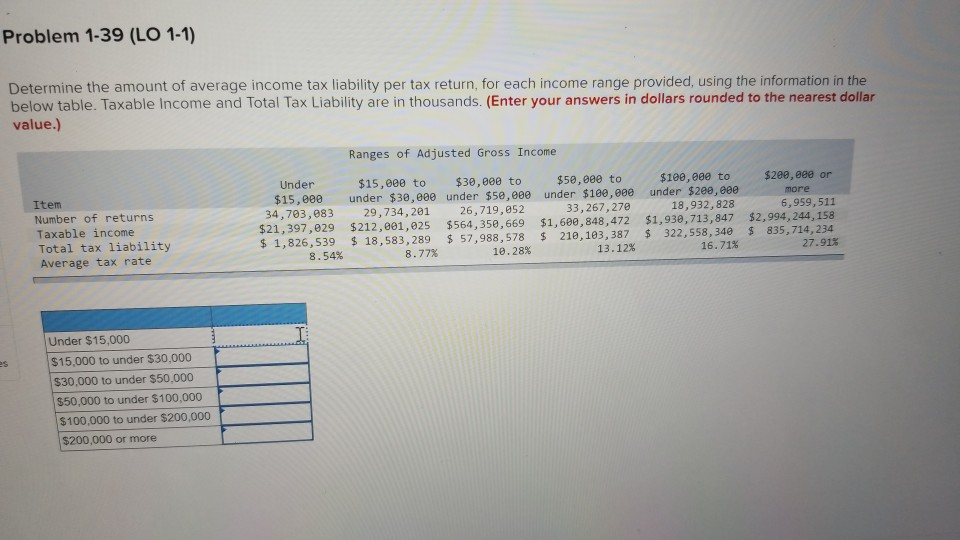

Solved Problem 1 39 LO 1 1 Determine The Amount Of Average Chegg

https://media.cheggcdn.com/media/9ec/9ec51619-cf20-4157-94f9-e208f37c3ee5/image.png

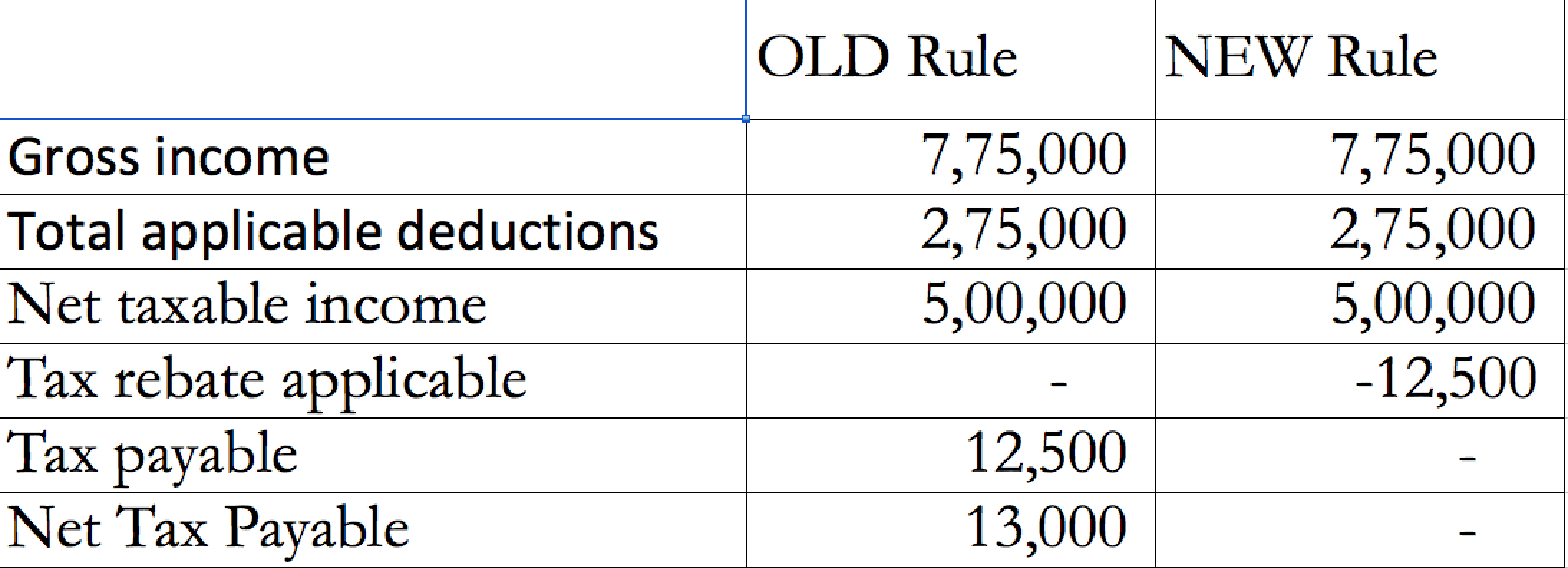

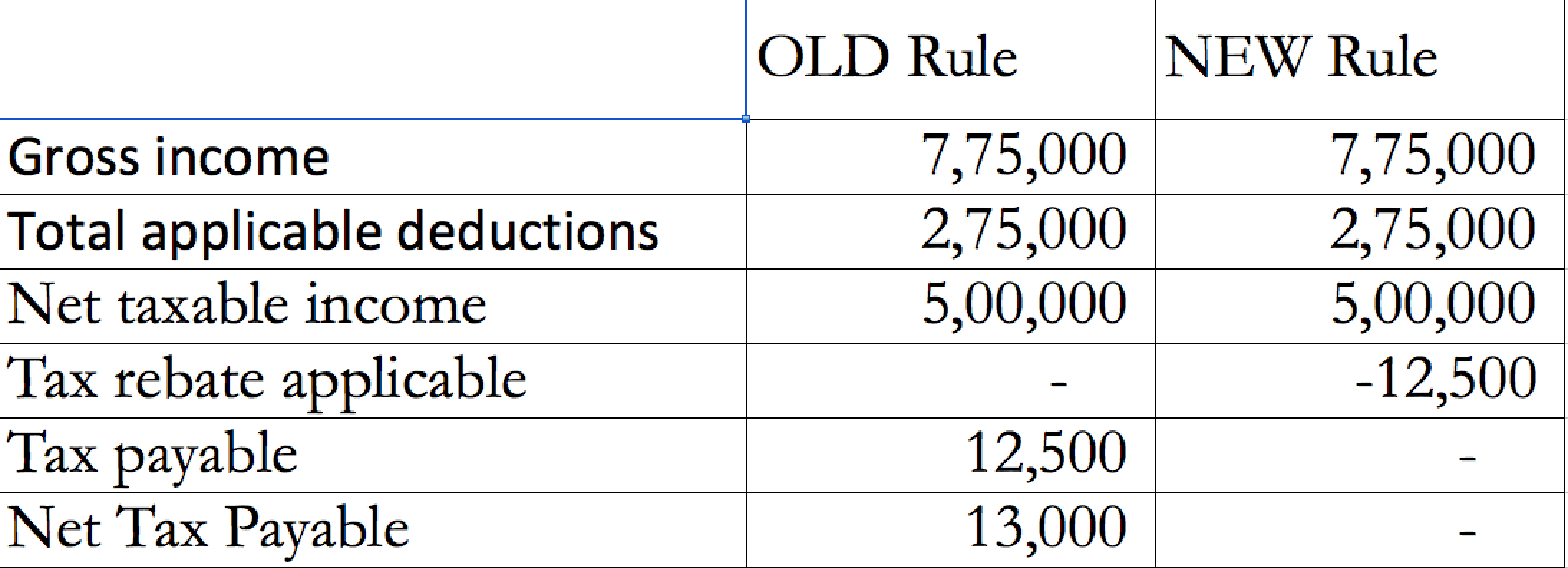

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Web 11 mars 2023 nbsp 0183 32 Is my state rebate payment taxable by the IRS The IRS has decided not to require taxpayers to declare payments related to quot general welfare and disaster relief quot Web You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job job expenses such

Web 10 f 233 vr 2023 nbsp 0183 32 February 10 2023 6 34 PM MoneyWatch Taxpayers in more than 20 states who received tax rebates last year got some guidance from the IRS after the Web They are different from deductions which reduce your taxable income Tax credits are a dollar for dollar reduction in the amount of tax you owe It s important to understand that

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.46.44-AM.png

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

https://www.codifab.fr/taxe-affectee/entreprises

Web La d 233 claration et le paiement de la taxe affect 233 e sont obligatoires pour toutes les personnes et les entreprises qui fabriquent des produits ou r 233 alisent des op 233 rations taxables que

https://turbotax.intuit.com/tax-tips/tax-relief/what-are-tax-rebates/L...

Web 1 d 233 c 2022 nbsp 0183 32 Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer money after a retroactive tax decrease These measures are more immediate than tax refunds

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Deferred Tax And Temporary Differences The Footnotes Analyst

Section 87A Tax Rebate Under Section 87A

Are Investment Expenses Tax Deductible In 2019 Antique Wooden World

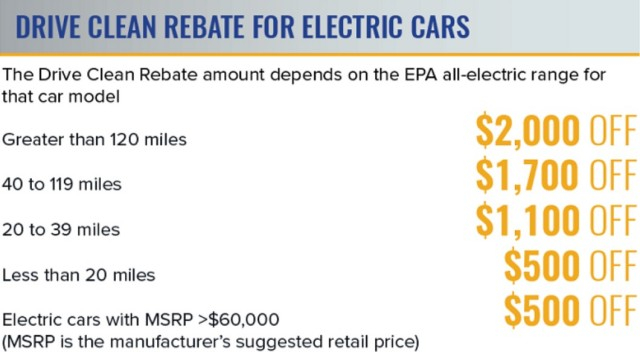

Are Car Rebates Taxable In New York 2022 Carrebate

Are Car Rebates Taxable In New York 2022 Carrebate

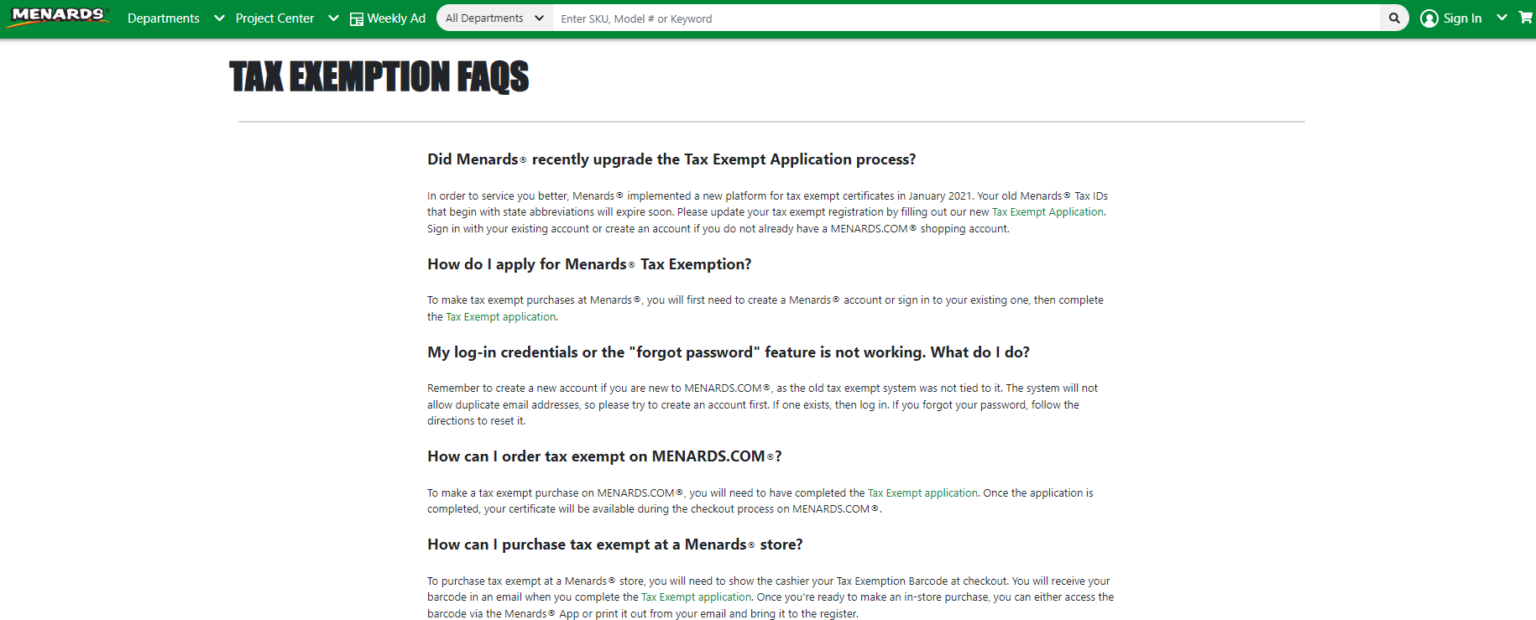

Are Menards Rebates Taxable Menards Rebate Form 2023

Is Property Tax Rebate Taxable Iras PRORFETY

Are GST Rebates Taxable Top 10 Reasons To Claim A GST Rebate

Rebate Taxable Tax - Web 24 juil 2023 nbsp 0183 32 Under the Coronavirus Aid Relief and Economic Security CARES Act up to 1 200 rebates are provided for individuals 2 400 for joint filers with an additional