Rebate U S 86 In Income Tax Web 24 avr 2015 nbsp 0183 32 24 April 2015 Dear Experts Assessee is the member of AOP and the income of the AOP is tax under the normal rate Now we want to file the return for one

Web 9 sept 2023 nbsp 0183 32 In most cases according to the IRS taxpayers who receive special state payments one time refunds rebates or other payments in 2023 won t have to include Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Rebate U S 86 In Income Tax

Rebate U S 86 In Income Tax

https://1.bp.blogspot.com/-U2u0724WwFU/XIufpz2wpbI/AAAAAAAAI4M/2rZZaVD9zCEv8-C1Fg7gR1XHuk0dpAsPgCLcBGAs/s1600/picture%2Bfor%2Btax%2Brebate%2B87A.jpg

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

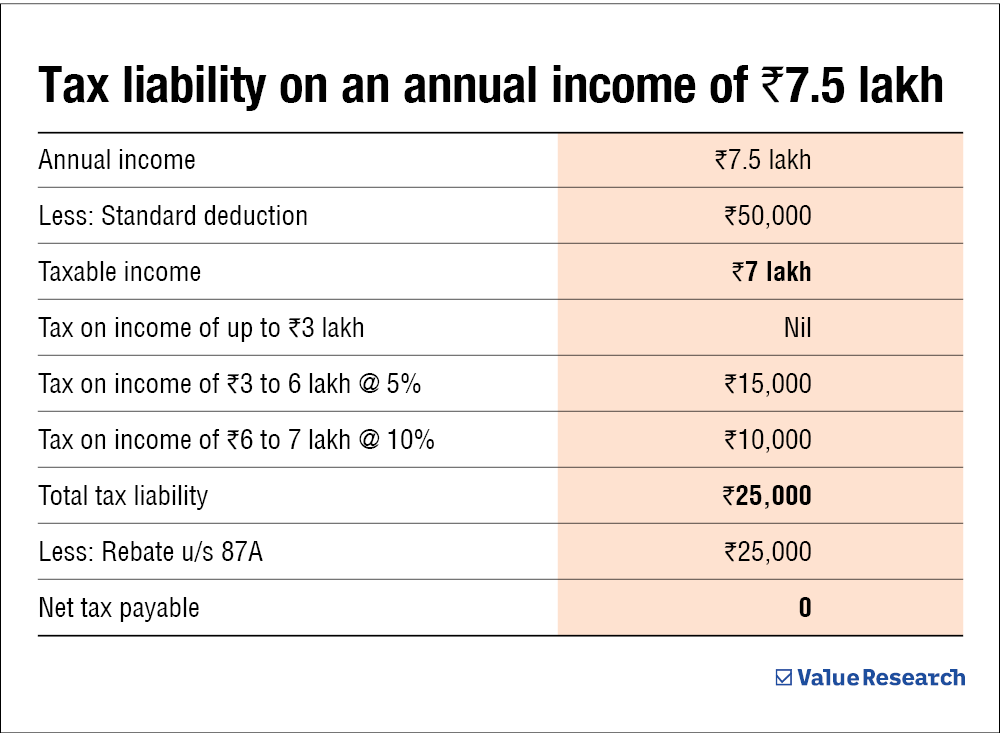

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

https://images.news18.com/ibnlive/uploads/2023/02/83255640-2381-4550-9fb8-1f5c2c312a75.jpg?impolicy=website&width=0&height=0

Web 28 juil 2022 nbsp 0183 32 The previous payout in pennies could reach hundreds of dollars this time around if Baker s figures are right and could result in about 7 of income taxes paid in 2021 being returned to taxpayers Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue

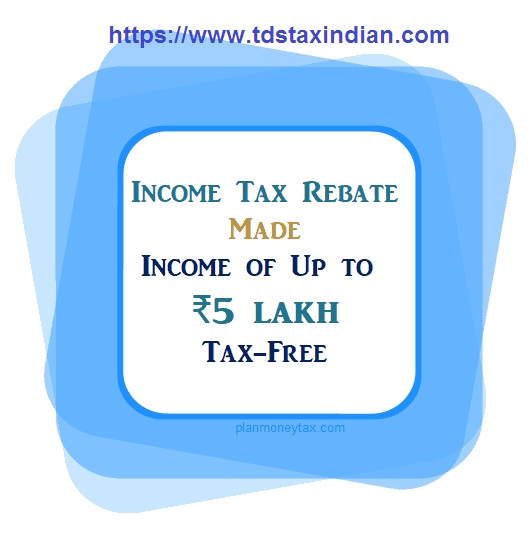

Web 1 f 233 vr 2023 nbsp 0183 32 Basic Income Tax exemption limit has been increased to Rs 3 00 000 from 2 50 000 under the new income tax regime A rebate u s 87A has been enhanced under the new tax regime from the current Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Download Rebate U S 86 In Income Tax

More picture related to Rebate U S 86 In Income Tax

Indian Budget 2023 Income Tax Rebate Limit Increased No Tax On Income

https://shabiba.eu-central-1.linodeobjects.com/2023/02/1675237419-1675237419-ominottsnayo-700x400.jpg

.png)

Rebate U s 87A Income Tax Rebate Under Section 87A JR Compliance Blogs

https://blogs.jrcompliance.com/store/media/What Are the Things to Remember to Avail Rebate Under Section 87A (1).png

.jpg)

87A Rebate Rebate U s 87A How To Get Income

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj0KQupb9BHOTR2bsOdB170DoC_nNylmDOhymeHI5CCfKQ__HBtBLZMBiCXNyhQABW8AIpWGJ6S4xrqZcSj5E9cl5U2Wc3pxnwE8Cg6mVtzxsd1aJTIQvG7_r3Vo56nHlZtAvZw1Ccn_EsMNIyXyvh9ZJE97FBqbadx1bcRciOfUSxM5DOgu3HHCNTa/s1200/image (95).jpg

Web 9 sept 2023 nbsp 0183 32 Increased Virginia standard deduction The proposed budget would temporarily increase the Virginia standard deduction for the 2024 and 2025 tax years Web Which EVs are eligible for the full 7 500 tax credit The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s

Web 9 janv 2021 nbsp 0183 32 Rebate is applicable u s 86 In case total income of PFAOP AOP is not taxable at MMR or any other rate higher than MMR the share of income of a member Web 3 ao 251 t 2023 nbsp 0183 32 This means under both old and new tax regimes a resident individual with taxable income up to 5 lakh is eligible to claim the tax rebate of 12 500 or the amount

Rebate U s 87A Income Tax Rebate Under Section 87A JR Compliance Blogs

https://blogs.jrcompliance.com/store/media/How Much Rebate US 87A is Allowed .png

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

https://www.caclubindia.com/experts/rebate-u-s-86-in-itr-2057129.asp

Web 24 avr 2015 nbsp 0183 32 24 April 2015 Dear Experts Assessee is the member of AOP and the income of the AOP is tax under the normal rate Now we want to file the return for one

https://www.kiplinger.com/taxes/will-your-state-rebate-check-be-taxed

Web 9 sept 2023 nbsp 0183 32 In most cases according to the IRS taxpayers who receive special state payments one time refunds rebates or other payments in 2023 won t have to include

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Rebate U s 87A Income Tax Rebate Under Section 87A JR Compliance Blogs

Tax Rebate For Individual Deductions For Individuals reliefs

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

Income Tax Rebate U s 87A For The Financial Year 2022 23

Section 87A Tax Rebate Under Section 87A

Section 87A Tax Rebate Under Section 87A

Marginal Relief For New Tax Regime Followers In Finance Bill 2023

Rebate U s 87A Income Tax Rebate Under Section 87A JR Compliance Blogs

Tax Deduction Changes 2022 Small Business Small Business 2022

Rebate U S 86 In Income Tax - Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your