Rebate U S 87a Applicable From Which Year Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable

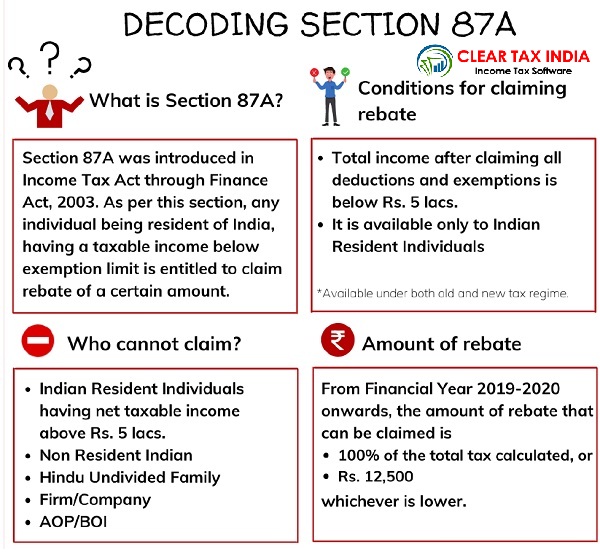

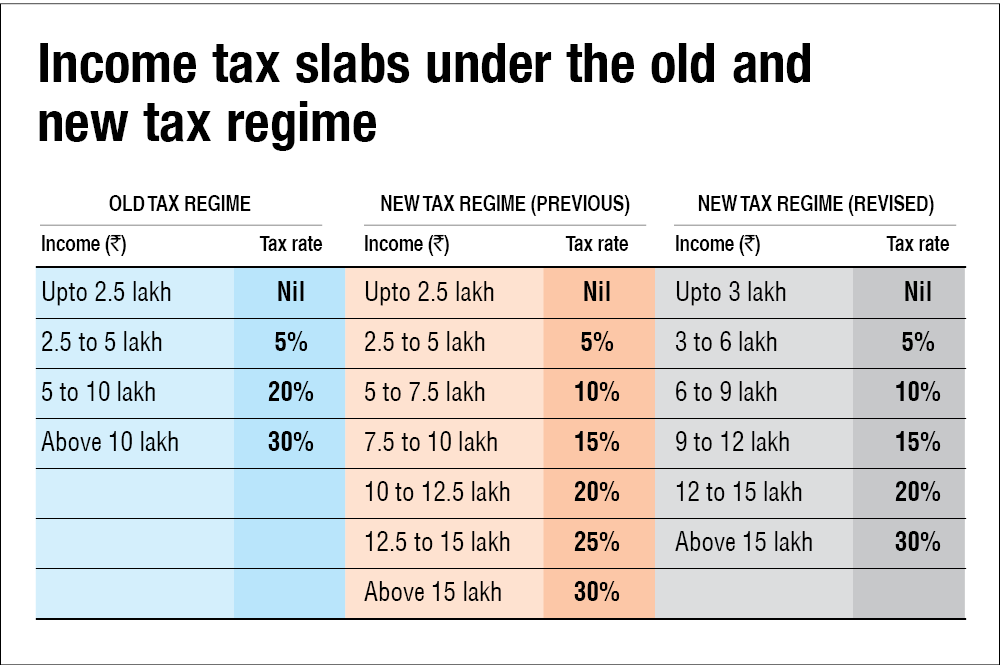

Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if their Section 87A rebate is available under the old and the new tax regime Rebate against various tax liabilities Section 87A rebate can be claimed against tax liabilities on Normal income which is taxed at the

Rebate U S 87a Applicable From Which Year

Rebate U S 87a Applicable From Which Year

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Is Rebate Under Section 87A Applicable For NRIs YouTube

https://i.ytimg.com/vi/yHWq64OK-lI/maxresdefault.jpg

Explanation Of Rebate U s 87A YouTube

https://i.ytimg.com/vi/Pyt_zAJs62E/maxresdefault.jpg

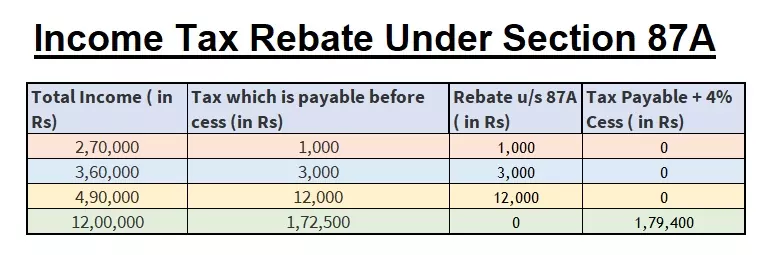

Under Section 87A the maximum rebate limit is Rs 12 500 under the old tax regime and Rs 25 000 under the new tax regime This rebate can only be claimed if Post 5th July 2024 The updated utility no longer provides rebate u s 87A for special rate incomes including STCG under Section 111A For Example If an individual income is Rs 7 lakh without any special rate

Rebate u s 87A is allowed before levy of Health and Education Cess Surcharge Rebate benefit is available to all category of Individuals but not to super senior citizen since he is already fully If your total income does not exceed Rs 7 lakh under the new tax regime or Rs 5 lakh under the old tax regime you can claim the rebate The maximum rebate for the Assessment Year 2024 25 can be

Download Rebate U S 87a Applicable From Which Year

More picture related to Rebate U S 87a Applicable From Which Year

Rebate U s 87A

https://img.indiafilings.com/learn/wp-content/uploads/2018/06/12005955/Rebate-87A.jpg

Rebate U s 87A Tax Slab Format For Computing Tax Liability Session 23

https://i.ytimg.com/vi/pdHTAr-HPP0/maxresdefault.jpg

Rebate U s 87A

https://media.licdn.com/dms/image/C5112AQHGhIc7iVAbrg/article-cover_image-shrink_600_2000/0/1523954816383?e=2147483647&v=beta&t=BtH1y3BpTu4KevMTicf4-bfJurzHAXOcHYOEp8_GexA

In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim Claim tax rebate under Section 87A only when the income does not exceed 5 lakhs The maximum rebate under section 87A for AY 2024 25 FY 2023 24 is 25 000 under the

Rebate under Section us 87A can be calculated by following the given steps Calculate your total income for the financial year Deduct the rebate offered under Section 80C to Section 80T Deduct any What is Income Tax Rebate U S 87A Under the old tax regime a rebate u s 87A is provided if your taxable income does not exceed Rs 5 00 lacs in a financial year

Rebate U s 87A Questions Answers YouTube

https://i.ytimg.com/vi/qcr-ZCYZS9Q/maxresdefault.jpg

Income Tax Rebate 2024

https://nadeemacademy.com/wp-content/uploads/2021/08/Income-Tax-Rebate.webp

https://tax2win.in/guide/section-87a

Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable

https://economictimes.indiatimes.com/wealth/tax/...

Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if their

Income Tax Calculator Fy 2023 24 Comparison Image To U

Rebate U s 87A Questions Answers YouTube

Income Tax Rebate Under Section 87A

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

The Curious Case Of Rebate U s 87A And Its Admissibility In Regard To

ALL ABOUT REBATE U S 87A YouTube

ALL ABOUT REBATE U S 87A YouTube

Decoding Rebate U s 87A Post Interim Budget For The F Y 2019 20

Rebate U s 87A

Income Tax Slab Rates For FY 2021 22 AY 2022 23 Bachat Mantra

Rebate U S 87a Applicable From Which Year - Rebate u s 87A is allowed before levy of Health and Education Cess Surcharge Rebate benefit is available to all category of Individuals but not to super senior citizen since he is already fully