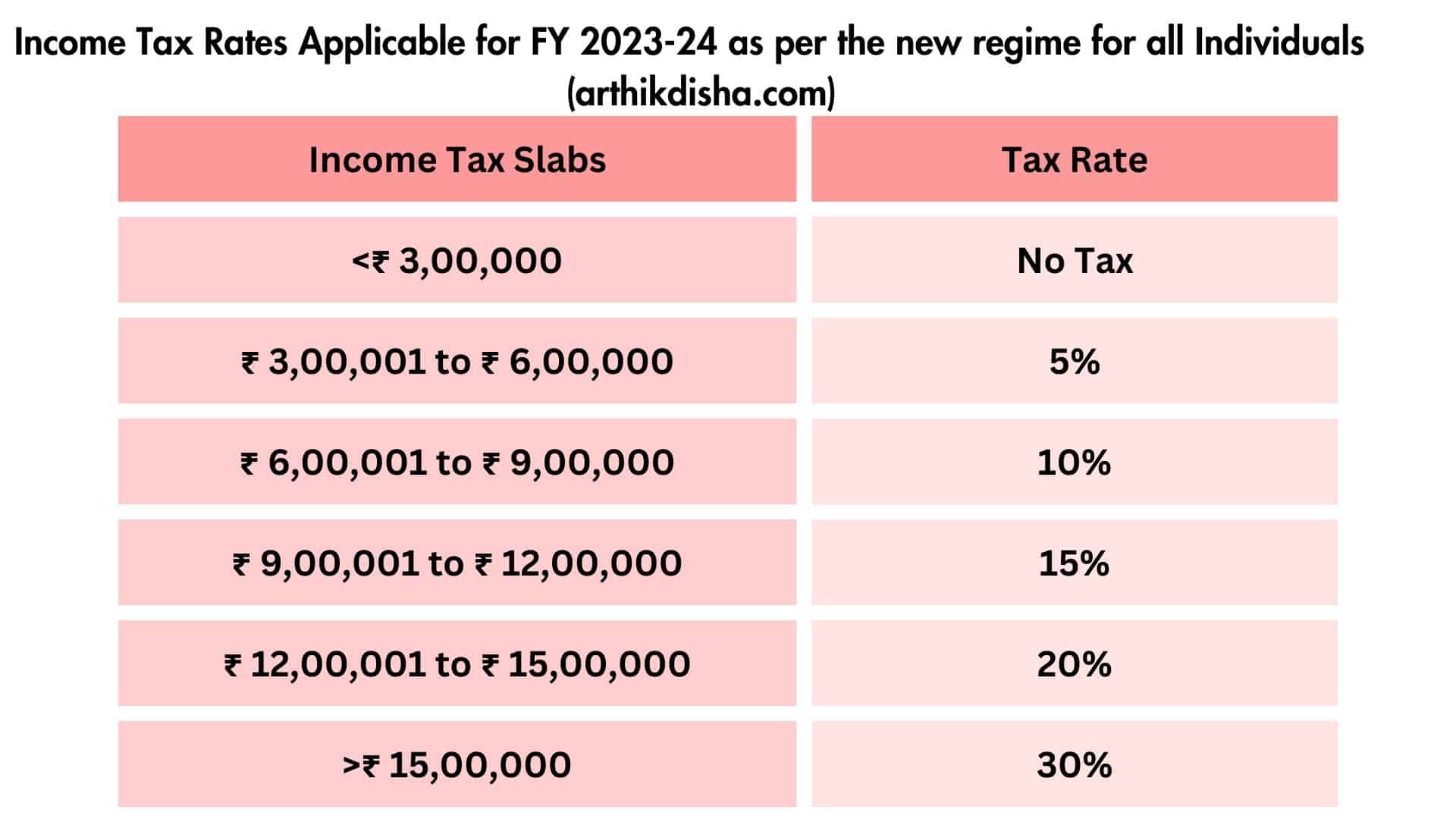

Rebate U S 87a For Ay 2023 23 Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an

Web 14 sept 2019 nbsp 0183 32 Amount of rebate allowed u s 87A 2023 24 Rs 7 00 000 under the new tax regime Rs 25 000 2022 23 Rs 5 00 000 Rs 12 500 2021 22 Rs 5 00 000 Rs Web 1 avr 2023 nbsp 0183 32 Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident

Rebate U S 87a For Ay 2023 23

Rebate U S 87a For Ay 2023 23

https://studycafe.in/wp-content/uploads/2023/02/Know-new-rebate-under-section-87A.jpg

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2022 23 In Hindi

https://i.ytimg.com/vi/jocxPhsi0f0/maxresdefault.jpg

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

https://i.ytimg.com/vi/TYfP6LlV2QU/maxresdefault.jpg

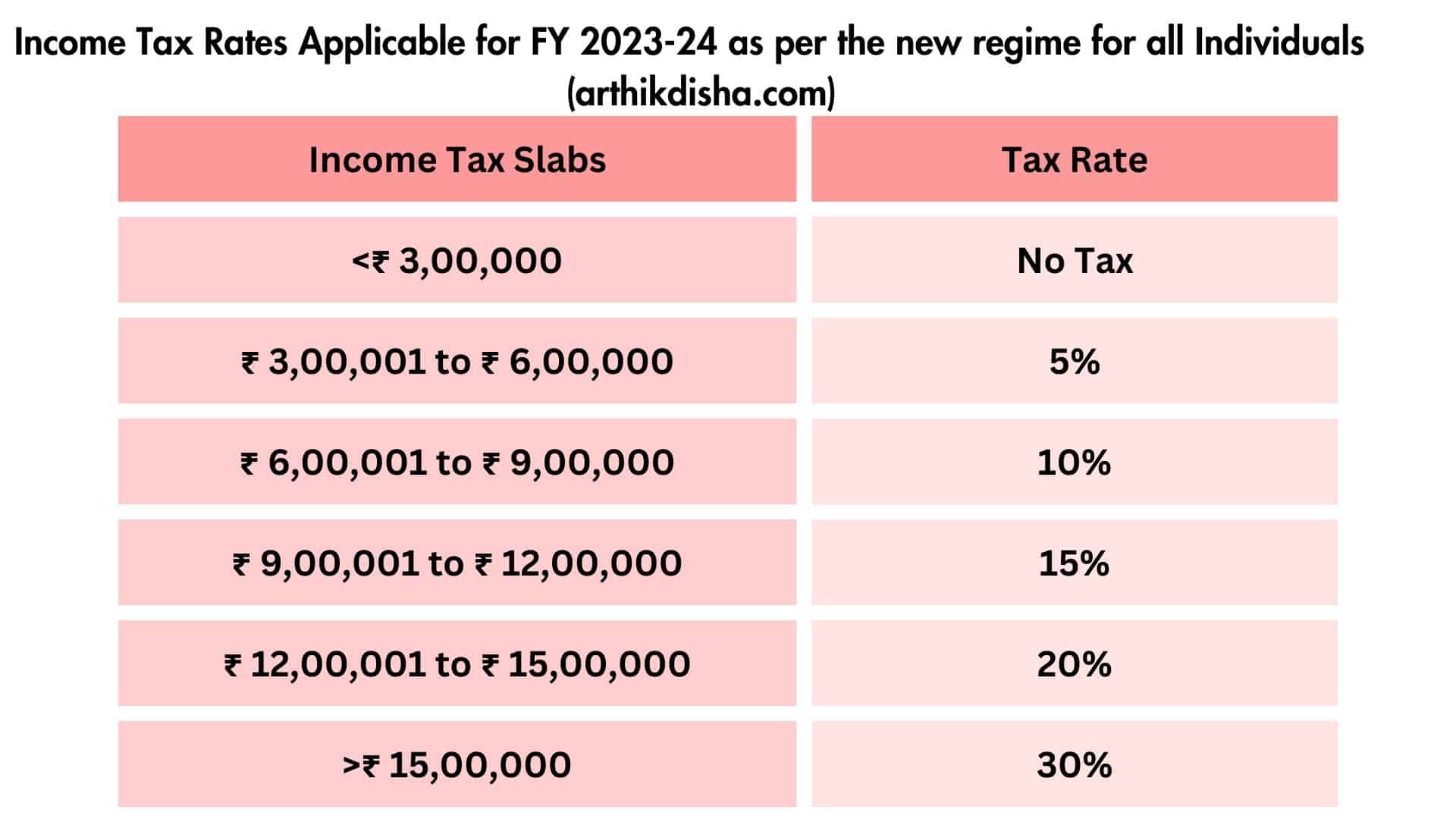

Web 3 f 233 vr 2023 nbsp 0183 32 A rebate of Rs 12 500 is available u s 87A for those under the OLD tax regime for individuals whose taxable income is Rs 5 lakh or less in a year Therefore the Section 87A Tax rebate is available under both Web Under the new income tax regime the amount of the rebate under Section 87A for FY 2023 24 AY 2024 25 has been modified A resident individual with taxable income up to Rs

Web 1 f 233 vr 2023 nbsp 0183 32 Section 87A Rebate for AY 2023 24 Income Tax Rebate under section 87A of Income Tax Act 1961 provides a rebate from income tax up to Rs 12500 to an individual resident assessee whose total Web 19 avr 2023 nbsp 0183 32 The tax rebate under Section 87A remains unchanged for those who opt for the old tax regime in FY 2023 24 How to Claim Tax Rebate under Section 87A If you

Download Rebate U S 87a For Ay 2023 23

More picture related to Rebate U S 87a For Ay 2023 23

Rebate Under Sec 87A On Basic Income Tax PY 2022 23 AY 2023 24

https://i.ytimg.com/vi/iBVPuOeMqvo/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGMgYyhjMA8=&rs=AOn4CLAkxwuVfXRiwLFdgZ5yJ77kkzr3_g

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

https://i.ytimg.com/vi/wZNZ6YgMsIc/maxresdefault.jpg

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

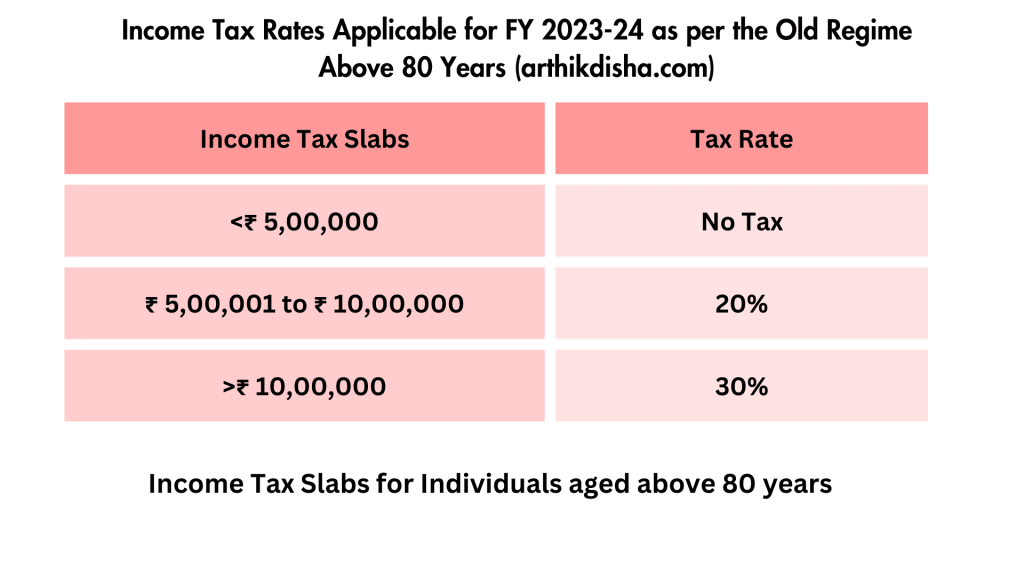

https://arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rates-Applicable-for-FY-2023-24-as-per-the-Old-Regime-Above-80-Years-arthikdisha.com_-1024x576.png

Web 4 ao 251 t 2023 nbsp 0183 32 People having taxable revenue of as much as Rs 7 lakh are eligible for tax rebate beneath part 87A of as much as Rs 25 000 thereby making zero tax payable Web 14 d 233 c 2022 nbsp 0183 32 A tax rebate of Rs 12 500 or an amount equal to the tax whichever is lower shall be allowed to individual falling under the limit given under Section 87A for AY 2023 24 Given that if an individual s

Web Rebate u s 87A of Income Tax Act for AY 2023 2024 Rebate is available to resident individual Rebate is not available to HUF Rebate is available to resident individual whose total Web The income tax rebate under Section 87a provides some relief to the taxpayers who fall under the tax category of 10 Any individual whose annual net income does not exceed

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rates-Applicable-for-FY-2023-24-as-per-the-new-regime-for-HUF-and-all-Individuals-1.jpg

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-what-is-rebate-under-section-87a-for-ay-2020-21-financial-control-from-87a-rebate-ay-2023-20-post.jpg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 Amount of rebate allowed u s 87A 2023 24 Rs 7 00 000 under the new tax regime Rs 25 000 2022 23 Rs 5 00 000 Rs 12 500 2021 22 Rs 5 00 000 Rs

Rebate U s 87A Of Income Tax 7 Lakhs Income Tax

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Rebate U s 87A

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

Rebate U s 87A Including Tax On STCG LTCG INCOME TAX YouTube

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Rebate Under 87a Of Income Tax For 2023 24 With Budget 2023 Changes

Rebate Under Section 87A

Budget 2023 I Changes In Tax Rates I New Tax Regime I Rebate U s 87A I

Rebate U S 87a For Ay 2023 23 - Web 21 ao 251 t 2023 nbsp 0183 32 The maximum 87A rebate is up to 12 500 old and new regime till FY 2022 23 and 25 000 for the new regime from FY 2023 24 The rebate is not applicable