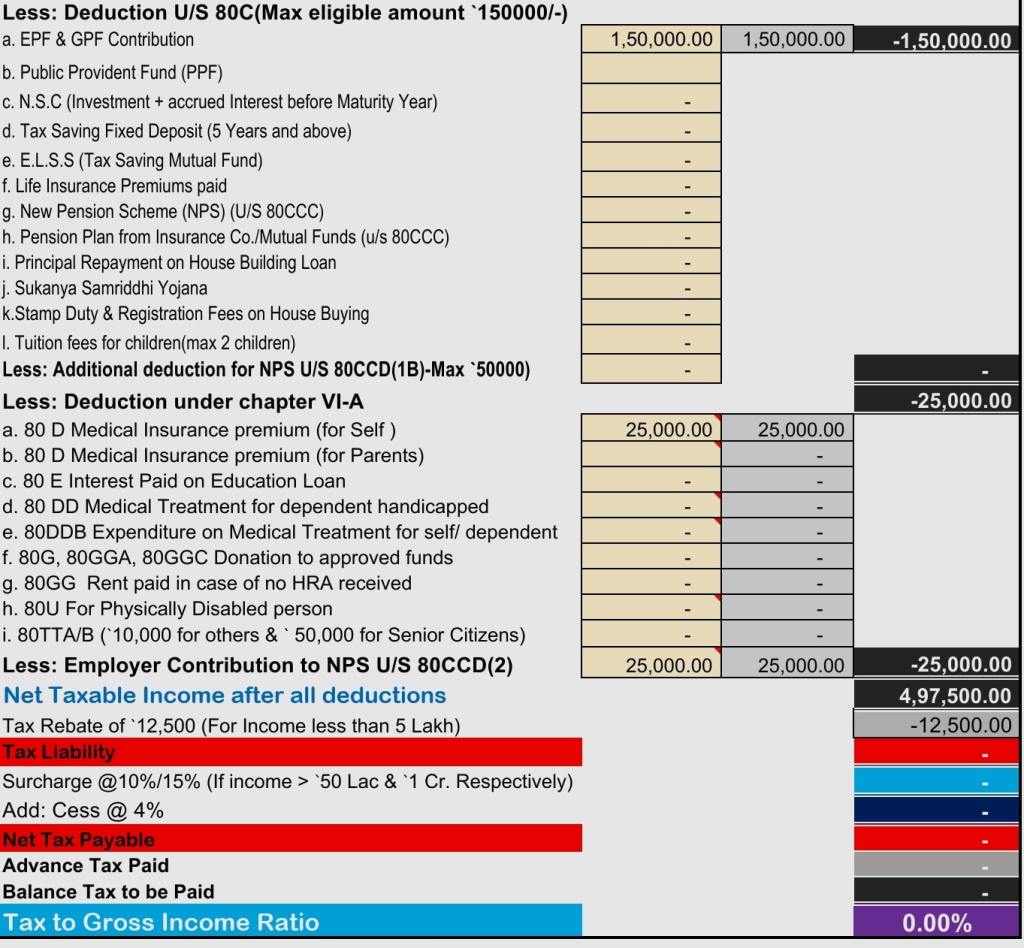

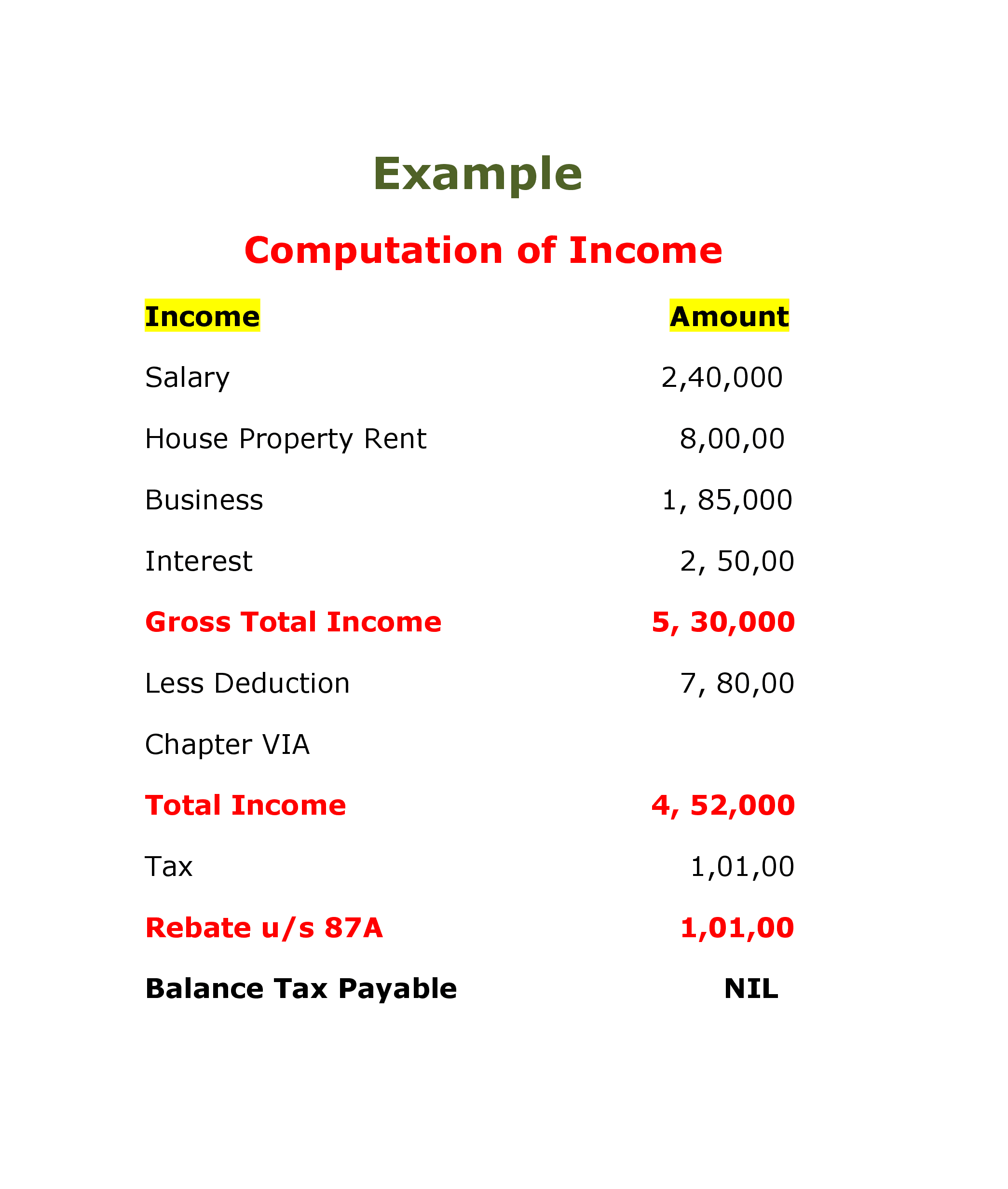

Rebate U S 87a For Ay 2024 23 Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime

Senior citizens can claim a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 For the FY 2021 22 and FY 2022 23 AY 2022 23 AY 2023 24 the rebate u s 87A remains unchanged at Rs 12 500 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Budget 2023 the government announced that any individual opting for the new tax regime and having taxable income up to Rs 7 lakh will be eligible for a tax rebate of Rs 25 000

Rebate U S 87a For Ay 2024 23

Rebate U S 87a For Ay 2024 23

https://financepost.in/wp-content/uploads/2019/04/rebate.png

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully Explained YouTube

https://i.ytimg.com/vi/R8TJaxFoAE8/maxresdefault.jpg

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/05/Screenshot_20230524_084225_Microsoft-365-Office.jpg

This article summarizes Income Tax Rates Surcharge Health Education Cess Special rates and rebate relief applicable to various categories of Persons viz Individuals Resident Non Resident HUF Firms LLP Companies Co operative Society Local Authority AOP BOI artificial juridical persons for income liable to tax in the Financial Y A rebate u s 87A is available if his total income during the previous year does not exceed Rs 7 00 000 Rebate is available to the extent of Rs 25 000 and no rebate will be available if total income exceeds Rs 7 00 000 The situation is exhibited in the Table given herein below New Marginal Scheme

CIRCULAR NO 1 2024 DATED the 23rd of January 2024 AMENDMENTS OF THE INCOME TAX ACT 1961 CARRIED OUT THROUGH FINANCE ACT 2023 87A Rebate of income tax in case of certain individuals of section 11 of the Act provides that registration u s 12AA or 12AB shall become inoperative if the trust or institution is approved under clause 23C Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax rebate effectively makes zero tax outgo of an individual Budget 2023 has proposed to extend the amount of tax rebate under new tax regime from taxable income of Rs 5 lakh to Rs 7 lakh

Download Rebate U S 87a For Ay 2024 23

More picture related to Rebate U S 87a For Ay 2024 23

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://i0.wp.com/arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rebate-US-87A-for-AY-2024-25-FY-2023-24-1-1.png?w=1280&ssl=1

Income Tax Rebate U S 87A For The FY 2020 21 AY 2021 22 FY 2019 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/income-tax-rebate-u-s-87a-for-the-fy-2020-21-ay-2021-22-fy-2019.jpg?fit=1280%2C720&ssl=1

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New Tax Rebate FinCalC TV

https://i.ytimg.com/vi/Yo8nxqN-uJg/maxresdefault.jpg

This return is applicable for an Individual or Hindu Undivided Family HUF who is Resident other than Not Ordinarily Resident or a Firm other than LLP which is a Resident having Total Income up to 50 lakh and having income from Business or Profession which is computed on a presumptive basis u s 44AD 44ADA 44AE and income from any of In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim rebate under 87A under new tax regime which shall be applicable from FY 2023 24 AY 2024 25 onwards What are the Eligibility Criteria to Claim a Rebate u s 87A

Understanding Tax Rebate u s 87A AY 2023 24 and Beyond for the Financial Year 2023 24 and the Assessment Year 2024 25 as per Budget 2023 The maximum limit of rebate available under section 87A of the Income tax Act 1961 has been increased to Rs 25 000 from Rs 12 500 in Budget 2023 Getty Images 3 6 Who are eligible for this rebate under section 87A According to the Income tax Act the rebate under section 87A is available to only resident individuals

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/05/SmartSelect_20230524_092110_Microsoft-365-Office-1024x654.jpg

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/05/SmartSelect_20230524_092144_Microsoft-365-Office-1024x948.jpg

https://caclub.in/income-tax-rebate-u-s-87a-individuals/

Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime

https://greatsenioryears.com/guide-rebate-u-s-87a-for-senior-citizens/

Senior citizens can claim a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 For the FY 2021 22 and FY 2022 23 AY 2022 23 AY 2023 24 the rebate u s 87A remains unchanged at Rs 12 500

Union Budget 2023 Rebate U s 87A Enhanced For New Income Tax Regime TaxCharcha

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2022 23 In Hindi Income Tax Computation

Rebate U s 87A Of I Tax Act Income Tax

Rebate U s 87A Of Income Tax Act Rebate AY 2023 24 Income Tax Computation YouTube

Rebate U s 87A Of Income Tax Act Rebate AY 2023 24 Income Tax Computation YouTube

Rebate U S 87A AY 2018 19 Proper Clarification CA Taranjit Singh RIPE YouTube

87A Rebate Rebate U s 87A How To Get Income Tax Rebate

Income Tax Rebate Under U s 87a And Sec 89 Relief Of Income Tax Act For AY 2020 21 YouTube

Rebate U S 87a For Ay 2024 23 - A rebate u s 87A is available if his total income during the previous year does not exceed Rs 7 00 000 Rebate is available to the extent of Rs 25 000 and no rebate will be available if total income exceeds Rs 7 00 000 The situation is exhibited in the Table given herein below New Marginal Scheme