Rebate U S 87a For Ay 2024 24 The tax rebate u s 87A has been increased vide Section 8 of the Finance Act 2019 from Rs 2 500 to 12 500 applicable from AY 2020 21 and onwards Earlier Section 87A was introduced by the Finance Act 2017 and tax relief of up to Rs 2 500 was available to resident individuals having taxable income up to Rs 3 5 lacs

In the fiscal year 2023 24 AY 2024 25 senior citizens with taxable income up to Rs 7 00 000 under the new tax regime are eligible for a rebate of Rs 25 000 or the amount of tax payable whichever is lower This change in the rebate limit is effective from FY 2023 24 AY 2024 25 Page Contents 1 Tax Rates applicable to Individuals Resident Non Resident for FY 2023 24 AY 2024 25 2 Income Tax Rate applicable to HUF AOP BOI Other Artificial Juridical Person Old Tax Regime for FY 2023 24 AY 2024 25 3 New Tax Regime for Individual HUF AOP BOI AJP u s 115BAC for FY 2023 24 AY 2024 25 4

Rebate U S 87a For Ay 2024 24

Rebate U S 87a For Ay 2024 24

https://i.ytimg.com/vi/R8TJaxFoAE8/maxresdefault.jpg

FAQs On Rebate U s 87A FinancePost

https://financepost.in/wp-content/uploads/2019/04/rebate.png

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/05/Screenshot_20230524_084225_Microsoft-365-Office.jpg

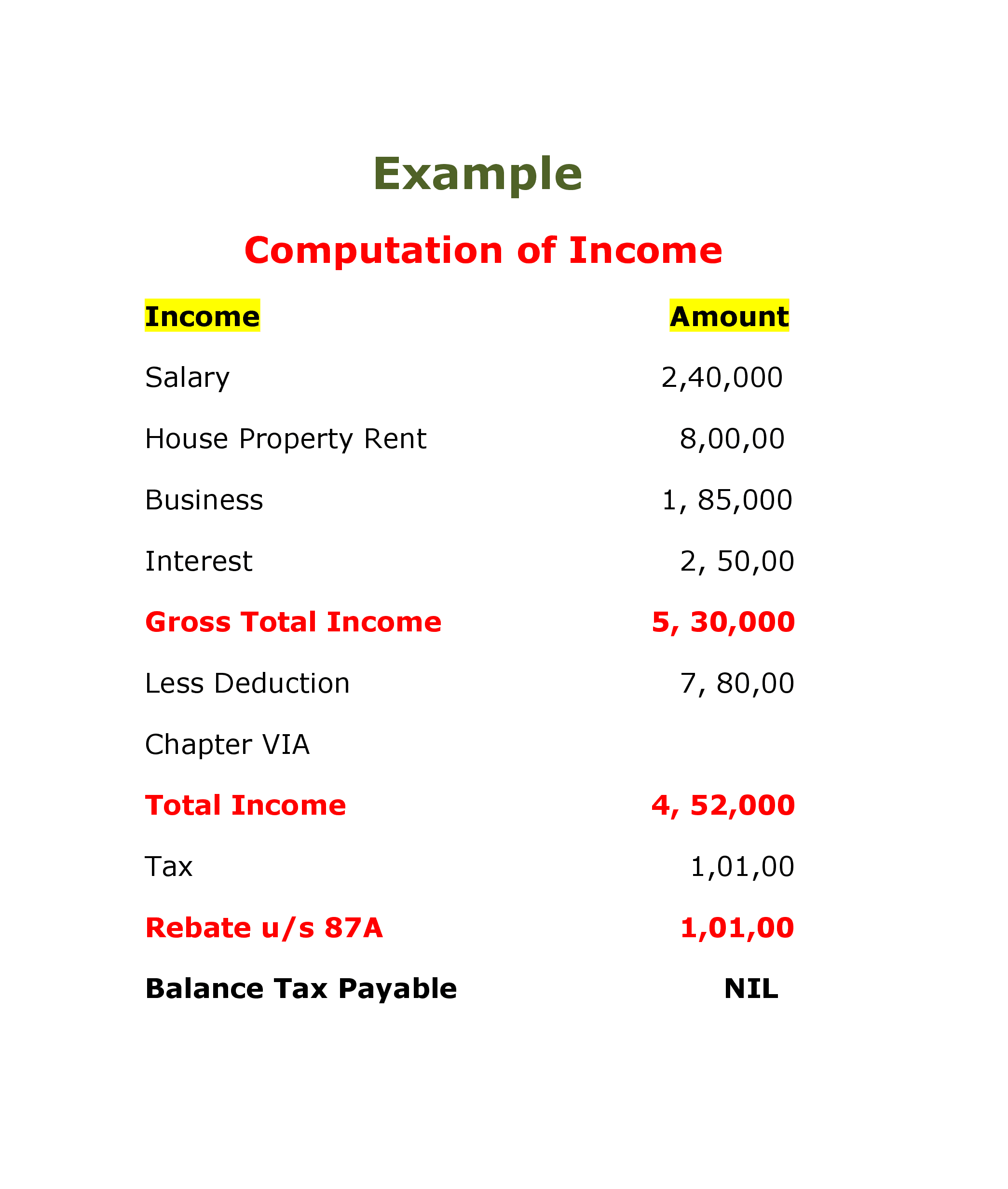

Rebate u s 87A provides a benefit on tax payments to a Resident Individual The only condition to avail of the benefit is Your total taxable income after reducing the deductions under Chapter VI A Section 80C 80D and so on shall not exceed the threshold limit According to the Income tax Act the rebate under Section 87A is available to only resident individuals Taxpayers such as non resident individuals NRIs Hindu Undivided Family HUF and firms are not eligible for the rebate under Section 87A How much tax rebate is available under Section 87A

Section 87A of the Income Tax Act 1961 provides 100 tax relief for residents with taxable income up to Rs 12 500 and up to Rs 500 000 from 2023 24 It should be noted that if the total income exceeds Rs 500 000 there will be no marginal relief unlike the tax relief in the new tax regime from 2024 25 A rebate u s 87A is available if his total income during the previous year does not exceed Rs 7 00 000 Rebate is available to the extent of Rs 25 000 and no rebate will be available if total income exceeds Rs 7 00 000 The situation is exhibited in the Table given herein below New Marginal Scheme

Download Rebate U S 87a For Ay 2024 24

More picture related to Rebate U S 87a For Ay 2024 24

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://i0.wp.com/arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rebate-US-87A-for-AY-2024-25-FY-2023-24-1-1.png?w=1280&ssl=1

Income Tax Rebate U S 87A For The FY 2020 21 AY 2021 22 FY 2019 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/income-tax-rebate-u-s-87a-for-the-fy-2020-21-ay-2021-22-fy-2019.jpg?fit=1280%2C720&ssl=1

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New Tax Rebate FinCalC TV

https://i.ytimg.com/vi/Yo8nxqN-uJg/maxresdefault.jpg

In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim rebate under 87A under new tax regime which shall be applicable from FY 2023 24 AY 2024 25 onwards What are the Eligibility Criteria to Claim a Rebate u s 87A Tax Slabs for AY 2023 24 Senior and Super Senior Citizens can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain exemptions and deductions like 80C 80D 80TTB HRA available in the Old Tax

The present 100 Percent tax rebate under section 87A up to total income of Rs 5 lakhs was introduced by the Finance Act 2019 w e f 01 04 2020 Section 87A Rebate for AY 2024 25 Section 87A rebate has been increased to Rs 7 lakhs under New Tax Regime However no changes has been made in the rebate for those not opting New Tax Regime The maximum limit of rebate available under section 87A of the Income tax Act 1961 has been increased to Rs 25 000 from Rs 12 500 in Budget 2023 Getty Images 3 6 Who are eligible for this rebate under section 87A According to the Income tax Act the rebate under section 87A is available to only resident individuals

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/05/SmartSelect_20230524_092110_Microsoft-365-Office-1024x654.jpg

Rebate U s 87A Of I Tax Act Income Tax

https://carajput.com/art_imgs/basic-understanding-of-rebate-us-87a-of-i-tax-act.jpg

https://caclub.in/income-tax-rebate-u-s-87a-individuals/

The tax rebate u s 87A has been increased vide Section 8 of the Finance Act 2019 from Rs 2 500 to 12 500 applicable from AY 2020 21 and onwards Earlier Section 87A was introduced by the Finance Act 2017 and tax relief of up to Rs 2 500 was available to resident individuals having taxable income up to Rs 3 5 lacs

https://greatsenioryears.com/guide-rebate-u-s-87a-for-senior-citizens/

In the fiscal year 2023 24 AY 2024 25 senior citizens with taxable income up to Rs 7 00 000 under the new tax regime are eligible for a rebate of Rs 25 000 or the amount of tax payable whichever is lower This change in the rebate limit is effective from FY 2023 24 AY 2024 25

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Union Budget 2023 Rebate U s 87A Enhanced For New Income Tax Regime TaxCharcha

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2022 23 In Hindi Income Tax Computation

Rebate U s 87A Of Income Tax Act Rebate AY 2023 24 Income Tax Computation YouTube

Rebate U s 87A Of Income Tax Act Rebate AY 2023 24 Income Tax Computation YouTube

Rebate U S 87A AY 2018 19 Proper Clarification CA Taranjit Singh RIPE YouTube

87A Rebate Rebate U s 87A How To Get Income Tax Rebate

Income Tax Rebate Under U s 87a And Sec 89 Relief Of Income Tax Act For AY 2020 21 YouTube

Rebate U S 87a For Ay 2024 24 - 87A Rebate of income tax in case of certain individuals 88 Rebate on life insurance premia contribution to provident fund etc omitted for determining the income tax payable in respect of the total income for FY 2023 24 AY 2024 25 of an individual or Hindu undivided family or association of persons other than a co operative society