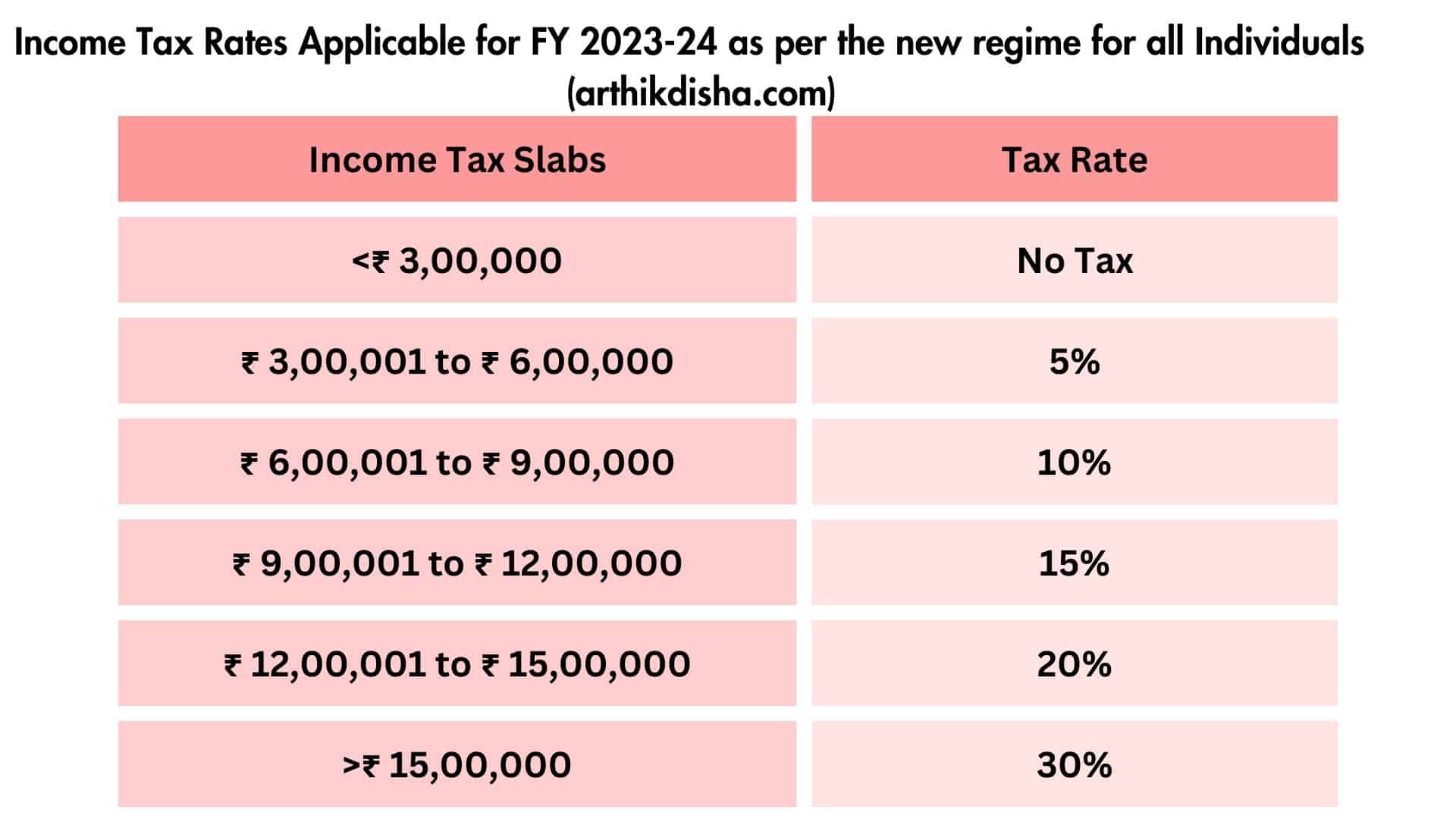

Rebate U S 87a New Tax Regime Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus

Web 14 sept 2019 nbsp 0183 32 For the FY 2023 24 AY 2024 25 the rebate limit has been increased to Rs 7 00 000 under the new tax regime This means a resident individual with taxable Web 4 juin 2023 nbsp 0183 32 Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24

Rebate U S 87a New Tax Regime

Rebate U S 87a New Tax Regime

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

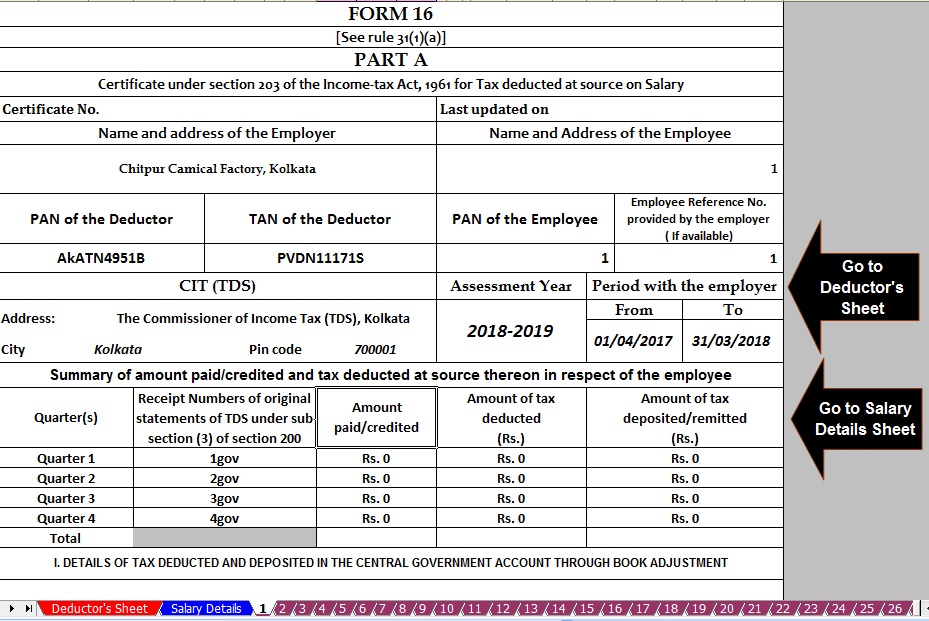

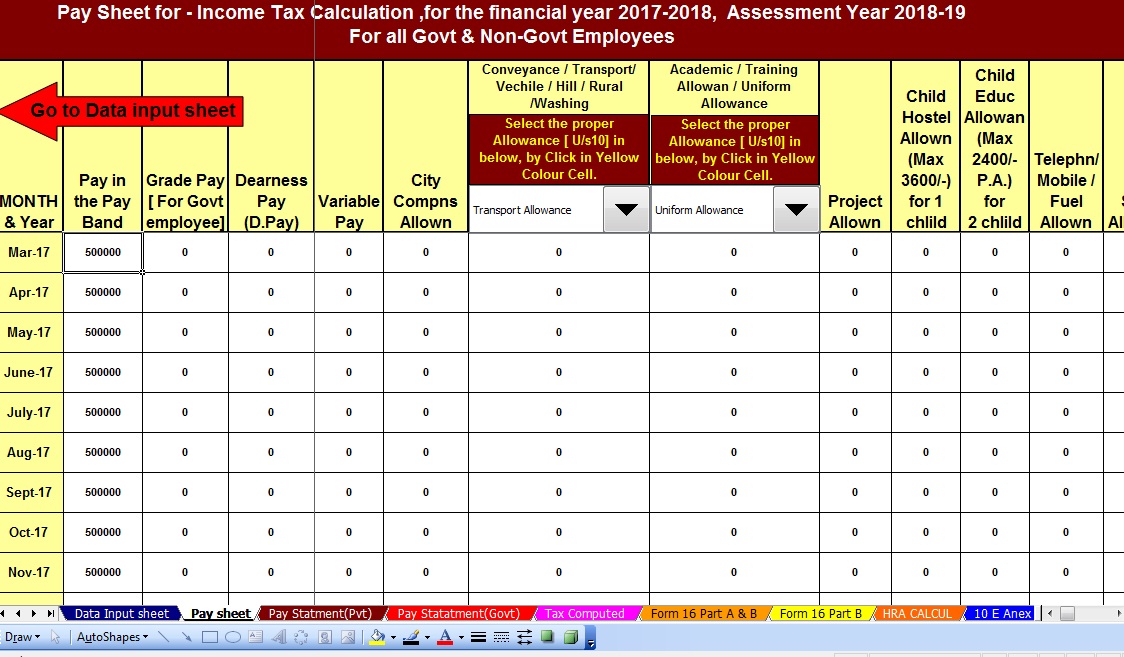

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

https://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

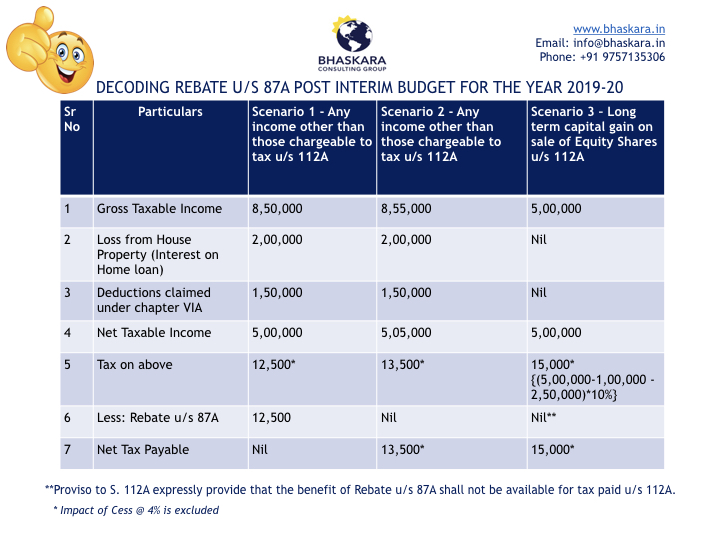

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Web 1 avr 2023 nbsp 0183 32 Resident individuals under existing tax regime having a total income of up to Rs 500 000 can receive a tax rebate of up to Rs 12 500 under Section 87A for AY 2023 Web 6 lignes nbsp 0183 32 2 janv 2021 nbsp 0183 32 Section 87A Tax rebate is available under both new and old tax regimes for FY 2020 21

Web 8 juin 2023 nbsp 0183 32 87A Rebate in New Tax Regime As per the Finance Act 2023 the threshold limit for total income eligible for rebate under Section 87A has been proposed to be Web The income tax rebate under Section 87a provides some relief to the taxpayers who fall under the tax category of 10 Any individual whose annual net income does not exceed

Download Rebate U S 87a New Tax Regime

More picture related to Rebate U S 87a New Tax Regime

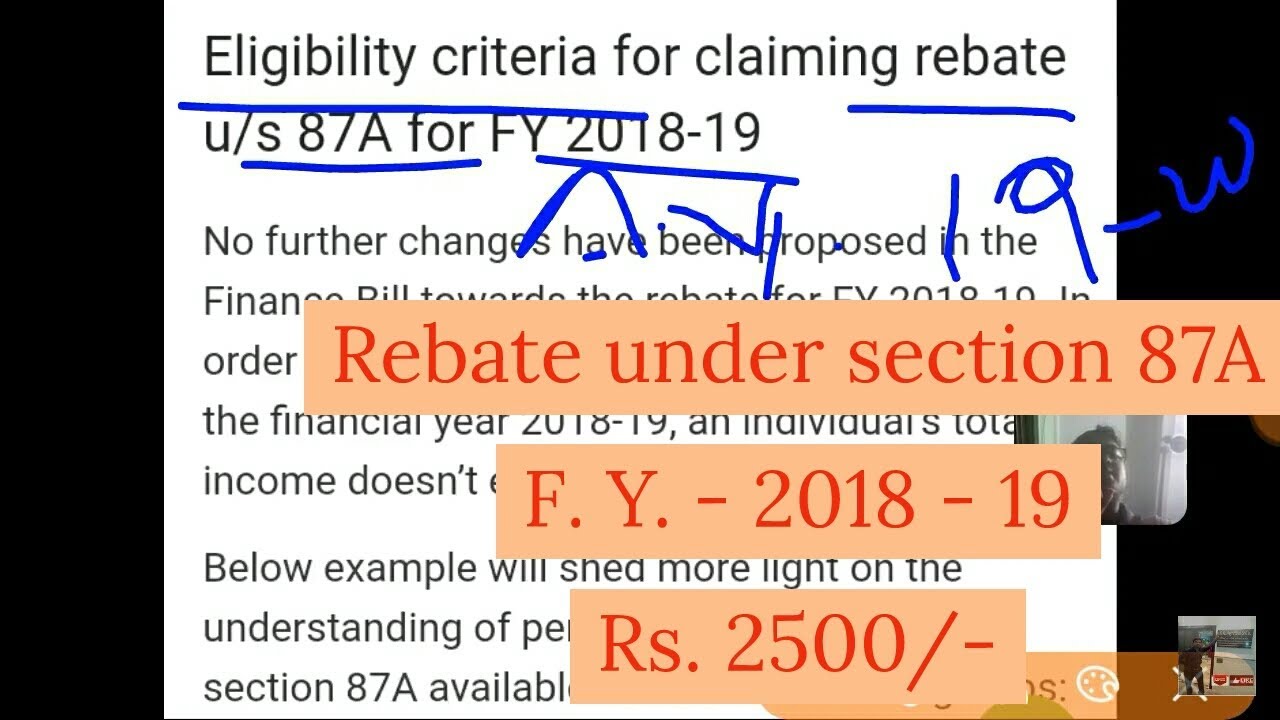

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

https://i.ytimg.com/vi/OS6nlwtzz-A/maxresdefault.jpg

Rebate U S 87A For FY 2017 18 AY 2018 19 All You Need To Know With

https://3.bp.blogspot.com/-4ZbVXkADr6g/WhrfWzJfxpI/AAAAAAAAF5o/S5m-5Ew-xTwrLlSQqmmByiMGUXld-nSOwCLcBGAs/s1600/Form%2B16%2BPart%2BA%2526B%2BPage%2B3.jpg

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

https://4.bp.blogspot.com/-t1m3eDQUAcE/WQbgmdUorJI/AAAAAAAAEhs/5azXe2bZDHYxffMXRPiXtXZ0v88DBNTXgCLcB/s1600/Govt%2BNon%2BGovt%2BPage%2B2.jpg

Web 2 f 233 vr 2023 nbsp 0183 32 In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim Web 6 f 233 vr 2023 nbsp 0183 32 13 4 5Y CAGR Income Tax Rebate u s 87A Of Income Tax Act 1961 Section 87A of the Income Tax Act was introduced in 2013 to provide relief to taxpayers The Budget 2023 introduces tax rebate

Web 10 avr 2023 nbsp 0183 32 Step 1 Calculate the gross income for the year Step 2 Reduce all the deductions standard deductions tax savings etc Step 3 Declare the income after Web 8 mars 2023 nbsp 0183 32 Under new tax regime A resident taxpayer with taxable income up to 7 00 000 would receive a tax rebate of 25 000 or the amount of tax payable

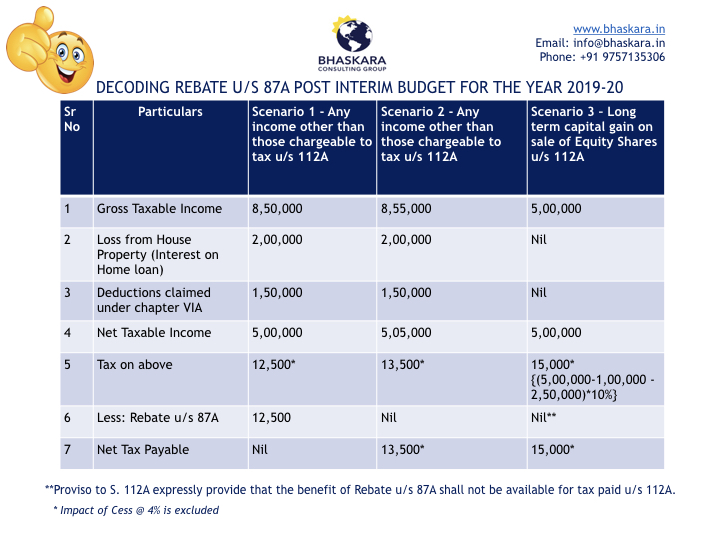

Decoding Rebate U s 87A Post Interim Budget For The F Y 2019 20

http://bhaskara.in/wp-content/uploads/2019/02/87A-Rebate-Provisions.jpeg.001.jpeg

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

https://financialcontrol.in/wp-content/uploads/2018/06/Rebate-87A.jpg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 For the FY 2023 24 AY 2024 25 the rebate limit has been increased to Rs 7 00 000 under the new tax regime This means a resident individual with taxable

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Decoding Rebate U s 87A Post Interim Budget For The F Y 2019 20

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

Rebate Of Income Tax Under Section 87A YouTube

Income Tax Rebate U s 87A For The Financial Year 2022 23

Income Tax Rebate U s 87A For The Financial Year 2022 23

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Rebate U S 87a New Tax Regime - Web 3 f 233 vr 2023 nbsp 0183 32 A income tax rebate under section 87 of Rs 25 000 is available u s 87A for the NEW tax regime for individuals whose taxable income is Rs 7 lakh or less in a year