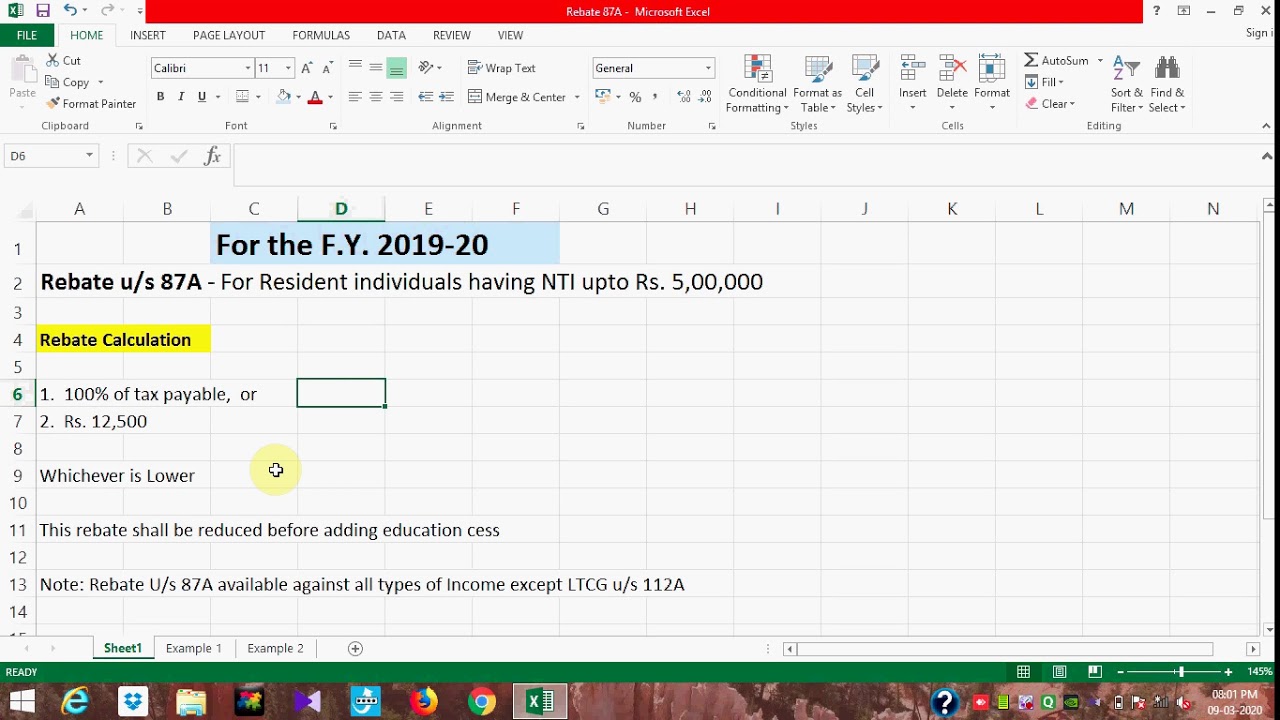

Rebate U S 87a Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an Web 28 d 233 c 2019 nbsp 0183 32 Certain basic conditions for availing rebate U s 87A a Assessee must be a Resident Individual and b His Total Income after Deductions under Chapter VIA

Rebate U S 87a

Rebate U S 87a

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

https://financialcontrol.in/wp-content/uploads/2018/06/How-to-calculate-rebate-us-87A.jpg

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

https://i.ytimg.com/vi/OS6nlwtzz-A/maxresdefault.jpg

Web 1 f 233 vr 2023 nbsp 0183 32 Section 87A entitles a resident individual to claim tax rebate of up to Rs 12 500 against his tax liability in case his income is limited to Rs 7 lakh Once you start Web Section 87A Eligibility Criteria for FY 2022 23 and FY 2023 24 An individual can claim a tax rebate us 87A provided he or she meets the following conditions The individual must be

Web 2 f 233 vr 2023 nbsp 0183 32 Rebate under section 87A of Income Tax Act helps taxpayers to reduce their tax liability Resident individuals having a net taxable income less than or equal to INR Web What is tax rebate u s 87A A tax rebate is a type of discount offered on your tax liability If your annual income net of deductions and exemptions does not exceed INR 5 lakhs

Download Rebate U S 87a

More picture related to Rebate U S 87a

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

https://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

https://i.ytimg.com/vi/KqZNdnxM0Bo/maxresdefault.jpg

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

https://financialcontrol.in/wp-content/uploads/2018/06/Rebate-87A.jpg

Web Rebate under section 87a is available to resident individuals for Assessment year 2015 2016 given that their total net income does not exceed Rs 5 lakh in an year Key Points Web 12 avr 2022 nbsp 0183 32 The rebate u s 87A is claimed by filing the tax return The fact that your total income exceeds the minimum threshold of Rs 2 50 000 you are liable to file a tax

Web 21 ao 251 t 2023 nbsp 0183 32 Under Section 87A of the Income Tax Act 1961 resident individuals with a taxable income of up to 5 lakhs can claim a tax rebate of 12 500 or the payable tax Web 10 avr 2023 nbsp 0183 32 Section 87A rebate is available under both the old and new tax regimes For FY 2023 24 the rebate limit of Rs 7 lakh in the new tax regime is applicable For FY 2022 23 the tax rebate limit is Rs 5 lakh for both regimes

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully

https://i.ytimg.com/vi/R8TJaxFoAE8/maxresdefault.jpg

Rebate U s 87A

https://media.licdn.com/dms/image/C5112AQHGhIc7iVAbrg/article-cover_image-shrink_600_2000/0/1523954816383?e=2147483647&v=beta&t=BtH1y3BpTu4KevMTicf4-bfJurzHAXOcHYOEp8_GexA

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an

REBATE U s 87A Under Income Tax B Ca Cs Cma And Ignou Exams With

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully

Rebate U s 87A YouTube

Rebate U s 87A Tax Slab Format For Computing Tax Liability Session 23

.png)

Rebate U s 87A Income Tax Rebate Under Section 87A JR Compliance Blogs

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New

What Is TAX REBATE U s 87A EXAMPLES Of Tax Rebate Budget 2019 New

Rebate Of Income Tax Under Section 87A YouTube

REBATE U S 87A YouTube

REBATE U S 87A INCOME TAX ACT REBATE 87A Rebate 87A

Rebate U S 87a - Web Section 87A Eligibility Criteria for FY 2022 23 and FY 2023 24 An individual can claim a tax rebate us 87A provided he or she meets the following conditions The individual must be