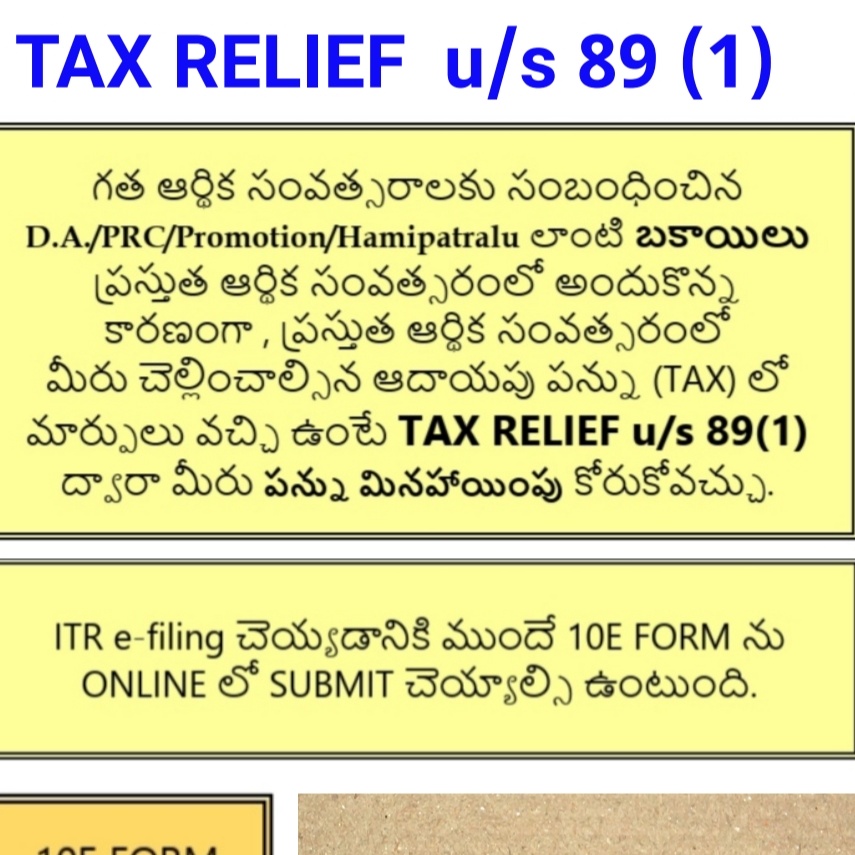

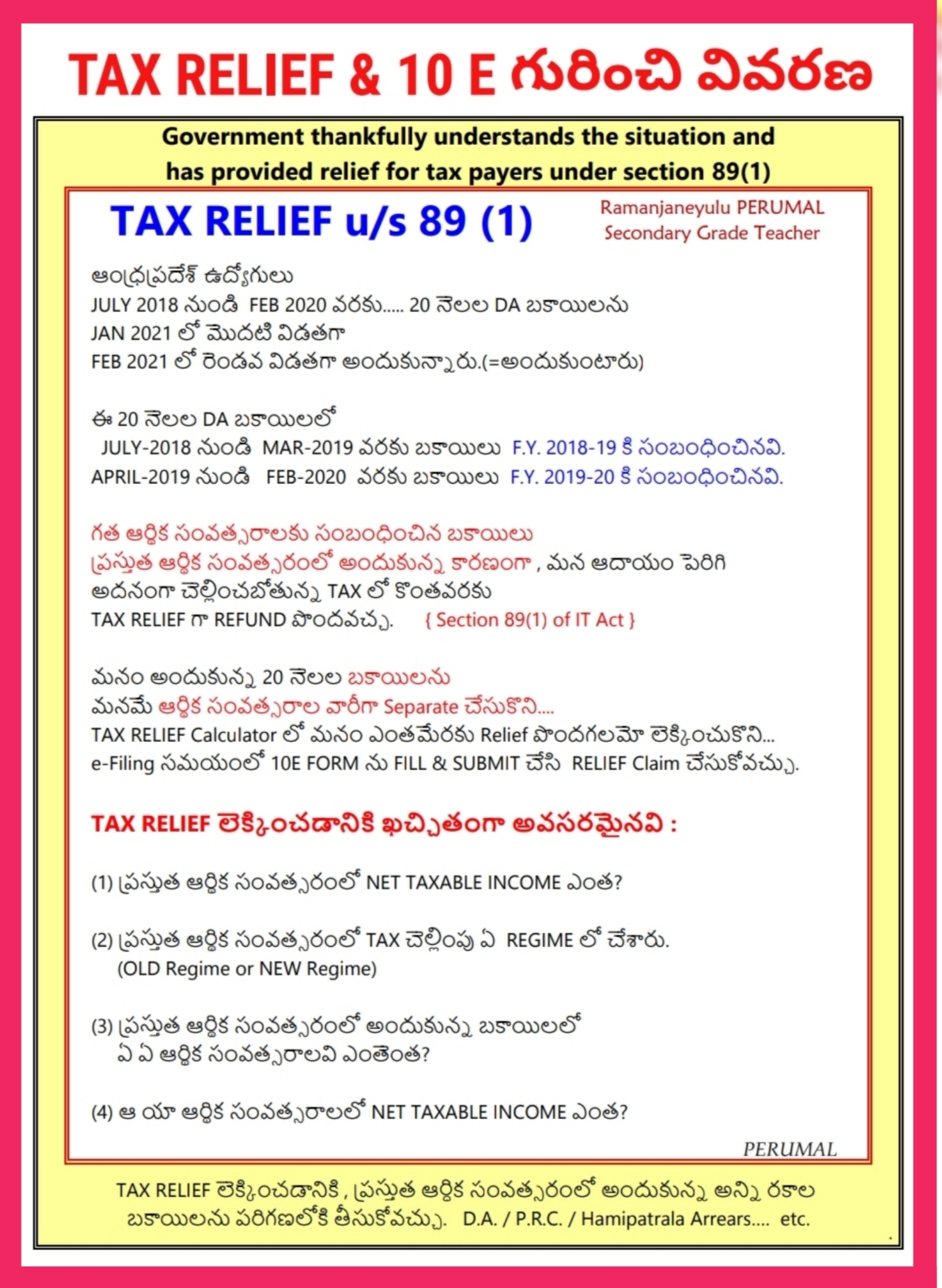

Rebate U S 89 Of Income Tax Act Web 4 janv 2022 nbsp 0183 32 Tax Relief Tax Rebate Meaning If any individual receive any portion of his salary in arrears or in advance or profits in lieu of salary 17 3 he or she can claim relief

Web The advance or arrears received from an employer affect your taxes and are reflected in the year of receipt Relief under section 89 1 according to saves you from additional tax burden if there is a delay in receiving Web Any one who has received arrears of salary allowances pension and likes to avail tax relief u s 89 1 i e treating the amount of arrears for taxability to the period of previous

Rebate U S 89 Of Income Tax Act

Rebate U S 89 Of Income Tax Act

https://1.bp.blogspot.com/-tZFrTAS5gvo/XhUd-5p6j3I/AAAAAAAALfQ/Bb1lpmHCvMk08MD2EPLY5qHVFx-Gt0TlgCNcBGAsYHQ/s1600/Picture%2B5%2Bof%2BArrears%2BRelief%2BCalculator%2B%2B19-20.jpg

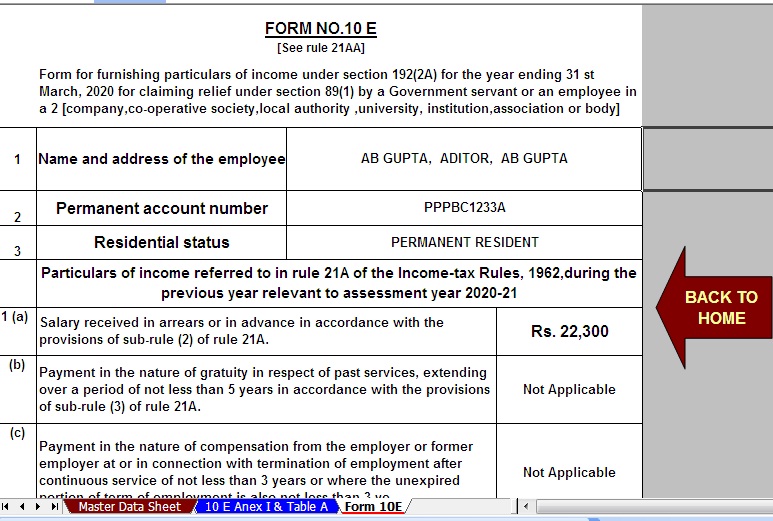

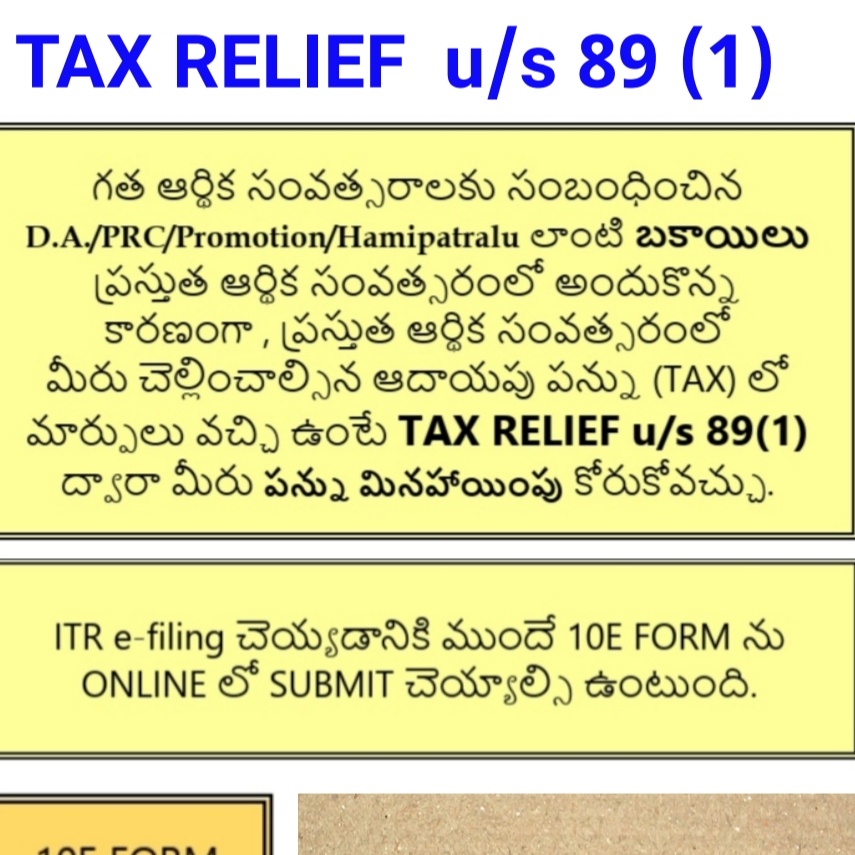

TAX RELIEF U S 89 1 You Can Read The FILE Above For A Full

https://1.bp.blogspot.com/-mGVyFlaKZmg/YDEX-u40vLI/AAAAAAAAht8/N3zA4fpxAKofXgvy3dc9JOcETOI5uxvQwCLcBGAsYHQ/s855/Screenshot_20210220-193707__01.jpg

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

https://1.bp.blogspot.com/-Ipsw29iUnkc/XuXc-jYh0sI/AAAAAAAANdM/-Y63uNNLCDYYME4lvkjYUc1f27RxYOyjgCNcBGAsYHQ/s1600/2.jpg

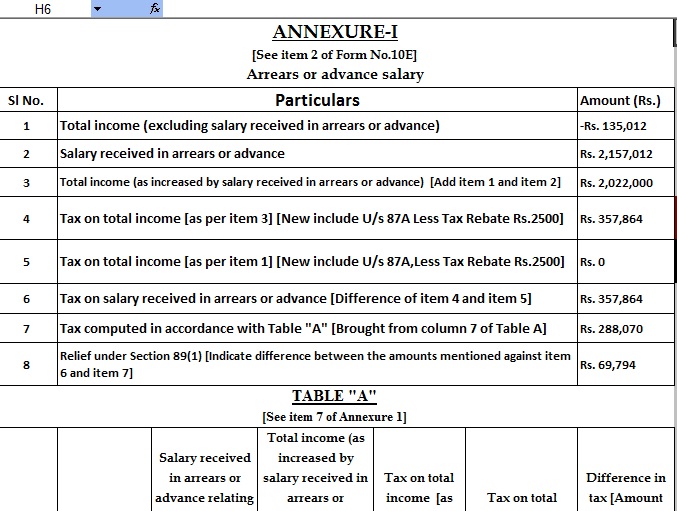

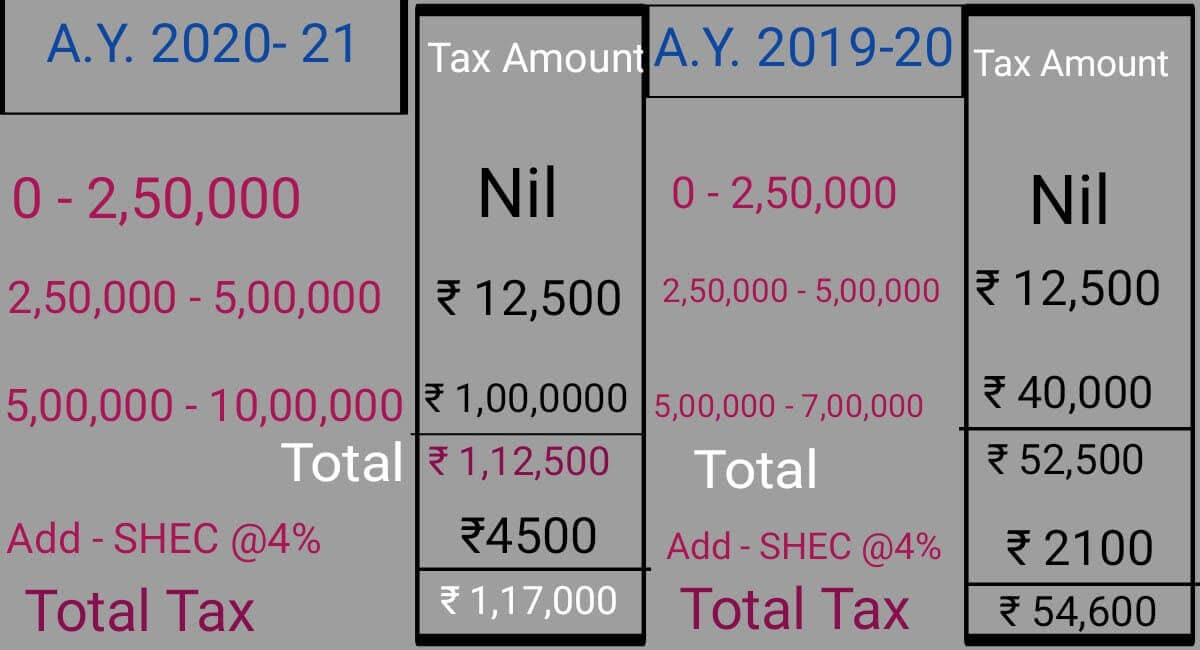

Web 3 ao 251 t 2023 nbsp 0183 32 Section 89 1 of the Income Tax Act 1961 states that if an assessee s income has dues of salary from the previous year then the assessee can claim relief Web 3 nov 2022 nbsp 0183 32 Income Tax Rebate Eligibility And Types Of Tax Rebates In India Calculation of Relief under Section 89 Step 1 Compute the present year s tax due by adding the arrears in total income Step 2 Next

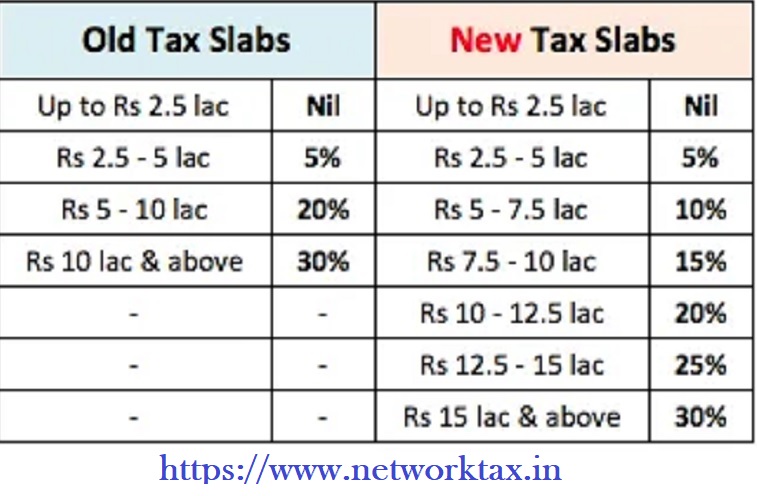

Web 11 mai 2023 nbsp 0183 32 If the total income of a taxpayer includes any past salary paid in the current financial year and the tax slab rates are different in both years this may lead to higher tax dues Thus the Income Tax Act Web opting for the New Tax Regime u s 115BAC except for deduction u s 80CCD 2 Rebate u s 87A The rebate is available to a resident individual if his total income does not

Download Rebate U S 89 Of Income Tax Act

More picture related to Rebate U S 89 Of Income Tax Act

TAX RELIEF U S 89 1 APEdu

https://1.bp.blogspot.com/-j6X0OE9ffFM/YDEOEiHCHbI/AAAAAAAAQmw/Xw1A_C7hIYUi9pdKYp4dEzU6FQl2Tp0pwCLcBGAsYHQ/s2045/IMG_20210220_185539.jpg

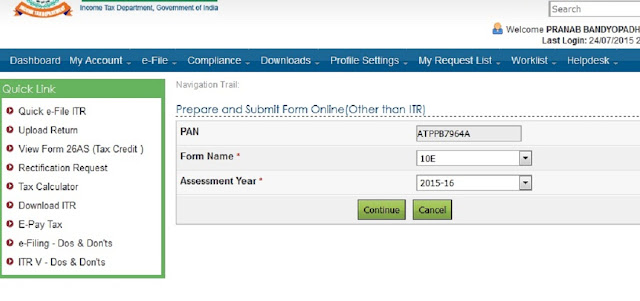

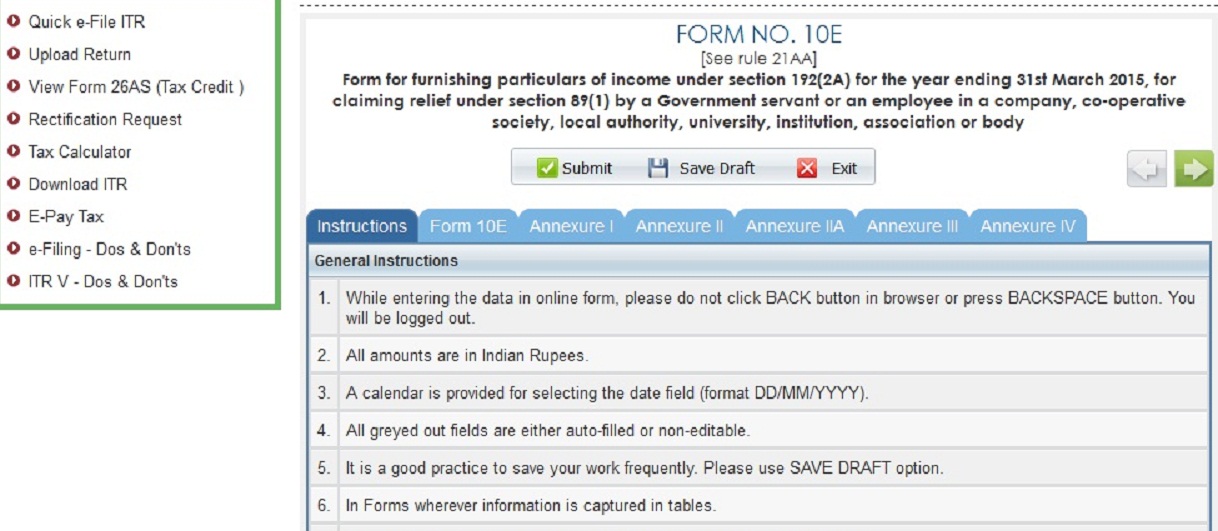

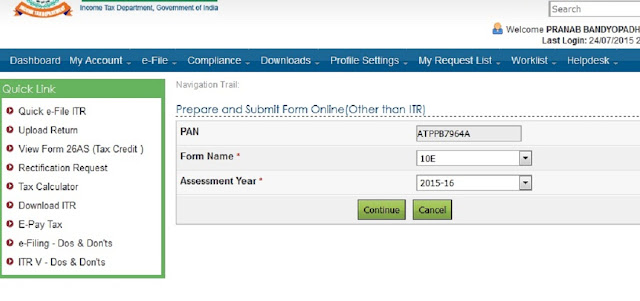

Now It Is Compulsory To Upload 10E Form For Claim Relief U s 89 1 To

https://2.bp.blogspot.com/-wrcqm6PmAiE/VhU1EyN4OmI/AAAAAAAADPY/y4q-1wC5op0/w1200-h630-p-k-no-nu/other.gif

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

https://1.bp.blogspot.com/-FA5sF9RVbPs/X1BnDNbfM8I/AAAAAAAAOSk/xMZjeJeXwBQcSU_kLIeub9xWgP1PLULrgCNcBGAsYHQ/s1600/New%2BTax%2BSlab%2Bfor%2BA.Y.2021-22.jpg

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can Web The Inflation Reduction Act also extended the tax break for residential charging systems through 2032 and made it retroactive to Jan 1 2022 It s worth 1 000 or 30 of the

Web 15 oct 2022 nbsp 0183 32 As per section 89 1 of the Income Tax Act 1961 relief for income tax has been provided when in a financial year an employee receives salary in arrears or Web Here are the steps to calculate relief under section 89 1 of the Income tax Act 1961 Calculate tax payable on total income including arrears in the year in which it is

How To E filing For Upload 10E Form For Claim Relief U s 89 1 To The

https://1.bp.blogspot.com/-TsaiSAPvQNM/VhZ51E9tvfI/AAAAAAAAAh4/BO_RzHYttFg/s640/1-1.jpg

How To E filing For Upload 10E Form For Claim Relief U s 89 1 To The

https://3.bp.blogspot.com/-VUGVEtBq7no/VhZ6S0o3RDI/AAAAAAAAAiA/GM4Igc-S6Zc/s1600/2-2.jpg

https://taxguru.in/income-tax/tax-relief-section-89-income-tax-act...

Web 4 janv 2022 nbsp 0183 32 Tax Relief Tax Rebate Meaning If any individual receive any portion of his salary in arrears or in advance or profits in lieu of salary 17 3 he or she can claim relief

https://www.canarahsbclife.com/tax-university…

Web The advance or arrears received from an employer affect your taxes and are reflected in the year of receipt Relief under section 89 1 according to saves you from additional tax burden if there is a delay in receiving

Procedure To Claim Relief U s 89 1 Or How To Upload 10E Form

How To E filing For Upload 10E Form For Claim Relief U s 89 1 To The

Relief Under Section 89 Of Income Tax Act In Hindi 89

Form 10E Is Mandatory To Claim Section 89 Relief SAP Blogs

Rebate U s 87A Of Income Tax Act 87A Rebate For AY 2023 24 In Hindi

Section 89 Of Income Tax Act How To Claim Relief

Section 89 Of Income Tax Act How To Claim Relief

Relief U s 89 1 Disallowed While Processing ITR How To Claim Relief U

Rebate Relief Section 87A Section 89 1 Income Tax

Income Tax Rebate Under Section 87A

Rebate U S 89 Of Income Tax Act - Web opting for the New Tax Regime u s 115BAC except for deduction u s 80CCD 2 Rebate u s 87A The rebate is available to a resident individual if his total income does not