Rebate Under 87a Of Income Tax Act Web 3 f 233 vr 2023 nbsp 0183 32 Who is eligible for tax rebate under Section 87A According to the Income tax Act the rebate under Section 87A is available to only resident individuals

Web 3 lignes nbsp 0183 32 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for Web 6 lignes nbsp 0183 32 26 avr 2022 nbsp 0183 32 Eligibility Criteria for Claiming Tax Rebate Under Section 87A Tax rebate under Section 87A is

Rebate Under 87a Of Income Tax Act

Rebate Under 87a Of Income Tax Act

https://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Rebate U s 87A Of Income Tax Act 1961 Income Tax Act

https://carajput.com/art_imgs/rebate-us-87a-of-income-tax-act-1961.jpg

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

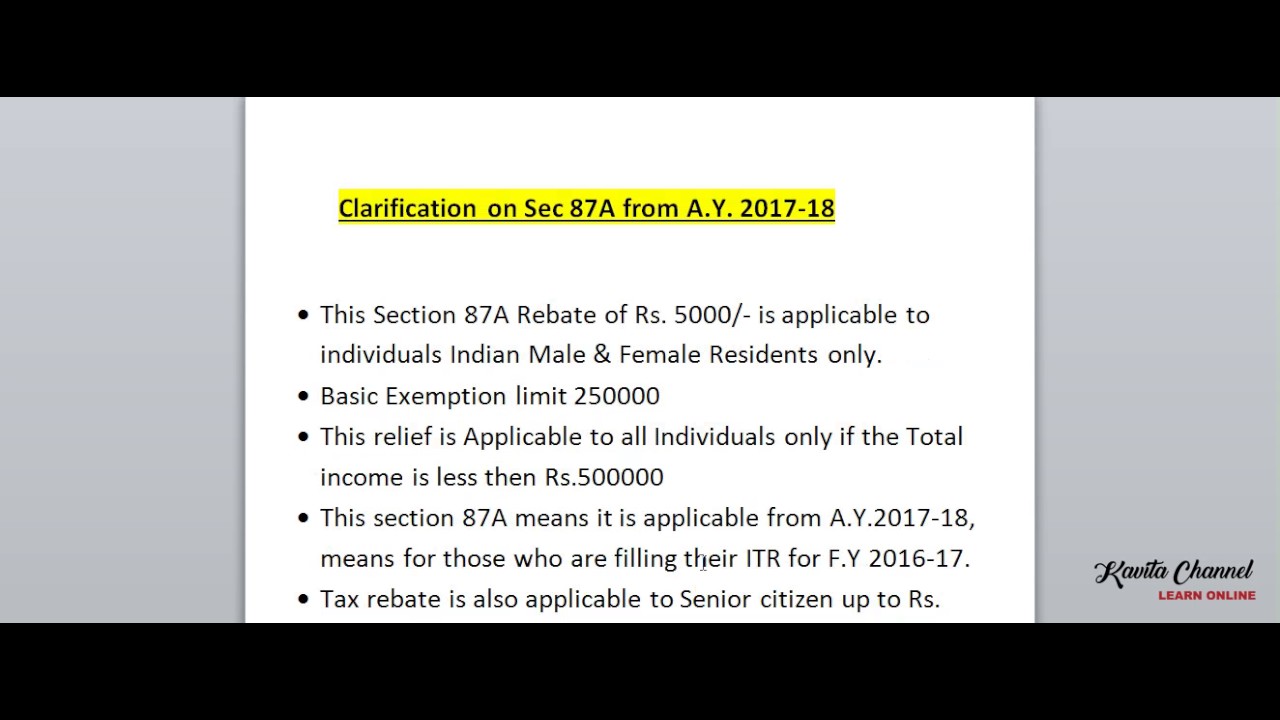

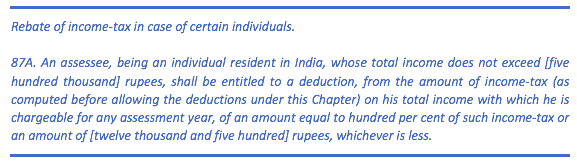

Web 87A An assessee being an individual resident in India whose total income does not exceed 85 five hundred thousand rupees shall be entitled to a deduction from the Web Tax Rebate Under Section 87A Claim Income Tax Rebate for FY 21 22 AY 22 23 What is Insurance What is Superannuation View All FAQs Section 80CCC Section 80DDB

Web 1 f 233 vr 2023 nbsp 0183 32 Section 87A entitles a resident individual to claim tax rebate of up to Rs 12 500 against his tax liability in case his income is limited to Rs 7 lakh Once you start Web 6 f 233 vr 2023 nbsp 0183 32 Income Tax Rebate u s 87A Of Income Tax Act 1961 Section 87A of the Income Tax Act was introduced in 2013 to provide relief to taxpayers The Budget 2023 introduces tax rebate under new tax

Download Rebate Under 87a Of Income Tax Act

More picture related to Rebate Under 87a Of Income Tax Act

Rebate Under 87a Of Income Tax REBATE UNDER 87A OF INCOME TAX ACT FOR

https://i.ytimg.com/vi/KePXPu9nUAQ/maxresdefault.jpg

Rebate Of Income Tax Under Section 87A YouTube

https://i.ytimg.com/vi/lgmblbkc7Qs/maxresdefault.jpg

Income Tax Rebate Under Section 87A

https://bemoneyaware.com/wp-content/uploads/2016/04/ITR-87a-rebate.png

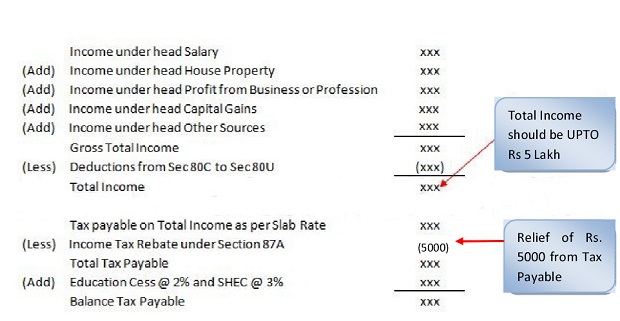

Web The available tax rebate under Section 87A of the Income Tax Act 1961 offers the benefit of nil taxation if you have a limited income However before claiming the rebate here Web 10 avr 2023 nbsp 0183 32 Step 1 Calculate the gross income for the year Step 2 Reduce all the deductions standard deductions tax savings etc Step 3 Declare the income after

Web 2 f 233 vr 2023 nbsp 0183 32 Arrive at your net taxable income after claiming the tax deductions If your net taxable income is up to INR 5 00 000 then you are eligible to claim a rebate under Web Individuals can enjoy a tax rebate under Section 87A when they earn a net taxable income within 5 00 000 in a given financial year Eligible candidates can claim a tax rebate of

Income Tax Rebate Under Section 87A

https://image.slidesharecdn.com/incometaxrebateundersection87a2017-2018-180420103021/85/income-tax-rebate-under-section-87a-2-638.jpg?cb=1666685634

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

https://live.staticflickr.com/7850/32304200437_b8b18b3f1c.jpg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 Who is eligible for tax rebate under Section 87A According to the Income tax Act the rebate under Section 87A is available to only resident individuals

https://tax2win.in/guide/section-87a

Web 3 lignes nbsp 0183 32 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Income Tax Rebate Under Section 87A

Know New Rebate Under Section 87A Budget 2023

.png)

Rebate U s 87A Income Tax Rebate Under Section 87A JR Compliance Blogs

Tax Rebate Under Section 87A A Detailed Guide On 87A Rebate

Rebate U s 87A

Rebate U s 87A

Income Tax Rebate U s 87A For The Financial Year 2022 23

Rebate Under Section 87A Of Income Tax Act YouTube

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

Rebate Under 87a Of Income Tax Act - Web 26 ao 251 t 2023 nbsp 0183 32 The tax rebate u s 87a is limited to Rs 12 500 This means that if your total payable tax is less than Rs 12 500 then you will not have to pay any tax However note