Rebate Under Provision Of Income Tax Web 1 f 233 vr 2023 nbsp 0183 32 A tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year It is just one type of provision that corporate finance departments set aside to

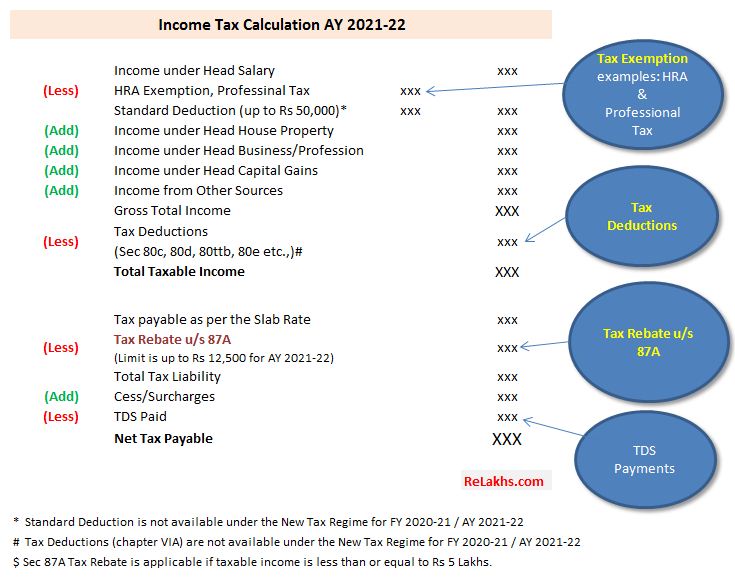

Web 3 ao 251 t 2021 nbsp 0183 32 As per the existing provisions any Indian Resident individual whose income lies below Rs 5 00 000 is eligible to claim a tax amount rebate under this section The amount of tax rebate can be either 100 Web 25 mai 2021 nbsp 0183 32 One of the income tax provisions to aid you to reduce your income tax liability is the provision of a rebate under Section 87A of the Income Tax Act Under

Rebate Under Provision Of Income Tax

Rebate Under Provision Of Income Tax

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/Decoding-Section-87A-Rebate-Provision-under-Income-Tax-Act.png

Income Tax Rebate Under Section 87A Goyal Mangal Company

https://www.cagmc.com/wp-content/uploads/2021/10/Section-87A-Rebate-Provision-under-Income-Tax-Act-1-1024x538.png

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/Tax-Rebate-under-Section-87-A.jpg

Web 15 mai 2022 nbsp 0183 32 Flat tax Revenu fiscal de r 233 f 233 rence Donation D 233 fiscalisation Actualit 233 s Imp 244 ts D 233 fiscalisation D 233 couvrez les dispositifs permettant de payer moins d imp 244 t sur Web You can claim a maximum rebate of up to 12 500 under Section 87A of the Income Tax Act for the financial year 2022 23 The maximum amount of the 87A rebate has been

Web 18 juil 2023 nbsp 0183 32 Section 80C is one of the most popular and favourite sections amongst the taxpayers as it allows to reduce taxable income by making tax saving investments or Web 28 ao 251 t 2020 nbsp 0183 32 Des investissements plafonn 233 s Pour b 233 n 233 ficier du dispositif 171 IR PME 187 les particuliers doivent effectuer des souscriptions en num 233 raire au capital initial ou aux

Download Rebate Under Provision Of Income Tax

More picture related to Rebate Under Provision Of Income Tax

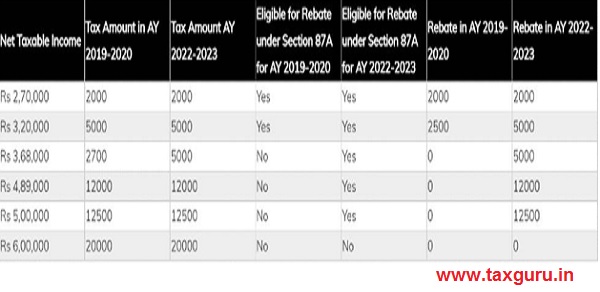

Comparative Provisions Of The Rebate Download Table

https://www.researchgate.net/publication/235205362/figure/tbl2/AS:648962990174221@1531736242563/Comparative-Provisions-of-the-Rebate.png

Decoding Section 87A Rebate Provision Under Income Tax Act

https://taxguru.in/wp-content/uploads/2021/08/Illustration.jpg

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Web Un d 233 cret vient de pr 233 ciser la date d entr 233 e en vigueur du taux major 233 de la r 233 duction d imp 244 t sur le revenu pour souscription au capital de soci 233 t 233 s non cot 233 es Ce dernier de Web Individuals can enjoy a tax rebate under Section 87A when they earn a net taxable income within 5 00 000 in a given financial year Eligible candidates can claim a tax rebate of

Web Income Tax Rebate 87A The income tax rebate under Section 87a provides some relief to the taxpayers who fall under the tax category of 10 Any individual whose annual Web 11 avr 2023 nbsp 0183 32 The 80C tax rebate is a provision in the Indian Income Tax Act that allows individuals to claim a deduction of up to Rs 1 5 lakh from their taxable income This

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

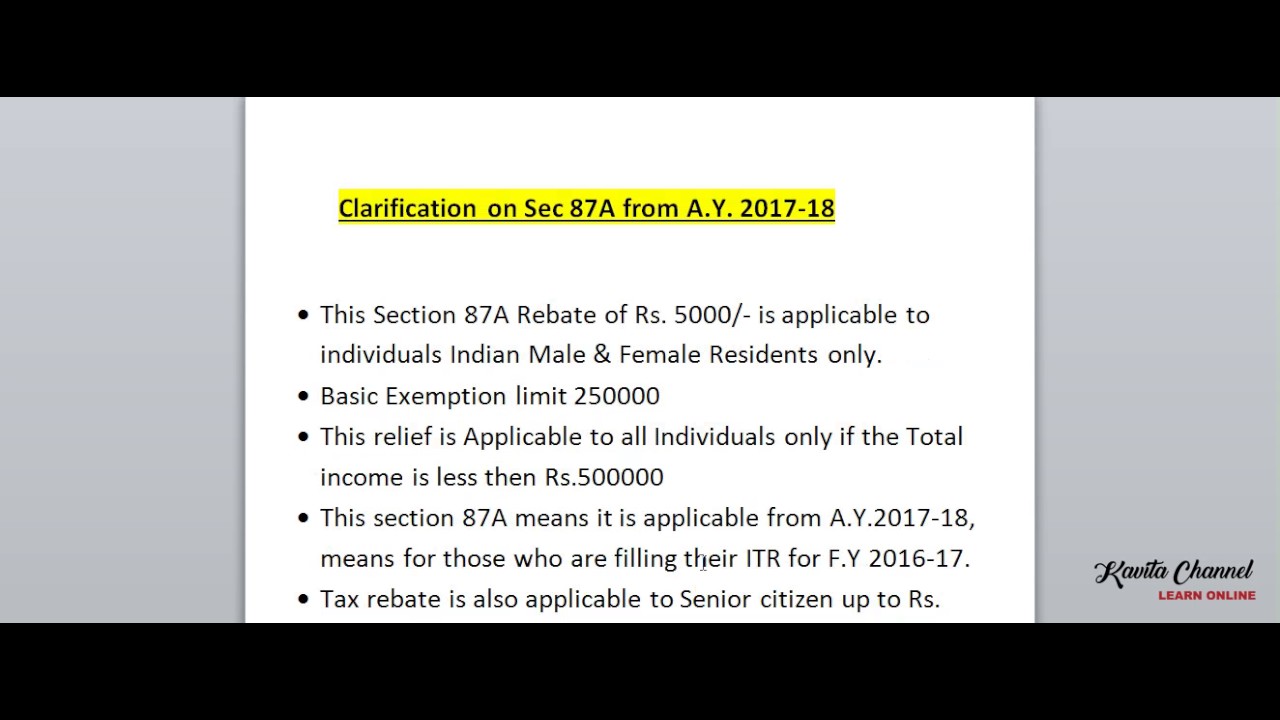

Income Tax Rebate Under Income Tax Section 87 A For F Year 2017 18 AY 2

https://i.pinimg.com/originals/e2/d1/83/e2d183f21594bbfe69cbb07158bc7fb1.jpg

https://tax.thomsonreuters.com/blog/tax-provi…

Web 1 f 233 vr 2023 nbsp 0183 32 A tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year It is just one type of provision that corporate finance departments set aside to

https://taxguru.in/income-tax/decoding-sectio…

Web 3 ao 251 t 2021 nbsp 0183 32 As per the existing provisions any Indian Resident individual whose income lies below Rs 5 00 000 is eligible to claim a tax amount rebate under this section The amount of tax rebate can be either 100

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Rebate Of Income Tax Under Section 87A YouTube

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Income Tax Rebate Under Section 87A

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Rebate Under Section 87A AY 2021 22 CapitalGreen

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Rebate Under Provision Of Income Tax - Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an