Rebate Under Sec 87a Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus

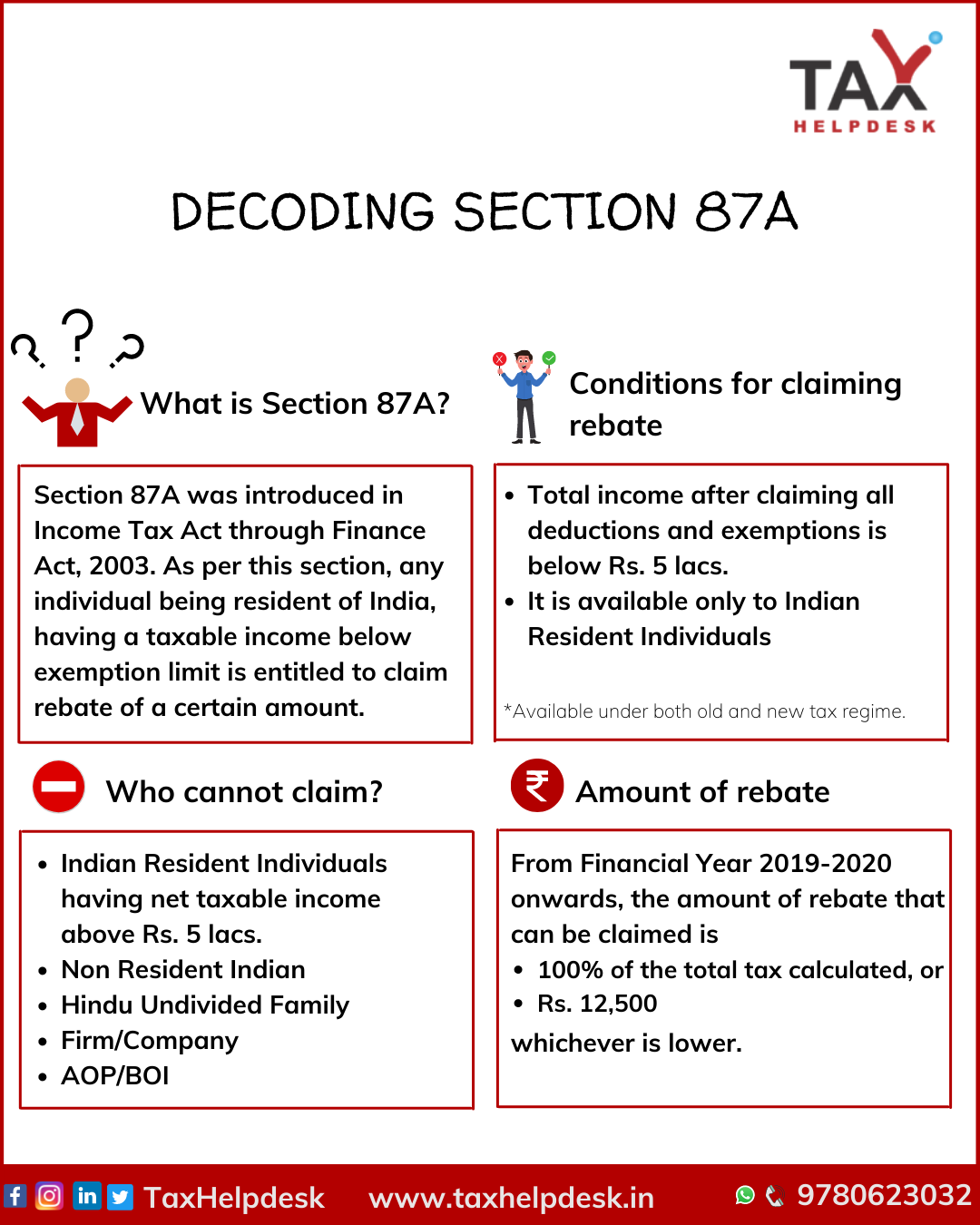

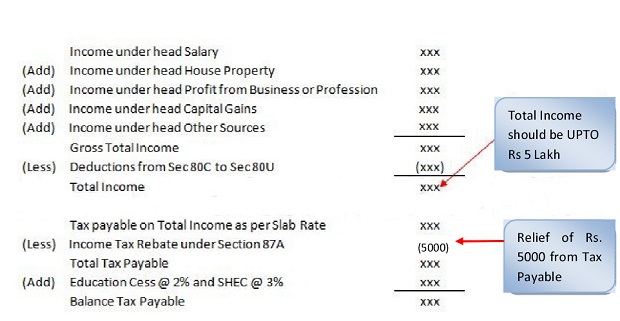

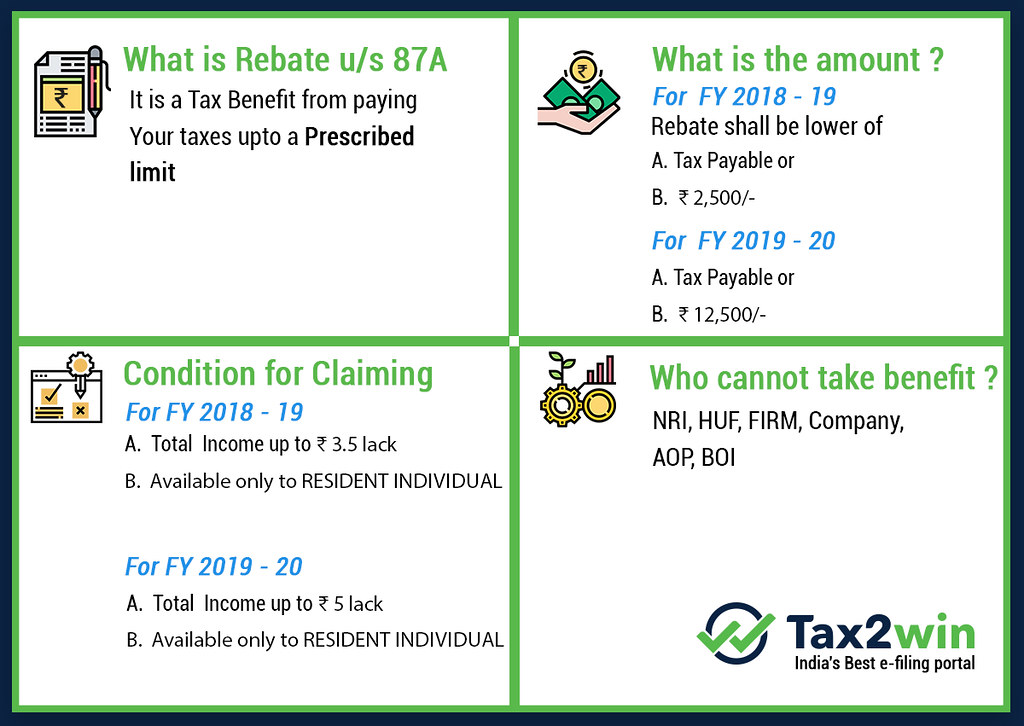

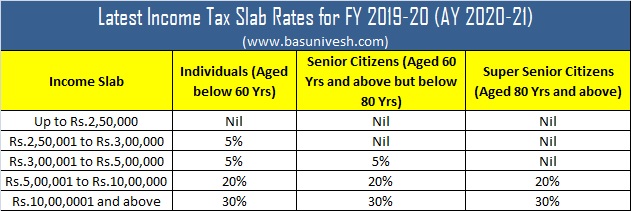

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Web 26 avr 2022 nbsp 0183 32 Tax rebate under Section 87A is available for both old and new tax regimes for Financial Year 2021 2022 The assessment Year 2022 2023 The limit remains the

Rebate Under Sec 87a

Rebate Under Sec 87a

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

https://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/image-91.png

Web 13 mai 2023 nbsp 0183 32 Through the available tax rebate under Section 87A your tax liability becomes nil if your net annual income is within INR 5 lakhs Eligible amount of rebate Web 4 nov 2016 nbsp 0183 32 Under section 87A claimable rebate is up to Rs 12 500 The important thing here is that taxable income is calculated not just on tax slab Someone earning Rs 8 lakh

Web 25 janv 2022 nbsp 0183 32 Only resident individuals can claim the tax rebate under Section 87A The maximum rebate amount of Rs 12 500 is for resident individuals under 60 years of age Web The income tax rebate under Section 87a provides some relief to the taxpayers who fall under the tax category of 10 Any individual whose annual net income does not

Download Rebate Under Sec 87a

More picture related to Rebate Under Sec 87a

Rebate Of Income Tax Under Section 87A YouTube

https://i.ytimg.com/vi/TvlWdoFkYts/maxresdefault.jpg

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/DECODING-SECTION-87A.png

Tax Rebate Under Section 87A All You Need To Know YouTube

https://i.ytimg.com/vi/JM0j9VqDYfI/maxresdefault.jpg

Web Individuals can enjoy a tax rebate under Section 87A when they earn a net taxable income within 5 00 000 in a given financial year Eligible candidates can claim a tax rebate of Web To calculate rebate under section 87A calculate your gross income and subtract the available deductions under Sections 80C to 80U Now if your net taxable income is less

Web 6 f 233 vr 2023 nbsp 0183 32 Updated on 6 Feb 2023 The tax rebate u s 87A allows a taxpayer to reduce his her tax liability marginally depending on the net total income In this article we will cover the eligibility steps to claim points Web 25 ao 251 t 2020 nbsp 0183 32 Section 87A was introduced for the first time in 2013 allowing taxpayers to avail rebate if their net taxable income was below the threshold levels What is an

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

Income Tax Rebate Under Section 87A

https://bemoneyaware.com/wp-content/uploads/2016/04/ITR-87a-rebate.png

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

Health Care Tax Rebate Calculator 2022 Carrebate

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Revised Tax Rebate Under Sec 87A After Budget 2019

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

Income Tax Rebate Under Section 87A

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Rebate Under Sec 87a - Web 25 janv 2022 nbsp 0183 32 Only resident individuals can claim the tax rebate under Section 87A The maximum rebate amount of Rs 12 500 is for resident individuals under 60 years of age