Rebate Under Section 87a Ay 2023 23 A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up Finance Act 2023 inserted proviso to the said section to provide rebate of income tax in cases where the total income of such assessee is chargeable to tax under sub section

Rebate Under Section 87a Ay 2023 23

Rebate Under Section 87a Ay 2023 23

https://blogger.googleusercontent.com/img/a/AVvXsEhZQi5Ln43Bt9k-pbvTrPSfypjB_GE_1j1Y9DeNCTK26XuHgerBTWwh58nQRJZgzuL143kSP6CctV6W3EwVilLcf3L52A5wtUVy8MS0GfbW4JPHrN0VLim6AVTMeYg2eS8WCLGRDcsn_c4mrZKezFEBY2LNHqM5kNZri1BcmUCS2JjDRxdKfZrspLxB=w1200-h630-p-k-no-nu

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

https://i.ytimg.com/vi/TYfP6LlV2QU/maxresdefault.jpg

New Income Tax Slab 2023 24

https://moneyexcel.com/wp-content/uploads/2023/02/incometax-slab-2023-24.jpg

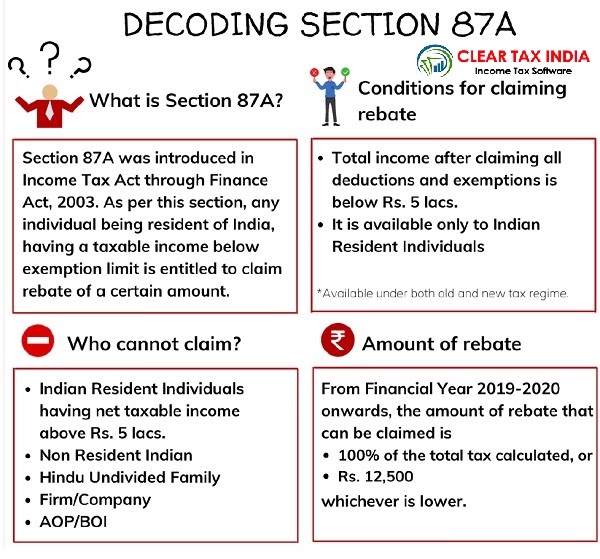

For taxpayers with normal income excluding special rate income like capital gains up to 12 lakh a tax rebate is now available The rebate limit has been increased from People with taxable incomes under Rs 5 lakhs are eligible for a tax rebate under Section 87A of the Income Tax Act of 1961 in the financial year 2022 23 Both the previous

The maximum 87A rebate is up to 12 500 old and new regime till FY 2022 23 and 25 000 for the new regime from FY 2023 24 The rebate is not applicable if the tax liability exceeds 12 500 and 25 000 under the old Budget 2023 announced that individuals will not have to pay any tax if the taxable income does not exceed Rs 7 lakh in a financial year The maximum limit of rebate available under section 87A of the Income tax Act 1961 has been

Download Rebate Under Section 87a Ay 2023 23

More picture related to Rebate Under Section 87a Ay 2023 23

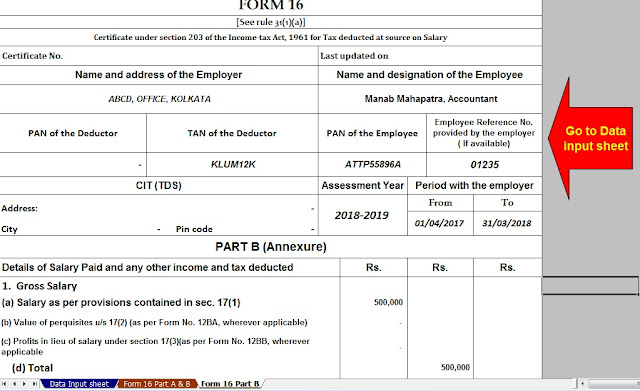

Rebate U S 87A For FY 2017 18 AY 2018 19 All You Need To Know With

https://1.bp.blogspot.com/-tC64BIUhKp8/Whrfb7j8QoI/AAAAAAAAF5s/o4IhOBNXA9opvrbrGqin_xE-Q_nGHK9wACLcBGAs/s640/Form%2B16%2BPart%2BB.jpg

Rebate Under Sec 87A On Basic Income Tax PY 2022 23 AY 2023 24

https://i.ytimg.com/vi/iBVPuOeMqvo/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGMgYyhjMA8=&rs=AOn4CLAkxwuVfXRiwLFdgZ5yJ77kkzr3_g

Income Tax Rebate U s 87A For Individuals AY 2023 24 2024 25 CA Club

https://caclub.in/wp-content/uploads/2022/04/income-tax-rebate-u-s-87a-individuals.webp

If your taxable income is below Rs 5 lakh in the financial year 2022 23 assessment year 2023 24 you may be eligible for a tax rebate under Section 87A of the Income Tax Act 1961 Discover who can claim the Income Tax Rebate under Section 87A for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 Learn how to easily claim the rebate in TaxTurtle

Under Section 87A taxpayers are entitled to a rebate of up to Rs 12 500 effectively reducing their income tax liability This rebate is applicable to individuals whose taxable income does not exceed Rs 5 00 000 as observed As per the latest 2023 rules of tax rebates in India A income tax rebate under section 87 of Rs 25 000 is available u s 87A for the NEW tax regime for individuals whose taxable income is Rs

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

Section 87A What Is The Income Tax Rebate Available Under Section 87A

https://static.toiimg.com/thumb/msid-61977901,width-1070,height-580,imgsize-117061,resizemode-6,overlay-toi_sw,pt-32,y_pad-40/photo.jpg

https://taxconcept.net › income-tax

A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if

https://economictimes.indiatimes.com › wealth › tax › ...

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

Income Tax Rebate Under Section 87A

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates

Section 87A Rebate For AY 2024 25 As Per Union Budget 2023 24

Income Tax Sec 87A Amendment Rebate YouTube

Section 87A Tax Rebate Under Section 87A Paisabazaar

Rebate Under Section 87a Ay 2023 23 - The maximum 87A rebate is up to 12 500 old and new regime till FY 2022 23 and 25 000 for the new regime from FY 2023 24 The rebate is not applicable if the tax liability exceeds 12 500 and 25 000 under the old