Rebate Under Section 87a Ay 2024 24 Income Tax Income Tax Deductions Income Tax Rebate under Section 87A Claiming the 87A Rebate Section 87A Income Tax Rebate under Section 87A Updated on 16 Jan 2024 05 49 PM In 2013 14 the government of India introduced a rebate u s 87A This rebate helps reduce the income tax liability of taxpayers

Lifestyle Guide Rebate U S 87A for Senior Citizens Guide Rebate U S 87A for Senior Citizens Leave a Comment Lifestyle Miscellaneous Activities By Francis Welcome to our comprehensive guide on the rebate u s 87A for senior citizens 2023 04 01 Kewal Garg Income Tax Updates Resident individuals under existing tax regime having a total income of up to Rs 500 000 can receive a tax rebate of up to Rs 12 500 under Section 87A for AY 2023 24 and onwards

Rebate Under Section 87a Ay 2024 24

Rebate Under Section 87a Ay 2024 24

https://www.gconnect.in/gc22/wp-content/uploads/2023/02/Finance-Bill-2023-1536x806.jpg

Tax Rebate Under Section 87A A Detailed Guide On 87A Rebate

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/87a-rebate.jpg

Exemption Under Section 87A With Automatic Income Tax Form 16 Part A And B And Part B Which

https://blogger.googleusercontent.com/img/a/AVvXsEhZQi5Ln43Bt9k-pbvTrPSfypjB_GE_1j1Y9DeNCTK26XuHgerBTWwh58nQRJZgzuL143kSP6CctV6W3EwVilLcf3L52A5wtUVy8MS0GfbW4JPHrN0VLim6AVTMeYg2eS8WCLGRDcsn_c4mrZKezFEBY2LNHqM5kNZri1BcmUCS2JjDRxdKfZrspLxB=w1200-h630-p-k-no-nu

Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24 Provided that where the total income of the assessee is chargeable to tax under sub section 1A of section 115BAC and the total income Rebate under section 87A From assessment year 2024 25 onwards an assessee being an individual resident in India whose income is chargeable to tax under sub section 1A of section 115BAC shall now be entitled to a rebate of 100 per cent of the amount of income tax payable on a total income not exceeding Rs 7 lakh

Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax rebate effectively makes zero tax outgo of an individual Budget 2023 has proposed to extend the amount of tax rebate under new tax regime from taxable income of Rs 5 lakh to Rs 7 lakh A resident individual whose net income does not exceed Rs 5 00 000 can avail rebate under section 87A It is deductible from income tax before calculating education cess The amount of rebate is 100 per cent of income tax or Rs 12 500 whichever is less Income Tax Rate to Local Authority for FY 2023 24 AY 2024 25 Local authority is

Download Rebate Under Section 87a Ay 2024 24

More picture related to Rebate Under Section 87a Ay 2024 24

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Rebate Of Income Tax Under Section 87A YouTube

https://i.ytimg.com/vi/lgmblbkc7Qs/maxresdefault.jpg

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

https://fincalc-blog.in/wp-content/uploads/2023/02/tax-rebate-under-section-87A.webp

The present 100 Percent tax rebate under section 87A up to total income of Rs 5 lakhs was introduced by the Finance Act 2019 w e f 01 04 2020 Section 87A Rebate for AY 2024 25 Section 87A rebate has been increased to Rs 7 lakhs under New Tax Regime However no changes has been made in the rebate for those not opting New Tax Regime Last updated on December 1st 2023 The taxes paid by the citizens of India are utilized to improve the country s economy The income tax system in India is progressive hence the Income Tax Department has created different tax slab rates for individuals based on their total income

Enhanced Benefits Tax Rebate under Section 87A for AY 2024 25 and Beyond in the New Regime Higher Rebate under the New Regime Marginal Relief for Tax Rebate u s 87A Taxes Not Subject to Rebate u s 87A Specific Exclusions Incomes Not Qualifying for Tax Rebate In Conclusion FAQs Related posts Rebate u s 87A for FY 2023 24 AY 2024 25 Under the new income tax regime the amount of the rebate under Section 87A for FY 2023 24 AY 2024 25 has been modified by Finance Act 2023 A resident individual with taxable income up to Rs 7 00 000 will receive a tax rebate upto Rs 25 000 tax The rebate under former old tax regime if chosen

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

https://stairfirst.com/blog/wp-content/uploads/2020/06/Adobe_Post_20200522_1633240.06060677195840691-1-2048x1536.png

New Income Tax Slab And Tax Rebate Credit Under Section 87A With Automated Income Tax Revised

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

https://tax2win.in/guide/section-87a

Income Tax Income Tax Deductions Income Tax Rebate under Section 87A Claiming the 87A Rebate Section 87A Income Tax Rebate under Section 87A Updated on 16 Jan 2024 05 49 PM In 2013 14 the government of India introduced a rebate u s 87A This rebate helps reduce the income tax liability of taxpayers

https://greatsenioryears.com/guide-rebate-u-s-87a-for-senior-citizens/

Lifestyle Guide Rebate U S 87A for Senior Citizens Guide Rebate U S 87A for Senior Citizens Leave a Comment Lifestyle Miscellaneous Activities By Francis Welcome to our comprehensive guide on the rebate u s 87A for senior citizens

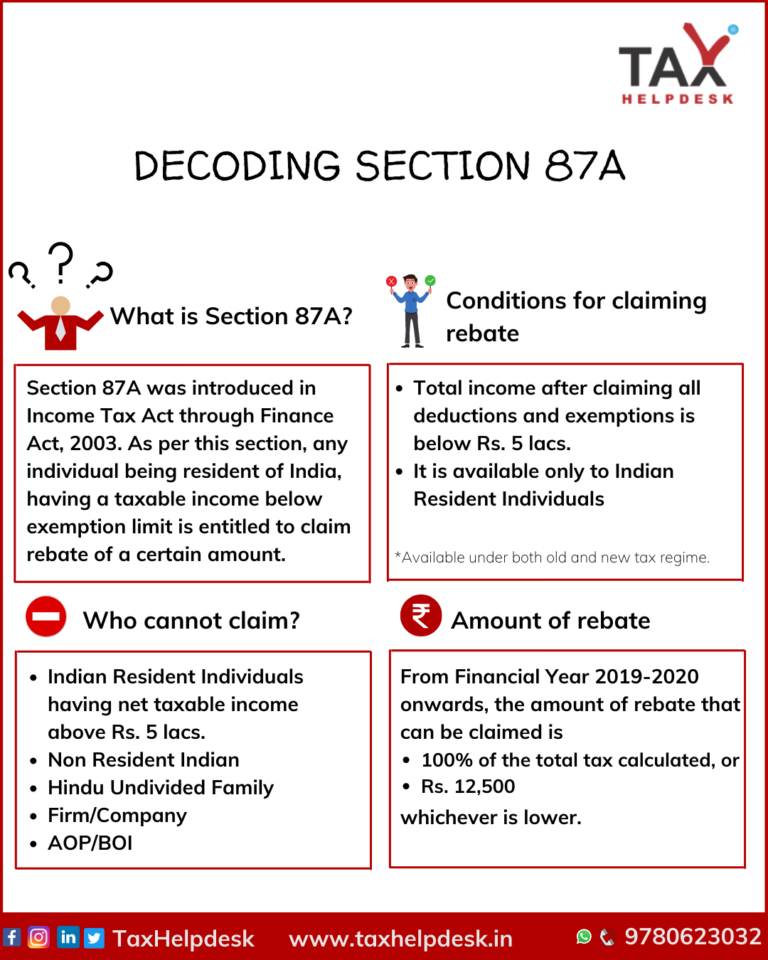

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

Income Tax Rebate Under Section 87A

Section 87a Of Income Tax Act Income Tax Taxact Income

Is Section 87A Rebate For Everyone SR Academy India

Tax Rebate For Individual Most Individual Tax Rates Go Down Under The TCJA Pease CPAs To

Tax Rebate For Individual Most Individual Tax Rates Go Down Under The TCJA Pease CPAs To

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And Rebate

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully Explained YouTube

Rebate Under Section 87A AY 2021 22 Old New Tax Regimes

Rebate Under Section 87a Ay 2024 24 - Buy Now 50 OFF IFB 30 L Convection Microwave Oven 30SC4 Metallic Silver STANDARD 13 390 18 990 Buy Now 29 OFF HUL Pureit Eco Water Saver Mineral RO UV MF AS wall mounted Counter top Black 10L Water Purifier 13 498 24 850