Rebate Under Section 87a For Ay 2024 24 In the fiscal year 2023 24 AY 2024 25 senior citizens with taxable income up to Rs 7 00 000 under the new tax regime are eligible for a rebate of Rs 25 000 or the amount of tax payable whichever is lower This change in the rebate limit is effective from FY 2023 24 AY 2024 25

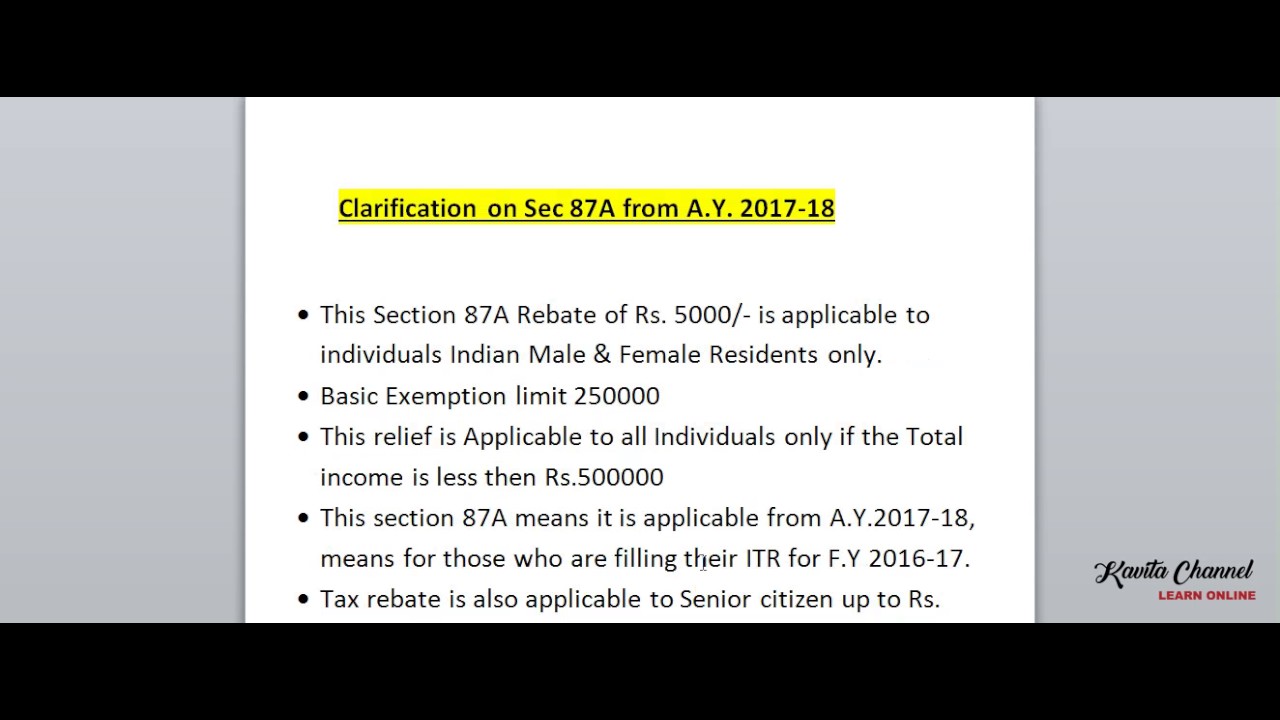

Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Budget 2023 the government announced that any individual opting for the new tax regime and having taxable income up to Rs 7 lakh will be eligible for a tax rebate of Rs 25 000

Rebate Under Section 87a For Ay 2024 24

Rebate Under Section 87a For Ay 2024 24

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/87a-rebate.jpg

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And

https://www.gconnect.in/gc22/wp-content/uploads/2023/02/Finance-Bill-2023-1536x806.jpg

Exemption Under Section 87A With Automatic Income Tax Form 16 Part A And B And Part B Which

https://blogger.googleusercontent.com/img/a/AVvXsEhZQi5Ln43Bt9k-pbvTrPSfypjB_GE_1j1Y9DeNCTK26XuHgerBTWwh58nQRJZgzuL143kSP6CctV6W3EwVilLcf3L52A5wtUVy8MS0GfbW4JPHrN0VLim6AVTMeYg2eS8WCLGRDcsn_c4mrZKezFEBY2LNHqM5kNZri1BcmUCS2JjDRxdKfZrspLxB=w1200-h630-p-k-no-nu

Default for determining the income tax payable in respect of the total income for FY 2023 24 AY 2024 25 of an individual or Hindu undivided family or association of persons other than a co operative society or body of individuals whether incorporated or not or an Rebate under section 87A to a resident individual who has opted out A rebate u s 87A is available if his total income during the previous year does not exceed Rs 7 00 000 Rebate is available to the extent of Rs 25 000 and no rebate will be available if total income exceeds Rs 7 00 000 The situation is exhibited in the Table given herein below New Marginal Scheme

Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax rebate effectively makes zero tax outgo of an individual Budget 2023 has proposed to extend the amount of tax rebate under new tax regime from taxable income of Rs 5 lakh to Rs 7 lakh A resident individual whose net income does not exceed Rs 5 00 000 can avail rebate under section 87A It is deductible from income tax before calculating education cess The amount of rebate is 100 per cent of income tax or Rs 12 500 whichever is less Income Tax Rate to Local Authority for FY 2023 24 AY 2024 25 Local authority is

Download Rebate Under Section 87a For Ay 2024 24

More picture related to Rebate Under Section 87a For Ay 2024 24

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Rebate Of Income Tax Under Section 87A YouTube

https://i.ytimg.com/vi/lgmblbkc7Qs/maxresdefault.jpg

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

https://fincalc-blog.in/wp-content/uploads/2023/02/tax-rebate-under-section-87A.webp

In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim rebate under 87A under new tax regime which shall be applicable from FY 2023 24 AY 2024 25 onwards What are the Eligibility Criteria to Claim a Rebate u s 87A What is Tax Rebate Under Section 87 A Steps to Claim Rebate Who is Eligible Things to Consider FAQs Understanding Rebate Under Section 87 A Income tax rules in India are based on a progressive tax system so tax payers with higher income pay more tax based on the applicable income tax slab rate while those with lower income have a lowe Read More

Section 87A Rebate under New Tax Regime for AY 2024 25 is as under Rebate u s 87A limit has been increased to Rs 25000 for those with taxable income up to Rs 7 lakhs in new tax regime New Tax Regime Tax slabs reduced and tax exemption limit increased to Rs 3 lakhs Section 87A Rebate for AY 2023 24 Tax Rebate under Section 87A for AY 2023 24 and Beyond in the Existing Regime Eligibility and Key Provisions Therefore Section 87A of the Income Tax Act of 1961 provides a 100 tax rebate Eligible resident individuals with up to Rs 500 000 taxable income for AY 2023 24 qualify However this rebate doesn t apply if income exceeds Rs 500 000

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

https://stairfirst.com/blog/wp-content/uploads/2020/06/Adobe_Post_20200522_1633240.06060677195840691-1-2048x1536.png

New Income Tax Slab And Tax Rebate Credit Under Section 87A With Automated Income Tax Revised

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

https://greatsenioryears.com/guide-rebate-u-s-87a-for-senior-citizens/

In the fiscal year 2023 24 AY 2024 25 senior citizens with taxable income up to Rs 7 00 000 under the new tax regime are eligible for a rebate of Rs 25 000 or the amount of tax payable whichever is lower This change in the rebate limit is effective from FY 2023 24 AY 2024 25

https://caclub.in/income-tax-rebate-u-s-87a-individuals/

Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime

Income Tax Rebate Under Section 87A

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

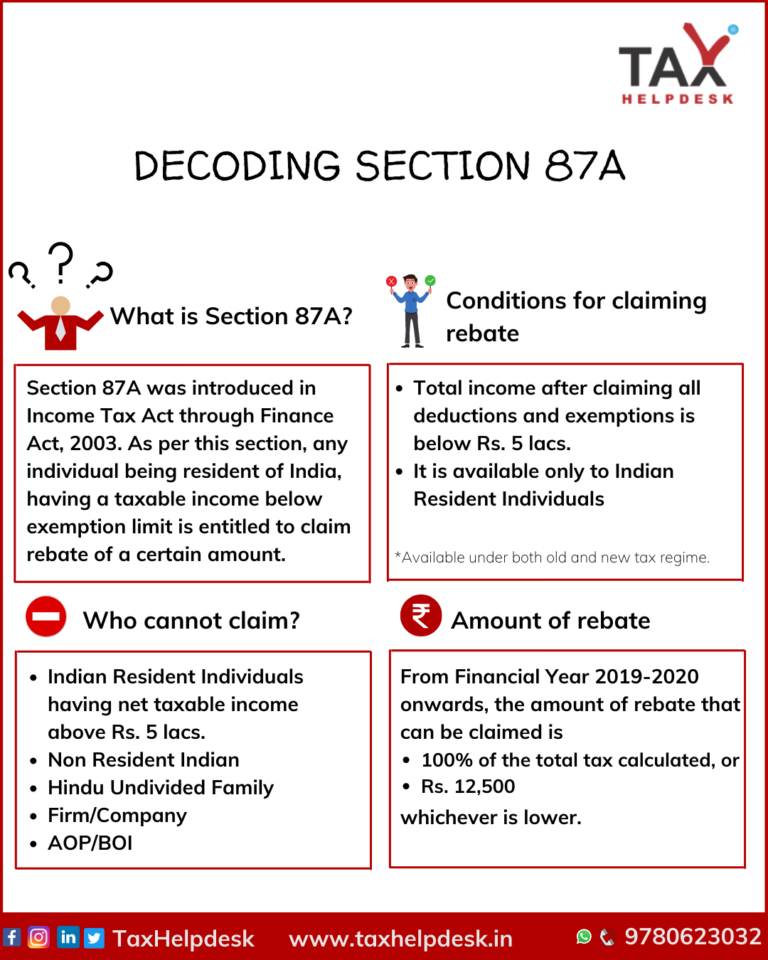

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

Section 87a Of Income Tax Act Income Tax Taxact Income

Is Section 87A Rebate For Everyone SR Academy India

Tax Rebate For Individual Most Individual Tax Rates Go Down Under The TCJA Pease CPAs To

Tax Rebate For Individual Most Individual Tax Rates Go Down Under The TCJA Pease CPAs To

Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And Rebate

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully Explained YouTube

Rebate Under Section 87A AY 2021 22 Old New Tax Regimes

Rebate Under Section 87a For Ay 2024 24 - A rebate u s 87A is available if his total income during the previous year does not exceed Rs 7 00 000 Rebate is available to the extent of Rs 25 000 and no rebate will be available if total income exceeds Rs 7 00 000 The situation is exhibited in the Table given herein below New Marginal Scheme