Rebate Under Section 87a For Fy 2024 23 In the fiscal year 2023 24 AY 2024 25 senior citizens with taxable income up to Rs 7 00 000 under the new tax regime are eligible for a rebate of Rs 25 000 or the amount of tax payable whichever is lower This change in the rebate limit is effective from FY 2023 24 AY 2024 25

Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24 Provided that where the total income of the assessee is chargeable to tax under sub section 1A of section 115BAC and the total income Rebate under section 87A From assessment year 2024 25 onwards an assessee being an individual resident in India whose income is chargeable to tax under sub section 1A of section 115BAC shall now be entitled to a rebate of 100 per cent of the amount of income tax payable on a total income not exceeding Rs 7 lakh

Rebate Under Section 87a For Fy 2024 23

Rebate Under Section 87a For Fy 2024 23

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/87a-rebate.jpg

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And

https://www.gconnect.in/gc22/wp-content/uploads/2023/02/Finance-Bill-2023-1536x806.jpg

Rebate Of Income Tax Under Section 87A YouTube

https://i.ytimg.com/vi/lgmblbkc7Qs/maxresdefault.jpg

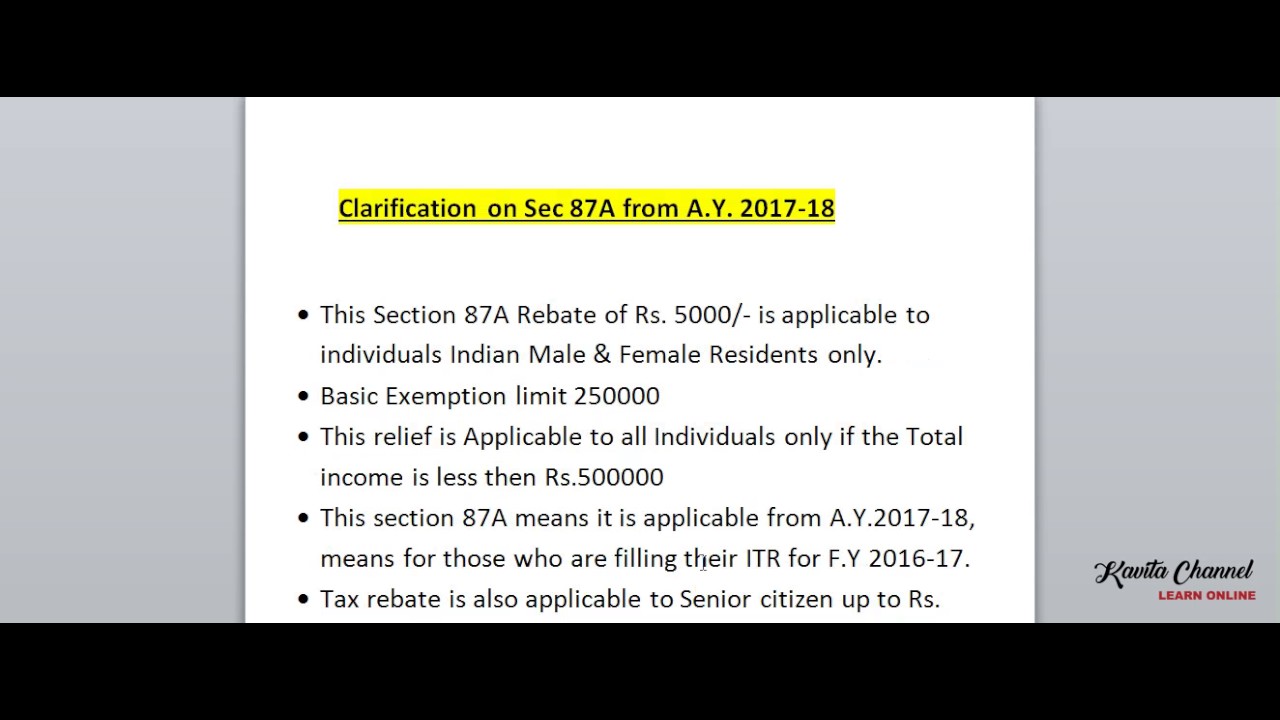

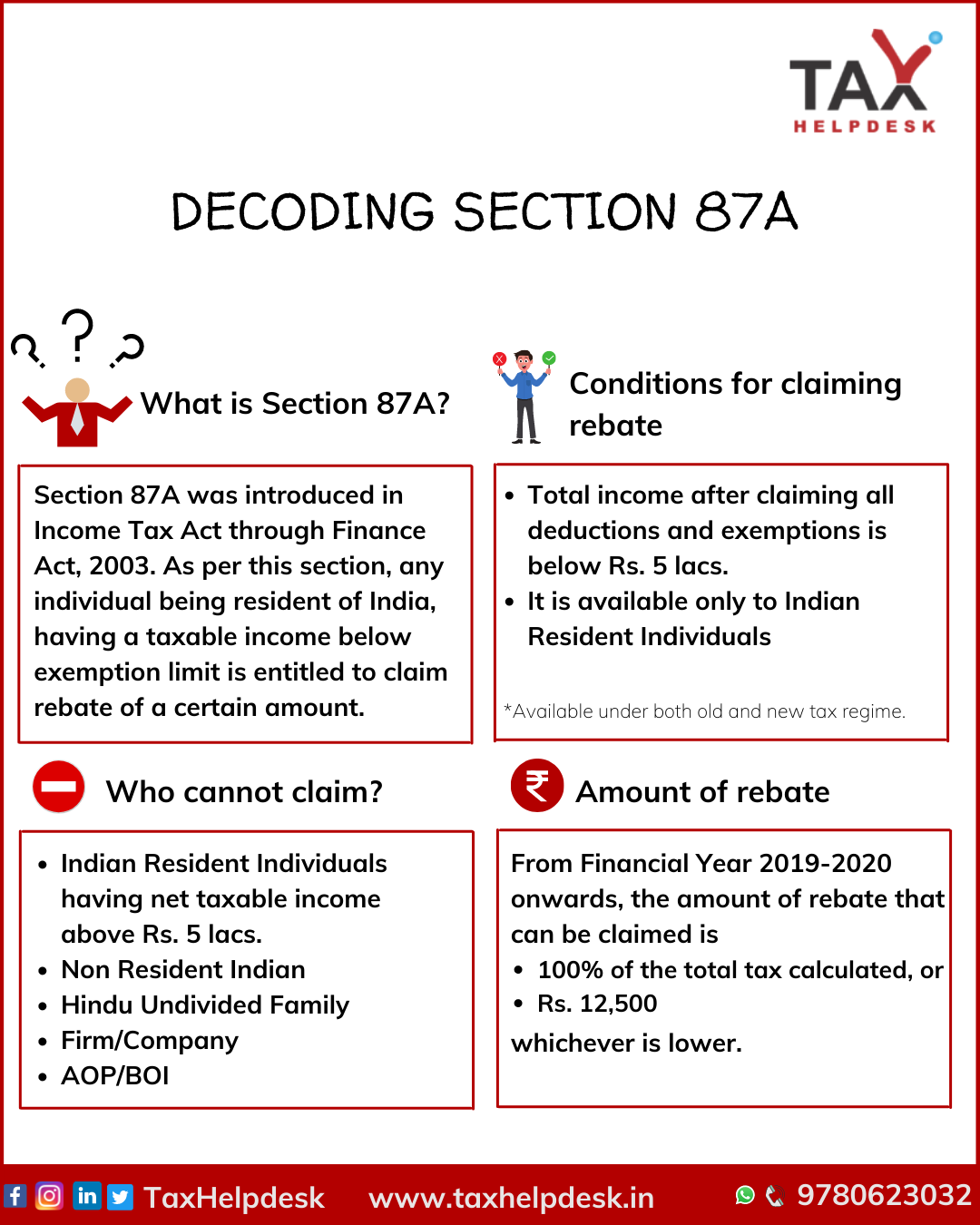

Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime This is due to tax rebate under section of 87A of the Income Tax Act A tax rebate reduces the tax amount It is allowed only to RESIDENT INDIVIDUALS While computing taxes they are first calculated as per the slab rates

The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Budget 2023 the government announced that any individual opting for the new tax regime and having taxable income up to Rs 7 lakh will be eligible for a tax rebate of Rs 25 000 On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

Download Rebate Under Section 87a For Fy 2024 23

More picture related to Rebate Under Section 87a For Fy 2024 23

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

https://stairfirst.com/blog/wp-content/uploads/2020/06/Adobe_Post_20200522_1633240.06060677195840691-1-1920x1440.png

Rebate Under Section 87A How It Works Eligibility Max Life Insurance

https://www.maxlifeinsurance.com/static-page/assets/homepage/Rebate_Under_Section_87_A_2_1_de5ad95a65.webp

Section 87A Tax Rebate FY 2019 20 How To Check Rebate Eligibility

https://www.relakhs.com/wp-content/uploads/2021/01/Rebate-Section-87A-1000x600.jpg

Rebate u s 87A for FY 2023 24 AY 2024 25 Under the new income tax regime the amount of the rebate under Section 87A for FY 2023 24 AY 2024 25 has been modified by Finance Act 2023 A resident individual with taxable income up to Rs 7 00 000 will receive a tax rebate upto Rs 25 000 tax Step 1 Calculate the gross income for the year Step 2 Reduce all the deductions standard deductions tax savings etc Step 3 Declare the income after deductions and tax deductions in the Income Tax Return ITR Step 4 Claim a tax rebate under section 87A if your total income does not exceed Rs 5 lakh Remember the maximum rebate under

The present 100 Percent tax rebate under section 87A up to total income of Rs 5 lakhs was introduced by the Finance Act 2019 w e f 01 04 2020 Section 87A Rebate for AY 2024 25 Section 87A rebate has been increased to Rs 7 lakhs under New Tax Regime However no changes has been made in the rebate for those not opting New Tax Regime Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax rebate effectively makes zero tax outgo of an individual Budget 2023 has proposed to extend the amount of tax rebate under new tax regime from taxable income of Rs 5 lakh to Rs 7 lakh

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Income Tax Rebate Under Section 87A Legalraasta

https://www.legalraasta.com/blog/wp-content/uploads/2021/08/Income-tax-rebate-tax-deduction-and-exemption-scaled.jpg

https://greatsenioryears.com/guide-rebate-u-s-87a-for-senior-citizens/

In the fiscal year 2023 24 AY 2024 25 senior citizens with taxable income up to Rs 7 00 000 under the new tax regime are eligible for a rebate of Rs 25 000 or the amount of tax payable whichever is lower This change in the rebate limit is effective from FY 2023 24 AY 2024 25

https://taxguru.in/income-tax/marginal-relief-u-s-87a-tax-regime-u-s-115bac1a.html

Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24 Provided that where the total income of the assessee is chargeable to tax under sub section 1A of section 115BAC and the total income

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

Income Tax Rebate U s 87A For The Financial Year 2022 23

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

All You Need To Know About Section 87A At TaxHelpdesk TaxHelpdesk

New Income Tax Slab And Tax Rebate Credit Under Section 87A With Automated Income Tax Revised

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A

Know New Rebate Under Section 87A Budget 2023 PowerRebate

Section 87A Tax Rebate FY 2023 24 Under Old New Tax Regimes

Section 87a Of Income Tax Act Income Tax Taxact Income

Rebate Under Section 87a For Fy 2024 23 - On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax