Rebate Under Section 87a If Applicable Web 3 f 233 vr 2023 nbsp 0183 32 Who is eligible for tax rebate under Section 87A According to the Income tax Act the rebate under Section 87A is available to only resident individuals

Web 14 sept 2019 nbsp 0183 32 Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable Web 27 juil 2023 nbsp 0183 32 If a taxpayers taxable income is eligible for tax rebate under section 87A but he has income by way of LTCG from equity mutual funds or listed equity shares then

Rebate Under Section 87a If Applicable

Rebate Under Section 87a If Applicable

https://www.legalraasta.com/blog/wp-content/uploads/2021/08/Income-tax-rebate-tax-deduction-and-exemption-scaled.jpg

Va A Decidir Comedia Apellido How To Calculate Rebate Abierto Pl tano

https://financialcontrol.in/wp-content/uploads/2018/06/How-to-calculate-rebate-us-87A.jpg

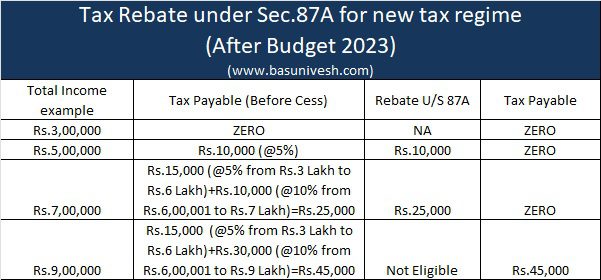

Section 87A How Is Income Up To Seven Lakhs Tax free BasuNivesh

https://b2382649.smushcdn.com/2382649/wp-content/uploads/2023/02/Budget-2023-Tax-Rebate-under-Sec.87A-for-new-tax-regime.jpg?lossy=1&strip=1&webp=1

Web Section 87A Eligibility Criteria for FY 2022 23 and FY 2023 24 An individual can claim a tax rebate us 87A provided he or she meets the following conditions The individual Web 2 f 233 vr 2023 nbsp 0183 32 In Budget 2023 the tax rebate for individuals has been increased to INR 25 000 which means individuals having taxable income up to INR 7 00 000 can claim

Web 26 avr 2022 nbsp 0183 32 Can an NRI claim a Section 87A rebate Ans The rebate is applicable only to Indian residents So individuals who are non residents cannot avail of the rebate Web 10 avr 2023 nbsp 0183 32 How to claim rebate benefits under 87A Step 1 Calculate the gross income for the year Step 2 Reduce all the deductions standard deductions tax savings etc

Download Rebate Under Section 87a If Applicable

More picture related to Rebate Under Section 87a If Applicable

Tax Rebate Under Section 87A Investor Guruji Tax Planning

https://investorguruji.com/wp-content/uploads/2022/04/Section-87A-1024x597.jpg

Tax Rebate Under Section 87A Investor Guruji Tax Planning

https://investorguruji.com/wp-content/uploads/2022/04/rebate-undern-section-87A.jpg

How To Solve For Income Tax Amy Fleishman s Math Problems

https://i.pinimg.com/736x/b5/1d/a1/b51da136da3645c53e1d0b5dea60983c.jpg

Web What is Tax Rebate Under Section 87 A Steps to Claim Rebate Who is Eligible Things to Consider FAQs Understanding Rebate Under Section 87 A Income tax rules in India Web 25 ao 251 t 2020 nbsp 0183 32 Rebate under section 87A is available in the form of deduction from the tax liability Rebate under section 87A will be lower of 100 of income tax liability or Rs

Web 3 d 233 c 2020 nbsp 0183 32 All individual taxpayers whether male or female can avail the benefit of rebate u s 87A Senior citizens above the age of 60 years and below 80 years are also Web Any individual whose total net income does not cross Rs 5 lakh can claim tax rebate under section 87a of the Income Tax Act 1961 One can get a tax rebate of up to

Rebate Under Section 87A FY 2020 2021 Can Get The Tax Benefits Who Are

https://1.bp.blogspot.com/-7Xtx_UXqyek/X1LkeZMdZmI/AAAAAAAAOTY/huaC80OeV7IgW-zC9_Jvbp2XfRwfaHjFgCNcBGAsYHQ/s1600/Picture%2Bfor%2BTax%2BRebate%2B87A.jpg

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 Who is eligible for tax rebate under Section 87A According to the Income tax Act the rebate under Section 87A is available to only resident individuals

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount As per Rebate u s 87A provides exemption if an individual s taxable

Section 87a Of Income Tax Act Income Tax Taxact Income

Rebate Under Section 87A FY 2020 2021 Can Get The Tax Benefits Who Are

Tax Rebate Under Section 87A A Detailed Guide On 87A Rebate

Tax Rebate For Individual Deductions For Individuals reliefs

Is Section 87A Rebate For Everyone SR Academy India

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

Section 87A Income Tax Rebate Eligibility How To Claim It

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

Rebate Under Section 87a If Applicable - Web Rebate is applicable to those under a specific income Section 87A allows those whose incomes do not exceed 3 50 000 to apply for the reimbursement This discount which