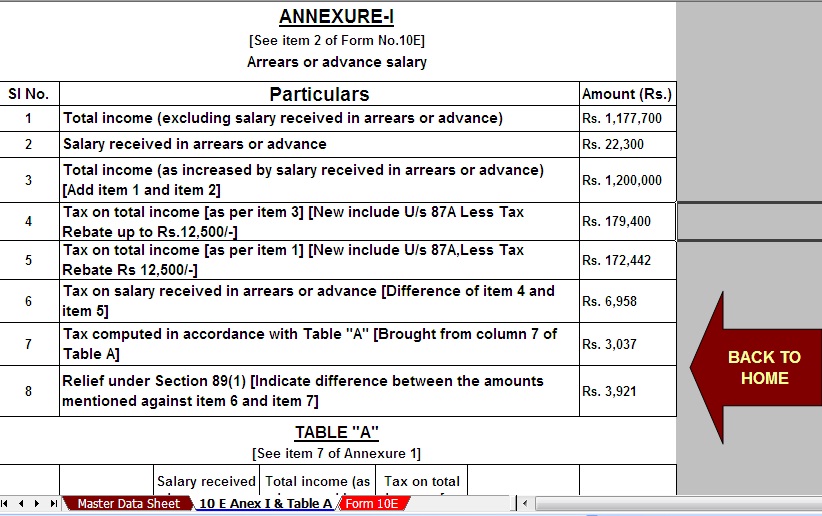

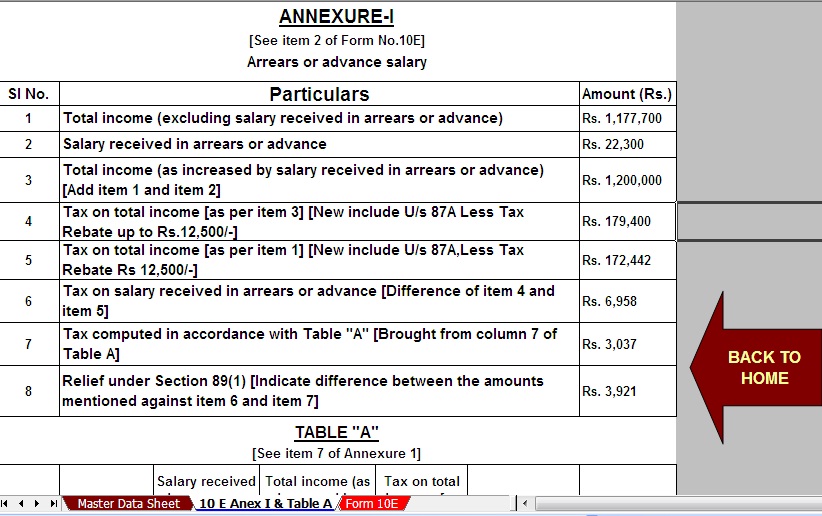

Rebate Under Section 89 1 Of Income Tax Web Description Amount in Rs Salary received in arrear Rule 21A 2 Enter details Gratuity received for past services extending a period of not less than 5 years but less than 15

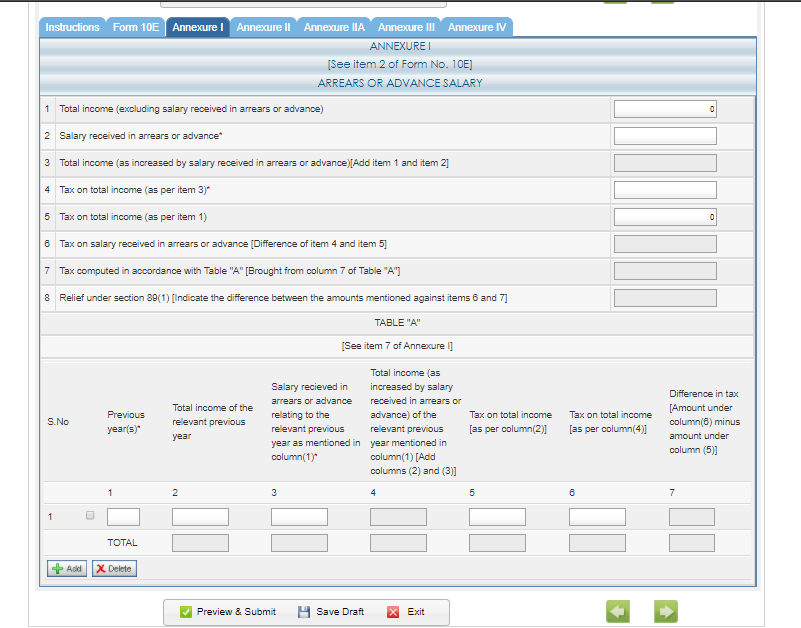

Web 4 janv 2022 nbsp 0183 32 If any individual receive any portion of his salary in arrears or in advance or profits in lieu of salary 17 3 he or she can claim relief under section 89 1 of Income Web Relief under section 89 1 according to Income Tax Act saves you from additional tax burden if there is a delay in receiving income An employee must meet certain conditions to claim relief under this section

Rebate Under Section 89 1 Of Income Tax

Rebate Under Section 89 1 Of Income Tax

https://1.bp.blogspot.com/-ZRrL4WW2D5Q/XibxjnGjVKI/AAAAAAAALqc/7UitAFsKJfw1bS7YBrBckOwnB3GZziZJQCNcBGAsYHQ/s640/Picture%2B6%2Bof%2BGovt%2B%2526%2BNon%2Bgovt%2B%2B19-20.jpg

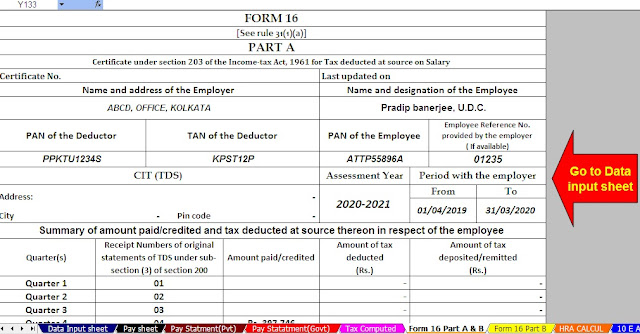

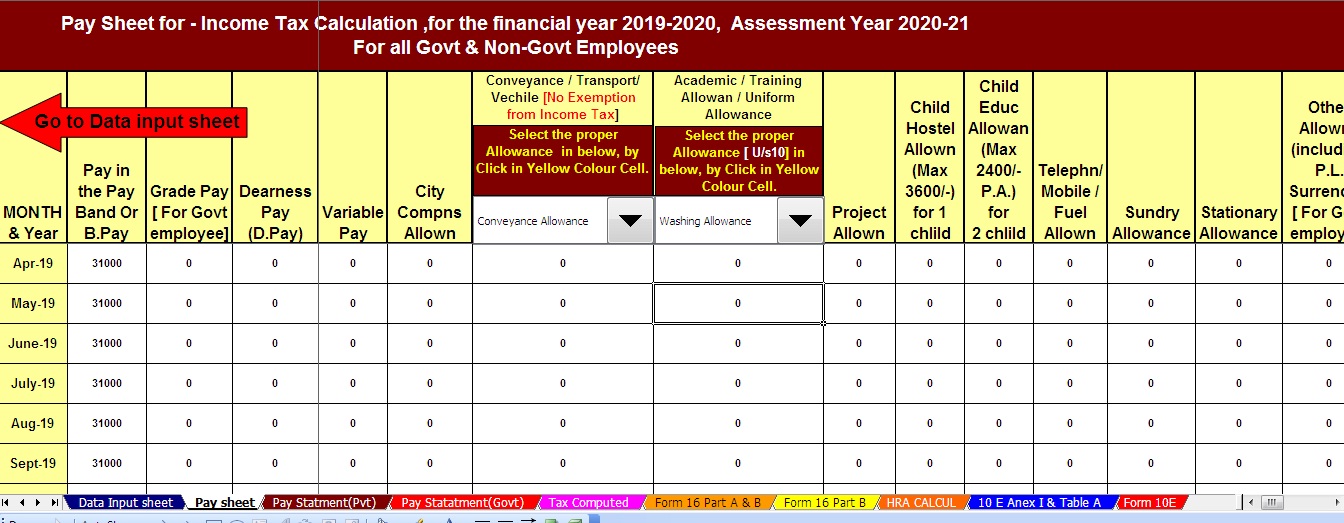

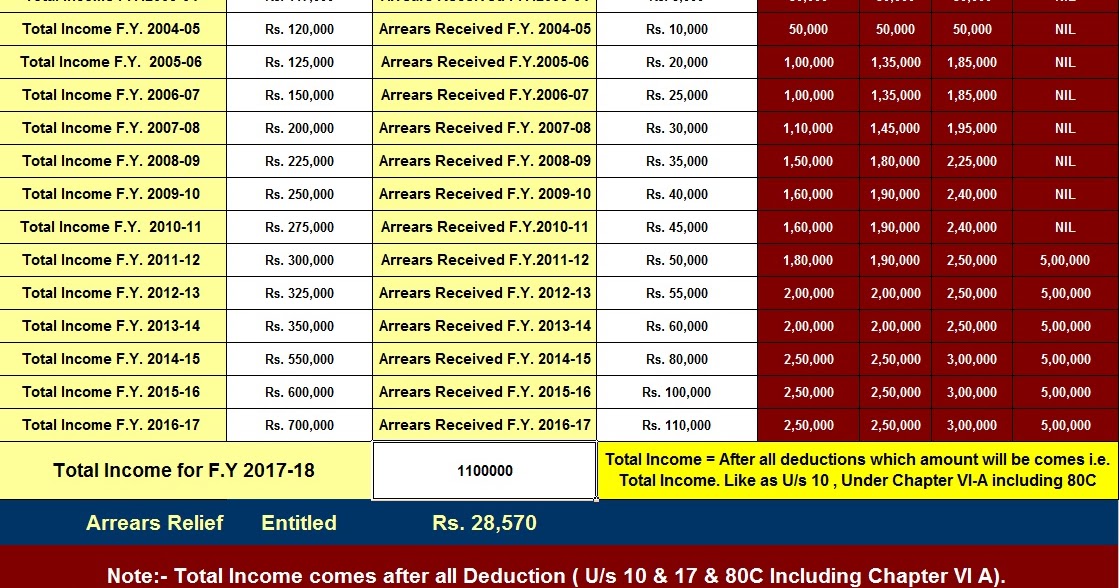

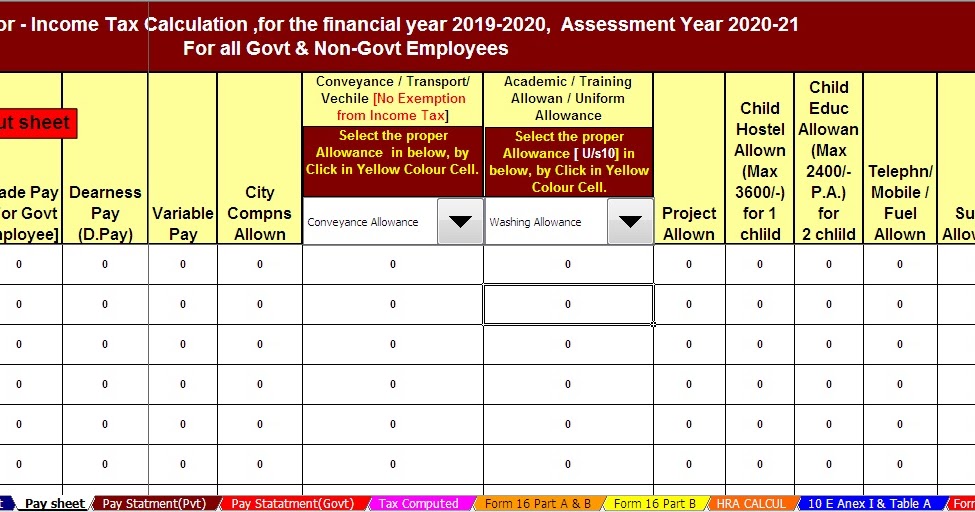

Income Tax Arrears Relief Calculator U s 89 1 Income Tax Form 10E

https://1.bp.blogspot.com/-0hQ9nLiRzGI/XjLMSDzJzwI/AAAAAAAALxE/Lv1BTGiDMvAhxGuySzsZAzpEu-0hQn0TQCNcBGAsYHQ/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

Relief Under Section 89 L Section 89 Of Income Tax Act L Relief Under 89 1

https://manthanexperts.com/wp-content/uploads/2020/09/Releif-under-section-89-of-ITA-768x403.jpg

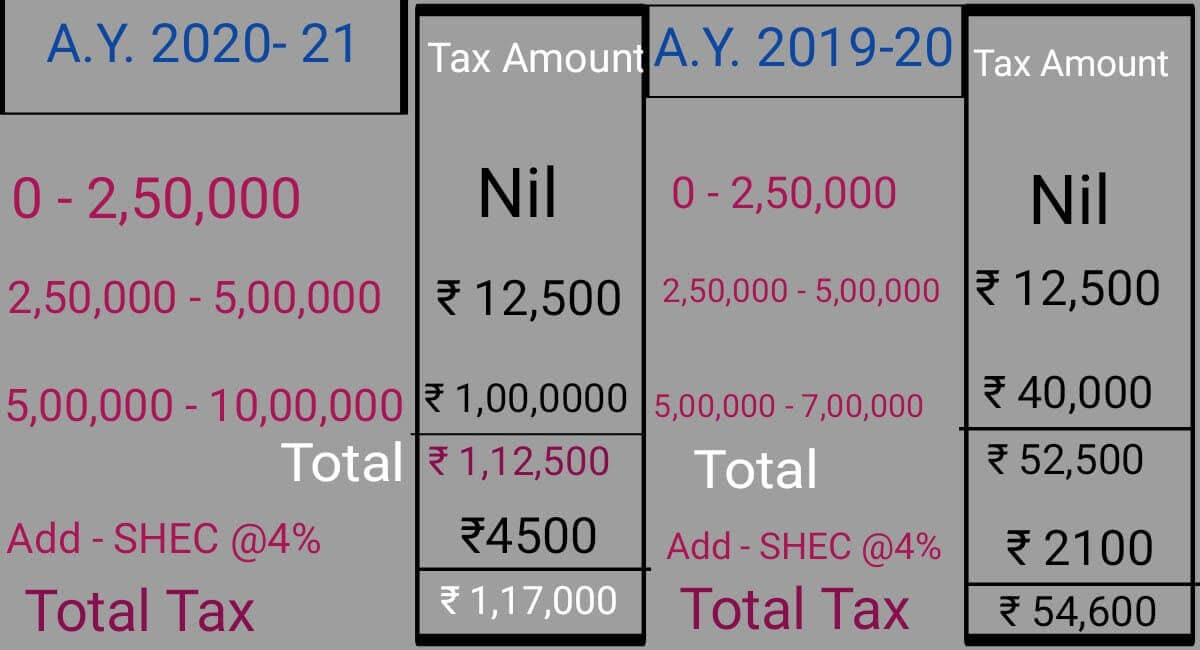

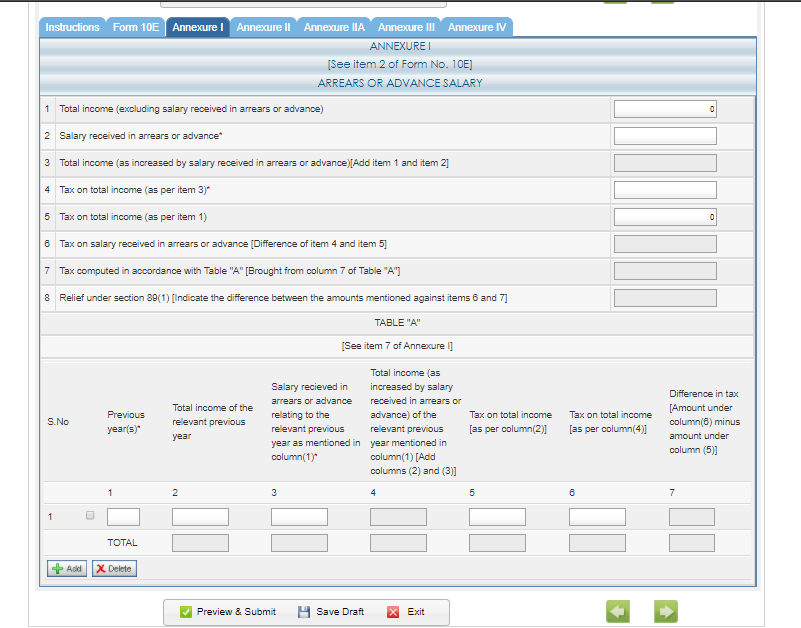

Web Here are the steps to calculate relief under section 89 1 of the Income tax Act 1961 Calculate tax payable on total income including arrears in the year in which it is Web 27 f 233 vr 2020 nbsp 0183 32 However the Income Tax Act provides assessees relief in those situations u s 89 1 Relief under Section 89 1 Relief under section 89 1 for arrears of salary

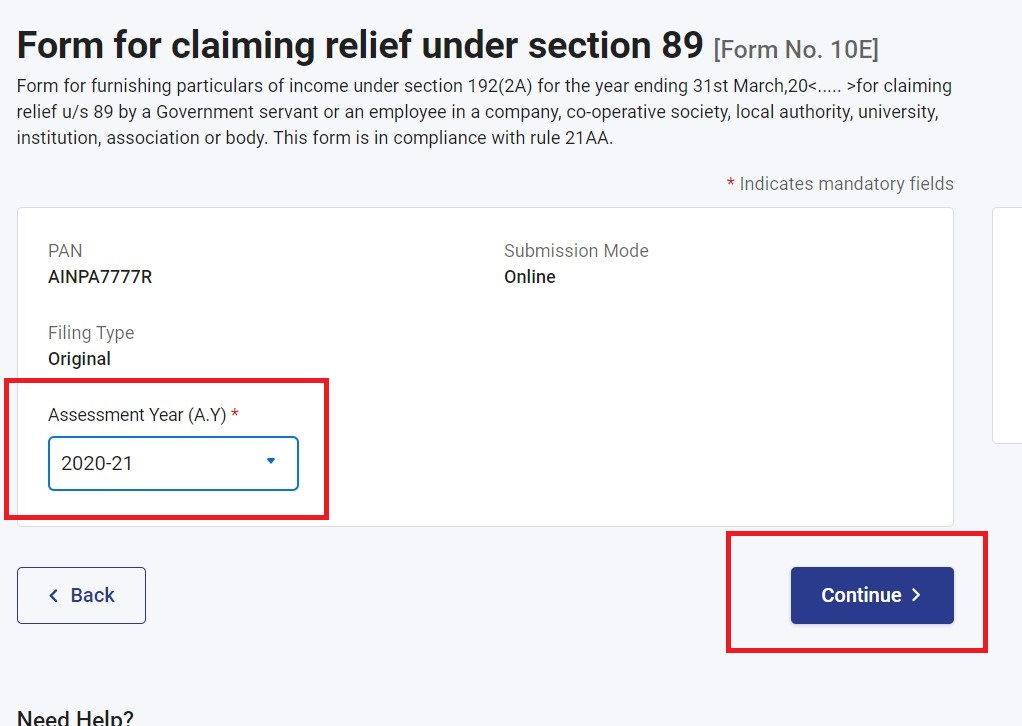

Web 11 mai 2023 nbsp 0183 32 How to claim tax relief on Salary Arrears under Section 89 1 Arrears or Salary advances are taxable in the year of receipt The income tax department allows tax relief u s 89 of the Income Tax Act to Web 8 mai 2023 nbsp 0183 32 It is mandatory to fill out Form 10E when an individual wants to claim tax relief under Section 89 1 of the Income Tax Act 1961 Section 89 1 provides tax tax relief

Download Rebate Under Section 89 1 Of Income Tax

More picture related to Rebate Under Section 89 1 Of Income Tax

Relief Under Section 89 Of Income Tax Act In Hindi 89

https://www.taxjankari.com/wp-content/uploads/2019/02/ay.jpg

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

https://1.bp.blogspot.com/-AtF8rfaCFLM/XibwI-dnLdI/AAAAAAAALpw/T369csBM5mA1ezc33rQY5LaSOSVuqJzPACNcBGAsYHQ/s1600/pictture%2B3%2BGovt%2B%2526%2BNon-Govt%2Bfor%2B19-20.jpg

Income Tax Relief Under Section 89 1 Read With Rule 21A With

https://1.bp.blogspot.com/-NfC7vVdLCss/WfQvjk7wqdI/AAAAAAAAFtA/l58RcloHSosIKsLbvc_gpycm49-JzfVNgCLcBGAs/w1200-h630-p-k-no-nu/Arrears%2BRelief%2BPage%2B1.jpg

Web 12 juil 2023 nbsp 0183 32 Below are the detailed steps to calculate the relief under section 89 Step 1 We need to calculate the tax payable on the total income including the arrears of Web The excess between the tax on additional salary as calculated under step 1 and 2 shall be the relief admissible under section 89 If there is no excess no relief is admissible If the

Web 7 sept 2020 nbsp 0183 32 The employee can claim relief of Rs 15 000 under section 89 1 of the Income tax Act 1961 No relief shall be allowed if the amount of step 2 is more than Web 3 ao 251 t 2023 nbsp 0183 32 An employee must meet certain conditions to claim relief under Section 89 1 Salary is received in arrears or in advance Salary received for more than 12

Relief Under Section 89 1 For Arrears Of Salary MyITreturn Help Center

https://help.myitreturn.com/hc/article_attachments/360003419711/mceclip1.png

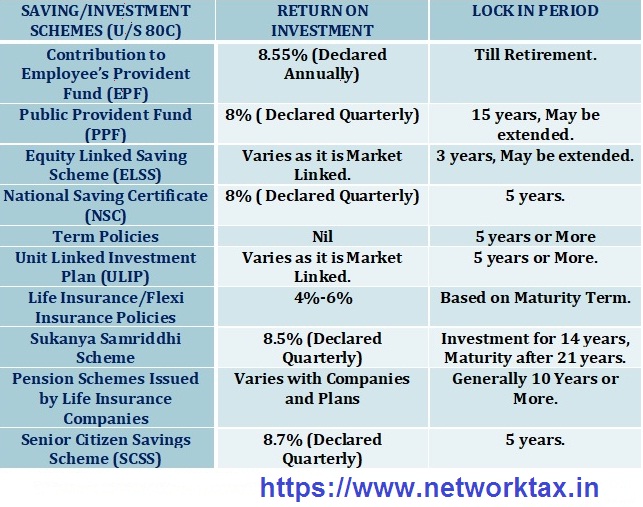

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

https://1.bp.blogspot.com/-mRQaYQLP59U/X1BnNR-2zcI/AAAAAAAAOSo/EWOnKzg142kD8ZJUWja_MuANbn2VPKdWgCNcBGAsYHQ/s1600/picture%2Bfor%2Bincome%2Btax%2B80C.jpg

https://incometaxindia.gov.in/Pages/tools/relief-under-section-89.aspx

Web Description Amount in Rs Salary received in arrear Rule 21A 2 Enter details Gratuity received for past services extending a period of not less than 5 years but less than 15

https://taxguru.in/income-tax/tax-relief-section-89-income-tax-act...

Web 4 janv 2022 nbsp 0183 32 If any individual receive any portion of his salary in arrears or in advance or profits in lieu of salary 17 3 he or she can claim relief under section 89 1 of Income

Taxability Of Arrear Of Salary Relief Under Section 89 1 With

Relief Under Section 89 1 For Arrears Of Salary MyITreturn Help Center

Theme Presentation1

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

Rebate Relief Section 87A Section 89 1 Income Tax

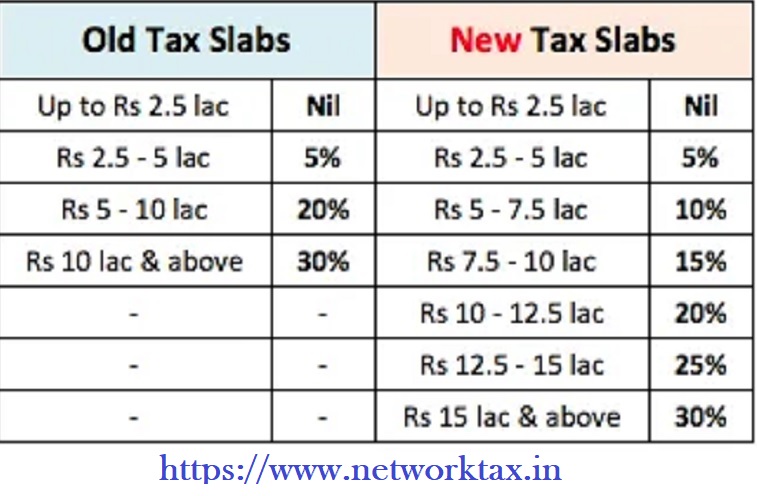

Budget 2023 Summary Of Direct Tax Proposals

Budget 2023 Summary Of Direct Tax Proposals

How To Calculate Relief U s 89 1 Of The Income Tax Act

Procedure For Relief Under Section 89 1 Irtsa

Section 89 Under Companies Act 2013 Ebizfiling

Rebate Under Section 89 1 Of Income Tax - Web 9 d 233 c 2021 nbsp 0183 32 This blog discusses the FAQs on income tax returns ITR income tax deductions income tax rebate relief under Section 89 Form 10E set off of losses