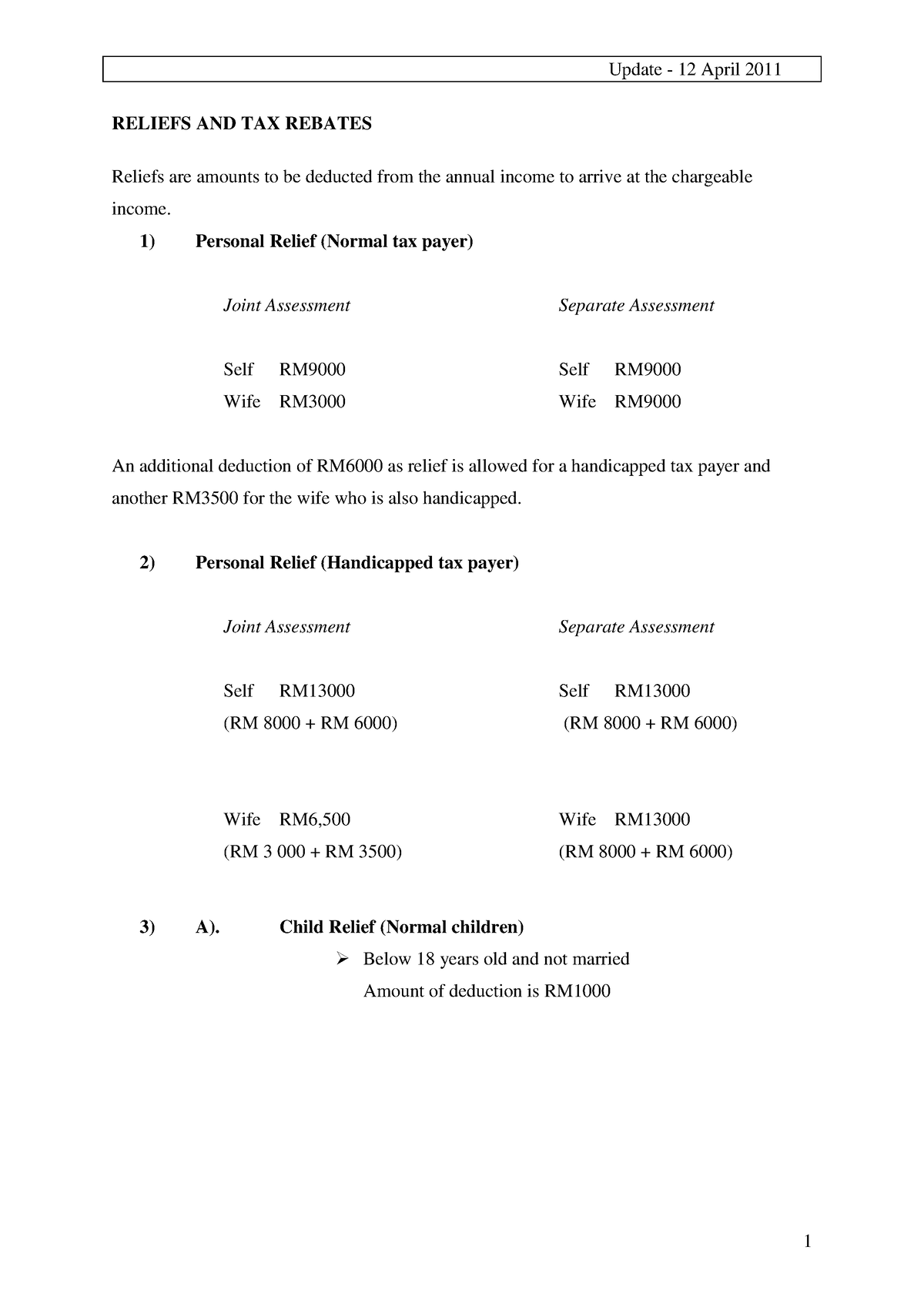

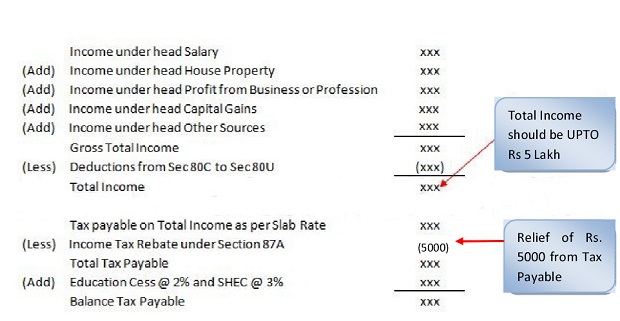

Rebates And Reliefs Under Income Tax Act Web 1 Subject to the provisions of this section an assessee being an individual or a Hindu undivided family shall be entitled to a deduction from the amount of income tax as

Web 7 lignes nbsp 0183 32 RELIEFS SECTION 87A Persons Covered Rebate REBATE FROM INCOME TAX PAYABLE WHEN THE NET Web REBATES AND RELIEFS Income tax Act 1961 F REVERSAL OF IGST ITC AND PAYMENT THROUGH DRC 03 F 10 37 of the Income Tax Act F Export of service F

Rebates And Reliefs Under Income Tax Act

Rebates And Reliefs Under Income Tax Act

https://1.bp.blogspot.com/-URwzarptYIA/XoXVUKy1nII/AAAAAAAAES8/NcAK7-qJ7fMV0VJNLHF0q7oD77USiDU2QCLcBGAsYHQ/s1600/RG2-page-002.jpg

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

REBATE AND RELIEFS UNDER INCOME TAX

https://studycafe.in/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2021/10/REBATE-AND-RELIEFS-UNDER-INCOME-TAX.jpg

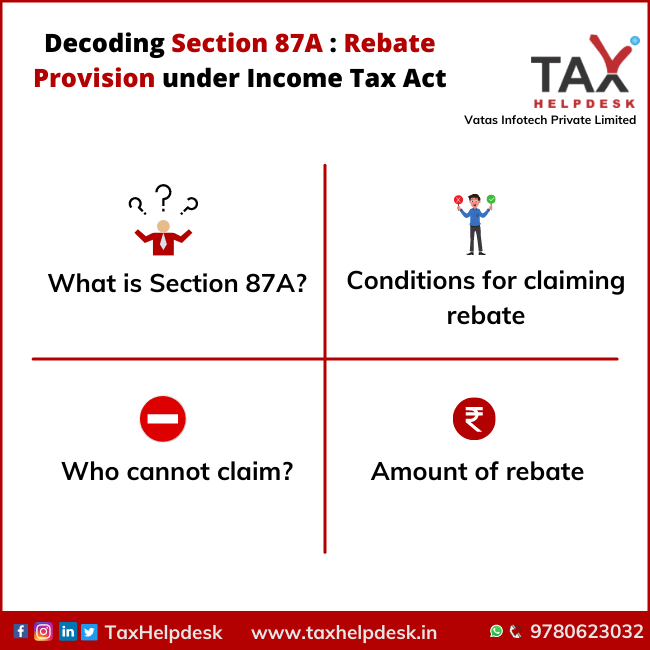

Web REBATES AND RELIEFS A Rebate of income tax Rebate to be allowed in computing income tax 87 Web 19 oct 2021 nbsp 0183 32 Rebate under section 87A of the Income Tax Act is a provision that helps taxpayers to reduce their tax liability This section is available to the person whose

Web 18 oct 2021 nbsp 0183 32 1 If the person is residential individual 2 If the persons total income does not exceed Rs 5 Lakhs after deducting all the deduction under Chapter VI A 3 Maximum limit for claiming rebate is Rs 12 500 Web 5 d 233 c 2017 nbsp 0183 32 REBATES AND RELIEFS A Rebate of income tax 87 Rebate to be allowed in computing income tax

Download Rebates And Reliefs Under Income Tax Act

More picture related to Rebates And Reliefs Under Income Tax Act

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Income TAX reliefs And Rebates RELIEFS AND TAX REBATES Reliefs Are

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/282139760885f52ec10c99459eb6f12f/thumb_1200_1697.png

Income Tax Return TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/07/Decoding-Section-87A-Rebate-Provision-under-Income-Tax-Act.png

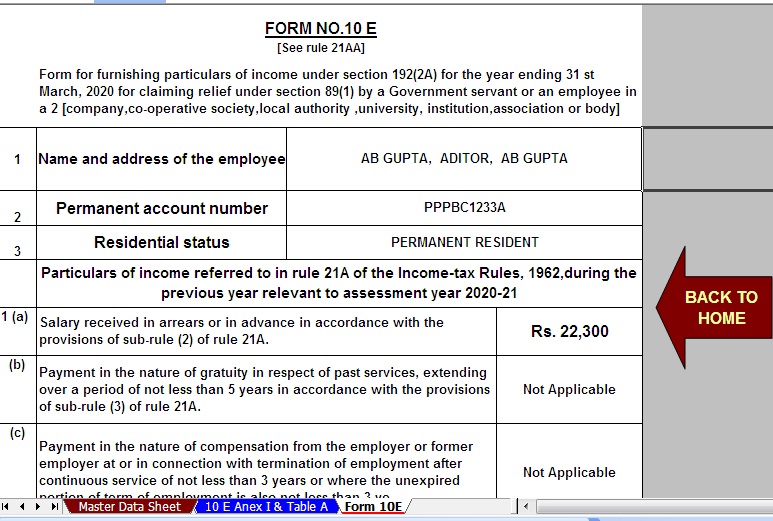

Web 6 lignes nbsp 0183 32 4 janv 2022 nbsp 0183 32 If any individual receive any portion of his salary in arrears or in advance or profits in lieu of Web Here are the eligibility criteria to claim income tax rebate under Section 87A of the Income Tax Act Must be a resident of India Your overall income after taking deductions into

Web You can claim a maximum rebate of up to 12 500 under Section 87A of the Income Tax Act for the financial year 2022 23 The maximum amount of the 87A rebate has been Web An income tax rebate is a refund on taxes payable when the amount paid as income tax is less than the tax payable If you have paid more tax than you owe you will be entitled to an income tax rebate and the additional tax amount will be refunded at

Lhdn Tax Relief 2021 Tax Relief Malaysia LHDN s Full List Of Things

https://4.bp.blogspot.com/-JTsquM0HYuI/XmW7noYMLVI/AAAAAAAAIt8/upx_BvbleAMpvjOk73KfmRmQcO37CDOqwCLcBGAsYHQ/s1600/LHDN%2Btax%2Brelief%2Bassessment%2Byear%2B2019.jpg

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

https://1.bp.blogspot.com/-tZFrTAS5gvo/XhUd-5p6j3I/AAAAAAAALfQ/Bb1lpmHCvMk08MD2EPLY5qHVFx-Gt0TlgCNcBGAsYHQ/s1600/Picture%2B5%2Bof%2BArrears%2BRelief%2BCalculator%2B%2B19-20.jpg

https://taxmacs.com/.../2018/05/8.-Chapter-VIII-Rebates-an…

Web 1 Subject to the provisions of this section an assessee being an individual or a Hindu undivided family shall be entitled to a deduction from the amount of income tax as

https://wirc-icai.org/.../part3/reliefs-under-income-tax-act-1961.html

Web 7 lignes nbsp 0183 32 RELIEFS SECTION 87A Persons Covered Rebate REBATE FROM INCOME TAX PAYABLE WHEN THE NET

What Is The Procedure For Appliation Under Rule 3A Of Income Tax Act

Lhdn Tax Relief 2021 Tax Relief Malaysia LHDN s Full List Of Things

DEDUCTION UNDER SECTION 80C TO 80U PDF

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

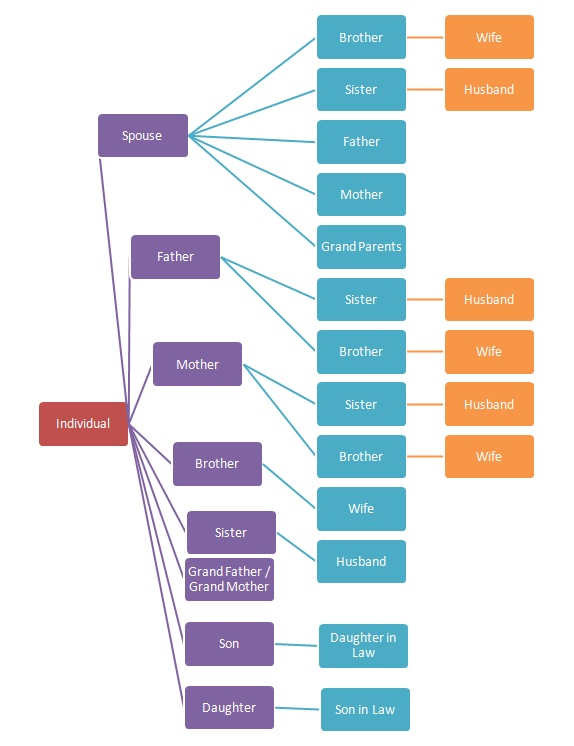

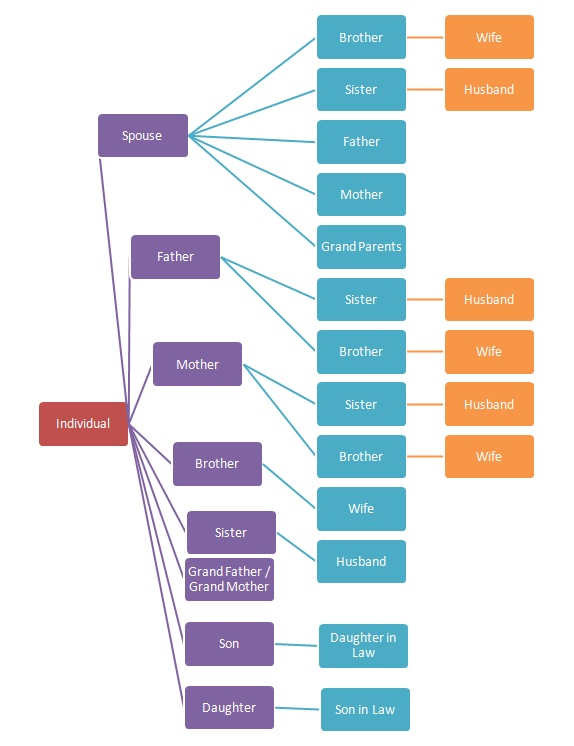

Section 2 41 Definition Of Relative Under Income Tax Act P R S R Co

Section 2 41 Definition Of Relative Under Income Tax Act P R S R Co

Travelling Expenses Tax Deductible Malaysia Paul Springer

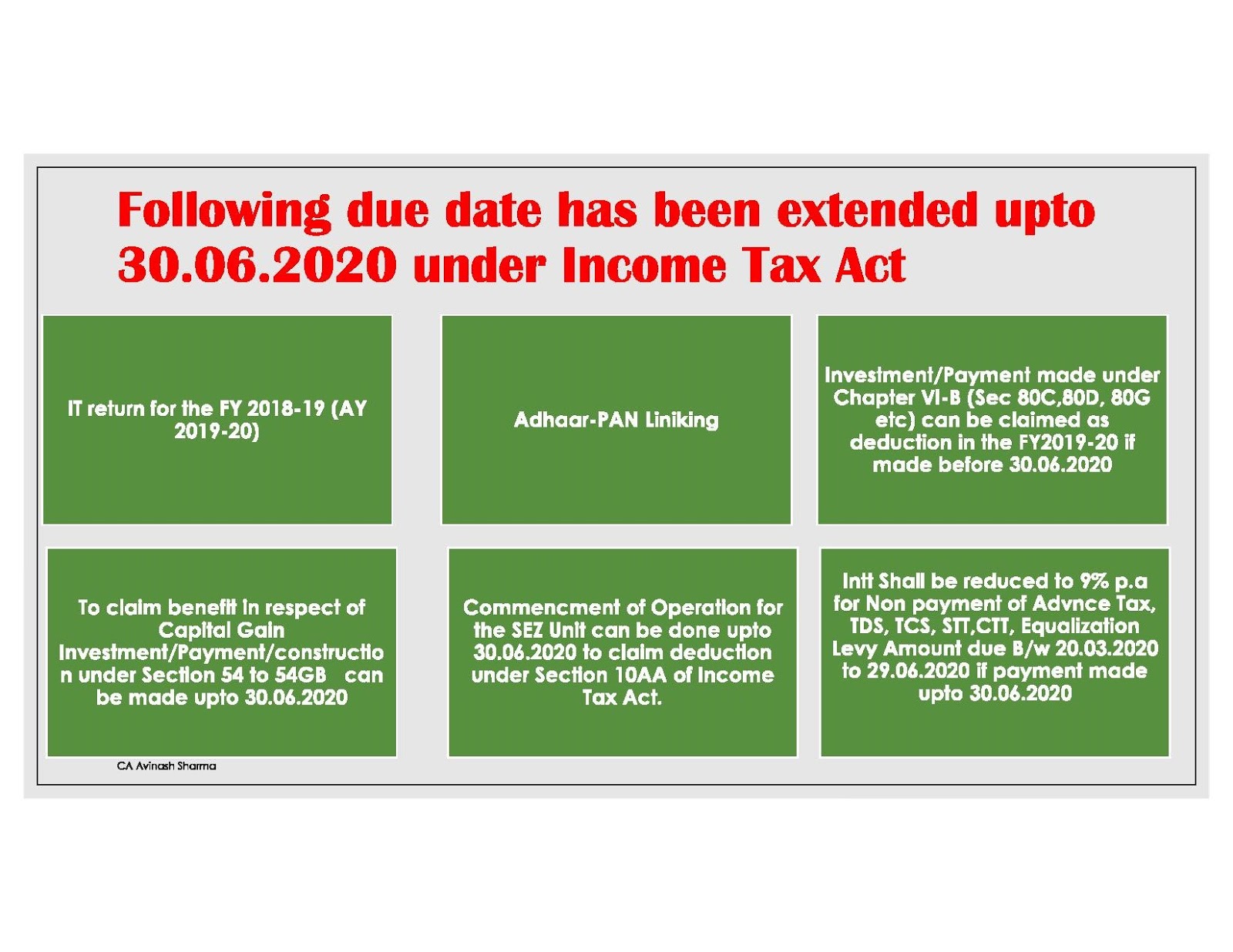

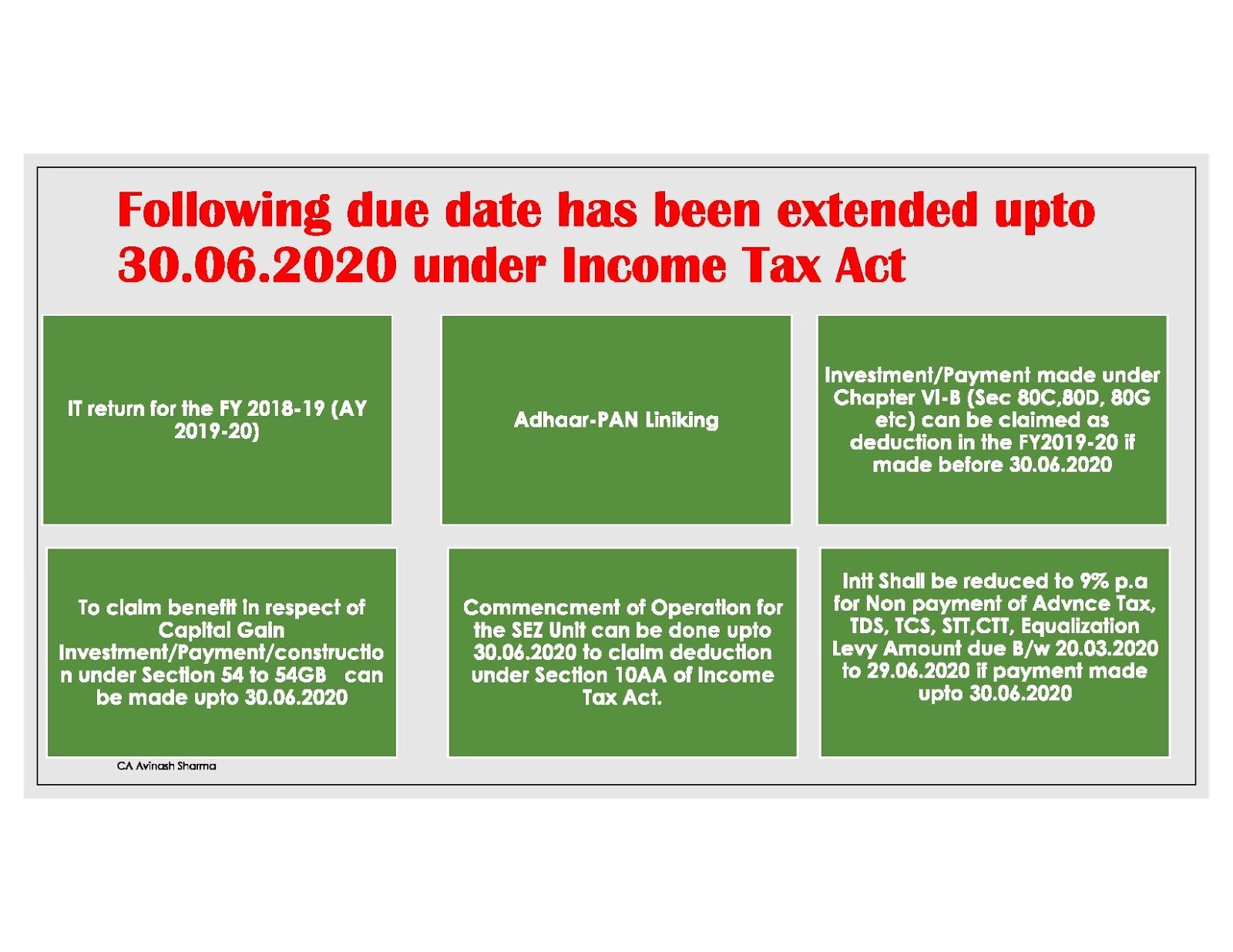

Relief Under Income Tax Act Taxation Ordinance 2020 CA Avinash

Section 4a Income Tax Act KaydenqiLewis

Rebates And Reliefs Under Income Tax Act - Web 3 nov 2022 nbsp 0183 32 Fortunately taxpayers can claim relief on the salaries they receive in the form of arrears or as advance under Section 89 This section comes under Chapter VIII Rebates and Reliefs of the Income Tax Act 1961 A person can claim relief under section 89 if he she receives an arrear of salary in the cases mentioned below Gratuity