Rebates For Heat Pumps 2024 The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Specifically If your household income is less than 80 percent of your state s median household income you are eligible for 100 percent of the rebates available Jan 9 2023 Getting a substantial instant discount would simplify electrification for homeowners and widen its appeal But that means a system must be put in place for a contractor a state energy

Rebates For Heat Pumps 2024

Rebates For Heat Pumps 2024

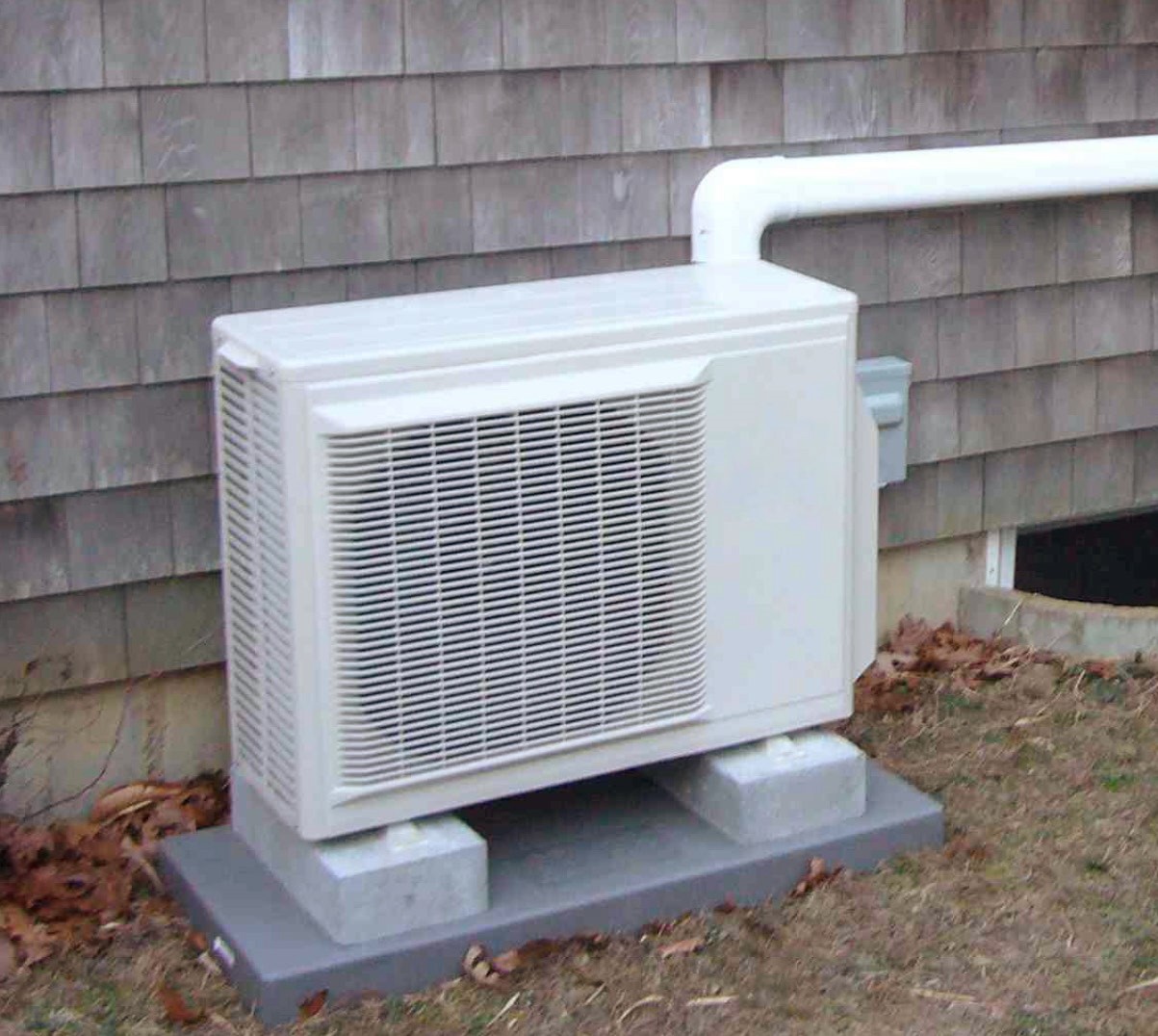

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pumps-rebates-2019-coastal-energy-129.png?w=800&ssl=1

Bosch Heat Pumps Rebates 24 7 Furnace AC Tankless Attic Insulation GTA Rebates Repairs

https://constanthomecomfort.com/wp-content/uploads/2022/10/bosch-hvac.jpg

Federal Rebates For Heat Pumps Save Money And Energy USRebate

https://i0.wp.com/www.usrebate.com/wp-content/uploads/2023/05/Federal-Rebates-For-Heat-Pumps.png?ssl=1

Natural Gas or Electric Propane Oil Heat Pump Other Air Source Heat Pump ASHP Ducted 15 2 SEER2 10 0 EER2 8 1 HSPF2 1 75 COP 5 Ductless 16 0 SEER2 9 0 EER2 9 5 HSPF2 1 75 COP 5 1 000 400 Note Work with your Trade Ally contractor to ensure the equipment you install qualifies for Focus on Energy rebates On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

Smart energy efficient upgrades like installing a heat pump or energy efficient lightbulbs can lower electricity costs For example a smart thermostat could save you 10 percent in annual energy costs Air source heat pumps can lower electricity usage for heating and cooling by nearly 65 percent Tax credits for solar panels and other products What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5

Download Rebates For Heat Pumps 2024

More picture related to Rebates For Heat Pumps 2024

Heat Pumps Rebates BC Enjoy Home Comfort With Up To 15 600 In Rebates Greater Vancouver

https://aireenergy.com/wp-content/uploads/2023/03/heat-pump-rebates-bc.jpg

Heat Pump Rebates Reduced In April JPUD

https://www.jeffpud.org/wp-content/uploads/Heat-Pump-outdoor-1-e1576515407997.jpg

2023 Heat Pump Rebates 24 7 Furnace AC Tankless Attic Insulation GTA Rebates Repairs

https://constanthomecomfort.com/wp-content/uploads/2022/12/Copy-of-How-do-I-find-a-business-idea.jpg

Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 100 free to use 100 online Access the lowest prices from installers near you Unbiased Energy Advisors ready to help Key takeaways All taxpayers are eligible for a federal tax credit worth up to 2 000 on high efficiency heat pumps

Heat pump space heating and cooling incentives When HEEHRA rebates roll out in late 2024 qualified Americans will be able to save up to 8 000 on a heat pump for space heating and cooling For some that covers 100 of the cost of a major appliance which will also save them hundreds of dollars a year in energy costs In 2024 you can claim 30 of the costs for all qualifying HVAC systems installed during the year as tax credits The maximum tax credit amount you can get back is 3 200 year Up to 1 200 for central air conditioners boilers furnaces and natural gas oil and propane water heaters up to 600 per item

Rebates On Heat Pumps Dave S World PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/rebates-on-heat-pumps-dave-s-world-43.jpg?w=2100&ssl=1

Nova Scotia Power Rebates On Heat Pumps PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pump-rebates-atmosphere-climate-control-specialists-71.png

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

https://www.consumerreports.org/appliances/heat-pumps/heat-pump-federal-tax-credits-and-state-rebates-a5223992000/

Specifically If your household income is less than 80 percent of your state s median household income you are eligible for 100 percent of the rebates available

Heat Pump Rebates Grants Greener Homes Grant Energy Advisor HomeStep ca Vancouver

Rebates On Heat Pumps Dave S World PumpRebate

Dominion Power Rebates On Heat Pumps

Heat Pump Incentives Orange Rockland

Save With Heat Pump Rebates Heatpumps ca

Federal Rebates For Heat Pumps HERETAB

Federal Rebates For Heat Pumps HERETAB

Eversource Rebates Heat Pumps PumpRebate

Heat Pump Rebates Mass Save Mass Save Rebate

Inflation Reduction Act Summary What It Means For New HVAC Systems

Rebates For Heat Pumps 2024 - Smart energy efficient upgrades like installing a heat pump or energy efficient lightbulbs can lower electricity costs For example a smart thermostat could save you 10 percent in annual energy costs Air source heat pumps can lower electricity usage for heating and cooling by nearly 65 percent Tax credits for solar panels and other products