Rebates On Home Energy Improvements Web 31 juil 2023 nbsp 0183 32 The energy efficient home improvement credit previously known as the nonbusiness energy property credit can help offset the cost of qualifying home energy

Web The flagship home energy discount included in the IRA is the residential clean energy credit which offers homeowners 30 off the cost of new qualified clean energy Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Rebates On Home Energy Improvements

Rebates On Home Energy Improvements

https://i.pinimg.com/originals/66/08/13/66081313f05ef6ca955ec4b293a85d58.png

PGW Offering Rebates For Home Energy Improvements CBS Philadelphia

https://assets2.cbsnewsstatic.com/hub/i/r/2014/04/02/ac53eb8e-1ec2-453b-8d1d-44d08149ef57/thumbnail/1200x630/c8a6a5958d047f1067dfa7fa1a57b1b5/pgw-auditphoto.jpg?v=b9ad248140817530b57bedd1355bcccb

Ct Rebates For Energy Efficient New Homes Renovations

https://activerain.com/image_store/uploads/agents/davidpopoffct/files/CTrebates.png

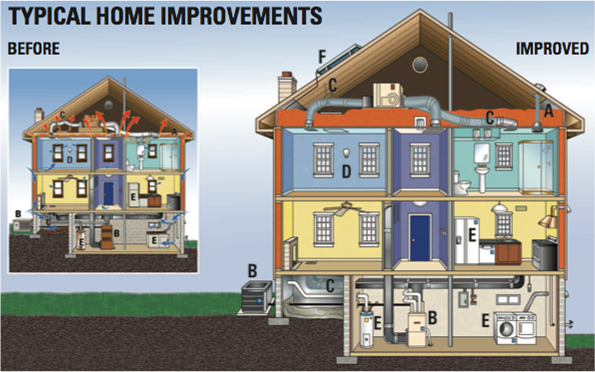

Web 26 juil 2023 nbsp 0183 32 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

Web 3 f 233 vr 2023 nbsp 0183 32 1 Go Renewable One of the best ways to save money on electricity is by generating your own Under the Inflation Reduction Act you can get a tax credit for 30 Web Home Efficiency Rebates will award grants to State energy offices to provide rebates that discount the price of energy saving retrofits in single family and multi family buildings

Download Rebates On Home Energy Improvements

More picture related to Rebates On Home Energy Improvements

New Rebates For Home Energy Ontario Energy Werx Windsor

http://windsor.energywerx.ca/wp-content/uploads/sites/8/2022/01/Enhanced-Ontario-Rebates-for-Home-Energy-Improvements-Energy-Werx-Windsor.jpg

Opportunity For Home Rebates Homes Of Silvercrest Vancouver

https://homesofsilvercrest.com/vancouver/wp-content/uploads/sites/9/2019/01/Energy-Rebates.jpg

Home Efficiency Rebate Get Up To 5 000 Back On Energy saving Home

https://i.pinimg.com/originals/f1/f0/4a/f1f04af5dbd6555037e4aade64380391.png

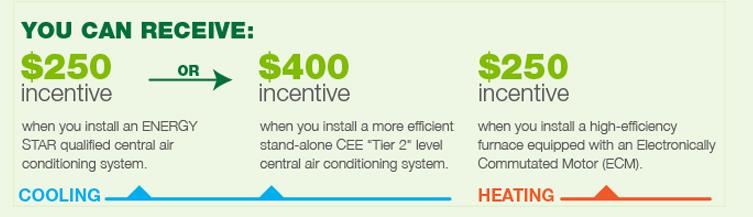

Web 9 mai 2016 nbsp 0183 32 Homeowners can receive up to a total of 500 in tax credit for installation of qualifying elements such as central air conditioning roofs and windows Even better if you re overhauling your home s energy source Web 9 I M A CONTRACTOR INTERESTED IN DELIVERING HOME ENERGY REBATES TO CUSTOMERS HOW CAN I PREPARE FOR THESE PROGRAMS 10 HOW WILL

Web Les 5 8 millions de foyers b 233 n 233 ficiaires du ch 232 que 233 nergie envoy 233 en mars et avril vont avoir droit 224 une prime de 100 suppl 233 mentaires en d 233 cembre L objectif Web 19 ao 251 t 2022 nbsp 0183 32 The IRA s 4 28 billion High Efficiency Electric Home Rebate Program will provide an upfront rebate of up to 8 000 to install heat pumps that can both heat and

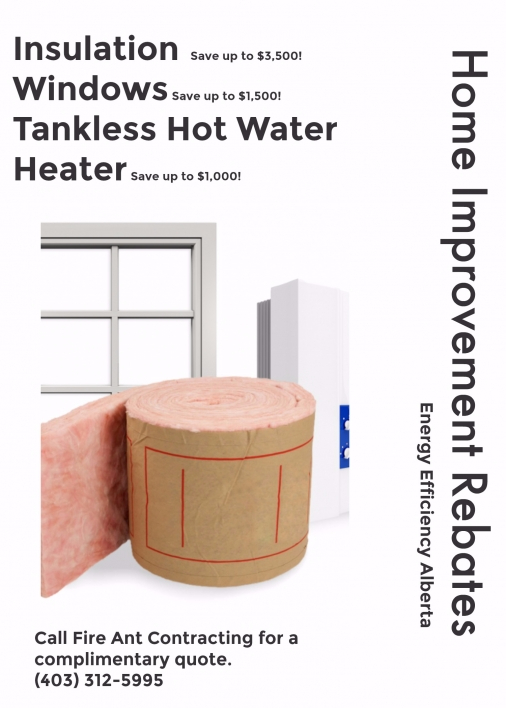

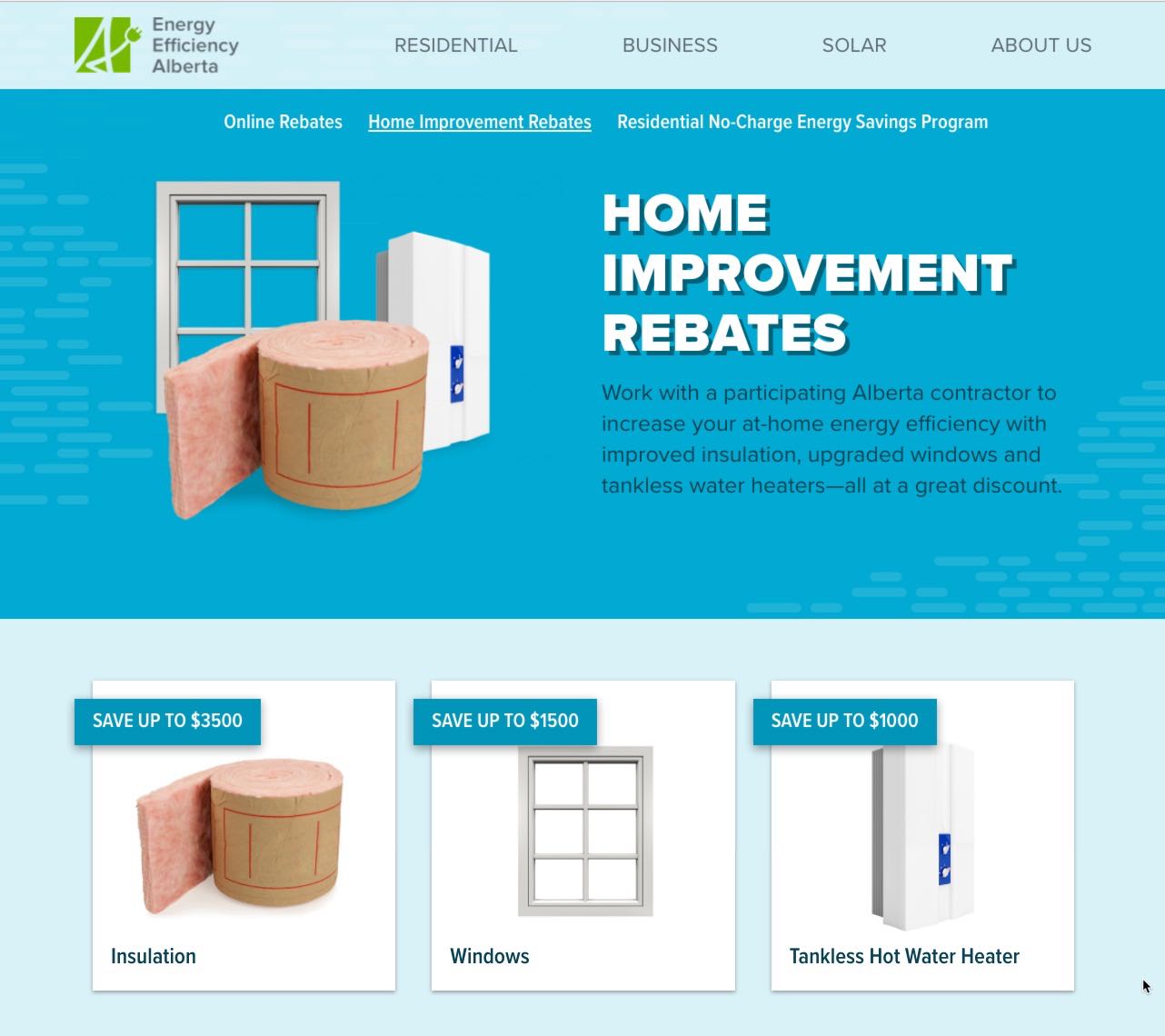

Home Improvement Rebate Program Fire Ant Contracting

https://fireantcontracting.com/uploads/Home_Improvement_Rebates.jpg

Energy Efficiency Rebates Green Energy Futures

https://www.greenenergyfutures.ca/wp-content/uploads/2017/10/Solar-10111-ee-rebates.jpg

https://www.cnet.com/home/energy-and-utilities/save-on-your-next-home...

Web 31 juil 2023 nbsp 0183 32 The energy efficient home improvement credit previously known as the nonbusiness energy property credit can help offset the cost of qualifying home energy

https://www.cnet.com/home/energy-and-utilities/how-to-get-tax-credits...

Web The flagship home energy discount included in the IRA is the residential clean energy credit which offers homeowners 30 off the cost of new qualified clean energy

Many Power Companies Offer Rebates On Energy saving Products We Can

Home Improvement Rebate Program Fire Ant Contracting

Top 5 Home Renovation Rebates And Tax Credits For 2020 Renco

Make Utility Rebates Part Of Your Energy Improvement Efforts Hillphoenix

Fromtheeditr Rebates For Energy Efficient Replacements Here s How

Progress Energy Rebates All About Energy

Progress Energy Rebates All About Energy

Energy Efficiency Rebates And Incentives Carolina Home Performance Inc

Energy Improvement Rebate Program Tangletown Neighborhood Association

Energy Improvement Rebates Phoenix Energy Audit Company APS Rebate

Rebates On Home Energy Improvements - Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat