Rebates On New Energy Efficient Hvac Units Business Web 1 janv 2023 nbsp 0183 32 Business Use of Home If you use a property solely for business purposes you can t claim the credit If you use your home partly for business the credit for eligible

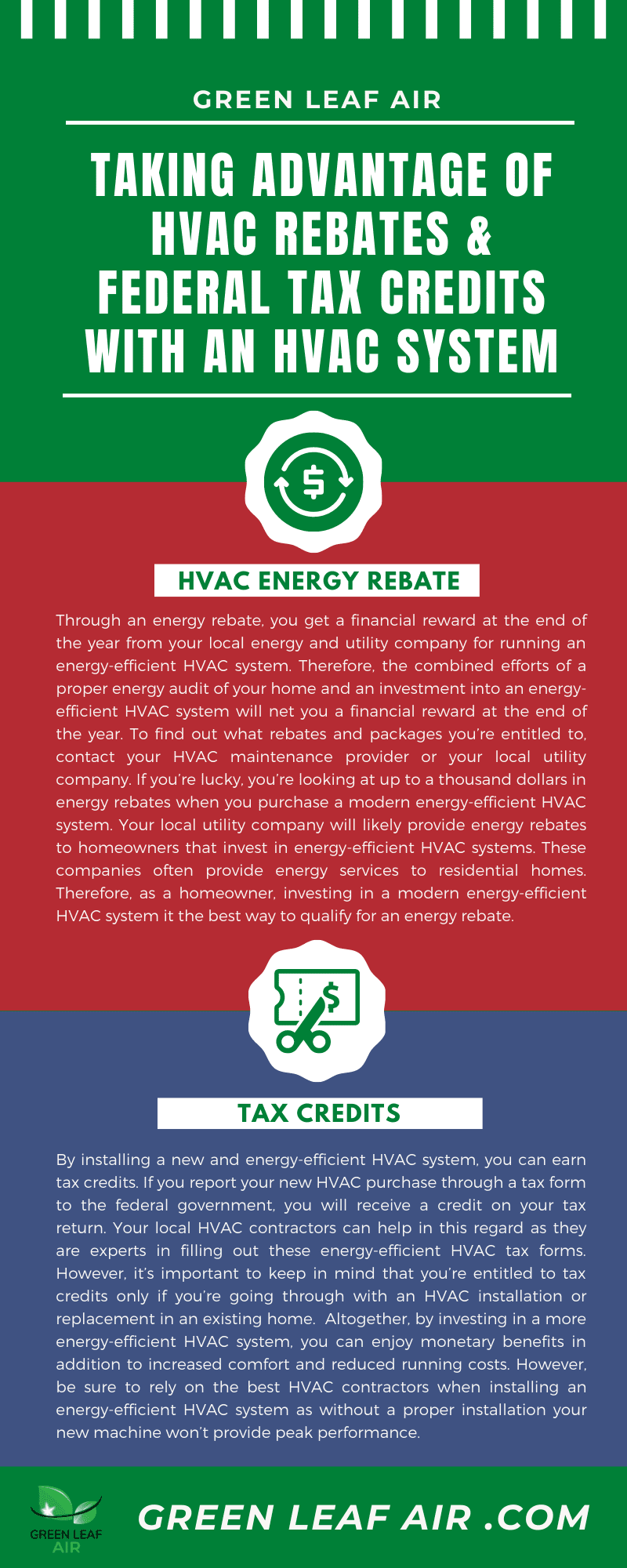

Web 13 avr 2023 nbsp 0183 32 The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including Web Make your HVAC system smarter with one of our top 3 rebates Variable frequency drives VFD for HVAC fans 80 hp Upgrade your existing HVAC supply return or exhaust air

Rebates On New Energy Efficient Hvac Units Business

Rebates On New Energy Efficient Hvac Units Business

https://149354076.v2.pressablecdn.com/wp-content/uploads/2020/10/Taking-Advantage-of-HVAC-Rebates-and-Federal-Tax-Credits-with-An-HVAC-System.png

New LADWP Program Offers 225 Rebate On Energy efficient AC Units For

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA11V2WX.img?h=630&w=1200&m=6&q=60&o=t&l=f&f=jpg

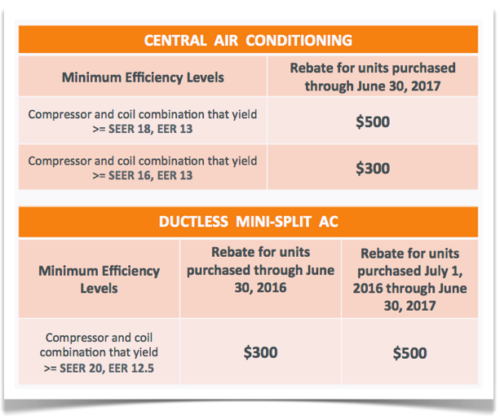

Air Conditioning Rebates Incentives Energy Efficiency Pays Energy

https://i.pinimg.com/originals/53/42/8a/53428a305298441650d9644746fc415b.png

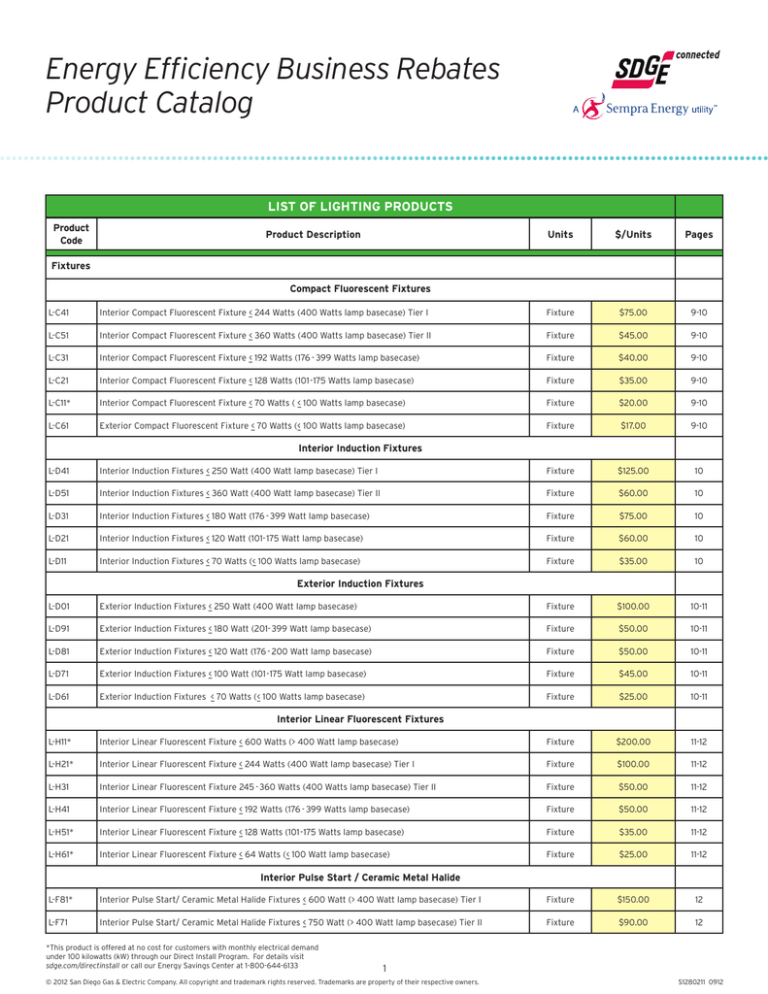

Web 2 ao 251 t 2016 nbsp 0183 32 Rebates Once you have upgraded to new eligible energy efficient products PG amp E will give you money Rebates are a fast easy way to get cash back for your Web Partial deductions of up to 60 per square foot can be taken for measures affecting the building envelope lighting or heating and cooling systems For more information see

Web 15 ao 251 t 2023 nbsp 0183 32 Government Rebates for Air Conditioning and Heating Explore new federal energy guidelines for 2023 and learn about HVAC rebates and energy efficient incentive program aimed toward Web Earn Cash for Improving Your Heating and Cooling Get rebates on eligible furnaces air conditioners heat pumps and thermostats You can also get a rebate for tuning up a

Download Rebates On New Energy Efficient Hvac Units Business

More picture related to Rebates On New Energy Efficient Hvac Units Business

Energy Efficiency Blog M E Flow

https://www.meflow.com/cms/thumbnails/34/534x450/images/blog/arlington-rebates-hvac.2305201208550.jpg

High Efficiency Air Conditioning New Jersey Rebates Skylands Energy

https://www.skylandsenergy.com/wp-content/uploads/2017/04/Rebates-table-2017-500x420.png

Energy Star Rebates Save Money On Energy Efficient Upgrades USRebate

https://i0.wp.com/www.usrebate.com/wp-content/uploads/2023/05/Energy-Star-Rebates.png?ssl=1

Web August 3 2023 DOE puso en marcha un nuevo sistema de fondos para que funcionarios estatales en el 225 rea de energ 237 a dise 241 en e implementen dos nuevos programas de Web This is NOT a separate rebate just an additional amount Rebate amount decreased for Spring 2022 SEER efficiency requirements for rebate tier decreased for Spring 2022

Web 3 janv 2023 nbsp 0183 32 The Inflation Reduction Act s Energy Efficient Home Improvement Tax Credit 25C is Making HVAC More Affordable The inflation Reduction Act IRA includes tax Web If you purchase energy efficient HVAC equipment you may qualify for the nonbusiness energy property credit which has been extended through the end of 2021 To qualify for

Duke Energy HVAC Rebates Logan A C Heat Services

https://www.logan-inc.com/sites/default/files/duke_rebates.jpg

Energy Efficiency Business Rebates Product Catalog

https://sb.studylib.net/store/data/018484568_1-5ce06bb84531b23e5a3b2404f77761f8-768x994.png

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 Business Use of Home If you use a property solely for business purposes you can t claim the credit If you use your home partly for business the credit for eligible

https://todayshomeowner.com/hvac/guides/hvac-tax-credit

Web 13 avr 2023 nbsp 0183 32 The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including

Florida Energy Rebates For Air Conditioners Florida Hvac Rebates

Duke Energy HVAC Rebates Logan A C Heat Services

Rebates For Energy efficient Appliances Available In Massachusetts

Florida Power Light Ends Most Energy Efficiency Rebates Miami Urban

Energy Efficient HVAC Guidelines To Choosing A New System

Tax Rebate On Energy Efficient Air Conditioners AirRebate

Tax Rebate On Energy Efficient Air Conditioners AirRebate

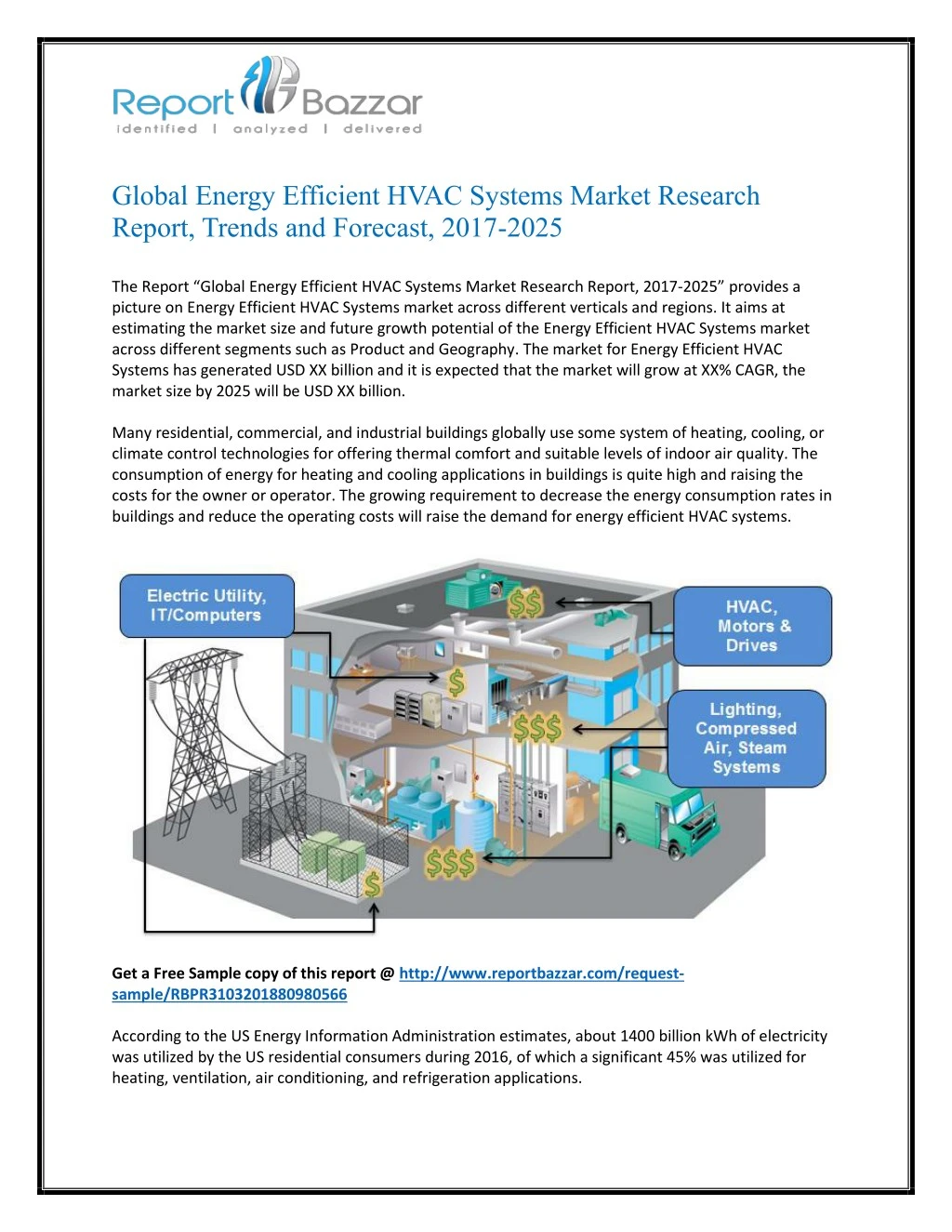

PPT Energy Efficient Hvac Systems Market Forecast To 2025 Dynamics

Energy Star Air Conditioner Rebates 4 Star Energy Rated Air

Pin On Places To Visit

Rebates On New Energy Efficient Hvac Units Business - Web Partial deductions of up to 60 per square foot can be taken for measures affecting the building envelope lighting or heating and cooling systems For more information see