Record Car Rebate Quickbooks Web 25 ao 251 t 2021 nbsp 0183 32 I ve got the steps that you need in recording your sales rebate in QuickBooks Online You can create a refund for the rebate amount since this was given

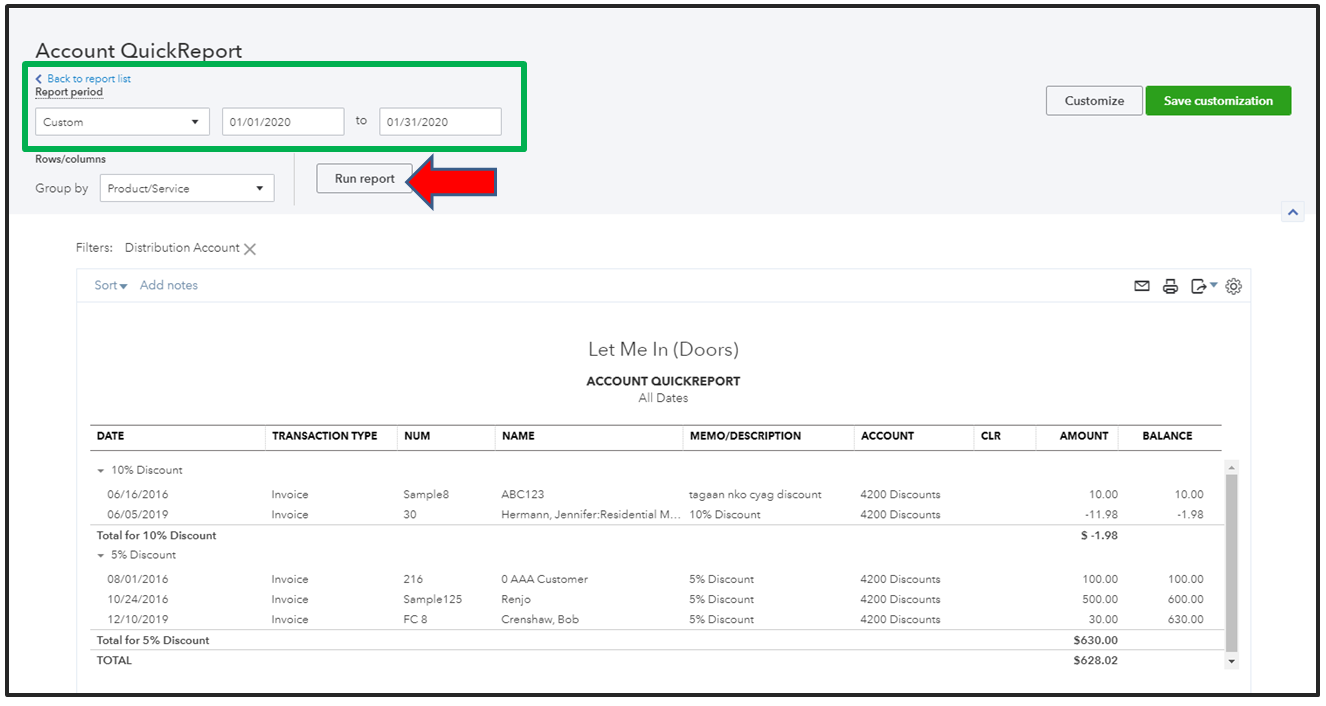

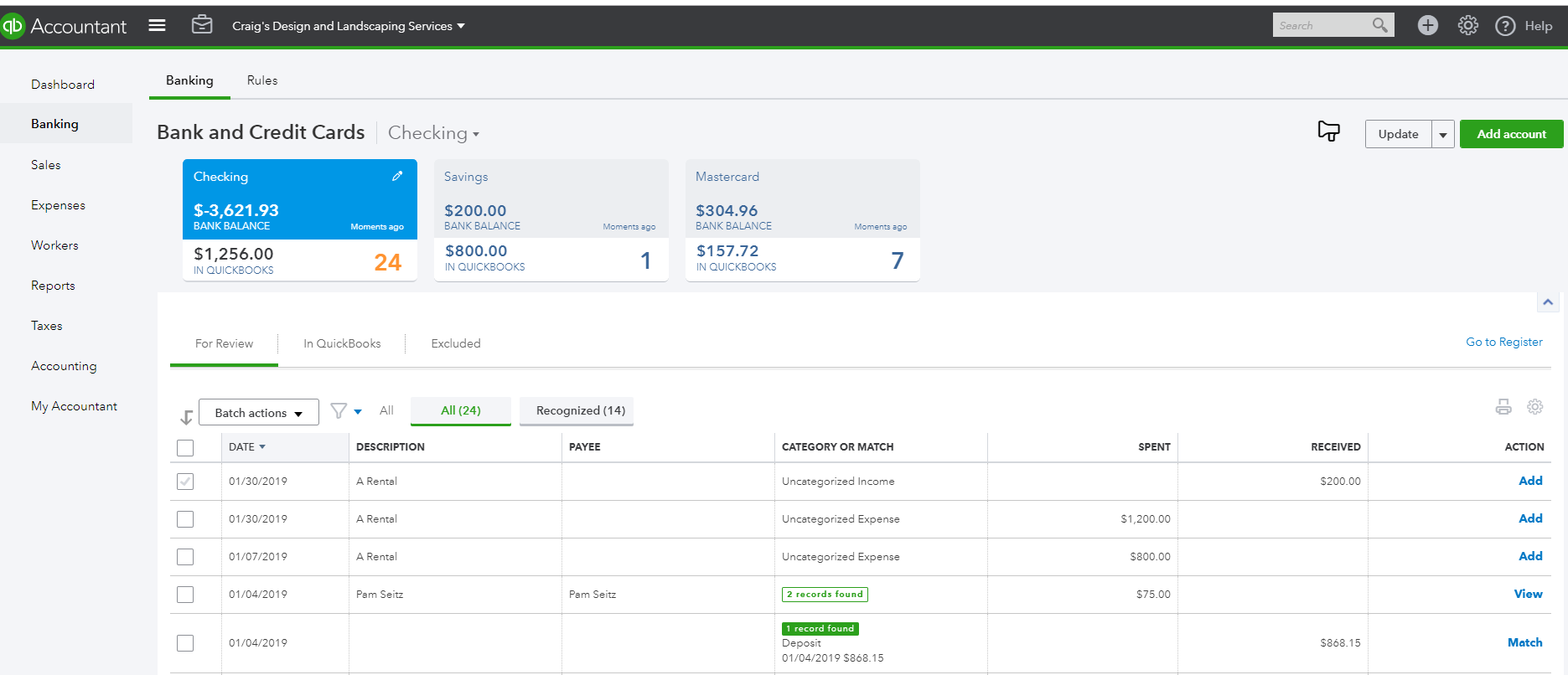

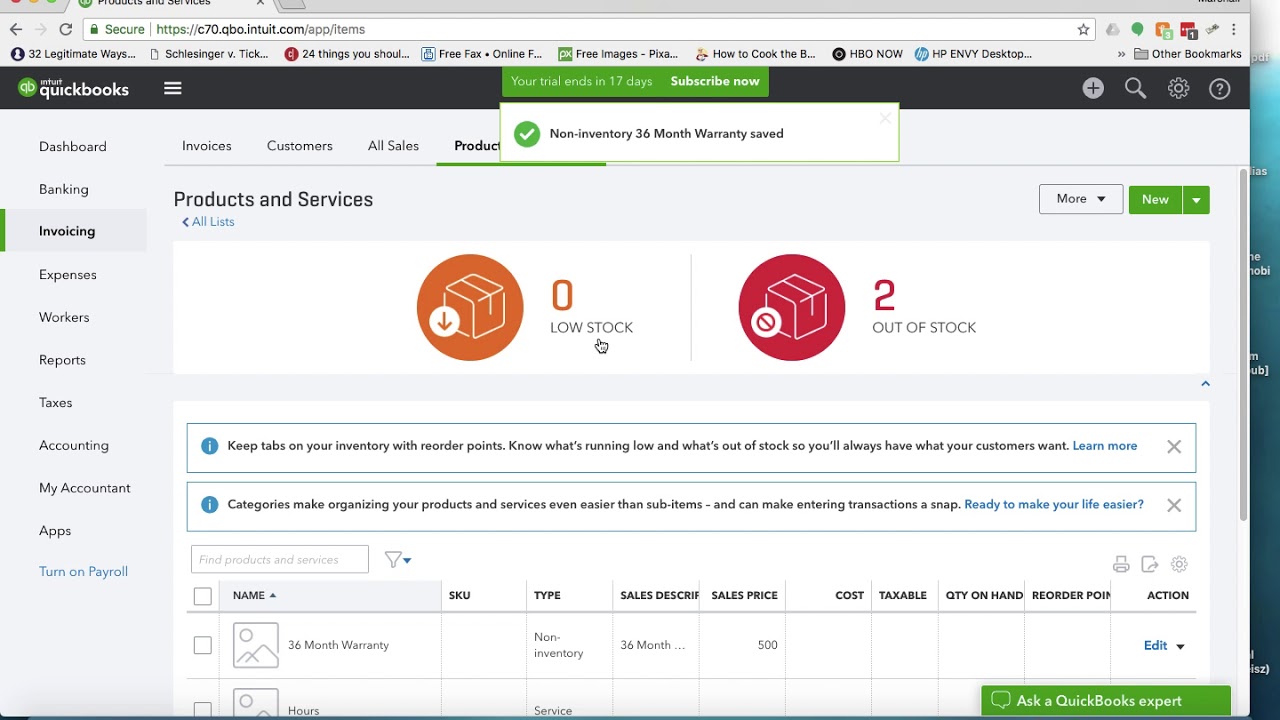

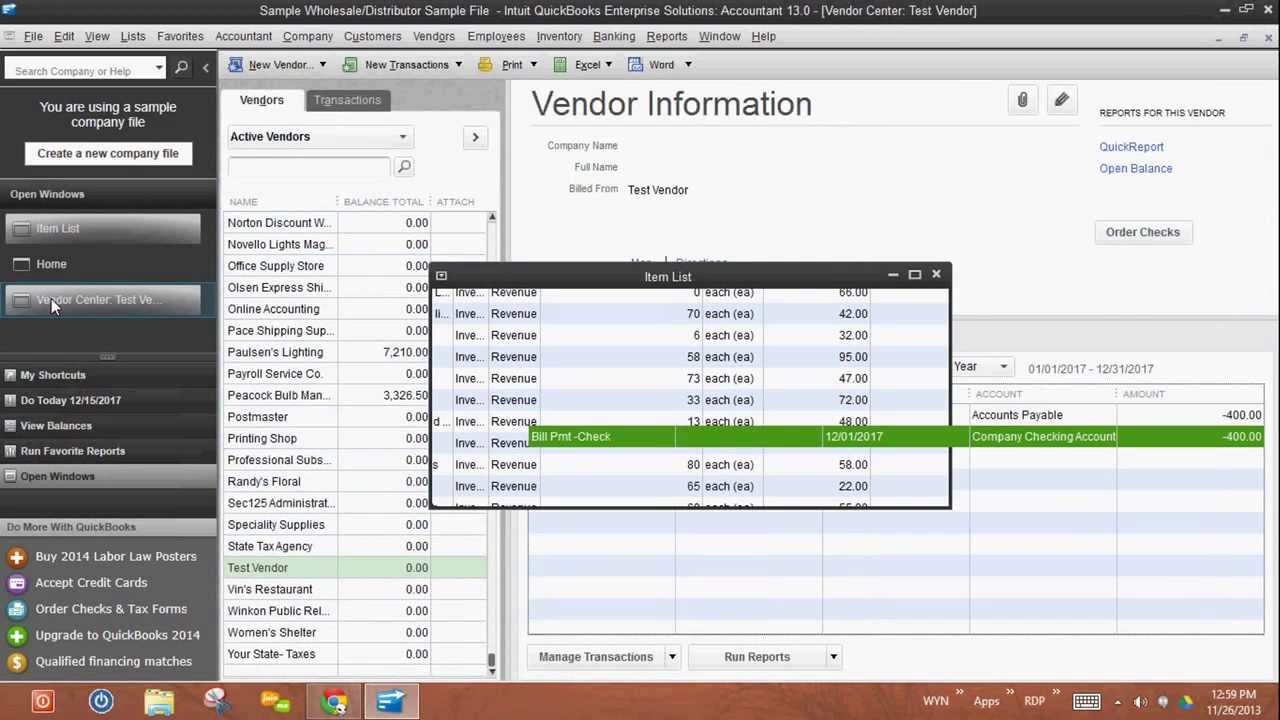

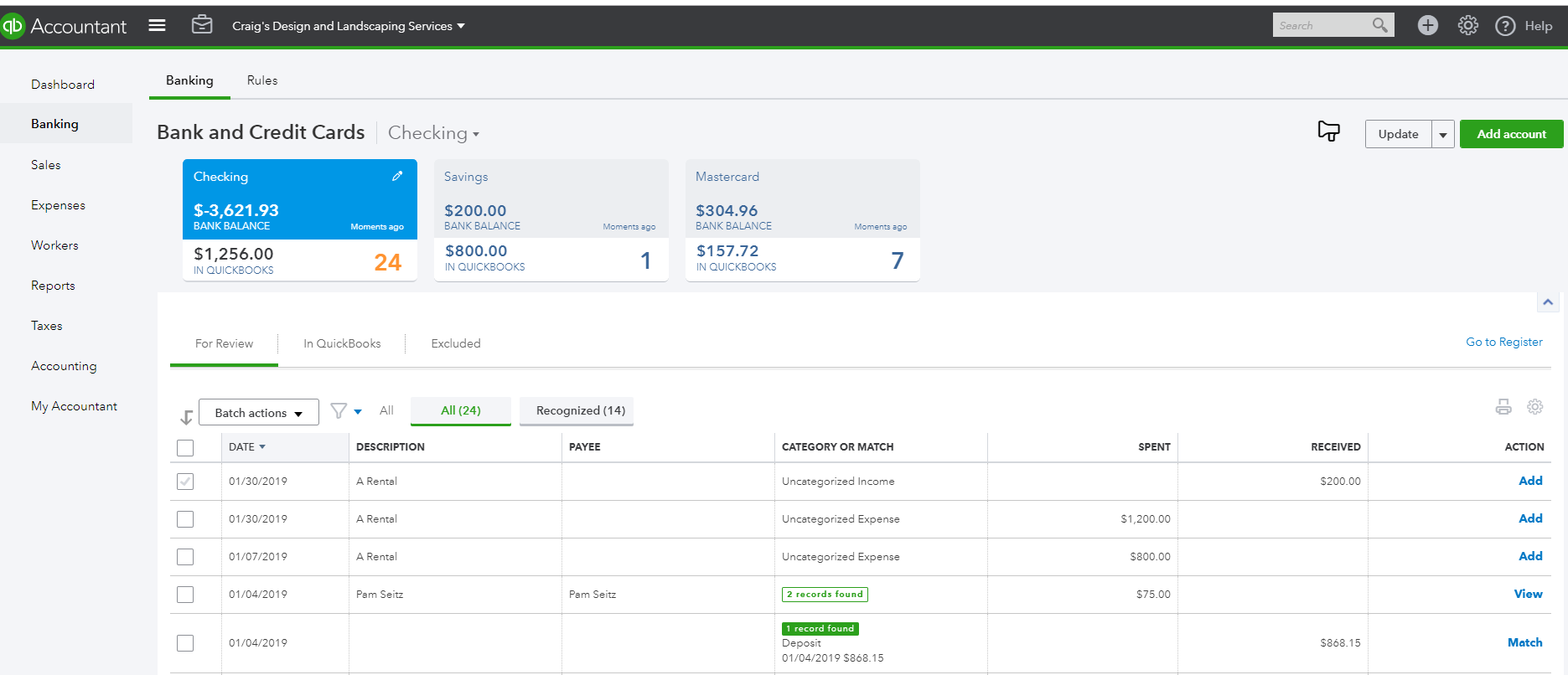

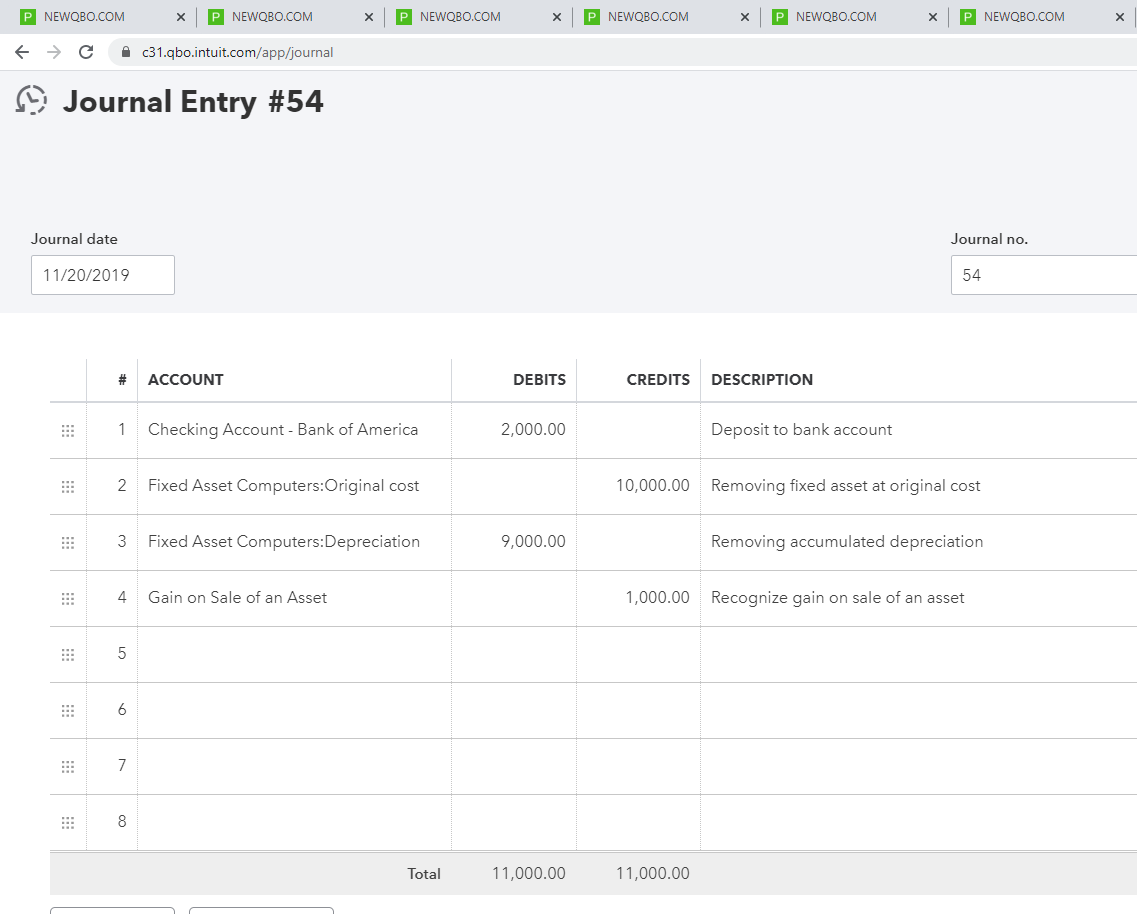

Web The rebate on the purchase of an automobile should be recorded as a reduction of the automobile s cost The lower automobile cost will result in lower depreciation expense Web To handle and record customer rebates in your QuickBooks business software you must create a dedicated income account to record rebates and a charge item for each rebate

Record Car Rebate Quickbooks

Record Car Rebate Quickbooks

https://i.ytimg.com/vi/AUysskdpP8E/maxresdefault.jpg

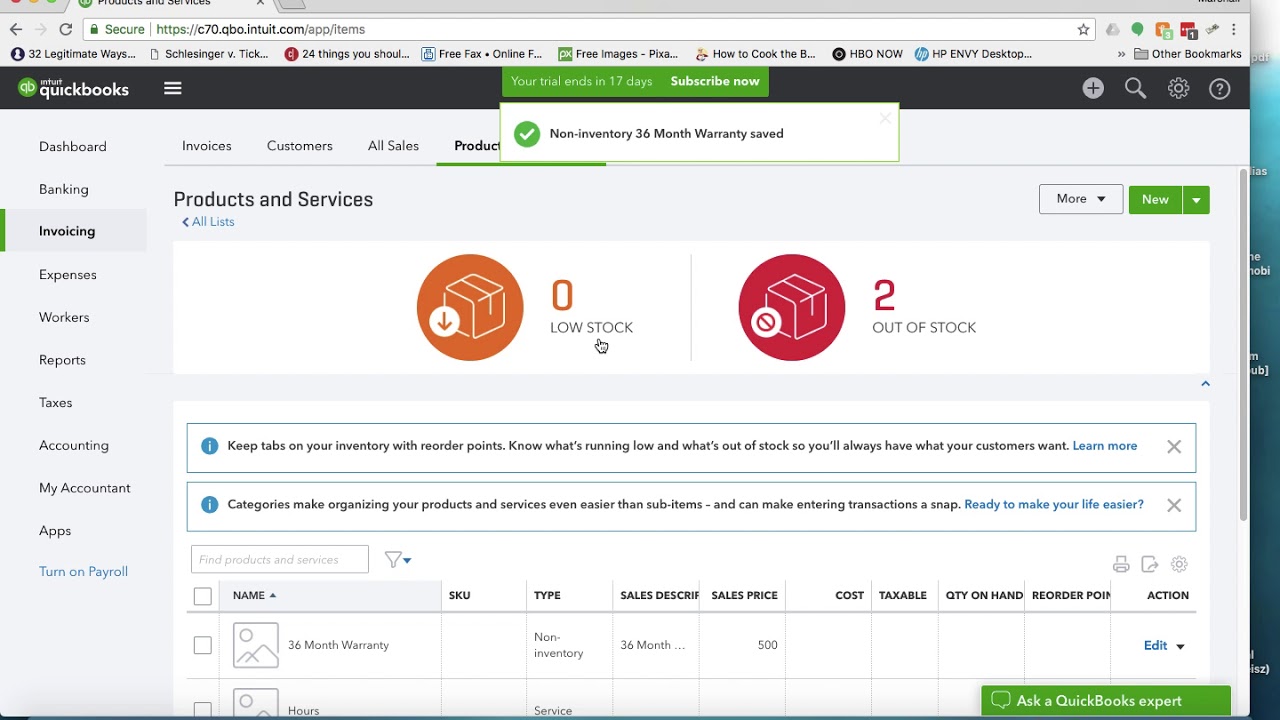

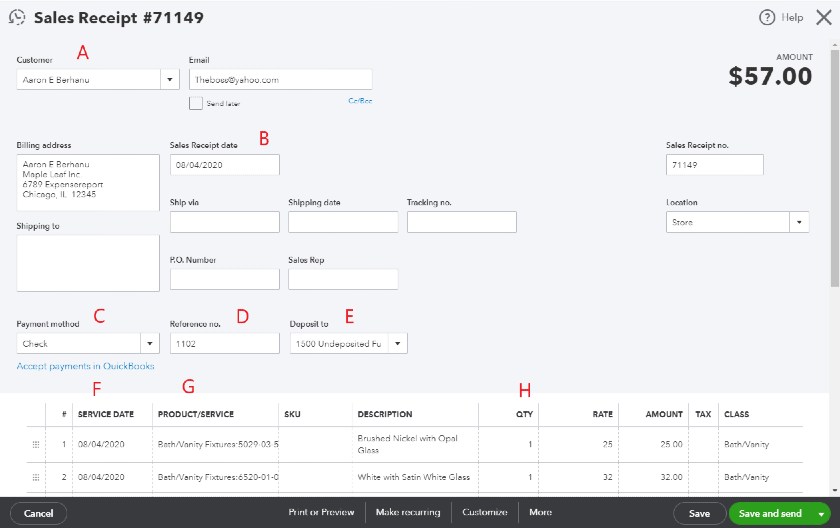

Quickbooks Pro 2008 Used Car Sales Receipt Hohpaafro

https://fitsmallbusiness.com/wp-content/uploads/2020/09/Screenshot_Creating_sales_receipt_form_in_QuickBooks_Online.jpg

Quickbooks Pro 2008 Used Car Sales Receipt Lasopamama

https://assets.lessenmytaxes.com/img/page-images/quickbooks/425.jpg

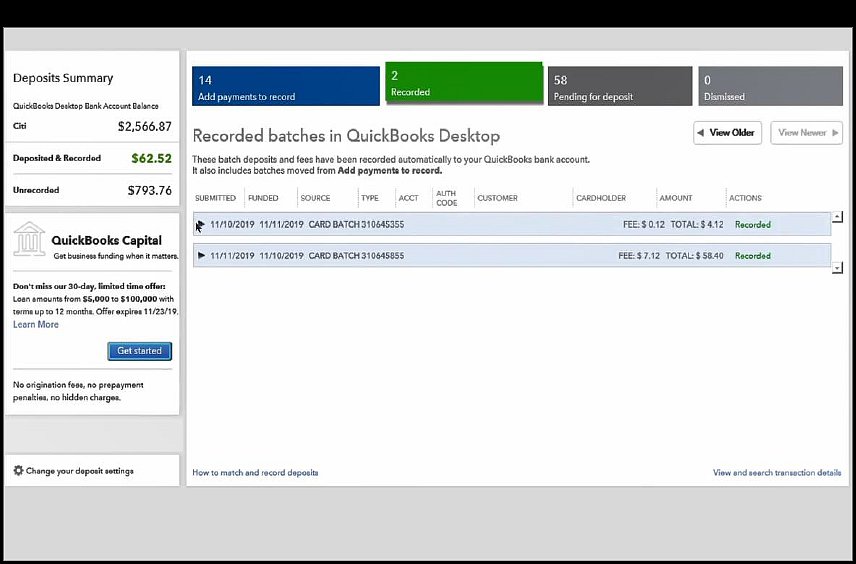

Web If you receive a vendor rebate certificate in QuickBooks you may wonder how to record it in your accounting This article explains the steps to create a vendor credit and apply it to Web 31 oct 2019 nbsp 0183 32 Level 1 posted October 31 2019 07 48 PM last updated October 31 2019 4 48 PM HST Rebate how to record in Quick Books Hello How do I show HST rebate

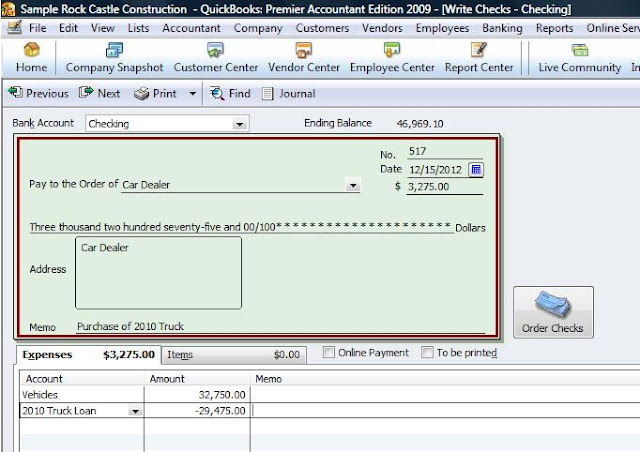

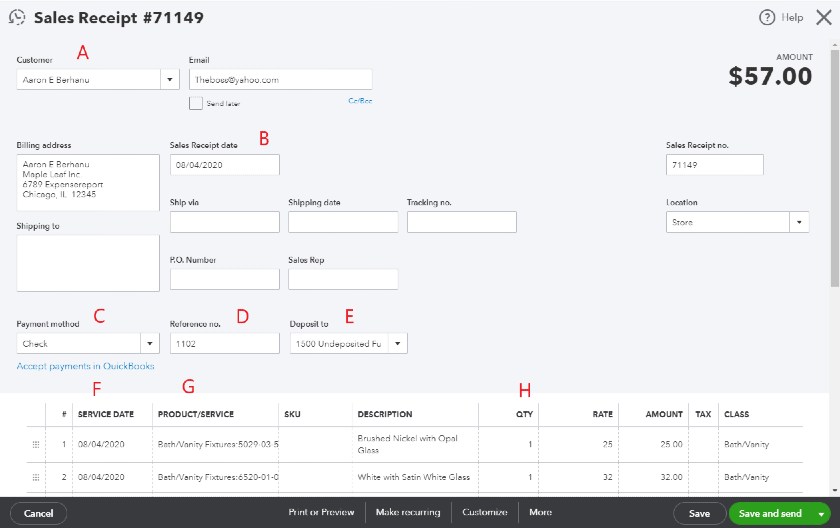

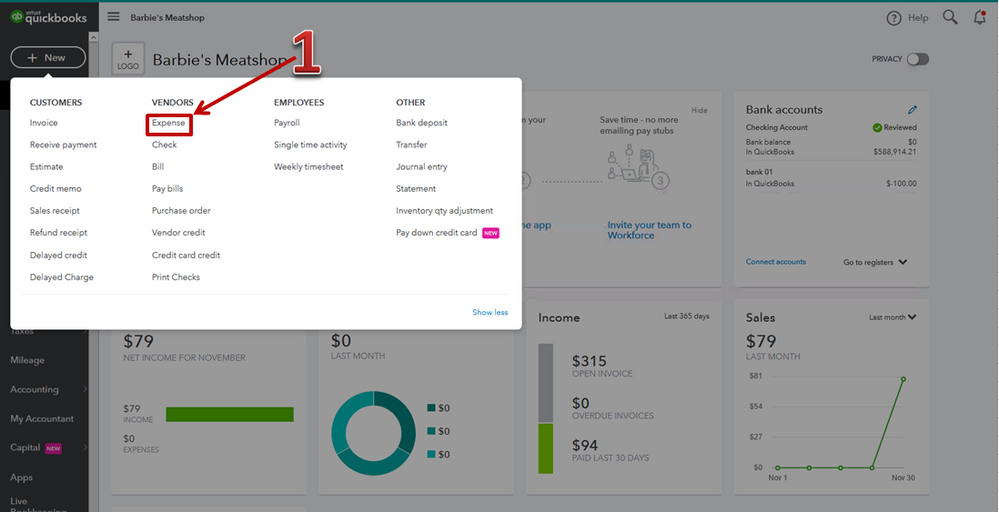

Web Select the customer who ll be receiving the rebate Click the Item drop down then select the rebate item you ve created Enter the amount Click the Edit menu then select Mark Web How do i record a vehicle purchase with a down payment and a manufacturer rebate this issue or error code is a known issue in Quickbooks Online QBO and or Quickbooks

Download Record Car Rebate Quickbooks

More picture related to Record Car Rebate Quickbooks

How To Categorize Car Payment In Quickbooks Info Loans

https://attachments.developer.intuit.com/appcard-e1c90d7a-5e86-4bb0-804f-22863a26f8d4.png

How To Enter A Rebate From A Vendor In Quickbooks PEYNAMT

https://quickbooks.intuit.com/learn-support/image/serverpage/image-id/35929i5AC83FC0BBCC0196?v=1.0

How To Categorize Car Payment In Quickbooks Info Loans

https://s3.amazonaws.com/cdn.freshdesk.com/data/helpdesk/attachments/production/14064241484/original/zgv-hDYq9eimLh1SHXymScYy2NepFmgeDg.png?1586269795

Web 12 d 233 c 2018 nbsp 0183 32 There are multiple ways to record your vehicle expense One way is to record the expense by creating a check Let me guide you how Click on the Plus Web Do you need to record the sale of a vehicle that you still owe money on Learn how to handle this situation in QuickBooks with this helpful article You ll find step by step

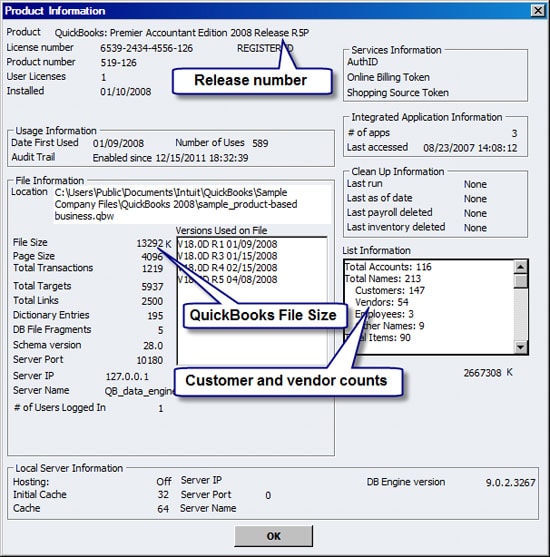

Web How to Record Vendor Rebates in QuickBooks Companies or users can register their vendor rebates in QuickBooks via the account option Here is a detailed step by step Web 2 juil 2014 nbsp 0183 32 Credit card reward points is akin to a refund or rebate of the finance charges paid on the card As such reward points reduces the effective interest rate and can be

How To Categorize Car Payment In Quickbooks Info Loans

https://lendahandaccounting.com/wp-content/uploads/2019/09/Bank-Feed_1.png

Ask Your Bookkeeper My Business Bought A Vehicle And We Have A Loan

http://1.bp.blogspot.com/_oeReCIaDyAY/S1TqMQ1VLXI/AAAAAAAAAMk/IQT5LB_gXUg/s640/check+to+buy+vehicle.jpg

https://quickbooks.intuit.com/learn-support/en-us/other-questions/how...

Web 25 ao 251 t 2021 nbsp 0183 32 I ve got the steps that you need in recording your sales rebate in QuickBooks Online You can create a refund for the rebate amount since this was given

https://www.accountingcoach.com/blog/automobile-rebate-accounting

Web The rebate on the purchase of an automobile should be recorded as a reduction of the automobile s cost The lower automobile cost will result in lower depreciation expense

How To Enter A Rebate From A Vendor In Quickbooks PEYNAMT

How To Categorize Car Payment In Quickbooks Info Loans

How To Categorize Car Payment In Quickbooks Info Loans

How Do I Record A Fully owned Company Delivery Vehicle That Has Been

Quickbooks Recording A New Fixed Asset YouTube

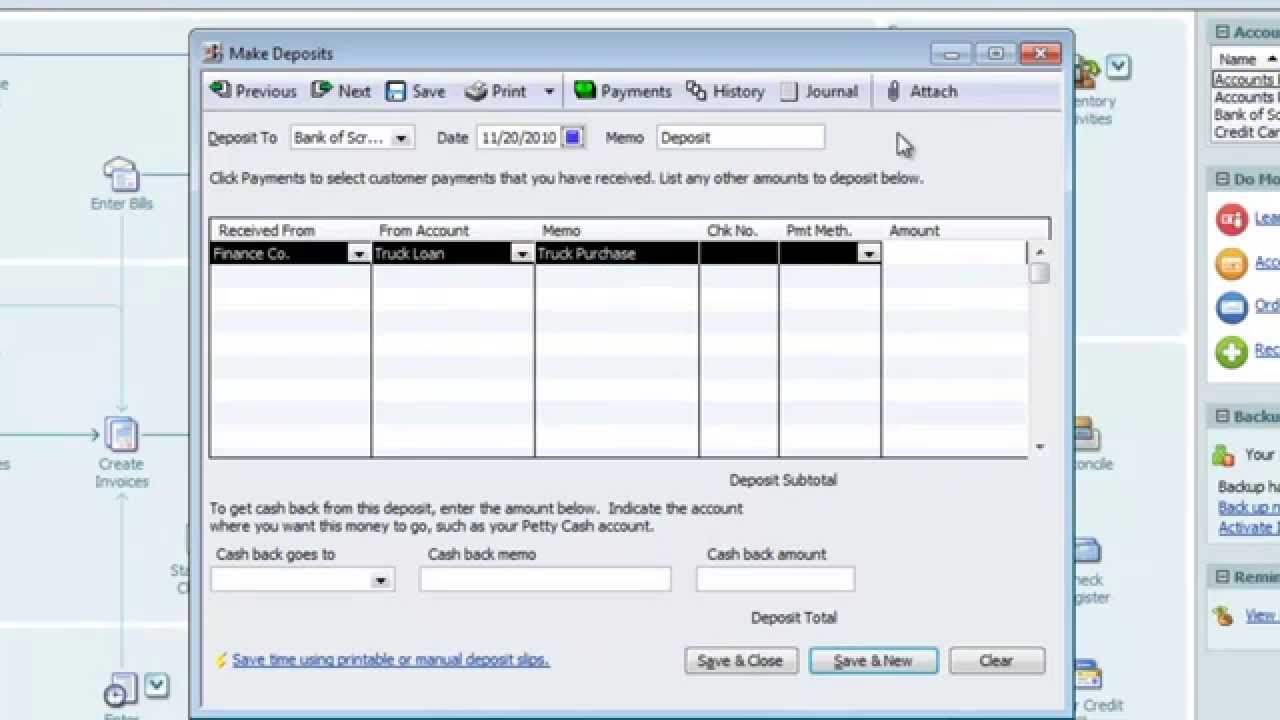

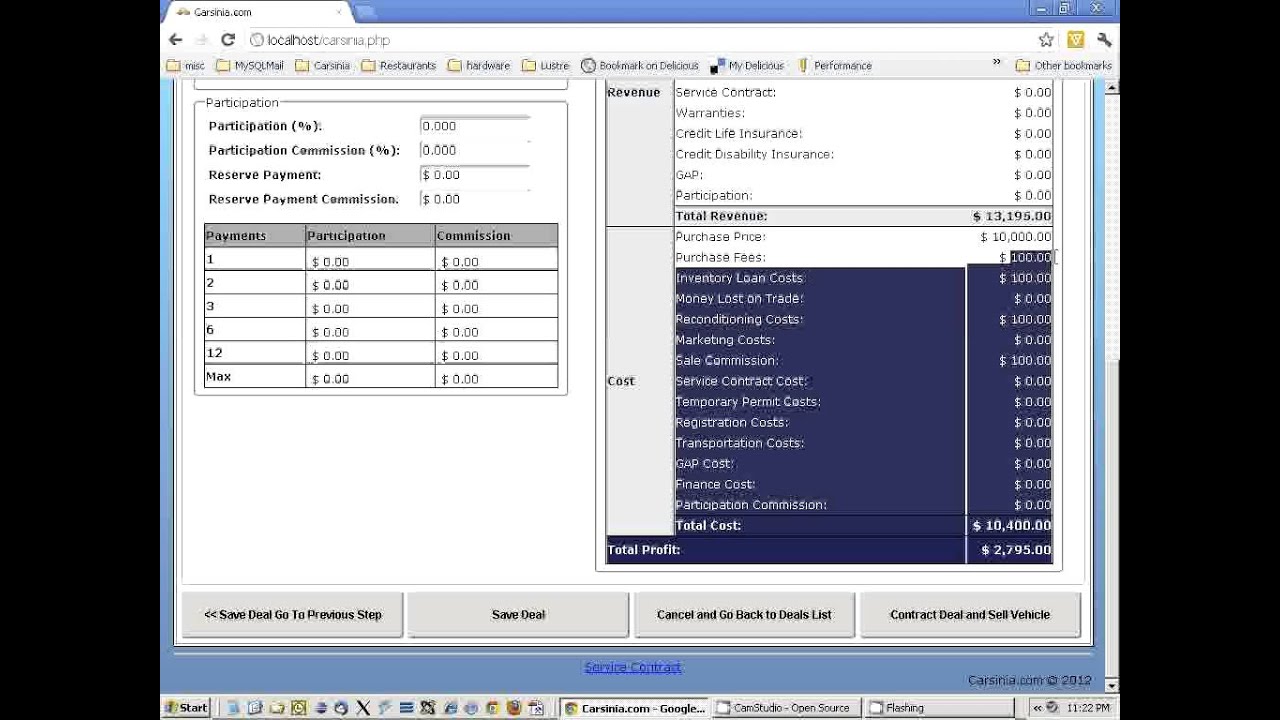

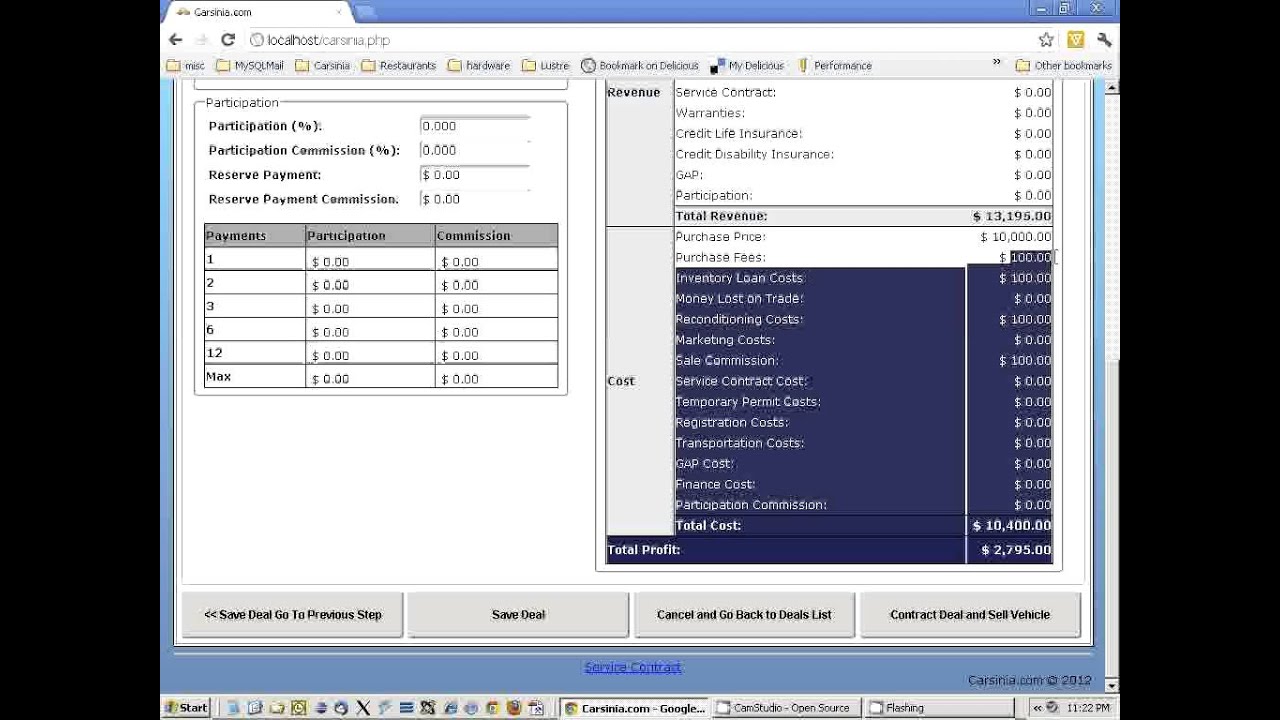

Web Based Car Dealer Accounting Software Quickbooks Integration YouTube

Web Based Car Dealer Accounting Software Quickbooks Integration YouTube

How To Enter A Rebate From A Vendor In Quickbooks PEYNAMT

QuickBooks 22 Recording Transactions 9 Of 10 YouTube

How To Record A Credit Card Refund In QuickBooks Online Scribe

Record Car Rebate Quickbooks - Web 31 oct 2019 nbsp 0183 32 Level 1 posted October 31 2019 07 48 PM last updated October 31 2019 4 48 PM HST Rebate how to record in Quick Books Hello How do I show HST rebate