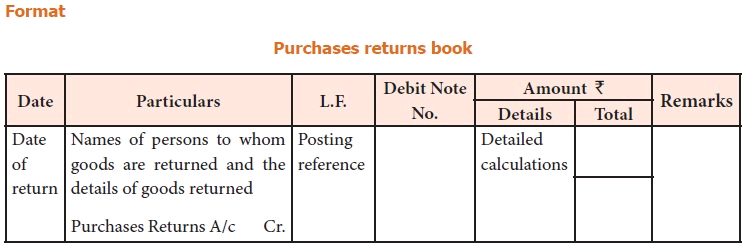

Recording Purchase Returns In Accounting Return outwards or purchase returns are shown in the trading account as an adjustment reduction from the total purchases for an accounting period It is not shown in the

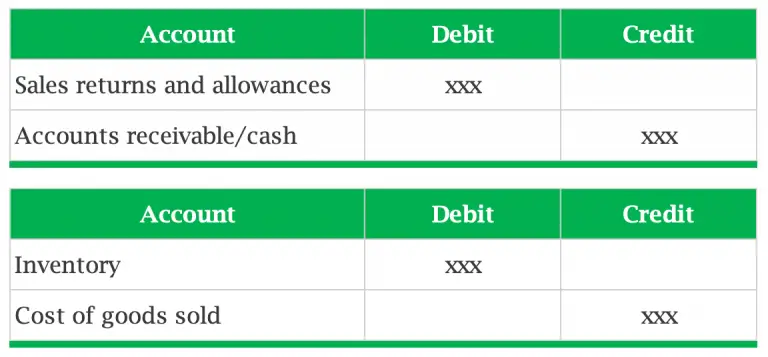

When presenting the purchases figure in the financial statements companies must account for purchase returns and allowances Companies report these accounts as a reduction in the Purchase returns are sometimes called returns outwards and are recorded in the accounting records as follows The accounting records will show the following bookkeeping entries for the purchase return of inventory The

Recording Purchase Returns In Accounting

Recording Purchase Returns In Accounting

https://help.tallysolutions.com/docs/te9rel60/Tax_India/gst/images/purchase_return_1.gif

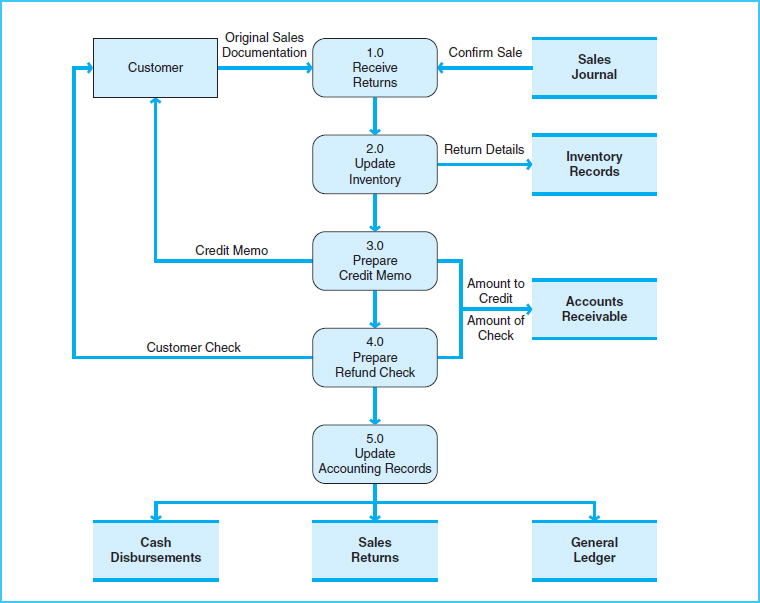

H ng D n When Customer Returns Defective Goods Of A Company Which Of

https://learn.financestrategists.com/wp-content/uploads/Journal-Entry-for-Purchase-Returns_image-2.png

What Is Purchase Returns In Accounting

https://1.bp.blogspot.com/-95nafgYY5OQ/YHGfSNCshJI/AAAAAAAAHOE/EwOklvcPAfAMkSZIbeajHxEeKtTmIeCuQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Purchase_Returns_in_accounting.jpg

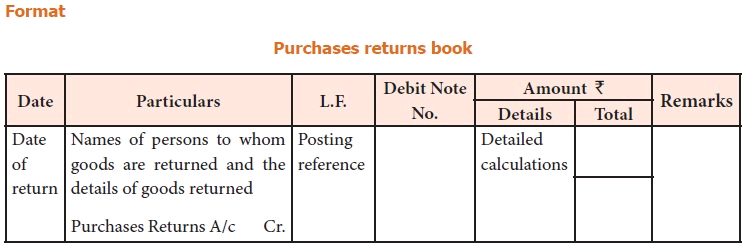

Purchase return journal entries show that a company has directly reversed stock from their inventory back to their suppliers Since goods purchase return Accounting for purchase returns and allowances is simple In the periodic inventory system the purchase returns and allowances are recorded into the purchase return and allowances

Under the periodic system the company needs to make the purchase return journal entry by debiting accounts payable or cash account and crediting purchase returns and allowances 1 record purchase of non current assets on credit 2 to write off bad debts 3 to record depreciation 4 to correct errors 5 to calculate capital In this chapter you will learn how to

Download Recording Purchase Returns In Accounting

More picture related to Recording Purchase Returns In Accounting

Recording Purchases Purchases Returns And Purchases Allowances LO

https://us-static.z-dn.net/files/dd1/a49d6d82ef24b1d3c0155f050d022b6f.jpg

What Is The Net Method Of Recording Purchase Discounts

https://learn.financestrategists.com/wp-content/uploads/Net-Method-of-recording-Purchase-discounts.png

RISKS AND CONTROLS IN THE SALES RETURN PROCESSES STUDY OBJECTIVE 3

https://www.oreilly.com/api/v2/epubs/9781118162309/files/images/ch008-f010.jpg

The journal entry to record refunds for returned inventory includes a debit to Cash or Accounts Receivable and a credit to Purchase Returns and Allowances The Purchase Returns and Allowances account which is a contra Accounting for Purchase return explained Accounting treatment of credit purchase and cash purchase returns Journal entries with illustrative examples

In accounting a purchase return is recorded to reflect the reduction in inventory and the corresponding decrease in accounts payable or increase in accounts receivable To create a purchase return journal entry you will first need to identify the merchandise that was returned Next you will need to record the credit that was given to you

What Is Double Entry Bookkeeping Debit Vs Credit System

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/07/21004831/Double-Entry-Accounting-Example-Calculation.jpg

Accounting Transactions Overview Types Double Entry Recording

https://cdn.corporatefinanceinstitute.com/assets/accounting-transactions.jpeg

https://www.accountingcapital.com › journal-entries › ...

Return outwards or purchase returns are shown in the trading account as an adjustment reduction from the total purchases for an accounting period It is not shown in the

https://www.wikiaccounting.com › purchase-returns-and-allowances

When presenting the purchases figure in the financial statements companies must account for purchase returns and allowances Companies report these accounts as a reduction in the

Accounting For Sales Return Journal Entry Example Accountinguide

What Is Double Entry Bookkeeping Debit Vs Credit System

Sales Returns And Allowances Recording Returns In Your Books

9 Exercise 4 3 Recording Purchases Purchases Returns And Purchases

Accounting The Accounting Cycle In A Merchandising Corporation

What Is Purchase Returns In Accounting Accounting Taxes And Insurance

What Is Purchase Returns In Accounting Accounting Taxes And Insurance

Purchases With Discount gross Principlesofaccounting

Accrued Expenses Journal Entry How To Record Accrued Expenses With

What Is Accounting Cycle Accounting Methods

Recording Purchase Returns In Accounting - Accounting for purchase returns and allowances is simple In the periodic inventory system the purchase returns and allowances are recorded into the purchase return and allowances