Recover Rebate Tax Credit Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Recover Rebate Tax Credit

Recover Rebate Tax Credit

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

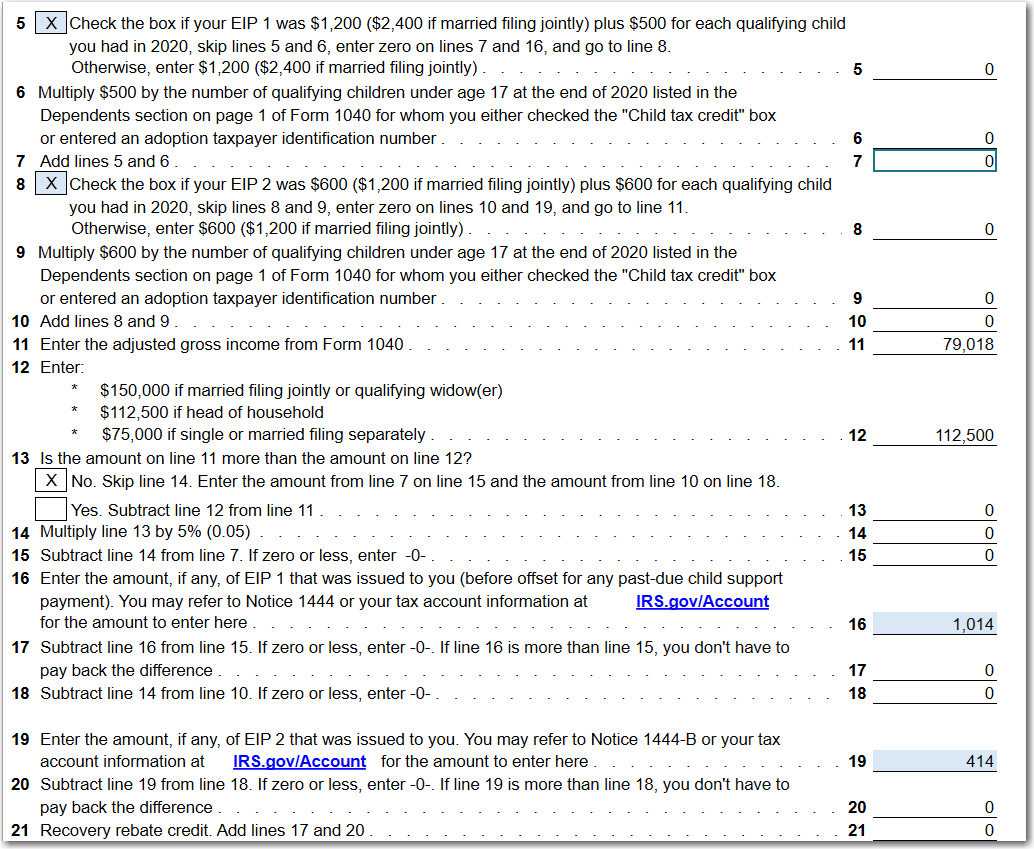

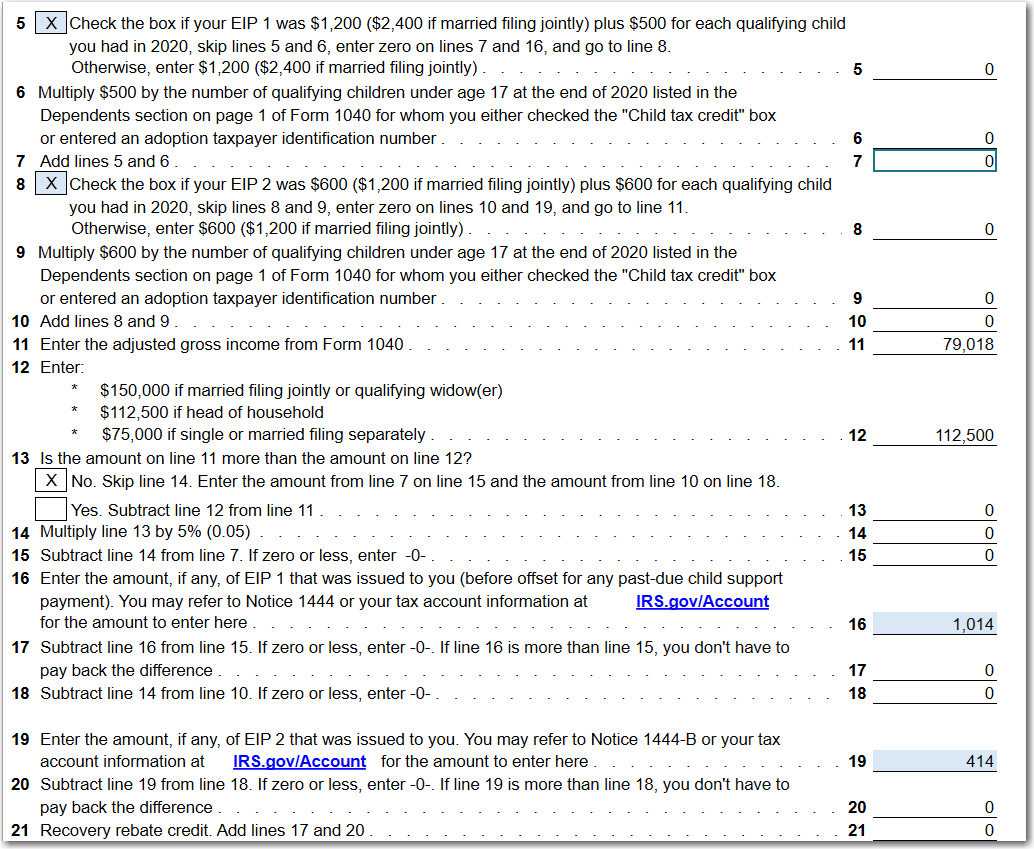

Recovery Rebate Credit Line 30 Form 1040 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

IRS CP 11R Recovery Rebate Credit Balance Due

https://www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Web 17 ao 251 t 2022 nbsp 0183 32 If you filed your 2020 and or 2021 taxes and failed to claim a Recovery Rebate Credit you can still try to file an Amended Tax Return 1040 X The IRS will not calculate your Recovery Rebate Web 10 d 233 c 2021 nbsp 0183 32 A1 You must file a 2020 tax return to claim a 2020 Recovery Rebate Credit even if you don t usually file a tax return See the 2020 Recovery Rebate Credit

Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on Web 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how

Download Recover Rebate Tax Credit

More picture related to Recover Rebate Tax Credit

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

Recovery Credit Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

Recovery Rebate Credit Worksheet 2020 Ideas 2022

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

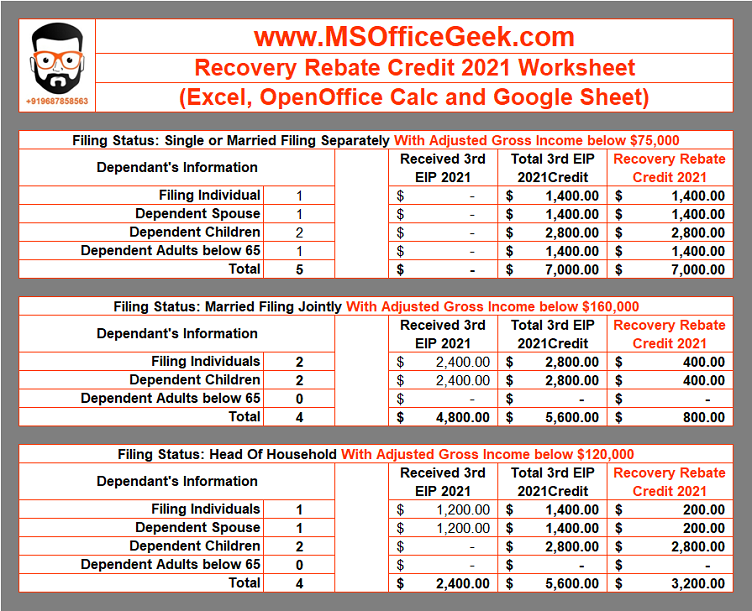

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form Web 19 janv 2022 nbsp 0183 32 The payment amounts are different than in 2020 as the maximum credit is 1 400 per person including all qualifying dependents claimed on a tax return as this

Web 15 janv 2021 nbsp 0183 32 IR 2021 15 January 15 2021 WASHINGTON IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early Web 27 avr 2023 nbsp 0183 32 If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/recovery-rebate-credit-worksheet-atx-line-30-covid-19-atx-community.jpg

Recovery Rebate Credit 2020 Calculator KwameDawson

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

Solved Recovery Rebate Credit Error On 1040 Instructions

Recovery Rebate Credit Worksheet Example Studying Worksheets Recovery

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

IRS Releases Draft Form 1040 Here s What s New For 2020

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

The Recovery Rebate Credit Calculator ShauntelRaya

Recover Rebate Tax Credit - Web 17 ao 251 t 2022 nbsp 0183 32 If you filed your 2020 and or 2021 taxes and failed to claim a Recovery Rebate Credit you can still try to file an Amended Tax Return 1040 X The IRS will not calculate your Recovery Rebate