Recovery Rebate 2022 Taxes The fastest way to get your tax refund is to file electronically and have it direct deposited contactless and free into your financial account You can have your refund direct deposited into your bank account prepaid debit card or mobile app and will need to provide routing and account numbers

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program Recovery Rebate Credit The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be able to take this credit only if You are eligible but were not issued an EIP 1

Recovery Rebate 2022 Taxes

Recovery Rebate 2022 Taxes

https://www.myexpattaxes.com/wp-content/uploads/Claim-the-2021-Recovery-Rebate-Credit-on-Your-US-Tax-Return-1024x605.jpg

Advantages Of Using A Grantor Trust In Planning North Dakota Estate

https://germanlawgf.com/wp-content/uploads/2021/12/Tax-Planning-for-2022-scaled.jpg

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/how-to-claim-stimulus-recovery-rebate-credit-on-turbotax-7.png?w=1003&ssl=1

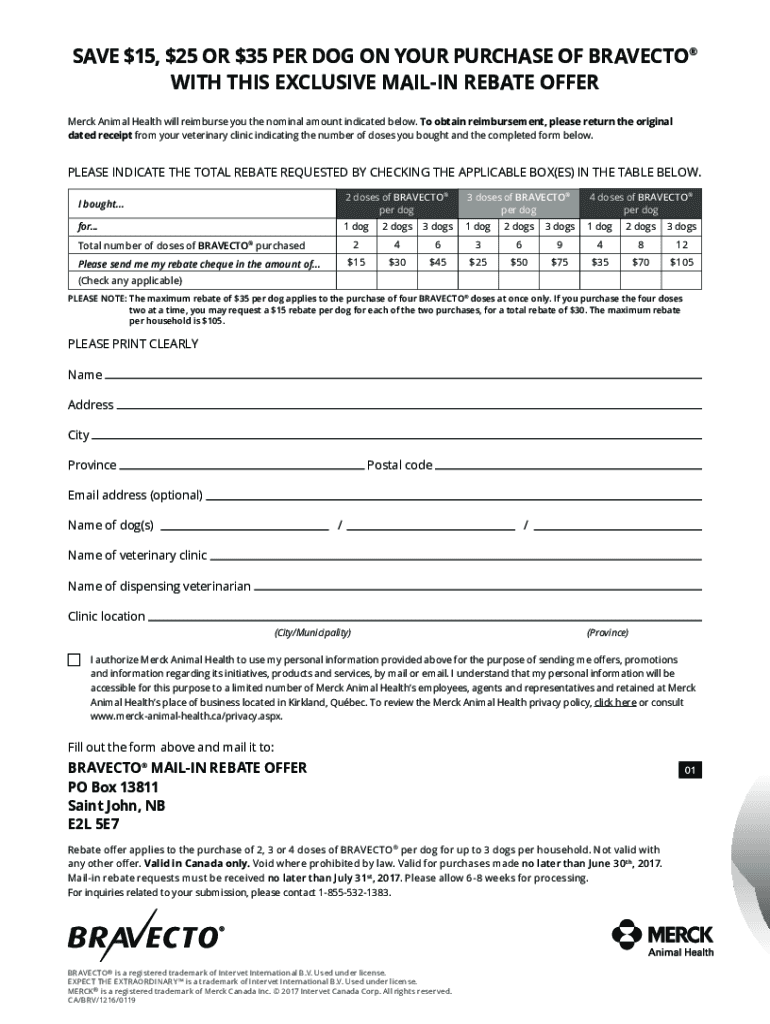

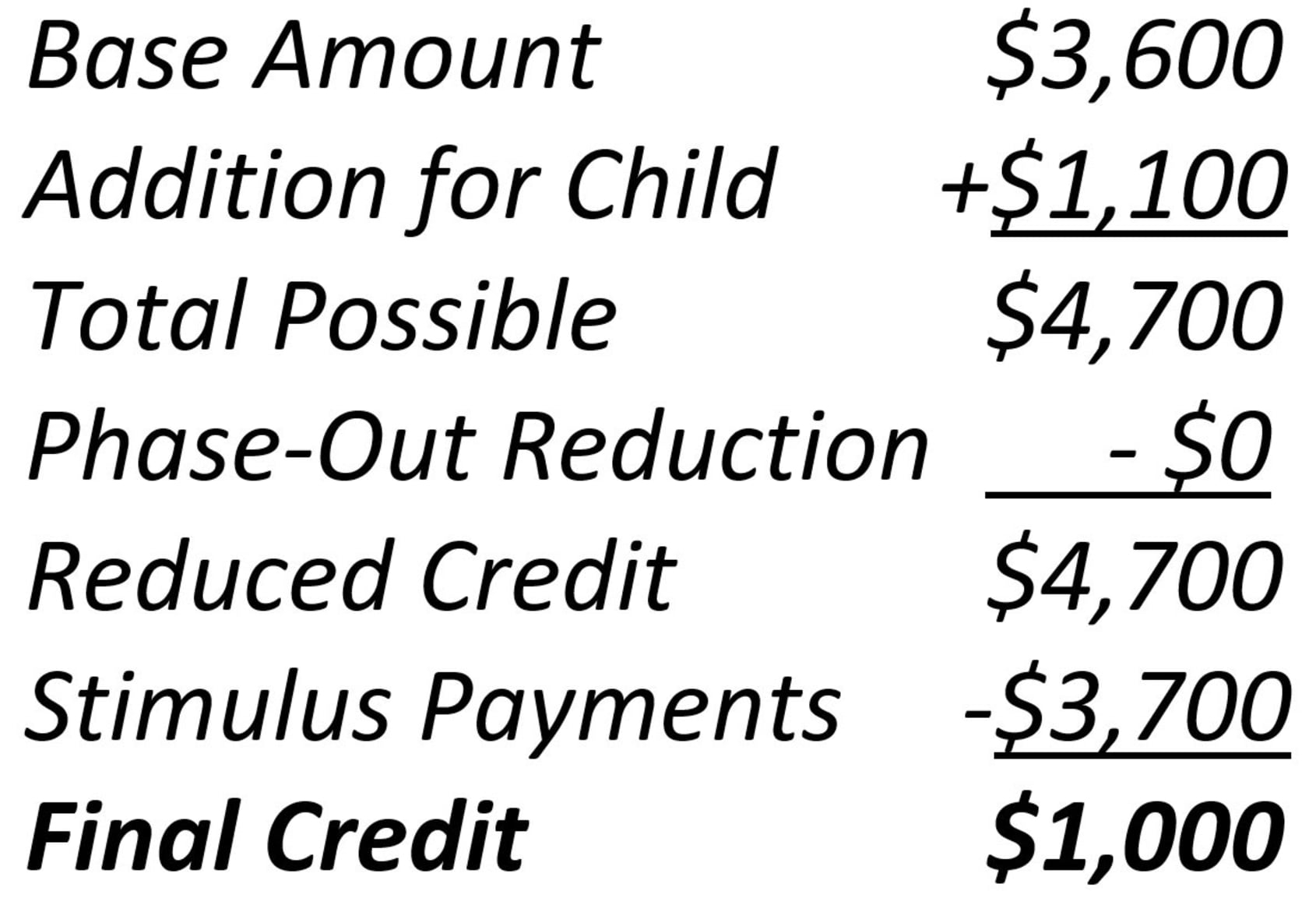

If you did not receive the additional 1 400 per qualifying in your third stimulus check you can claim the additional stimulus amounts in the form of a Recovery Rebate Credit on your 2021 tax return filed in 2022 The Recovery Rebate Credit allowed certain taxpayers to lower their taxes via a credit for the full Economic Impact Payment if it was not received for some reason in 2020 and or 2021

If you did not receive the correct amount of stimulus payment received only one stimulus payment or had a child born in 2021 and did not receive any stimulus for that child you will need to claim the Recovery Rebate Credit on your tax return to receive the correct stimulus payment The Recovery Rebate Credit as part of the CARES Act makes it possible for any eligible individual who did not receive an Economic Impact Payment or EIP to claim the missing amount on their tax return

Download Recovery Rebate 2022 Taxes

More picture related to Recovery Rebate 2022 Taxes

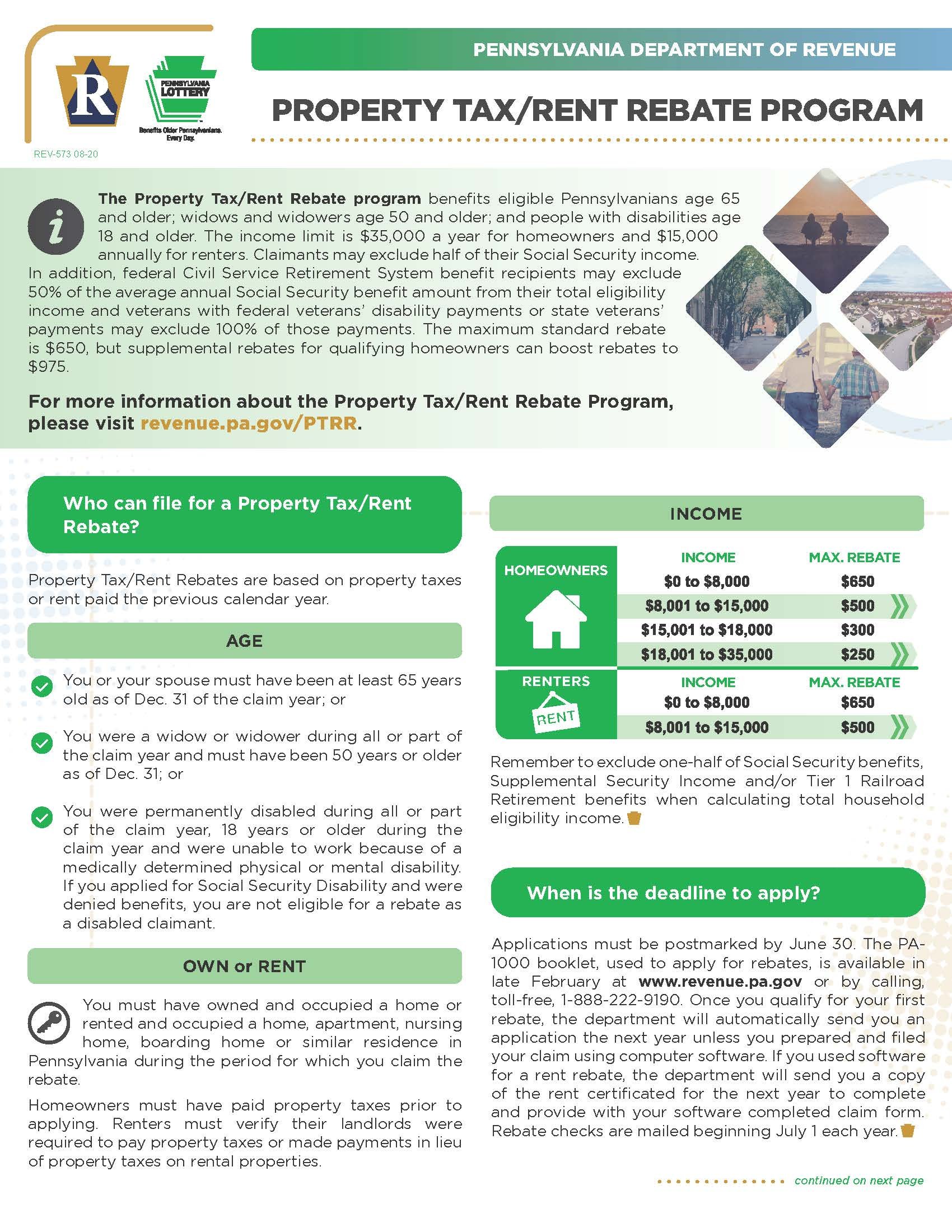

Older Disabled Residents Can File For Property Tax Rent Rebate Program

https://cdn.centraljersey.com/wp-content/uploads/sites/28/2022/01/20425_rev_rentRebate_NK_01-scaled.jpg

Recovery Rebate Credit Who Qualifies For This Payment In 2022 Marca

https://phantom-marca.unidadeditorial.es/da8b609a2e6998909efbd8fd484a86b8/crop/0x0/2046x1151/resize/1200/f/jpg/assets/multimedia/imagenes/2022/01/25/16431379973878.jpg

Getting A Bonus At Work This Year How You Can Save On Taxes

https://image.cnbcfm.com/api/v1/image/102289145-147265650.jpg?v=1575490548

The IRS letter can help tax filers determine whether they are owed more money and if they are eligible to claim the Recovery Rebate Credit on their 2021 tax return when they file a return this When filing your tax return you will use Line 30 of Form 1040 or Form 1040 SR to claim the Recovery Rebate Credit You will find instructions for how to calculate the credit in the instructions for either form

If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax return to make up the difference Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

Recovery Rebate Tax Credit Guidelines 2023 How To File For The

https://i.ytimg.com/vi/AEKUK2SMNRs/maxresdefault.jpg

https://www.irs.gov › pub › taxpros

The fastest way to get your tax refund is to file electronically and have it direct deposited contactless and free into your financial account You can have your refund direct deposited into your bank account prepaid debit card or mobile app and will need to provide routing and account numbers

https://www.irs.gov › pub › taxpros

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Recovery Rebate Form 1040 Printable Rebate Form

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

2022 Pa Property Tax Rebate Forms PropertyRebate

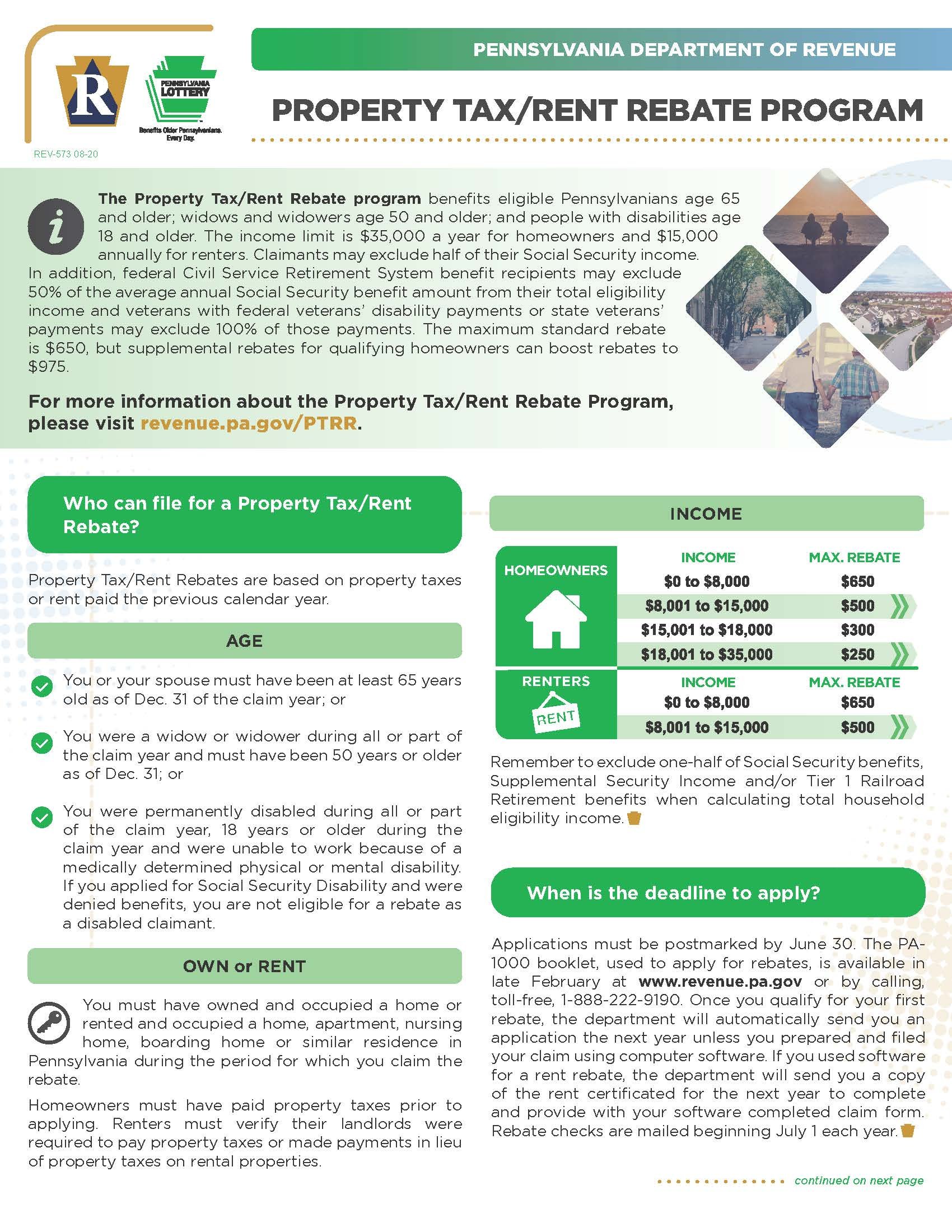

Bravecto Online Rebate 2022 Rebate2022 Recovery Rebate

2022 Income Tax Brackets Chart Printable Forms Free Online

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

The Recovery Rebate Credit Calculator MollieAilie

Council Tax Rebate 2022 Council Issues THIRD Date To Pay 150

Recovery Rebate 2022 Taxes - The Recovery Rebate Credit allowed certain taxpayers to lower their taxes via a credit for the full Economic Impact Payment if it was not received for some reason in 2020 and or 2021