Recovery Rebate Credit 2023 Turbotax Web 12 mai 2022 nbsp 0183 32 May 12 2022 6 21 AM Check your 2021 Form 1040 and see if there is an amount on line 30 If you see an amount there that is your recovery rebate credit If you were someone else s dependent for 2021 or if your income exceeded the limit then you may not have been eligible for the credit

Web 30 avr 2023 nbsp 0183 32 Taxpayers who are eligible can get Recovery Rebate credits in advance There is no need to alter your refund if the tax bill is greater than that of 2019 Your income will influence the amount of your rebate credit Your credit score will drop to zero if the income exceeds 75 000 Joint filers who jointly file with their spouse Web 21 nov 2022 nbsp 0183 32 2023 Recovery Rebate Credit Form Turbotax Taxpayers are eligible for tax credits through the Recovery Rebate program This allows them to get a refund on their tax obligations without having to amend the tax return The IRS administers the program and it is a completely free service When you are filing however it is important

Recovery Rebate Credit 2023 Turbotax

Recovery Rebate Credit 2023 Turbotax

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-stimulus-check-2021-turbotax-it-s-not-too-late-claim-a.png

Turbotax Recovery Rebate Credit 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-worksheet-turbotax-studying-worksheets-24.png?w=1050&ssl=1

Where To Enter Recovery Rebate Credit In Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/does-turbotax-give-the-irs-my-direct-deposit-information-trending-now.jpg?resize=683%2C1024&ssl=1

Web 2 d 233 c 2022 nbsp 0183 32 December 2 2022 by tamble Recovery Rebate Credit Turbotax 2023 The Recovery Rebate offers taxpayers the chance to get a tax return without having their tax returns modified The program is offered by the IRS Before you file however it is important that you are familiar with the regulations and rules of the program Web 13 nov 2022 nbsp 0183 32 However your recovery rebate credit will be diminished depending on your income Your credit rating will drop to zero If you earn more that 75 000 Joint filers will see their credit reduced at 150 000 for married couples Household heads are also likely to see their rebate refunds drop to 112 500

Web 5 avr 2022 nbsp 0183 32 Recovery Rebate Credit 2023 Turbotax Illinois Taxpayers from Illinois will receive their tax free rebate during this summer in 2023 The tax payers must file their Illinois 1040 form by October 17th 2023 to get their rebate The individual can get 50 in rebate cash and families with children can earn up to 400 in cash for free Web 30 d 233 c 2022 nbsp 0183 32 Based on your income however the recovery credit could be cut Your credit score will be reduced to zero for people who make over 75 000 Joint filers who file jointly with their spouse will see their credit drop to 150 000 Heads of household and joint filers will start to see their recovery rebate payments diminish to 112 500

Download Recovery Rebate Credit 2023 Turbotax

More picture related to Recovery Rebate Credit 2023 Turbotax

Stimulus Check Irs Turbotax STIMUQ Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/stimulus-check-irs-turbotax-stimuq.png

How To Claim Stimulus Check 2021 Turbotax It S Not Too Late Claim A

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-stimulus-check-2021-turbotax-it-s-not-too-late-claim-a.jpg?resize=1536%2C1025&ssl=1

35 What If Worksheet Turbotax Worksheet Source 2021 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/35-what-if-worksheet-turbotax-worksheet-source-2021-1.png

Web 21 f 233 vr 2023 nbsp 0183 32 Turbotax Recovery Rebate Credit Error 2023 Taxpayers are eligible for an income tax credit through the Recovery Rebate program This lets them claim a refund of their tax obligations without needing to alter their tax returns The program is provided by the IRS It is free It is nevertheless crucial to understand the regulations Web 1 d 233 c 2022 nbsp 0183 32 OVERVIEW Many Americans may be eligible for the Recovery Rebate Credit commonly referred to as the COVID stimulus payment The credit is for the 2020 tax year even though the last

Web 3 f 233 vr 2023 nbsp 0183 32 Feb 3 2023 If you re one of the many U S expats who are owed stimulus money you can still claim it through Recovery Rebate Credit As the matter of fact 2023 is the last year to get all the stimulus checks you might have missed It will either boost the amount of your tax refund or reduce the taxes you owe to the IRS Either way you win Web 27 avr 2023 nbsp 0183 32 How To Use The Recovery Rebate Credit To Claim A Missing Stimulus Check Forbes Advisor advisor Taxes Advertiser Disclosure How To Claim A Missing Stimulus Check Using The Recovery

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

Stimulus Checks Tax Return Irs Turbotax QATAX Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/stimulus-checks-tax-return-irs-turbotax-qatax.jpg?fit=828%2C1792&ssl=1

https://ttlc.intuit.com/community/after-you-file/discussion/how-do-i...

Web 12 mai 2022 nbsp 0183 32 May 12 2022 6 21 AM Check your 2021 Form 1040 and see if there is an amount on line 30 If you see an amount there that is your recovery rebate credit If you were someone else s dependent for 2021 or if your income exceeded the limit then you may not have been eligible for the credit

https://www.recoveryrebate.net/how-to-claim-2023-recovery-rebate...

Web 30 avr 2023 nbsp 0183 32 Taxpayers who are eligible can get Recovery Rebate credits in advance There is no need to alter your refund if the tax bill is greater than that of 2019 Your income will influence the amount of your rebate credit Your credit score will drop to zero if the income exceeds 75 000 Joint filers who jointly file with their spouse

Recovery Rebate Credit 2023 Limits Recovery Rebate

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

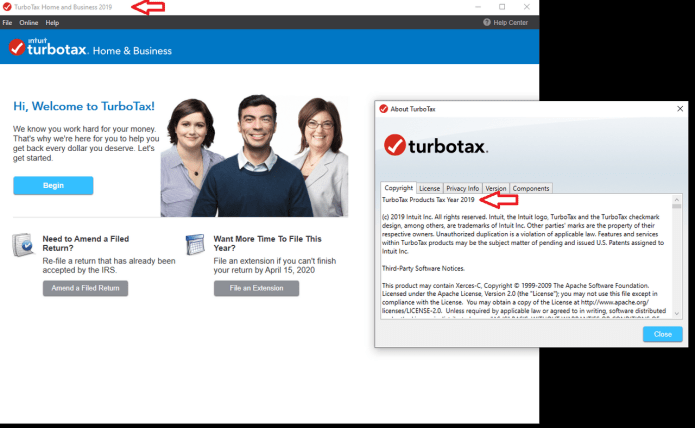

Turbotax Return TurboTax Tax Return App Max Refund Guaranteed For

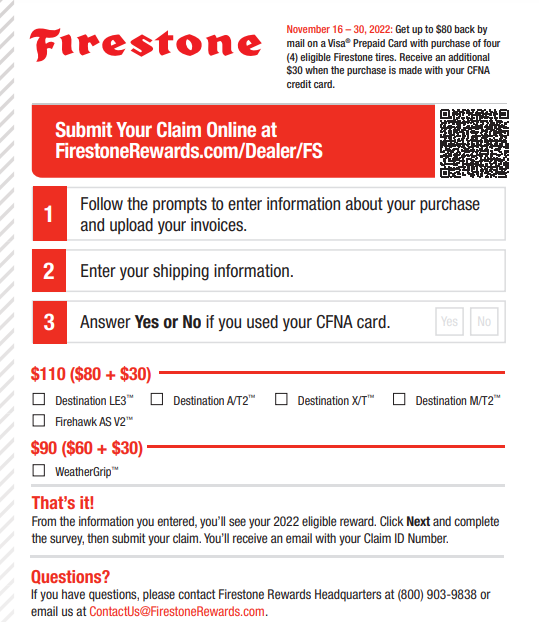

Firestone Rebates 2023 Printable Rebate Form Recovery Rebate

Recovery Rebate Credit 2023 Eligibility Calculator How To Claim

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Recovery Rebate Credit Qualifications 2023 Recovery Rebate

What Is Recovery Rebate Credit 2023 Recovery Rebate

What Is The Best Tax Software To Do It Yourself Best Tax Return

Recovery Rebate Credit 2023 Turbotax - Web 1 d 233 c 2022 nbsp 0183 32 Who is eligible for a recovery rebate In general people who had Major life changes such as having a baby or getting married or divorced A sizable increase or decrease in income A change in tax filing status for example no longer counted as a dependent on someone else s tax return